The Promise of Positive Optimal Taxation: Normative Sacrifice

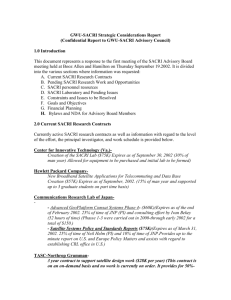

advertisement