ECON/SØK500 Natural resource economics, Spring 2003

advertisement

1

Updated, 19 April 2004

ECON/SØK500 Natural resource economics, Spring 2003

Olav Bjerkholt:

Lecture notes on the Theory of Nonrenewable Resources

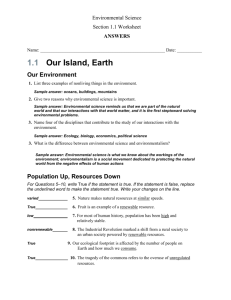

7. Renewable resources: Optimal taxation under an open-access regime

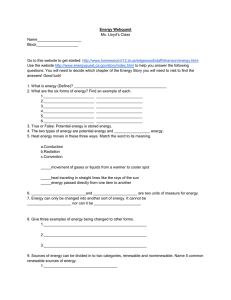

Perman et al. (2003) Chapter 17 Renewable resources cover a wide range of renewable

resource problems. As we can give these problems quite limited attention within our

course, we concentrate on the analytics of a stylized approach to the renewable resource

problem, interpretable as the harvesting of a non-migratory species of fish at a particular

location or even as a freshwater stock in a pond or reservoir.

We use control theory to study the optimal harvest, i.e. optimal from a social efficiency

point of view. We confront this with the harvest implied by "open access", as discussed

below. Finally, we try to derive taxation rules that might lead an open access regime

towards the optimal solution.

The renewable resource problem differs from the nonrenewable resource problem,

naturally in the law of motion of the resource stock. While the nonrenewable resource

stock in a non-stochastic setting, is changes as we have seen, by the stock being

diminished over time by the amount of resource depleted (harvested) from it, i.e.

St Rt .

For the renewable resource problem there is another element in the law of motion of the

resource stock, namely the endogenous growth of the stock, endogenous because it is

modeled as dependent upon the resource stock. We can write it as

(7.1)

St G ( St ) Rt

(In this lecture note the analytics is slightly different from Perman et al. (2003), and there

are minor differences in notation. One difference is the use of R instead of H for the

harvest (depletion) of the stock, consistent with the notation used for nonrenewable

resources. The use of H for harvest is common in this literature, but should be avoided as

H also is used for the Hamiltonian. One of the Perman et al. (2003) authors may also

have tried to pursue this idea, see the unnumbered equation (iii) just below (17.35) on

p.580!)

What kind of function is G(S)? This is discussed at some length in Perman et al. (2003),

section 17.1, particularly Box 17.1. For our purpose here we may as well assume the

simplest version, the logistic form given in (17.3) as

(7.2)

G ( St ) g (1

St

S MAX

) St

2

This function implies that the growth rate of S (with no harvesting) decreases from g at

S=0 to a growth rate of zero at S=SMAX. The absolute growth increases from zero at S=0

to a maximum of 1/2 gSMAX at S=1/2 SMAX and then declines and reaches zero at S=SMAX..

This logistics function, even in a more complicated version, is still a gross simplification

of the actual dynamics of endogenous growth of fish and other biological species. The

function does not pay attention to the full population dynamics which requires

representation of the size of the different cohorts, fertility patterns etc. Neither does it pay

attention to stochastic elements in the reproductive patterns, whether endogenous or

caused by external factors. Even less does it pay attention to the interrelation between the

species under consideration and other species. We leave, however, these aspects aside.

Just by looking at a graphical representation of the growth function G(S), one realizes

that this renewable resource has a infinite number of steady states, i.e. an infinite number

of combinations of stock size and harvest size that will leave the stock unchanged. This is

also too obvious to be constructed as an important insight. We also can draw the

conclusion that there is one stock size that allows a maximal size of the steady state

harvest, called the maximum sustainable yield, RMSY, with corresponding stock size SMSY.

We can add to this that for all other yields, that is R between zero and RMSY, there are two

different stock sizes that can yield this harvest in a steady state.

To harvest the renewable resource requires expenditure of effort which again requires

costs. Just as in the nonrenewable resource theory we can assume a cost function as a

function of harvest as a function representing the minimum cost to give rise to the given

harvest, b b( Rt ) . But even more than for the nonrenewable resource there are reasons

for including the stock level in the cost function, i.e. , with the usual properties:

bR 0, bRR 0, bS 0, bRS 0 . The cost of catching an amount of a non-migratory fish

can reasonably be assumed to be lower the denser the fish stock is. The same will hold

for other populations to which this theory may apply.

We can then proceed to formulate the optimal control problem for harvesting the

renewable resource when the price of harvested resource is given as p and the rate of

discount as r.

(7.3)

Max [ pRt b( Rt , St )]e rt dt

{ Rt }

subject to (7.1) and S 0 S .

0

The Hamiltonian in current values is then

(7.4)

H C ( Rt , St ,t ) pRt b( Rt , St ) t (G(St ) Rt )

where t is the shadow price of the resource stock. The necessary condition for a

maximum is

(7.5)

p bR ( Rt , St ) t 0

The shadow price must obey

(7.6)

t rt t G ( St ) bS ( Rt , St )

3

We see from (7.5) that the shadow price here as in the nonrenewable case has an

interpretation as resource rent, the net of price over marginal cost. The three equations

(7.1), (7.5) and (7.6) which jointly determines the optimal path of Rt , St and t are not by

immediate inspection easy to see through. We shall try to make it more transparent by

investigating whether there are stationary states solutions, i.e. solutions such that St S *

for all t, and as a consequence also constant Rt and t . It then follows that Rt G( St ) and

t 0 .Using this we can rewrite (7.6) with substitution from (7.5) and write it in three

alternative ways

(7.7)

r G( S * ) bS (G ( S * ), S * ) /( p bR (G ( S * ), S * )

(7.8)

r ( p bR (G ( S * ), S * ) p G ( S * ) (bR (G ( S * ), S * ) G ( S * ) bS (G ( S * ), S * ))

(7.9)

( p bR (G( S * ), S * )

p G( S * ) (bR (G( S * ), S * ) G( S * ) bS (G ( S * ), S * ))

r

r

(7.7) looks like a Hotelling rule(!), but perhaps difficult to interpret as it stands here. We

have in fact shown by this reasoning that there are stationary solutions, which should not

surprise for this kind of problem. From (7.7) we see that there is a correspondence

between r and stationary values of S, say S*=S*(r), thus for given r there is one stationary

solution. (Try to figure out whether a higher r corresponds to a lower or higher stationary

value of S?) If the start-out value of the stock S0 is different from S*(r), we would expect

the optimal path to lead from S0 to - or approaching - S*(r). This can be shown.

The other two alternative formulations, (7.8) and (7.9), are easier to interpret. We could

have simplified the expressions by noting that bR (G ( S * ), S * ) G( S * ) bS (G ( S * ), S * ) is the

total marginal cost of b(G(S),S), i.e. the marginal cost w.r.t S.

(7.10)

db(G ( S ), S )

bR (G ( S * ), S * ) G( S * ) bS (G ( S * ), S * )

dS

Before we interpret these solutions, let us try to reason along another track. If we think only about

stationary solutions, then everything is the same in every period. Let us simply ignore the time

dimension and search for the stationary stock value which gives the highest surplus, calculated

simply as the revenue over cost, in other words

Max[ pG ( S ) b(G ( S ), S )]

(7.11)

S

The first-order condition is

(7.12)

pG( S )

db

bR (G ( S ), S ) G( S ) bS (G ( S ), S )

dS

We can rewrite this as

(7.13)

G( S # ) bS (G ( S # ), S # ) /( p bR (G ( S # ), S # ) 0

Perman et al. calls this optimal value S# for the “static provate-prperty steady state”

(p.573). By comparison with (7.7) we find that the value of S in this static optimization

4

problem is the same as the value we found in the optimal control problem for the

stationary state corresponding to r=0. What is the explanation for this?

Let us first look at a graphical representation (without graphs!). With S measured on the

X-axis, we can draw the pG(S), which of course is a second degree polynomial curve, just

as (7.2), only multiplied with p. It starts in origo, rises to a maximum as discussed above,

and reaches zero again at S=SMAX.

What does the cost function b(G(S),S) look like over the relevant interval. Let us think of

the cost function as proportional in R, i.e. b(R,S)=c(S)R. Consider the point S=SMAX . At

this point the cost function must arguably be zero, as the catch is zero. When S decreases

from SMAX, the catch increases from zero and the cost increases because the catch

increases. At the same time the decrease in S works through the second argument to

increase the costs. Hence, we can draw the cost function leftwards from SMAX as

increasing, although we may have difficulty saying more about its shape without more

information about the technology. The cost function increases as S becomes smaller and

cuts through the pG(S) curve at some point S**.

We can then from (7.12) conclude that the solution point S# can be found just where the

tangents of pG(S) and the cost function are parallel (assuming that the shape of the cost

function is such that this point actually maximizes the vertical difference between the two

curves).

The point S# seems to be an optimal point for a steady state-solution as the profit is higher

that in any other point and the same profit will be realized every year. Why then did we

find above that proper optimization over time gives something else. Let us look at (7.8)

and (7.9) again. Let us think of S# as the starting point. The left-hand side of (7.8)

expresses the annual gain from catching an infinitesimal amount of S, thus moving to the

left on the pG(S) curve, and the right hand side expresses how much we give up in annual

revenue. As the right-hand side is zero for S=S# , we must move further to the left to

achieve the equality expressed by (7.8), and further the higher is r. So what it means is

that catching some of the stock now outweighs the future losses of a lower permanent

revenue.

(7.9) expresses the same idea only put in present-value terms. The left-hand side is the

present value of catching a unit of the stock today, the left-hand side expresses the cost in

terms of the present value of the permanent income from a changed steady state.

Thus we have found that dynamic optimization results in steady state solution which is

S=S# for r=0 and for higher r we find a new steady state S* to the left of S#. What if the

discount rate gets very high, let us say an infinite discount rate? The answer is easy, in

this case future income has no present value. Hence, the optimal action must be to catch

immediately all stock down to S** and continue in the steady state which gives no profit!

The dynamic solution we have found to the optimal exploitation of a biological stock

(fish) under the stated conditions, is by Perman et al.(2003) called the “present-valuemaximizing fishery model” (p.574) and as “private-property” optimum. We might as well

call it the (social) planning solution. The solution pays full attention to the connection

between stock, steady-state harvest and cost. Private agents would do that only if they

owned the stock (and were fully informed). We can regard the solution we have found as

5

competitive solution if the agents have enforceable property rights to the stock. One way

of thinking about this is that the entire fishery could be divided up in separate privately

owned stocks. In practice this is not easily possible for many of the stocks to which this

model could be relevant. We can, alternatively, regard the solution as the outcome of an

institutional system which simulates the private property solution, either a voluntary

cooperation or a system of tradable quotas or by taxation.

This points to the central element the fishery problem, the externality of the stock. If we

had the open access system, i.e. free entry of agents and no property rights or alternative

systems, no agent would have any incentive to pay attention to the dynamic effects of

stock changes. Under open-access conditions we have the following problem:

(7.14)

Max[ pR b( R, S )]

R

with first order condition

p bR 0

(7.15)

If we have the cost function suggested above with cost proportional with the harvest level

for any given size of the stock, we see that (7.15) implies

(7.16)

pR bR R b( R, S )

Hence, we end up in S** as defined above, where revenue equal costs. Open-access can

only give a short term profit as the stock is harvested down to the S** level. After that

there is no profit. Open access thus gives the same solution as present-value maximizing

with infinite discount rate!

Can the externality of the open access fishery be corrected by means of taxation? Let us

try. We introduce a tax t on the harvest. The agents will now maximize

(7.17)

Max[( p t ) R b( R, S )]

R

with first order condition

(7.18)

p bR t

By comparison with (7.9) we see that we can actually get to the optimal solution S* by

setting that tax t to

d ( pG ( S ) db

t [

]S S *

(7.19)

dS

dS

It seems very simple in practice, it may not seem so simple in practice, for a number of

reasons. Neither has it been used much in real life.

The stock externality is the essence of this problem, but there could also be another kind

of externality that makes the open access fishery different from the optimal harvesting,

namely inefficiency in the harvesting. The efficiency of each agent may depend upon

how many others are fishing, in short, fishing vessels may get in the way of each other.

Also this externality may be corrected by taxation, at least theoretically. To discuss it, it

is better to use another parametrization of the problem that the one used above. Cf

Perman et al. (2003), p.563. We introduce explicitly a variable representing the “effort”,

6

E, which could be fishing vessels or some other instrumental measure of the effort. The

cost can then be represented simply as

b qE

(7.20)

where q is the cost of each effort unit. The harvest is a function of effort and stock,

R=F(E,S). Perman et al. (2003 suggest that this function could be

R e E S

(7.21)

where e is a coefficient. We can then reformulate the dynamic optimization problem as

(7.22)

Max [ p F ( Et , St ) q Et ]e rt dt

{ Et }

0

The problem is equivalent to the one we have solved above. We leave it as an exercise to

work out the further details of the optimization problem.

Within this problem we could formulate the externality of the effort by a slight

reformulation of the production function. We could let the catch function for agent i be

Ri=F(Ei, Ê, S), where Ei is the effort of agent i and Ê be the total effort with a negative

effect on Ri. This externality could be corrected by a tax on q.