Yu-Chu Shen Vivian Wu and Glenn Melnick

Academy Health Annual Research Conference

June 29, 2009

Yu-Chu Shen

Naval Postgraduate School and NBER

Vivian Wu and Glenn Melnick

University of Southern California and Rand

We thank RWJF’s HCFO Initiative grant #56110 for funding this research

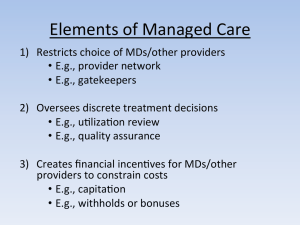

Background

Health care spending accelerated after

2000 after a decade of slow growth

Current administration has two choices to control health care spending: through the market or through regulation

In the past, look to managed care to rein in the provider spending

Research objectives

How does market structure affect hospital revenue:

HMO Penetration, HMO Concentration,

HMO For-profit share, hospital competition

Are HMO effects on revenue through both price and quantity?

Do these relationship change over time (1994-1999 and 2000-2005)?

Changes in HMO Market Structure 1995-2005

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

1994-1999 2000-2005

HMO penetration

Percent with <-2%pt growth

1994-1999 2000-2005

HMO Herfindahl index

Percent with (-2,2)%pt growth

1994-1999 2000-2005

HMO for-profit share

Percent with >2%pt growth

Data

Hospital data

Medicare hospital cost reports (HCRIS)

AHA surveys

MEDPAR (to construct hospital competition measure)

HMO data

Laurence Baker - thanks

Interstudy

Other area characteristics

Area Resource Files

Hospital system membership info from Kristin

Madison and Sujoy Chakravarty – thanks

Sample

All short-term, general, non-federal hospitals located in MSAs in the

United States.

Time period covered: 1994-2005

Methods Overview (1)

Dependent Variables

Net patient revenue

Price proxy

Quantity: adjusted patient days

Market Structure Variables

Measured at MSA level:

HMO penetration

HMO concentration (HHI)

HMO for-profit share

Measured at hospital level:

Hospital concentration (HHI)

Methods Overview (2)

Other control variables

Hospital characteristics

Other Market characteristics

Unit of observation: hospital

Hospital/MSA fixed-effects translog model

Standard errors are adjusted to account for clustering at the MSA level.

Predicted Change in Patient Revenue

(in percentage difference)

All

Hospitals

Hospitals by Levels of HMO Penetration

Low HMO

Penetratio n

HMO penetration increases by 10 percentage points

1994-1999 -4.15** -4.12+

2000-2005 -2.06+

HMO Herfindahl index increases by 0.10

1994-1999 0.40

-1.35

0.25

2000-2005 -0.09

-0.07

HMO for-profit share increases by 10 percentage points

1994-1999 -0.21

-0.03

2000-2005 -0.17

-0.45*

High HMO

Penetratio n

-4.33**

-3.46+

1.33

0.24

-1.16*

-0.57

Predicted Change in Price and Quantity

Price

HMO penetration increases by 10 percentage points

1994-1999 -3.72**

2000-2005 -1.76

Quantity

-1.75*

-1.14+

HMO Penetration Effects -

Summary

Of the three market aspects, HMO penetration has the strongest effect on hospital revenue.

Overall revenue containment effects weaken post-2000

Constrains prices and quantity in 1994-

1999 period

Price effect disappears in 2000-2005

Analysis of Relative Bargaining Power –

HMOs vs Hospitals

All

Hospitals

Hospitals by Levels of HMO Penetration

Low HMO

Penetratio n

HMO penetration increases by 10 percentage points

1994-1999 -4.15** -4.12+

2000-2005 -2.06+

HMO Herfindahl index increases by 0.10

1994-1999 0.40

-1.35

0.25

2000-2005 -0.09

-0.07

HMO for-profit share increases by 10 percentage points

1994-1999 -0.21

-0.03

2000-2005 -0.17

-0.45*

High HMO

Penetratio n

-4.33**

-3.46+

1.33

0.24

-1.16*

-0.57

Analysis of Relative Bargaining

Power – HMOs vs Hospitals

No linear relationship between HMO concentration and revenue.

Could be a threshold effect

Divide markets into 4 quadrants

HMO HHI >3200 HMO HHI <= 3200

Hospital HHI >3200

Hospital HHI <=3200

Both markets concentrated

HMO dominant markets

Hospital dominant markets

Both markets competitive

Predicted Difference in Revenue, Price and Quantity by HMO Market’s

Relative Bargaining Power

Whole Sample

Revenue

Both are concentrated markets

HMO dominant market

Hospital dominant markets

Price

Both are concentrated markets

HMO dominant market

Hospital dominant markets

Quantity

Both are concentrated markets

HMO dominant market

Hospital dominant markets

1994-1999

--

2000-

2005

--

-19% ** -26% **

1% + 2% **

---

-22% ** -29% **

3% ** 3% **

---

-9% ** -11% **

7% ** 4% **

Similar Results When Analyzing

Managed Care (HMO+PPO) in 2001-

2004

Bargaining Power Analysis -

Summary

Only highly concentrated managed care markets (HHI>3200) can depress revenue and price substantially

In 2001-2004, 11% of MSAs (7% of all hospitals) are in markets with

>3200 managed care HHI.

Conclusion and Discussion

High HMO penetration effect though weaker, still constrained hospital revenue growth in 2000s

But fewer markets are in that category.

Relative bargaining power between managed care and hospital markets matters

Highly concentrated HMO markets can hold down hospital price, but very few markets are in that category.