Ethics and Corporate Social responsibility Alexander Cappelen 210405

advertisement

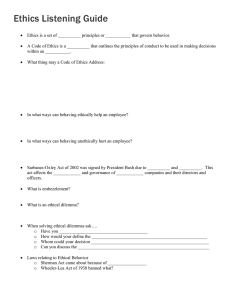

Ethics and Corporate Social responsibility Alexander Cappelen 210405 1 Ethics and decision making • Ethics – a tool for decision makers. • In the different social roles we occupy we all make decisions that have consequences for a large number of different agents. • These agents have different interests and might disagree about what the best decision is. • A decision maker has to balance conflicting demands from different groups. 2 Example: business managers Suppliers The public Costumers Employees Managers Owners Government 3 The need for ethics • We need ethics in order to handle these types of trade-offs. • Ethical theories are well-founded answers to the question of what is good and what is bad. – What is the best decision all things considered. • Three fundamental questions: – Towards who do we have obligations? – What type of obligations do we have? – How do we handle conflicting obligations? 4 Towards who do we have obligations • Some important answers : 1. Other people that we have certain relation to - family, our friends, our colleagues or our fellow citizens 2. All human beings – independent of our relationship to them. 3. Other life forms and the environment. 5 Different obligations • Vi can have different obligations towards different groups, for example: – An obligation to share our economic resources with our fellow family or fellow citizens. – An obligation to respect the human rights of all human beings. – An obligation not to inflict unnecessary pain on animals. 6 Who should managers care about? • Two competing answers: 1. Managers should only care about the interest of their owners – shareholder perspective. - The contractual relationship gives rise to special obligations. - Managers are unable to meet other obligations due to competition in the market. - Other agents are better suited: division of labour between the market and the government. 7 Cont. 2. Managers should care about all stakeholders (the stakeholder perspective). - Also other relations give rise to obligations. - Who are the stakeholders? - Those who are affected by our decisions? - The market does not necessarily punish the ethical firm. - The division of labour does not always work. - Weak states. - Lack of information. 8 What type of obligations do we have? Three answers: 1. Consequentialism: We are obligated to choose the ‘best’ alternative – influence in å positive direction. - Theory: utilitarianism/welfarism - Illustration: cost-benefit analysis, profit maximization, social welfare functions - - Case: Ford Pinto Focus: forward looking. Question/problem: - What consequences should we care about? Can any action be justified if the consequences are good? 9 Cont. 2. Duty ethics: we have an obligation to choose the ‘right’ action – to avoid unethical conduct. - Theory: Kant’s duty ethics Illustration: human rights (corruption?) - - Case: Statoil in Angola Focus: on the nature of the action. Question/problem: - When do we contribute to an action? Is there any actions that can never be justified? 10 Cont. 3. Desert ethics: We are obligated to reward or punish. - Theory: Libertarianism. Illustration: Rewarding effort, hiring the most qualified. - - Case: Just income distribution Focus: backwards looking. Question/problem: - What are we responsible for? What is an appropriate reward/punishment? 11 How should we handle conflicting obligations? 1. Identify situations in which there is no conflict. a. b. 2. Evaluate what obligations that one is best suited to take care of. a. b. 3. Corporate social responsibility as reputation management. Exploit opportunities for collaboration What obligations can we take care of? Are other agents better suited to take care of certain obligations? Weight the remaining obligations. a. b. Give absolute priority to one type of obligation. Trade-off between different obligations. 12 Conclusion • Corporate social responsibility is a question of when, not whether. – Companies have special obligations to other stakeholders than the owner • Their business operations potentially have important effects on the vital interests of other stakeholders. • When these stakeholders have few alternatives and lack information. • The company is better suited to take care of the interest of these stakeholders than other agents. 13 Ethical guidelines for the Norwegian Petroleum fund 14 National resources and ethical obligations • The existence of large petroleum reserves and substantial petroleum revenues in Norway puts this country in a unique position and give rise to two important ethical questions: – (1) To what extent do Norwegian’s have an ethical obligation to share these resources with others? • Poor people in other countries • Future generations of Norwegians – (2) How should we manage a large petroleum fund? • Important to distinguish between: ‘how should we spend?’ and ‘how should we invest?’ 15 Ethical management of the fund • In this talk I will be concerned with the second question – ethical management of the fund. • This question is important if the answer to the first question is that we should save at least some of the petroleum revenues for future generations of Norwegians and that this should be done by establishing a fund. – There are other ways to save resources for future generations, e.g. to invest the resources so as to increase the productive capacity of the economy. 16 Why is the management of the fund an ethical concern? • There are two main reasons why we should be concerned with the management of the fund should be an ethical concern: – (1) The management of the fund affects the return on the fund’s investments. The management of the fund thus affects prosperity of future generations of Norwegians. – (2) The fund, as a shareholder, affects the management of large corporations and these companies in turn affect the lives of the individuals in the countries in which they operate in important ways. 17 Background • The The Norwegian Government Petroleum Fund fund was established in 1990 in order to: – Reduce uncertainty by acting as buffer to smooth shortterm variations in the oil revenues. – Reduce the pressure in the Norwegian economy. • By making the spending of petroleum revenues more visible. – Finance future pension expenditures and a growing need for nursing and care services. • Smooth long-term consumption. 18 Background 19 How the fund works • The income of the Fund consists of the net cash flow from petroleum activities plus the return on the Fund’s capital and net financial transactions related to petroleum activities. • The expenditures of the Fund are the transfers to the Fiscal budget to finance the non-oil budget deficit. • The use of petroleum revenues over the Government budget is gradually phased into the economy approximately in pace with an estimated 4 pct. real return on the capital of the Petroleum Fund. 20 The management model • Division of labour between the Ministry of Finance and the Bank of Norway • Ministry of Finance – Makes the strategic investment decisions (the benchmark portfolio) – Determines the the risk limits. • Norges Banks tasks are: – To carry out the investment strategy, – Aim to maximize return 21 The benchmark portfolio 22 Important aspects of the fund • It is only allowed to invest in foreign stocks and obligations. • It is a financial investor. Is not allowed to own more than 3% of the stocks in any individual company. – A highly diversified portfolio – Does not take strategic positions • Limited degree of active management • Increasing degree of in-house management (today 80%) 23 The size of the fund • The first transfer to the Petroleum Fund was made in 1995. • Stocks was included in 1998 • The fund is today invested in approximately 2500 companies – Only 10% of the total number of companies in which the fund could be invested in. But these companies constitute 90% of the total value of the companies registered. – The number of companies are likely to increase considerably. 24 The size of the fund • The value of the fund is today 1100 billion NOK (100 billion dollars) or app. 50% of GDP. – App. 250.000 NOK per capita. • The size will more than double by 2010. • The fund owns app. 0.3% of the worlds stocks. 25 Ethical consideration in the management of the fund • Ethical guidelines have been discussed since the introduction of stocks in 1998. • Substantial resistance from the Ministry of Finance, Norges Bank and some political parties. – Concern about reduced rate of return and increased risk. – Concern about reduced accountability. – Concern about the possibility that the fund would turn into an ‘alternative budget’. – Concern about inconsistency with other parts of public policy. 26 Ethical consideration today • Two ‘concessions’: – The environmental fund. • Limited in size – only 2 billion NOK. – The Petroleum Fund Advisory Commission on International Law. • Has only resulted in the exclusion of one company. 27 Committee appointed to propose ethical guidelines • Several ‘scandals’ and pressure from different NGO’s, combined with the experience from other funds prepared the ground for the ‘ethicscommittee’. • Mandate: To propose ethical guidelines for the fund. – ”fremme forslag om et sett av etiske retningslinjer for Petroleumsfondet. Det er naturlig at spørsmål knyttet til miljø, menneskerettigheter, arbeidstakeres rettigheter samt styre og ledelse av selskaper blir vurdert i denne sammenhengen.” 28 Main elements of our work • Main goal: to propose a set of methods that would enable the fund to meet its ethical obligations. • Three ethical questions 1. Who do we have ethical obligations towards? 2. What type of obligations do we have? 3. How do we handle situations in which different obligations come in conflict? 29 Who do we have ethical obligations towards? • We focused on: – Distributive obligations towards future generations of Norwegians. – Obligation to respect the human rights of all humans. • When do we contribute to human rights violations? – Obligation to preserve the environment 30 What type of ethical obligations do we have? • Primarily two types of ethical obligations: (1) An obligation to maximize the funds return. (2) An obligation to avoid contributing to certain types of actions. (3) NOT an obligation to punish or reward. 31 How do we handle conflict between different obligations? 1. Identify situations in which there is no conflict. 2. Evaluate what type of obligations the fund is best suited to meet. 3. Weigh different obligations against each other 32 Identify • There is not always a conflict between the obligation we have towards future generations and the other obligations we have. • Long-term returns on a broadly diversified financial portfolio are dependent on sustainable economic development. – Might be conflict of interests between different shareholders. 33 Evaluate • Two questions: a. What obligations is it possible for the fund to meet? – Important that the ethical guidelines do not weaken the criteria for the verifiability of the fund’s financial performance. – Do we have the necessary information? • Often difficult to get information about human rights/labour rights violations. b. Can others meet these obligations in a better way? – Some obligations can better be met by other parts of the government, e.g.: • • Some distributive obligations Obligations to punish or reward 34 Weigh • Our priorities (1) We give absolute priority to some types of human rights violations etc. (2) Beyond this the goal is to maximize the long term return on the portfolio. 35 The proposal (1) • The following three methods was proposed and later adopted by Stortinget - as a basis for the ethical guidelines: • Negative screening – Negative screening of companies from the investment universe that produce, either themselves or through entities under their control, weapons that cause particularly widespread civilian suffering • chemical weapons, biological weapons, anti-personnel mines, non-detectable fragments, incendiary weapons, blinding laser weapons, nuclear weapons and cluster bombs. – Investment in companies that are involved in the production of some of these weapons is already prohibited under international law 36 The proposal (2) • Exclusion of companies – The fund should exclude companies from the investment universe that pose an unacceptable risk that the Fund might contribute to unethical actions or omissions. • Violation of fundamental humanitarian principles, grave violations of human rights, gross corruption or severe environmental degradation. – The Ministry of Finance should establish a council on ethics and international law to investigate individual companies and make recommendations to the Ministry on the exclusion of companies. 37 The proposal (3) • A corporate governance policy – Ministry of Finance should draw up guidelines for Norges Bank’s corporate governance policy. – These guidelines should be based mainly on the UN Global Compact and the OECD Guidelines for Multinational Enterprises. – Norges Bank shall be responsible for the implementation of this policy. 38 Ambition • The hope is that Norway, with these guidelines, will have made significant progress in the effort to promote the ethical accountability of major institutional investors and ensure that they use their influence to promote sustainable development. 39