Exchange Bulletin August 12, 2005 ...

Exchange

Bulletin

August 12, 2005 Volume 33, Number 32

The Constitution and Rules of the Chicago Board Options Exchange, Incorporated (“Exchange”), in certain specific instances, require the Exchange to provide notice to the Exchange membership. To satisfy this requirement, a complimentary copy of the

Exchange Bulletin, including the Regulatory Bulletin, is delivered by hard copy or e-mail to all effective members on a weekly basis.

CBOE members are encouraged to receive the Exchange and Regulatory Bulletin and Information Circulars via e-mail. E-mail subscriptions may be obtained by submitting your name, firm if applicable, mailing address, e-mail address, and phone number, to members@cboe.com, or, by contacting the Membership Department by phone, at 312-786-7449. There is no charge for e-mail delivery of the Exchange and Regulatory Bulletin or for Information Circulars. If you do sign up for e-mail delivery, please remember to inform the Membership Department of e-mail address changes.

Additional subscriptions for hard copy delivery after the first complimentary copy may be obtained by submitting your name, firm if any, mailing address, e-mail address and telephone number to: Chicago Board Options Exchange, Accounting Department, 400

South LaSalle, Chicago, Illinois 60605, Attention: Bulletin Subscriptions. The cost of an annual subscription (January 1 through

December 31) is $200.00 ($100.00 after July 1), payable in advance. The Exchange reserves the right to limit subscriptions by nonmembers.

For up-to-date Seat Market Quotes, call 312-786-7456 or refer to CBOE.com and click “Seat Market Information” under the “About

CBOE” tab. For access to the CBOE Member Web Site, please also notify the Membership Department by sending an e-mail to members@cboe.com or by phone at 312-786-7449.

Copyright © 2005 Chicago Board Options Exchange, Incorporated

CLASS

SEAT MARKET QUOTES AS OF FRIDAY, AUGUST 12, 2005

BID OFFER LAST SALE AMOUNT LAST SALE DATE

August 1, 2005 CBOE $700,000.00 $750,000.00

$723,000.00

CBOT FULL MEMBERSHIP

CLASS BID OFFER LAST SALE AMOUNT

With CBOE Exercise Right $2,100,000.00 $2,300,000.00 $2,225,000.00

LAST SALE DATE

July 25, 2005

Without CBOE Exercise Right N/A June 20, 2005 $0.00

$0.00

CBOE Exercise Right

CLASS

CBOE Exercise Right

$104,000.00 $145,000.00

$102,000.00

July 26, 2005

**CORRECTION TO BULLETIN DATED 8/5/05**

BID OFFER LAST SALE AMOUNT LAST SALE DATE

$0.00

$145,000.00

$102,000.00

July 26, 2005

Page 2 August 12, 2005 Volume 33, Number 32

Informational Circular IC05-92

August 4, 2005

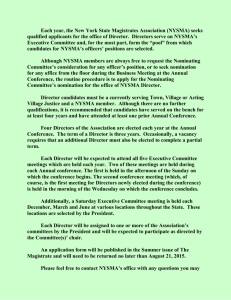

Selection of Nominees for Board of Directors and Nominating Committee

Chicago Board Options Exchange

The Nominating Committee is accepting applications for nominees for the 2005 annual election to fill positions on the Board of Directors and

Nominating Committee. Available positions include:

Board of Directors 1

1

3

Floor Director

Lessor Director

Public Directors

3-year term

3-year term

3-year terms

Nominating Committee

1

1

1

2

Firm Member

Floor Members

Lessor Member

Public Member

3-year term

3-year term and 1-year term

3-year term

3-year term

The Nominating Committee is re-issuing this circular in place of Information Circular IC05-85 because there is now an additional available Floor

Member position on the Nominating Committee for a 1-year term which is reflected above.

Please also note that the Exchange has amended its rules to provide for the regular committee appointment process to apply to the MTS

Committee. Accordingly, because the MTS Committee is no longer an elected committee and the Nominating Committee no longer nominates candidates to fill positions on the MTS Committee, the Nominating Committee is not accepting applications for MTS Committee positions.

The qualification criteria for the available positions on the Board of Directors and Nominating Committee are described in the attached materials.

The Nominating Committee requests that candidates who wish to be considered for nomination by the Nominating Committee complete and submit the attached Candidate Information Form (“Application”) by Monday, August 29, 2005.

(Application forms are also available on the CBOE Membership website at www.cboe.org and at the 4th and 7th floor reception desks.) The Nominating Committee strongly encourages candidates to submit a current resume or curriculum vitae along with their Application.

The Nominating Committee will seek to interview all candidates that submit an Application by August 29, 2005. Although the Nominating

Committee will continue to accept and consider any Applications submitted after August 29, 2005 up until the Committee meets to determine its slate of candidates (which it currently plans to do on September 29, 2005), candidates that submit an Application after August 29, 2005 are not guaranteed to have a Committee interview.

You may submit your Application in any of the following ways: (i) by hand, mail, or courier delivery to Arthur Reinstein, CBOE, 400 South LaSalle

Street, 7th Floor, Chicago, Illinois 60605; (ii) by e-mail to reinstei@cboe.com; or (iii) by facsimile to Arthur Reinstein at (312) 786-7919.

Individuals generally submit their names to the Nominating Committee for consideration by submitting an Application instead of through the submission of written nominations by others. The names of those who have submitted their names to the Nominating Committee to be considered for nomination will be posted on the Exchange’s bulletin board and on the Membership website.

The Nominating Committee will hold candidate interviews by appointment in September, 2005.

The Nominating Committee will schedule interviews by contacting candidates to appear before the Nominating Committee for an individual interview at one of its meetings. During these interviews, the Nominating Committee questions candidates about a broad range of relevant issues and seeks to ascertain the experience and expertise the candidate would bring to the Board of Directors or Nominating Committee. A candidate’s previous CBOE committee experience and regulatory history is also reviewed. After the interviews, the Nominating Committee selects the nominees that it believes will most effectively fill the available positions.

A candidate must satisfy the applicable qualification criteria for a position on the Board of Directors or Nominating Committee at the time of the

Nominating Committee slating meeting (currently scheduled for September 29, 2005) in order to be considered for nomination. A candidate that does not satisfy the qualification criteria at the time the candidate submits an Application may take steps to qualify before the Nominating

Committee slating meeting. The postings listing the candidates that have applied to be considered for nomination will indicate for each candidate as of the date of the posting whether the candidate satisfies the applicable qualification criteria, does not satisfy the applicable qualification criteria, or is being reviewed to determine whether or not the candidate satisfies the applicable qualification criteria.

The Nominating Committee expects to post its slate of candidates for available positions on the Board of Directors and Nominating Committee on or about September 30, 2005.

To run against the slated candidates, an individual must submit to the Office of the Secretary a petition signed by not less than 100 voting members of the Exchange. Any petitions must be received by no later than 5:00 p.m. (Chicago time) on October 31, 2005. The names of petition candidates, if any, will be posted on the Exchange bulletin board and on the Membership website.

The annual election meeting will be held on Thursday, November 17, 2005. The membership makes the final decisions with respect to ensuring that CBOE has the best leadership in the industry.

The following persons currently serve on the Nominating Committee: Gerald McNulty (GMC) (Chairman), Terrence Andrews (TAN), Lawrence

Blum, Daniel Carver (DPC), Thomas Durkin, Timothy Feeney (FNY), Donald Jacobs, Kenneth Mueller (OBE), and Nickolas Neubauer.

Please feel free to contact Gerald McNulty, Nominating Committee Chairman, at (312) 347-6328 if you have any questions regarding the nominating process or Arthur Reinstein, Legal Division, at (312) 786-7570 if you have any procedural questions regarding the nominating process or regarding how to complete the Application form.

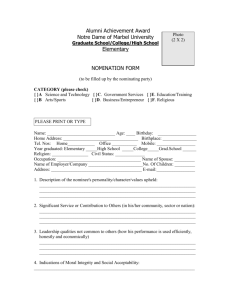

2005 CANDIDATE INFORMATION FORM

Return this form as soon as possible.

The Nominating Committee requests that completed forms be submitted by August 29, 2005.

The Nominating Committee strongly encourages candidates to also attach and submit a current resume or curriculum vitae.

Name: ___________________________________________________________________________________ Acronym: ______________________

Title: ___________________________________________________ Firm:___________________________________________________________

Business Address: ________________________________________________________________________________________________________

City/State/Zip: ____________________________________________________________________________________________________________

Home Address: ___________________________________________________________________________________________________________

City/State/Zip: ____________________________________________________________________________________________________________

Business Phone: ( ) ____________________________ Home Phone: ( ) ______________________________________

Trading Floor Phone: ( ) _________________________ Indicate: Trading Crowd Trading Booth Headset

Fax:____________________________________________________ Pager:__________________________________________________________

Cell Phone:______________________________________________ E-Mail: _________________________________________________________

POSITION(S) APPLIED FOR

1. Check the position(s) for which you are applying and indicate whether you currently satisfy the qualification criteria for the position(s) you have checked. (See page 4 for qualification criteria.)

3.

Floor Director (3-year term)

Lessor Director (3-year term)

Public Director (3-year term)

NOMINATING COMMITTEE

Firm Member (3-year term)

Yes

Yes

Yes

Yes

No

No

No

No

Floor Member (3-year term and 1-year term) Yes No

Lessor Member (3-year term) Yes No

Public Member (3-year term) Yes No

A candidate must be qualified at the time of the Nominating Committee slating meeting (currently scheduled for September 29, 2005) in order to be considered for nomination.

MEMBERSHIP STATUS

2. What are your current membership statuses, if any? (Check all that apply.)

Market-Maker Floor Broker DPM Designee

Owner Lessor Lessee

Remote Market-Maker

CBOT Exerciser ( CBOT Owner or CBOT Delegate)

Sole Proprietor

Nominee. Firm: ________________________________________________________________________________________________________

Registered For. Firm: ___________________________________________________________________________________________________

Person Associated with a Member Firm. Explain: ___________________________________________________________________________

________________________________________________________________________________________________________________________

None of the above

DISCIPLINARY HISTORY

Do you have any regulatory or disciplinary history and/or any pending regulatory or disciplinary matters? Yes No

4.

5.

6.

7.

9.

8.

Provide your employment history.

Employer

EMPLOYMENT HISTORY

Description of Position/Title Dates

COMMITTEE SERVICE

List all of your previous CBOE committee experience.

EDUCATION

Provide your educational background.

BUSINESS AFFILIATIONS

Identify all persons or entities involved in the securities, futures, or banking industry with whom you have a material business relationship and the nature of that relationship. Entities include, but are not limited to, corporations, partnerships, limited liability companies, securities exchanges or associations, commodities exchanges, not for profit organizations, and business associations.

A material business relationship includes being a shareholder, partner, director, officer, manager, member, or employee of an entity and any other business relationship that accounted for 10% or more of your income in the last 12 months or that is otherwise significant to you. If you are a shareholder or otherwise own an equity interest in a corporation, you need not identify that status unless you, directly or indirectly, beneficially own, or have the right to acquire, 5% or more of a class of voting security of the corporation, or unless your ownership may otherwise be deemed a material business relationship.

Person or Entity Description of Relationship

Identify all material business relationships that any member of your immediate family has with a person or entity involved in the securities, futures, or banking industry and the nature of that relationship. A member of your immediate family is defined as (i) a spouse or (ii) a child who resides with you.

Close Relative Person or Entity Description of Relationship

Identify any other relationships that you or a member of your immediate family have, or any other activities in which you or a

member of your immediate family are engaged, which could be regarded as constituting a conflict of interest with respect to your service as a CBOE director or Nominating Committee member.

PREVIOUS APPLICATIONS TO NOMINATING COMMITTEE

10. Identify all positions on the Board of Directors and Nominating Committee for which you applied to the Nominating Committee to be considered for nomination in the prior three years.

Year Position(s)

2004

2003

2002

11.

12.

13.

For Floor Director and Nominating Committee Floor Member candidates: Are you primarily engaged in business on the floor of the

Exchange in the capacity of a member?

For public and lessor candidates for the Board of Directors and Nominating Committee: Are you individually registered as a brokerdealer?

For public and lessor candidates for the Board of Directors and Nominating Committee: Identify if you have any direct or indirect affiliation with a broker-dealer or with an entity that is directly or indirectly affiliated with a broker-dealer as a parent, subsidiary, affiliate, or otherwise.

FLOOR DIRECTOR AND FLOOR MEMBER CANDIDATES ONLY

Person or Entity

PUBLIC AND LESSOR CANDIDATES ONLY

Yes

Yes

No

No

Description of Relationship

The Nominating Committee will seek to interview all candidates that submit this form by August 29, 2005. Although the Nominating

Committee will continue to accept and consider forms submitted by candidates after August 29, 2005 up until the Committee meets to determine its slate of candidates (which it currently plans to do on September 29, 2005), candidates that submit this form after August 29,

2005 are not guaranteed to have a Committee interview. The Nominating Committee will schedule interviews by contacting candidates to appear before the Nominating Committee for an individual interview at one of its meetings.

Completed forms and any accompanying resume or curriculum vitae should be submitted to:

Chicago Board Options Exchange, Incorporated

400 South LaSalle Street, 7 th Floor

Chicago, Illinois 60605

Fax: (312) 786-7919

Please also feel free to contact Gerald McNulty, Nominating Committee Chairman, at (312) 347-6328 if you have any questions regarding the nominating process or Arthur Reinstein, Legal Division, at (312) 786-7570 if you have any procedural questions regarding the nominating process or regarding how to complete this form.

Date of Issuance of Form: August 4, 2005

BOARD OF DIRECTORS QUALIFICATION CRITERIA (CBOE Constitution Section 6.1)

The Board of Directors consists of 23 directors – 22 directors who are elected by the membership of the Exchange (as described below) and the

Chairman of the Board, who is a member of the Board by virtue of his office. organization.

4 Floor A member who directly or indirectly owns and controls a membership and is primarily engaged in business on the floor of the Exchange in the capacity of a member.

1 Lessor A person who directly or indirectly owns and controls a membership with respect to which s/he acts solely as lessor and who is not actively engaged in business as a "broker-dealer" or as a "person associated with a broker-dealer" as those terms are defined in the Securities Exchange Act of 1934. who is not individually engaged in business on the Exchange floor.

The ordinary place of business of at least one of the two off-floor directors in each Class shall be a location more than 80 miles from the Exchange's trading floor.

11 Public A non-member who is not a broker-dealer or person affiliated with a broker-dealer.

For purposes of Section 6.1:

A person is considered to directly own and control a membership only if the person individually and directly owns of record and beneficially all right, title and interest in the membership.

A person is considered to indirectly own and control a membership only if the person: (A) has the sole and exclusive right to vote the membership and control its sale, and (B) is in possession of and subject to all of the risks and rewards of a direct owner of at least a fifty percent (50%) interest in a membership, either through ownership of an equity interest in a member organization or of a beneficial interest in a trust, which in either case is the owner of one or more memberships as permitted under the Rules.

NOMINATING COMMITTEE QUALIFICATION CRITERIA (CBOE Constitution Section 4.1)

The Nominating Committee consists of 10 elected members, as described below:

2 Firm An officer of a member organization that primarily conducts a non-member public customer business.

4 Floor A member who is primarily engaged in business on the floor of the Exchange in the capacity of a member.

2 Lessor A person who directly or indirectly owns and controls (as defined in Section 6.1) one or more memberships in respect of which s/he acts solely as lessor.

At least one of the lessor members may not be actively engaged in business as a "broker-dealer" or as a "person associated with a broker-dealer" as those terms are defined in the Securities Exchange Act of 1934.

For the 2005 annual election: Since the lessor member position that is not expiring is currently held by a person who is not a broker-dealer or a person associated with a broker-dealer, the open lessor member position may be filled by a person that directly or indirectly owns and controls one or more memberships in respect of which s/he acts solely as lessor and the person may or may not be actively engaged in business as a broker-dealer or as a person associated with a broker-dealer.

2 Public Representative of the public.

Page 7 August 12, 2005 Volume 33, Number 32 Chicago Board Options Exchange

Informational Circular IC05-95

August 10, 2005

Persons Who Have Submitted Their Names to Be Considered for Nomination to Board of Directors and Nominating Committee

For each annual election, the Nominating Committee selects nominees to fill expiring terms on the Board of Directors and Nominating Committee. To date, the individuals listed below have submitted their names to the Nominating Committee to be considered for nomination to fill these positions for the 2005 annual election.

A candidate is required to satisfy the qualification criteria for the applicable position at the time of the Nominating Committee slating meeting

(currently scheduled for September 29, 2005) in order to be considered for nomination. Any candidate that does not currently satisfy the qualification criteria may take steps to qualify before that time. A notation is included below after the name of each candidate indicating whether that candidate currently satisfies the applicable qualification criteria (denoted with a Q), does not currently satisfy the applicable qualification criteria (denoted with an N), or is being reviewed to determine whether or not the candidate currently satisfies the applicable qualification criteria

(denoted with an R).

Floor Director Lessor Director

Board of Directors

Public Director

James Boris (Q)

Eugene Sunshine (Q)

Mark Zurack (Q)

Nominating Committee

Firm Member Floor Member Lessor Member

Jeffrey Kirsch (Q)

Public Member

Information Circular IC05-99

August 12, 2005

Nominating Committee Open Meetings

Pursuant to CBOE Constitution Section 4.3, the Nominating Committee will be holding two meetings for purpose of selecting nominees for the

2005 annual election that will be open to the membership. The meetings will be held on September 14, 2005 in the Executive Conference

Room and on September 21, 2005 in the Executive Conference Room.

Any members wishing to express their views to the Nominating Committee regarding factors they believe the Nominating Committee should take into consideration in selecting nominees or regarding the candidates for the Board of Directors and Nominating Committee are welcome to attend. If you would like to attend, please contact Arthur Reinstein, Legal Division, at (312) 786-7570 by no later than September 6, 2005 to schedule an appointment to speak to the Nominating Committee during one of these meetings. If you are not able to appear in person, you may make an appointment to speak to the Nominating Committee by phone.

The following persons currently serve on the Nominating Committee: Gerald McNulty (GMC) (Chairman), Terrence Andrews (TAN), Lawrence

Blum, Anthony Carone (AJC), Daniel Carver (DPC), Thomas Durkin, Timothy Feeney (FNY), Donald Jacobs, Kenneth Mueller (OBE), and

Nickolas Neubauer.

Please also feel free to contact Gerald McNulty, Nominating Committee Chairman, at (312) 347-6328 if you have any questions regarding the nominating process or Arthur Reinstein, Legal Division, at (312) 786-7570 if you have any procedural questions regarding the nominating process.

Page 8 August 12, 2005 Volume 33, Number 32 Chicago Board Options Exchange

MEMBERSHIP INFORMATION FOR 8/4/05 THROUGH 8/10/05

MEMBERSHIP APPLICATIONS RECEIVED FOR

WHICH A POSTING PERIOD IS REQUIRED

Individual Membership Applicants Date Posted

Christopher J. McHugh (CMQ)

Zydeco Trading LLC

440 S. LaSalle, #970

Chicago, IL 60605

Termination Date

8/9/05

Eric T. McGoey, Nominee

Goldman Sachs & Co.

426 Childs Street

Wheaton, IL 60187

8/8/05 Jeff A. Schleusner (SLU)

PEAK6 Capital Management LLC

141 W. Jackson Blvd - Ste. 500

Chicago, IL 60604

8/9/05

MEMBERSHIP LEASES

Member Organizations

New Leases Effective Date Lessee(s): Termination Date

Lessor: Burt R. Bondy

Lessee: SLK-Hull Derivatives LLC

Rate: 1.25% Term: Monthly

Lessor: Richard E. Sims

Lessee: Wolverine Trading LLC

Rate: 1.25% Term: Monthly

8/4/05

8/4/05

Monadnock Capital Management, LP

1900 Market Street, Suite 616

Philadelphia, PA 19103

EFFECTIVE MEMBERSHIPS

8/4/05

Lessor: David Schorvitz LLC

Lessee: SLK-Hull Derivatives LLC

Rate: 1.25% Term: Monthly

8/4/05

Individual Members

Nominee(s) / Inactive Nominee(s): Effective Date

Lessor: Hartz Construction Company, Inc.

8/10/05

Lessee: Cutler Group, LP

Rate:

Raymond F. Hurley, NOMINEE

1.25% Term: Monthly

Michael R. Lossia (MRL)

PEAK6 Capital Management LLC

141 W. Jackson, Suite 500

Chicago, IL 60604

Type of Business to be Conducted: Market Maker

8/9/05

Lessor: VCF, Inc.

Lessee: Ronin Capital, LLC

David Michael Johnson, NOMINEE

Rate: 1.25% Term: Monthly

Terminated Leases

8/10/05

Termination Date

Raymond F. Hurley (RAE)

Cutler Group, LP

440 S. LaSalle, Ste. 1124

Chicago, IL 60605

Type of Business to be Conducted: Market Maker

8/10/05

JOINT ACCOUNTS

Lessor: Burt R. Bondy

Lessee: Goldman Sachs & Co.

8/4/05

New Participants Acronym Effective Date

Kathleen A. McCullough QLO 8/5/05 Lessor: Richard E. Sims

Lessee: Monadnock Capital Management, LP

Kevin Thomas, NOMINEE

8/4/05

Kathleen A. McCullough QEW 8/5/05

Lessor: David Schorvitz LLC

Lessee: BBS Partners LLC

8/4/05 Kathleen A. McCullough QFS 8/5/05

Kathleen A. McCullough QJY 8/5/05

Lessor: Andrie Trading LLC

Lessee: Man Securities Inc.

John V. Phaby (PHB), NOMINEE

MEMBERSHIP TERMINATIONS

8/9/05

Kathleen A. McCullough

Kathleen A. McCullough

QMD

QNA

8/5/05

8/5/05

Kathleen A. McCullough QPO 8/5/05

Individual Members

Nominee(s) / Inactive Nominee(s): Termination Date

Kathleen A. McCullough

Kathleen A. McCullough

QUT

QVA

8/5/05

8/5/05

Frank A. Brodlo (FBO)

BBS Partners LLC

440 S. LaSalle, Ste. #623

Chicago, IL 60605

8/4/05

Kathleen A. McCullough

Kathleen A. McCullough

QYH

QYS

8/5/05

8/5/05

Gavin B. Rowe QLK 8/9/05

Kevin J. Thomas (KTO)

Monadnock Capital Management, LP

5266 Brentwood Cr.

Long Grove, IL 60047

John L. O’Donnell (ODL)

Equitec Structured Products, LLC

8743 Carriage Lane

Tinley Park, IL 60477

8/4/05

8/8/05

Kevin M. Scanlan

New Accounts

Kevin C. Applehoff

John J. Kaminsky

QLK

Acronym

QLK

QLK

8/9/05

Effective Date

8/4/05

8/4/05

Page 9

New Accounts

Harry J. Kasprzyk

Sergio Padilla

David Rodriguez

Miguel Rosales

Acronym

Terminated Participants Acronym

Christopher J. McHugh

Christopher J. McHugh

August 12, 2005

QLK

QLK

QLK

QLK

QKX

QZK

Volume 33, Number 32

Effective Date

Chicago Board Options Exchange

MEMBER ADDRESS CHANGES

8/4/05

Individual Members Effective Date

8/4/05

8/4/05

J. Slade Winchester

2208 Blaisdell Ave.

Minneapolis, MN 55404

8/4/05

8/4/05

Termination Date

Ronald A. Marsh

2633 N. Paulina Street

Chicago, IL 60614

8/9/05

8/9/05

8/9/05

Jeffrey J. Walsh

440 S. LaSalle - Ste. 1124

Chicago, IL 60605

8/9/05

CHANGES IN MEMBERSHIP STATUS

Member Organizations Effective Date

Individual Members Effective Date

8/5/05

Daniel T. Hillegass 8/5/05

From: Nominee For Group One Trading, LP; Market Maker /

To:

Floor Broker

CBT Registered For Group One Trading, LP; Market

Maker / Floor Broker

A D W Corp.

Attn: Bernice Weiss

6352 San Michel Way

DelRay Beach, FL 33484

164 Associates

565 Locust St.

Winnetka, IL 60093

8/8/05

Kathleen A. McCullough 8/5/05

From: Nominee For Global Execution Brokers, LP; Floor

To:

Broker

Nominee For Susquehanna Investment Group; Market

Maker / Floor Broker

POSITION LIMIT CIRCULARS

Pursuant to Exchange Rule 4.11, the Exchange issued the below listed Position Limit Circulars between August 8 and August 11, 2005. The complete circulars are available from the Department of Market Regulation, in the data information bins on the 2nd Floor of the Exchange, and on the CBOE website at cboe.com under the “Market Data” tab.

To receive regular updates of the position limit list via fax, contact Candice Nickrand at (312) 786-7730. Questions concerning position and exercise limits may be directed to the Department of Market Regulation to Dan Earner at (312) 786-7059 or Tim Mac Donald at (312) 786-7706.

Position Limit Circular PL05-36

August 8, 2005

SpectraSite, Inc. (“SSI”) merger completed with

Asteroid Merger Sub, LLC, a wholly owned subsidiary of

American Tower Corporation Class A (“AMT/VXK/WVY”)

Effective Date August 8, 2005

Position Limit Circular PL05-37

August 11, 2005

Unocal Corporation (“UCL/VCL/WCL”) merger completed with

Blue Merger Sub, Inc., a wholly owned subsidiary of Chevron

Corporation (“CVX/VCH/WCH”)

Effective Date August 11, 2005

Page 10 August 12, 2005 Volume 33, Number 32 Chicago Board Options Exchange

RESEARCH CIRCULARS

The following Research Circulars were distributed between August 5 and August 11, 2005. If you wish to read the entire document, please refer to the CBOE website at www.cboe.com and click on the “Trading Tools” Tab. New listings and series information is also available in the Trading

Tools section of the website. For questions regarding information discussed in a Research Circular, please call The Options Clearing Corporation at 1-888-OPTIONS.

Research Circular #RS05-558

August 5, 2005

*****UPDATE*****UPDATE*****UPDATE*****

Unocal Corporation (“UCL/VCL/WCL”) Proposed

Election Merger with Chevron Corporation (“CVX/VCH/WCH”)

Research Circular #RS05-559

August 8, 2005

SpectraSite, Inc. (“SSI”) Merger COMPLETED with American Tower Corporation Class A (“AMT/VXK/WVY”)

Research Circular #RS05-560

August 8, 2005

Impax Laboratories, Inc. (“IPXLE/UPR”)

Underlying Symbol Change to “IPXL”

Effective Date: August 8, 2005

Research Circular #RS05-561

August 8, 2005

IAC/INTERACTIVECORP (“IACI/QTH/VSW/YOY & adj. EKJ/OWK”)

DISTRIBUTION of Expedia, Inc. (“EXPD”)and REVERSE SPLIT

Ex-Distribution Date: August 9, 2005

Research Circular #RS05-564

August 10, 2005

*****UPATE*****UPDATE*****UPDATE*****

Nextel Communications, Inc. (“NXTL/FQC/VFU/WFU”)

Proposed Merger with Sprint Corporation (“FON/VN/WO”)

Research Circular #RS05-565

August 10, 2005

Sprint Corporation (“FON”)

Name, Stock and Option Symbol Change to

Sprint Nextel Corporation (“S”)

Anticipated Effective Date: August 15, 2005

Research Circular #RS05-567

August 10, 2005

Unocal Corporation (“UCL/VCL/WCL”) Election Merger

COMPLETED with Chevron Corporation (“CVX/VCH/WCH”)

Research Circular #RS05-568

August 10, 2005

SpectraSite, Inc. (“SSI/adj. SZS”)

Determination of Cash-in-Lieu Amount

Research Circular #RS05-570

August 11, 2005

SunGard Data Systems Inc. (“SDS/OSW/YYK”) Merger

COMPLETED with Solar Capital Corp.

August 17, 2005

Regulatory

Circulars

Regulatory

Bulletin

Volume RB16, Number 33

The Constitution and Rules of the Chicago Board Options Exchange, Incorporated

(“Exchange”), in certain specific instances, require the Exchange to provide notice to the membership. The weekly Regulatory Bulletin is delivered to all effective members to satisfy this requirement.

Copyright © 2004 Chicago Board Options Exchange, Incorporated

Regulatory Circular RG05-64

Date:

To:

From:

Re:

July 27, 2005

Members and Member Firms

Market Operations Department

Restrictions on Transactions in

Aphton Corporation (APHT)

On the opening of business on July 25, 2005 the listing of Aphton Corporation (APHT) was transferred to the Nasdaq SmallCAP Market.

As previously announced by CBOE, trading on CBOE in existing series of APHT (VHX,

WQM) options has been subject to the following restrictions since July 25, 2005. Only closing transactions maybe effected in any series of APHT (VHX, WQM) options except for

(i) opening transactions by Market-Makers executed to accommodate closing transactions of other market participants and (ii) opening transactions by CBOE member organizations to facilitate the closing transactions of public customers executed as crosses pursuant to and in accordance with CBOE Rule 6.74(b) or (d).

The execution of opening transactions in APHT (VHX, WQM) options, except as permitted above, and/or the misrepresentation as to whether an order is opening or closing, will constitute a violation of CBOE rules, and may result in disciplinary action. Member organizations should ensure that they have appropriate procedures in place to prevent their customers from entering opening orders in this restricted option class.

There are no restrictions in place with respect to the exercise of APHT (VHX, WQM) options. The provisions of this circular apply to any options on Aphton traded on CBOE.

Any questions regarding this circular may directed to Kerry Winters at (312) 786-7312 or

Joanne Heenan-Hustad at (312) 786-7786.

Regulatory Circulars continued

Regulatory Circular RG05-65

Date: August 1, 2005

To:

From:

Subject:

The Membership

Financial Planning Committee

Fee Reductions for August 2005

CBOE has averaged approximately 1,580,000 contracts per day (CPD) during the period

July 2004 through July 2005.

Per the Prospective Fee Reduction Program, Market-Maker and DPM transaction fees and floor brokerage fees will be reduced by 20% per contract from standard rates during August

2005 (July 2005 discounts were also 20%).

Fee

Standard

Rate

Aug. ‘05

Rate

Equities Market-Maker Trans. Fee

Equities DPM Trans. Fee

QQQQ, SPY & Indexes

Mrkt.-Maker/DPM Trans. Fee

Floor Brokerage Fee

22 cents

12 cents

(1)24 cents

4 cents

17.6 cents

9.6 cents

(1) 19.2 cents

3.2 cents

(1) Above rates exclude a 10 cents license fee surcharge for the following products:

• Dow Jones indexes

•

•

•

Mini Nasdaq 100 (MNX)

Nasdaq 100 (NDX)

Russell 2000 cash-settled index (RUT)

Please call Ermer Love (312-786-7032) if you have any questions.

Regulatory Circular RG05-66

Date:

To:

August 8, 2005

Members and Member Firms

From: Index Floor Procedure Committee

SPX Floor Procedure Committee

SEC Approval of 1000 Spoke RAES Wheel Re:

The Securities and Exchange Commission recently approved a CBOE rule filing (SR-

CBOE-2005-24) which allows the appropriate Floor Procedure Committee (“appropriate FPC”) to implement a new order assignment procedure for RAES referred to as the “1000 Spoke

RAES Wheel”. The 1000 Spoke RAES Wheel (“Wheel”) would replace any current RAES allocation structure in those classes where the appropriate Floor Procedure Committee determines to apply it.

RB2 August 17, 2005, Volume RB16, Number 33

Regulatory Circulars continued

Regulatory Circular RG05-66 continued

Summary of the 1000 Spoke Wheel Assignment Methodology

Under CBOE Rule 6.8.06(d), which sets forth the procedures for the Wheel, the appropriate

FPC determines whether the assignment of RAES orders to logged-in Market-Makers is based on the percentage of a Market-Maker’s contracts traded in that index option class

(excluding RAES contracts traded) compared to all Market-Maker contracts traded (excluding RAES contracts) during the review period, or the percentage of the Market-Maker’s inperson agency 1 contracts traded in that class (excluding RAES contracts traded) compared to all Market-Maker in-person agency contracts traded (excluding RAES contracts) during the review period. The review period will be set by the appropriate FPC and it may be for any period not in excess of 10 trading days within the previous 30 calendar days. The trading days within the review period may be for non-consecutive trading days. The percentage distribution will be calculated at the conclusion of each trading day and will be applied to the

Wheel distribution on the following trading day. This means that a particular Market-Maker’s entitlement will change every day based upon the percentage of contracts (all contracts

(excluding RAES contracts) or in-person agency contracts (excluding RAES contracts), as applicable) that Market-Maker traded in the previous review period.

Generally, this means, for example, that if a particular Market-Maker traded 2% of all the contracts (excluding RAES contracts) in an index option class for a particular review period at the conclusion of a trading day, then that Market-Maker would be assigned 2% of the

RAES contracts on the following trading day.

New Market-Makers

Any Market-Maker that logs onto RAES during a particular review period will be guaranteed an entitlement during that review period of 1 spoke. Similarly, an existing Market-Maker who was on vacation for the whole of the previous review period, and who thus had no trading history during that review period would receive a 1 spoke allocation if he or she logged on

RAES during the review period immediately following his or her return.

Spoke Size

The Wheel can be envisioned as having a number of spokes, each generally representing .1

percent of the total participation of all Market-Makers in the class. Thus, a Market-Maker will generally be assigned 1 spoke for each .1 percent of his or her Market-Maker participation during the review period. If the spoke size is 1 contract and all Market-Makers who traded contracts in that option class during the review period are logged on RAES, and no other Market-Makers are logged on, the Wheel would consist of 1000 contracts, representing 100 percent of all Market-Maker activity during the review period. The Committee may also establish a spoke size greater than 1 contract. Setting the spoke size to 5 contracts, for example, would redefine the Wheel for a particular option class as a Wheel of 5000 contracts. Although increasing the spoke size means the Wheel would not revolve as quickly through the logged on Market-Makers, the participation percentage of the individual

Market-Makers does not change.

1 Agency contracts are any contracts represented by an agent (booked orders and orders represented by brokers) and do not include contracts traded between Market-Makers in person in the trading crowd.

August 17, 2005, Volume RB16, Number 33 RB3

Regulatory Circulars continued

Regulatory Circular RG05-66 continued

Wedge Size

A wedge is the maximum number of spokes that may be assigned to a Market-Maker in any one “hit” during a rotation of the Wheel. The purpose of the wedge is to break up the distribution of contracts into smaller groupings to reduce the exposure of any one Market-

Maker to market risk. If the size of the wedge is smaller than the number of spokes to which a particular Market-Maker may be entitled based on his or her participation percentage, that Market-Maker would receive one or more additional assignments during one revolution of the Wheel. For example, in the case where 1 spoke is equal to 1 contract and the Market-Maker’s participation percentage is 5 percent (5 percent of 1000 spokes, which equals 50 contracts if each spoke equals 1 contract) and the wedge size is 5, that Market-

Maker first would be assigned 5 contracts on the Wheel and would then receive additional allocations of 5 contracts at a different place on the Wheel during the same revolution of the Wheel. The wedge size is variable at the discretion of the appropriate FPC.

Questions concerning this circular may be directed to Greg Burkhardt, Trading Systems

Support, at (312) 786-7531.

Regulatory Circular RG05-67

Date: August 8, 2005

From:

Re:

Market Operations Department

Restrictions on Transactions in

Impax Laboratories (ILPXE/UPR)

On the opening of business on August 8, 2005, Impax Laboratories (UPR) was delisted from the Nasdaq.

As of August 8, 2005 trading on CBOE in existing series of UPR options will be subject to the following restrictions. Only closing transactions maybe effected in any series of UPR options except for (i) opening transactions by Market-Makers executed to accommodate closing transactions of other market participants and (ii) opening transactions by CBOE member organizations to facilitate the closing transactions of public customers executed as crosses pursuant to and in accordance with CBOE Rule 6.74(b) or (d).

The execution of opening transactions in UPR options, except as permitted above, and/or the misrepresentation as to whether an order is opening or closing, will constitute a violation of CBOE rules, and may result in disciplinary action. Member organizations should ensure that they have appropriate procedures in place to prevent their customers from entering opening orders in this restricted option class.

There are no restrictions in place with respect to the exercise of UPR options. The provisions of this circular apply to any options on UPR traded on CBOE.

Any questions regarding this circular may directed to Kerry Winters at (312) 786-7312 or

Joanne Heenan-Hustad at (312) 786-7786.

RB4 August 17, 2005, Volume RB16, Number 33

Rule Changes,

Interpretations and Policies

EFFECTIVE-ON-FILING RULE CHANGE(S)

The following rule filing(s) were submitted to the SEC “effective-on-filing,” and have taken effect pursuant to Section 19(b)(3) of the Securities Exchange Act. They will remain in effect barring further action by the SEC within 60 days after their publication in the Federal

Register. Copies are available on the CBOE public website at www.cboe.com/legal/ effectivefiling.aspx.

SR-CBOE-2005-61 Extension of Position Limit Pilot Program

On August 8, 2005, the Exchange filed Rule Change File No. SR-CBOE-2005-61, which filing proposes to extend the pilot program for position and exercise limits for equity option contracts and options on the Nasdaq-100 Index Tracking Stock (“QQQQ”) an additional 6 months. Any questions regarding the rule change may be directed to James Flynn, Legal

Division, at 312-786-7070. The text of the proposed rule amendments is set forth below.

Proposed new language is underlined. Proposed deleted language is [bracketed and stricken out].

Rule 4.11 - Position Limits

Rule 4.11. Except with the prior permission of the President or his designee, to be confirmed in writing, no member shall make, for any account in which it has an interest or for the account of any customer, an opening transaction on any exchange if the member has reason to believe that as a result of such transaction the member or its customer would, acting alone or in concert with others, directly or indirectly, (a) control an aggregate position in an option contract dealt in on the

Exchange in excess of 13,500 or 22,500 or 31,500 or 60,000 or 75,000 option contracts (whether long or short), except that for a pilot program period of 6 months

(“Rule 4.11 Pilot Program Period”) from [February 23, 2005] August 24, 2005 through

[August 23, 2005] February 23, 2006, the position limits shall be 25,000 or 50,000 or 75,000 or 200,000 or 250,000 option contracts (whether long or short), of the put type and the call type on the same side of the market respecting the same underlying security, combining for purposes of this position limit long positions in put options with short positions in call options, and short positions in put options with long positions in call options, or such other number of option contracts as may be fixed from time to time by the Exchange as the position limit for one or more classes or series of options, or (b) exceed the applicable position limit fixed from time to time by another exchange for an option contract not dealt in on the Exchange, when the member is not a member of the other exchange on which the transaction was effected. In addition, should a member have reason to believe that a position in any account in which it has an interest or for the account of any customer is in excess of the applicable limit, such member shall promptly take the action necessary to bring the position into compliance. Reasonable notice shall be given of each new position limit fixed by the Exchange, by publicly posting notice thereof. Limits shall be determined in the manner described in Interpretations .02

and .04 below.

August 17, 2005, Volume RB16, Number 33 RB5

Rule Changes,

Interpretations and

Policies continued

SR-CBOE-2005-62 Clarification of Exchange Rules Relating to Proxy Statements

On August 9, 2005, the Exchange filed Rule Change File No. SR-CBOE-2005-62, which filing proposes to clarify Exchange Rules relating to proxy statements. Any questions regarding the rule change may be directed to James Flynn, Legal Division, at 312-786-

7070. The text of the proposed rule amendments is set forth below. Proposed new language is underlined. Proposed deleted language is [bracketed and stricken out].

Rule 31.82

Application of Proxy Rules

Exchange Rules apply to member organizations regardless of whether the security involved is traded on the Exchange. However, if a conflict arises between these rules and those of another registered national securities association or exchange, the rules of the Exchange apply only if it is the principal market for the security.

. . . Interpretations and Policies:

.01

For the purposes of Rule 31.82, no conflict will be deemed to exist between Exchange rules and the rules of another registered national securities exchange or association relating to the giving of proxies by a member organization if the rules of the registered national securities exchange or association contain a provision that would allow a member to elect to apply CBOE rules to the giving of such proxies rather than the rules of the other registered national securities exchange or association.

* * * * *

Rule 31.83. Giving of Proxies—Restrictions on Member Organizations

Except as provided in Rule 31.85, [N]no member organization shall give, or authorize the giving of, a proxy to vote stock registered in its name, or in the name of its nominee, unless such member organization is the beneficial owner of such stock.

* * * * *

Rule 31.85. Giving Proxies by Member Organization

(a) – (h) No Change.

. . . Interpretations and Policies:

.01 For purposes of Rule 31.85(a)(1) and (2), a member organization will be deemed to have transmitted proxy-soliciting material to the beneficial owner of stock if the material is delivered to an investment adviser, registered under the

Investment Advisers Act of 1940 or under the laws of a state, who exercises discretion pursuant to an advisory contract for the beneficial owner and has been designated in writing by the beneficial owner of such stock (a “designated investment adviser”) to receive soliciting material in lieu of the beneficial owner; and the member organization may act in accordance with any voting instructions submitted by the designated investment adviser on behalf of the beneficial owner.

RB6 August 17, 2005, Volume RB16, Number 33