MEPS: A National Information Resource to

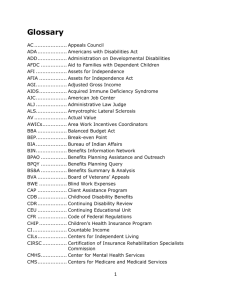

advertisement

MEPS: A National Information Resource to Support pp Health Research and Inform Policy y and Practice Steven B. Cohen PhD Joel W. Cohen PhD & Jessica C. Banthin PhD Presentation AHRQ mission and emphasis on information and research efforts that translate into policy and practice MEPS overview Program outreach and impact Research Update Modeling and Simulation Studies MEPS S Data a a Products oduc s and a d Dissemination sse a o Medical Expenditure Panel Survey (MEPS) Annual Survey of 14,000 households: provides national estimates of health care use, expenditures, insurance coverage, sources off payment, t access to t care and d health care quality Permits studies of: Distribution of expenditures and sources of payment Role of demographics, family structure, insurance Expenditures for specific conditions Trends over time MEPS Components p Household Component (HC) Medical Provider Component (MPC) Insurance Component (IC) MEPS Household Component Sample Design Oversampling of policy relevant domains 1996 Minorities (Blacks & Hispanics) 1997 Minorities Low income Children with activity limitations Adults with functional limitations Predicted high expenditure cases Elderly 1998--2001 1998 Mi iti Minorities 2002--2008 2002 Minorities, Asians, Low Income 2009+ Minorities Asians Minorities, 14,000 households; ~32,000 persons HC - Purpose p Estimates annual health care use and expenditures Provides distributional estimates Supports person and family level analysis Tracks changes in insurance coverage and d employment l t Longitudinal design; linkage to NHIS Key Features of MEPS MEPS--HC Survey of U.S. civilian noninstitutionalized population Sub Sub--sample of respondents to the National Health Interview Survey (NHIS) – Linkage to NHIS Oversample of minorities and other target groups Panel Survey – new panel introduced each year – Continuous data collection over 2 ½ year period – 5 inin-p person interviews ((CAPI)) – Data from 1st year of new panel combined with data from 2nd year of previous panel MEPS Overlapping Panels ((Panels 13 and 14)) MEPS Household Component MEPS Panel 13 20082009 1/1/2008 NHIS 2007 Round 1 1/1/2009 Round 2 Round 3 NHIS 2008 Round 4 Round 1 Round 5 Round 2 Round 3 Round 4 MEPS Panel 14 2009-2010 Round 5 MEPS - Integrated Survey g Features Design National Health Interview Survey serves as sample l fframe ffor Household H h ld Component Census Bureau Business Register serves as Insurance Component sample frame Secondary data on health care measures supplement surveys Linked surveyy of medical providers p Distinct data sources linked for longitudinal g analyses y Evaluation of Accuracy of MEPS after Adjustments for Survey Nonresponse MEPS has overlapping panel design: 1st year of new panel combined with data from 2nd year of previous year’s panel to yield annual data Multiplicative response rates: product of NHIS RR and MEPS RR (multiplicative function of round specific RR: 3 rounds for new panel/5 rounds for old panel) Detailed adjustments for survey nonresponse: NHIS to MEPS round 1/MEPS round 1 to round 3: to derive annual estimates for year t MEPS round 3 to round 5: annual estimates for year t+1. Testing for Panel Effect Capacity of MEPS to Produce Comparable NHIS Estimates of Health I Insurance Coverage C Medical Provider Component Purpose Compensate for household item nonresponse Gold standard for expenditure estimates Greater accuracy and detail Imputation source Supports methodological studies Medical Provider Component Targeted Sample All associated hospitals and associated physicians Sample of associated officeoffice-based physicians All associated home health agencies All associated pharmacies Data Collected Dates of visit Diagnosis and procedure codes Charges (except Rx) and payments MPC: Correction Source for Item Nonresponse p Source for event level expenditures Household Reported Nonresponse reported nonresponse 1Recalibrated Provider reported reported nonresponse nonresponse MEPS value - Yij Yij = Provider $ij Yij = Provider $ij Y = Household $ij 1 ij Yij = Imputed $ij as necessary based on analyses of concordance b t between sources Determination of Factors for Expenditure Imputation Hot Deck Imputation: Classification Variables for Donors and Recipients Factors associated with predicting medical expenditures Factors associated with item nonresponse Collection of Rx Data in MEPS ~8,000 8,000 pharmacies sampled annually – data on prescribed medicines purchased by households Data obtained: – Medication Name – National Drug Code (NDC) – Quantity Dispensed – Strength St th and dF Form – Sources of Payment – Amount A t Paid P id b by E Each hS Source MEPS Insurance p Component Annual survey of 40 40,000 000 establishments National and State Level estimates of employer sponsored coverage: Availability of health insurance Access to health insurance Cost of health insurance Benefit and payment y provisions of private health insurance Published Estimates from the MEPS--Insurance Component MEPS Each year the MEPSMEPS-IC produces 280 tables of State St Statet -level l l estimates ti t ffor privateprivate i t -sector t employers: l – Premiums, – Contributions, C t ib ti – Enrollments, – Take Take--up rates, and – Other (i.e., percent of employees with a choice off plans) l ) Survey began in 1996 with estimates for 40 States Since Si 2003, 2003 estimates i are available il bl ffor allll S States Current Capacity p y AHRQ’ss MEPS data and research findings AHRQ provide national and state specific estimates of: the uninsured population – by length of time, availability of offers, income level the characteristics of employer sponsored coverage – availability, employee take up, premium costs (employer/employee) health care utilization, expenditures, source of payment, p y , and health status p profiles by y insurance coverage status Trends in medical care costs, coverage and use Impact of economic and behavioral factors, payment and individual demand on health care service utilization and expenditures Distribution of expenditures, concentration and persistence of high levels Expenditures for chronic conditions: focus on patients with multiple chronic conditions Trends T d in i prescription i ti medications di ti b by d drug class l Research on Health Insurance Tracks overall health insurance status of the U.S. population – Estimates of uninsured by population characteristics – Duration of spells of uninsurance – Trends in estimates of the uninsured More focused research examines – Factors associated with insurance take up – Financial consequences of being uninsured – Relationship between uninsurance and health status MEPS Definition and estimation of uninsured Types T off estimates ti t off uninsured i d – calendar l d year focus: 1 First half of calendar year 1. 2. Annual profiles 3 Two consecutive years 3. 4. Point in time 5. Long 5 Longo g-term e u uninsured: su ed 4 co consecutive secu e yea years s As a longitudinal g survey y MEPS can examine health insurance dynamics, changes in coverage, and spells without insurance Economic Research Infrastructure Data infrastructure to support intramural, extramural work on cost and financing, financing efficiency and quality, quality access, disparities. – Significant intramural expertise and activity – Large and growing use by extramural researchers Data Center onon-site for work with MEPS The Th link li k between b t research h and d data d t – Substantive expertise reflected in design of AHRQAHRQ- sponsored p data resources and tools – Maintain and increase quality, integrity, and relevance through researcher researcher--informed data improvements, substantive and technical assistance Assistance to Congress on Coverage Trends and Cost Provision of AHRQ research findings to inform health policy – national estimates of the long term uninsured – estimates of the number of uninsured children eligible for CHIP – state estimates of the availability and cost of employer sponsored coverage – concentration of health care expenditures Fast Fast--track responses to requests from CBO, CRS, Senate and House Committees and Congressional g staff Recent Collaborations CDC, Medicaid Chronic Disease Directors and National Pharmaceutical Council Development of tool to calculate prevalenceprevalence-based state state-specific Medicaid and total cost estimates for : heart diseases, stroke, hypertension, congestive heart failure, diabetes, and cancer Cost estimation tool based on Medical Expenditure Panel Survey (MEPS) data consideration of enhancements that identifies the impact p of specific p i t interventions ti on costs t and d health h lth outcomes t National Academy of Sciences: IOM Study on Health Insurance Status and Its Consequences Assessment of health status and financial burdens faced by the uninsured, i d focus f on impact i t off coverage trends t d over prior i decade d d Visible use of AHRQ’s MEPS as a sentinel data base Recent Collaborations Kaiser Permanente Care Management Institute: Concentration of Health Care Expenditures Effort focused on the 1% of population accounting f 25% off medical for di l expenditures dit coordination in development of predictive models study impact of enhanced care management on cost and health NAS Panel: Research Program on the Design of National Health Accounts Focus on measuring changes in the population’s health within an health accounts framework Examination E i ti off costt and d value l off h health lth care Visible use of AHRQ’s MEPS as a sentinel data base MEPS Informs Consumers’ Checkbook Guide to Health Plans Annual publication Rates every plan available to federal employees and retirees Compares likely cost of various plan options p to employee Example: Estimated 2007 cost to average family of 4 with head of household under 55 years of age Approximate Yearly Cost to You ($) Plan Cod e Plan Name Yearly Premiu m ($) If Your Health Care Usage were Low If Your Health Care Usage were Average If Your Health Care Usage were High Yearly Limit on Cost to You Excluding Dental ($) Local Plans E35 Kaiser-St 1210 1420 2670 4800 8880 E32 Kaiser-Hi 2480 2590 3340 4680 7230 JP2 M.D. IPA 2190 2340 3300 5170 7990 JN5 Aetna Open AccessBasic 1420 1630 3090 5900 8880 JN2 Aetna Open Access-Hi Access Hi 3080 3260 4570 7100 10540 222 Aetna HealthFund CDHP 1310 1310 3770 7700 13260 2G2 CareFirst Bl Ch i BlueChoice 2250 2480 3680 6030 10510 Modeling g and Simulation Efforts In prior decade, decade MEPS predecessor survey (NMES) used to model costs and impacts of various proposed reforms – Costs of reform to households – Costs to nation – Changes in coverage – Tax impacts Modeling g and Simulation Efforts Using MEPS data data, these areas remain our strengths, with addition of: – Medicaid/ SCHIP eligibility simulation model – Expenditures by service (including prescription drug expenditures) – State level estimates of coverage and expenditures ((largest g states by y population)) – Improved tax simulation model – Employer p y survey y data by y state Research Uses of the M di l E Medical Expenditure dit P Panell S Survey Advancing Excellence in Health Care Research Objectives Provide analytic oversight of survey Guide construction of analytic files Conduct policy relevant research Provide technical assistance Research Areas Health insurance Use and expenditures Access, quality and satisfaction Health status and health behaviors Health care reform Health insurance status of civilian noninstitutionalized p population p under age g 65,first half 1996-2007 Private Public only y Uninsured 80 70 60 68 7 68.7 69 2 69.2 70 4 70.4 19.2 18.9 17.8 70 4 70.4 69 9 69.9 69 1 69.1 67 9 67.9 67.1 65.8 64.9 65.0 63.1 18.2 18.8 18.5 18.8 19.0 19.5 19.4 20.6 15.6 15.6 2005 2006 Perc cent 50 40 30 17.9 20 16 3 16.3 10 12.1 11.9 11.8 11.7 11.9 12.1 13.5 14.2 15.2 1996 1997 1998 1999 2000 2001 2002 2003 2004 0 2007 Source: Center for Financing, Access, and Cost Trends, AHRQ, Medical Expenditure Panel Survey, Household Component Summary Tables 1996–2006 Number of uninsured under age 65 MEPS, 1996 1996–2007 2007 Any time in year Number in millions 62 0 62.0 62.2 59 1 59.1 60 58.5 61 7 61.7 First half of year 61.9 62.9 63.9 65.8 45.9 47.0 48.1 49.8 34.4 35.8 2004 2005 61.7 44.5 44.2 31.6 32.1 31.0 28.7 31.5 31.3 32.0 33.7 1996 1997 1998 1999 2000 2001 2002 2003 42.0 42.6 43.8 45.7 Full year 68.0 50.1 53.5 40 20 37.1 0 2006 2007 Source: Center for Financing, Access, and Cost Trends, AHRQ, Household Component of the Medical Expenditure Panel Survey, 1996–2006 Full-Year Files and 1996–2007 Point-in-Time Files Number of children under age 18 by allyear insurance status MEPS, 1996–2006 Private Number in n millions 40 39.8 39.7 41 4 41.4 42 0 42.0 Public only 40 4 40.4 39.4 Uninsured 38.9 38.6 37.4 37.3 37.0 17 7 17.7 18.4 19.2 30 20 14.1 16.1 16.5 10.9 11.8 11.6 11.3 12.4 70 7.0 71 7.1 65 6.5 5.3 63 6.3 56 5.6 5.1 4.6 4.7 4.1 4.1 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 10 0 Source: Center for Financing, Access, and Cost Trends, AHRQ, Household Component of the Medical Expenditure Panel Survey, 1996–2006 Full-Year Files Health Insurance Status of Adults Ages 21-64: December 2006 Any iinsurance A Individual Market Employment-related E l t l t d Public Coverage 90 78 3 78.3 80 Perce ent 70 60 69.5 70.6 67.5 65.6 85.2 82.5 53.6 50 40 30 20 10 4.2 9.9 9.3 3.2 10.2 3.9 15 3 15.3 6.1 0 21-29 21 29 30-44 30 44 45-54 45 54 55-64 55 64 Source: Center for Financing, Access, and Cost Trends, AHRQ, Household Component of the Medical Expenditure Panel Survey, 2006. Retiree Coverage for Adults, Ages 55-64: December 2006 Any retiree A ti coverage Dependent Policyholder P li h ld Dep., Pholder Age 65+ 20 16.8 15.6 Perce ent 14 9.4 10 7.9 32 3.2 2.2 0.1 0 Men Women Source: Center for Financing, Access, and Cost Trends, AHRQ, Household Component of the Medical Expenditure Panel Survey, 2006. Health Insurance Premiums Employee/Employer Contributions for Single Coverage 1996 - 2006 Advancing Excellence in Health Care 2006 $788 $ 2005 $723 2004 $671 2003 $606 2002 $565 2001 $498 2000 $450 1999 $420 1998 $383 $3,330 $ , $3,268 $3,034 $2,875 $2,624 $2 391 $2,391 $2,205 $1,905 $1,791 1997 $320 $1,731 1996 $342 $1 650 $1,650 Employee p y Contribution Premiums increased 3.2% & employee contributions t ib ti increased 9.0% over 2005, continuing the trend from previous years years. Employer Contribution AHRQ MEPS Insurance Component Tables 19961996-2006 Health Insurance Premiums Employee/Employer Contributions for Family Coverage 1996 - 2006 Advancing Excellence in Health Care 2006 $2,890 $ , 2005 $2,585 2004 $2,438 2003 $2,283 2002 $8,491 $ , $8,143 $7,568 $6,966 $1,987 2001 $1 741 $1,741 2000 $1,614 1999 $1,438 1998 $1,382 1997 $1,305 $1 2 1996 $1,275 $6,482 $5 768 $5,768 $5,158 $4,620 $4,208 $4,027 $3 6 9 $3,679 Employee Contribution Employer Contribution Premiums increased 6.1% & employee contributions increased 11.8% over 2005, continuing the trend from previous years. AHRQ MEPS Insurance Component Tables 19961996-2006 Advancing Excellence in Health Care Average Annual Health Insurance Premium per Enrolled Employee at PrivatePrivate-Sector Establishments Offering g Health Insurance: US and Ten Largest g States, 2006 State UNITED STATES California T Texas New York Florida Illinois Pennsylvania Ohio Michigan New Jersey Georgia Single Coverage $4,118 $4,036 $4,133 $4 133 $4,605 $3,936 $4,245 $4,277 $4,054 $4,446 $4,471 $3,873 $3 873 Employee-Plus EmployeePlus-One Coverage $7,988 $7,989 $8,081 $8 081 $8,779 $7,735 $7,984 $8,764 $7,884 $8,654 $8,791 $7,609 $7 609 Family Coverage $11,381 $11,493 $11,690 $11 690 $12,075 $11,046 $11,781 $11,794 $10,967 $11,452 $12,233 $10 793 $10,793 AHRQ MEPS Insurance Component Tables - 2006 Premiums for employer-sponsored health insurance, family coverage, private sector by firm size, size 1996 1996–2006 2006 $12,000 $11 438 $11,438 $11,381 $11,000 $11,095 $$10,000 , $9,000 All firms Small firms L Large firms fi $8,000 $7,000 $6,000 $4,957 $5,000 $4,954 $4,938 $4,000 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Employer costs for employer-sponsored health insurance, family coverage, private sector t b by firm fi size, i 1996–2006 1996 2006 $9,000 $8,590 $8,491 $8,000 $7,994 $7,000 All firms Small firms $6,000 Large firms $5,000 $4,000 $3,000 $3,702 $3,679 $3,571 $2 000 $2,000 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Source: Center for Financing, Access, and Cost Trends, AHRQ, Medical Expenditure Panel Survey – Insurance Component, 2003, Tables II.C.2, II.C.3, II.D.2, II.D.3, II.E.2 and II.E.3 Employee contributions for employer-sponsored health insurance, family coverage, private i t sector t by b firm fi size, i 1996–2006 1996 2006 $3,500 $3,101 $3,000 $2,890 $2,848 $2,500 All firms Small firms Large firms $2,000 $1,367 $1,500 $1,275 $1,255 $1 000 $1,000 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Source: Center for Financing, Access, and Cost Trends, AHRQ, Medical Expenditure Panel Survey – Insurance Component, 2003, Tables II.C.2, II.C.3, II.D.2, II.D.3, II.E.2 and II.E.3 Private Sector Employees With FSAs 2001 FSAs, 2001--2005 Advancing Excellence in Health Care Percent of employees with FSAs 100% 80% 60% 40% 20% 0% 2001 2002 2003 < 10 employees 10-24 employees 100-999 100 999 employees 1000+ employees 2004 2005 25-99 employees Source: 2001-2005 Medical Expenditure Panel Survey – Insurance Component, private sector establishments. Average Deductibles With and Without FSAs Advancing Excellence in Health Care Average Deductibles With and Without FSAs 900 0.70 800 0.60 0.50 600 500 0.40 400 0.30 300 0.20 200 0.10 100 0 0.00 2001 2002 2003 2004 2005 Year Percent of employees with FSAs Average deductible with FSA Average deductible without FSAs Source: 2001-2005 Medical Expenditure Panel Survey – Insurance Component, private sector establishments. Proportion Averag ge deductible 700 Percentt Advancing Excellence in Health Care Percentage of single workers who are offered health insurance and take up offered coverage according to health insurance preferences 100 90 80 70 60 50 40 30 20 10 0 Weak preferences Uncertain preferences Strong preferences Offered Taking up Healthy enough Offered Taking up Offered Not worth cost Taking up Take risks Preference measure Monheit and Vistnes, "Health Insurance Enrollment Decisions: Preferences for Coverage, Worker Sorting, and Insurance Take-up" Inquiry (45)1 Summer 2008. Percent of adults ages 18 – 64 uninsured all year by health insurance preferences, f 2001 Advancing Excellence in Health Care Perrcent unins sured 35 30 25 20 15 Weak preferences Uncertain preferences Strong preferences 10 5 0 Healthy y enough Not worth cost Take risks Can overcome illness Preference measure Monheit and Vistnes, "Health Insurance Enrollment Decisions: Preferences for Coverage, Worker Sorting, and Insurance Take-up" Inquiry (45)1 Summer 2008. Distribution of Workers by Plan Choice A il bilit 2006 Availability, Not offered insurance Offered a choice of plans Offered 1 plan 70 58.4 Perce ent 60 50 42.2 40 30 35.23 25.59 22.56 20 16.01 10 0 From own jjob Source: MEPS-HC, 2006 Through g an HIEU Take-up Rates for Wage-Earners age 21-64 Wh H Who Have Off Offers, 2006 Offered 1 plan Offered a choice of plans 100 90 Perce ent 80 76.31 80.49 73.39 72.06 70 60 50 40 30 20 10 0 From own job Source: MEPS-HC, 2006 Through an HIEU Percentage distribution of health care spending, by type of service, U.S. civilian noninstitutionalized population, population 2006 Total expenses = $1 $1.03 03 trillion Hospital inpatient 2.0 3.3 3 3 3.6 Office-based 29.7 Prescription medicines Hospital outpatient 7.4 Dental 8.7 Emergency room 23 7 23.7 21.6 Home health care Other medical services and equipment Note: Percentages may not add to exactly 100.0 due to rounding. Source: Center for Financing, Access, and Cost Trends, AHRQ, Household Component of the Medical Expenditure Panel Survey, 2006 Source of payment distribution for health care spending, di by b age, 2006 All ages 41.7 Private Insurance 7.1 Medicare Out of Pocket Medicaid Other 8 8.7 23.5 19.0 <18 years y 18–64 years 50.7 55.5 65+ years 15.2 2.4 7.3 14.1 0.5 6.6 4.6 20.5 7.4 23.7 9.7 20.8 60.9 Note: Percentages may not add to exactly 100.0 due to rounding. Source: Center for Financing, Access, and Cost Trends, AHRQ, Household Component of the Medical Expenditure Panel Survey, 2006 Trends in Concentration Percen ntage off expend ditures 1977 100 90 80 70 60 50 40 30 20 10 0 1987 1996 2006 97 97 97 97 70 70 69 63 55 56 56 48 38 39 38 31 27 28 28 21 Top 1% Top 2% Top 5% Top 10% Top 50% Population ranked by expenditures Source: National Medical Care Expenditure Survey, 1977; National Medical Expenditure Survey, 1987; Medical Expenditure Panel Survey, 1996 and 2006. Percentage of population w P with same percenttile rank in 200 06 Persistence in the level of health care expenditures, U.S. civilian noninstitutionalized population population, 2005 to 2006 100 75.3 74 2 74.2 Top 50% Lower 50% 80 62.9 60 53.5 40.3 40 20 31.3 18.1 0 Top 1% Top 5% Top 10% Top 20% Top 30% Percentile rank by health care expenditures, 2005 Source: Center for Financing, Access, and Cost Trends, AHRQ, Household Component of the Medical Expenditure Panel Survey, HC-106 (Panel 10, 20052006) Advancing Excellence in Health Care 15 Highest Cost Conditions, 2006 ($ in billions)) Heart Disease ($78) Trauma ($68) Cancer ($58) Mental M t l Disorders Di d ($57) Pulmonary Conditions ($51)) ($ Hypertension ($49) Diabetes ($48) Osteoarthritis ($38) Back Problems ($35) Hyperlipidemia H perlipidemia ($26) Circulatory Conditions ($26) Kidney Disease ($26) Central Nervous System y Disorders ($26) ($ ) Upper GI Disorders ($21) Other Endocrine, Endocrine Nutritional and Immune Disorders ($20) Source: Center for Financing, Access and Cost Trends, Agency for Healthcare Research and Quality: Medical Expenditure Panel Survey, 2006 Expenditures on Chronic Conditions as a Percent of Total Expenses for adults age 18 & over, over by age, age 2005 Percent 100 80 60 51.8 40 56.6 58.9 55-64 65 and older 49.6 29.2 20 0 18 & over 18-34 35-54 Note: Estimates do not include expenses for dental care and other medical equipment and services. Source: Center for Financing, Access, and Cost Trends, AHRQ, Household Component of the Medical Expenditure Panel Survey, 2005 Cost of Obesity From Wang, Beydoun, and Liang, “Will All Americans Become Overweight or Obese? Estimating the Progression and Cost of the US Obesity Epidemic,” Obesity October 2008. Prescription Drugs From Donohue, Huskamp, and Zuvekas, “Dual Eligibles With Mental Disorders And Medicare Part D: How Are They Faring?” Health Affairs May/June 2009. Regression Model Goodness of Fit: Hosmer--Lemeshow Tests for Elderly RX Hosmer Expenditures > 0 Advancing Excellence in Health Care Residuals as % of M R Mean 10 5 0 -5 1 2 3 4 5 6 7 8 9 10 9 10 -10 -15 -20 Deciles of Predicted Expenditure Distribution EEE Residuals s as % of Mean 10 5 0 -5 1 2 3 4 5 6 7 8 -10 -15 -20 Deciles of Predicted Expenditure Distribution GGM Gamma Poisson Linear OLS Steven C. Hill and G. Edward Miller. “Health Expenditure Estimation and Functional Form: Applications of the Generalized Gamma and Extended Estimating Equations Models.” Forthcoming in Health Economics. Economics Advancing Excellence in Health Care Comparisons of cumulative distributions of Medicare expenditures in the MEPS to other measures Zuvekas and Olin, “Accuracy of Medicare Expenditures in the Medical Expenditure Panel Survey,” Inquiry 46:92-108 (Spring 2009) Advancing Excellence in Health Care Journal Articles Using MEPS AHRQ Modeling and d Si Simulation l ti Eff Efforts t Overview Division of Modeling and Simulation activities to support health reform: Reconciliation of MEPS expenditure estimates to National Health Expenditure Accounts (NHEA) Additional data products Basic Research Microsimulation models MEPS--HC: Data Products MEPS MEPS is one one--stop data source for many key components of health policy microsimulation models Virtually all major health models use MEPS data in some way – most often they use the individual level medical expenditure data The Modeling Division produces several data products and tools to enhance MEPS for policy simulation (available in the Data Center) MEPS--HC: Augmented MEPS g Data Federal and state income tax simulations (from NBER TAXSIM) 2002 data aligned g to NHEA and p projected j forward to 2016 Imputed employer contributions (regression(regressionbased IC models) Other enhancements: – Immigration, citizenship status through 2005 – Fully imputed jobs variables Importance of Reconciling MEPS to NHEA Benchmarked, projected data are critical to all models and questions NHEA and MEPS provide the two most comprehensive h i estimates ti t off health h lth care spending in the U.S. Reconciling estimates from both sources serves as an important quality assurance exercise for both. Augmented MEPS files include expenditures adjusted for survey underreporting and more Simulated Taxes MEPS collects detailed income and asset data that support simulation of federal, state, payroll, and property taxes Simulations produce estimates of: tax payments marginal tax rates payments, Send data files to NBER’s TAXSIM Make M k further f th refinements fi t and d calculations inin-house MEPS-HC: Basic Research MEPSy Simulations to Inform Policy Elasticities are key parameters in most microsimulation models: Premium elasticity of taketake-up (Blumberg, Ni h l B Nichols, Banthin) thi ) Tax Tax--price elasticity of group coverage (Selden&Bernard) Tax Tax--price elasticity of self self--employed (Selden) Tax subsidies,, winnerswinners-losers,, and withinwithin-firm incidence of employer contributions (Bernard&Selden) Burden of health care (Banthin&Bernard) – Within Within--year burdens (Selden) Recent research on Role of Assets in Insurance Enrollment Questions What is the difference in wealth between insured and uninsured families? How much better can we predict demand for insurance using asset and wealth data? Wealth, Income and the Affordability of Health Insurance D. D Bernard Bernard, JJ. Banthin Banthin, and W. W Encinosa Differences in asset holdings byy insurance status Median net worth of privately insured families was 23.2 times that of the uninsured Among families w/ access to employer coverage, median net worth of privately insured families was 15.4 times that of the uninsured Among families in the individual market, median di nett worth th off privately i t l iinsured d ffamilies ili was 34.6 times that of the uninsured The role of wealth in private insurance enrollment: simulation results The standard income model performs relatively well for the employer coverage market. In I the th individual i di id l market, k t th the wealth lth model d l performs significantly better The standard model overestimates enrollment for those with low wealth and underestimates enrollment for those with high wealth Standard St d d model d l estimates ti t are misleading i l di ffor two subpopulations: low income and high wealth, high income and low wealth Simulation Models at AHRQ Modeling Division develops and maintains two key simulation models: KIDSIM PUBSIM New model in progress: Employer p y _SIM KIDSIM Detailed statestate-specific Medicaid and CHIP eligibility simulations for children and parents Yields most accurate estimates of eligible uninsured i d children hild (CBO lletter, tt JJuly l 2007) Model used to estimate Track progress over time take--up rates take crowd--out rates crowd Simulated take up of coverage under possible expansion – Net costs of public coverage for children – – – – Currently updating model to 2007 Children Eligible for Public g , 19971997-2005 KIDSIM Coverage, E lig ib le C h ild re n (m illio n s ) 50 40 All Eligible Medicaid Eligible CHIP Eligible 30 20 10 0 1997 1999 2001 2003 2005 P e r c e n t E li g ib le w h o a r e U n inn s u r e d Percent Eligible but Uninsured Children,, 20002000-2005 KIDSIM 25.0% All Eligible Eli ibl Medicaid Eligible CHIP Eligible 20 0% 20.0% 15 0% 15.0% 10.0% 0 0% 2000 2001 2002 2003 2004 2005 Percent of Eligible Families with Uninsured Child,, 2005 KIDSIM 50% 40% 30% 20% 10% 0% 43% 21% 16% All CHIP All 26% Medicaid Medicaid-CHIP Eligible Families with 2+ Children EligibleI li ibl Ineligible P e rc e n t M e d ic a id C H I P F a m i li e s w i t h U n i n s u r e d C h ild Medicaid-CHIP Families with MedicaidUninsured Child by CHIP Policy, 2005 KIDSIM 27 4% 27.4% 30.0% 20.4% 20.0% 10.0% 0.0% p CHIP Medicaid Expansion Anyy Separate p CHIP CHIP Program Structure PUBSIM Builds on KIDSIM for all nonnon-elderly adults (esp. childless adults) Detailed statestate-specific Medicaid Medicaid, CHIP and state funded programs - eligibility simulations Simulated disability status based on health and employment status MEPS--IC: Data MEPS Large sample of establishments (n=42,700 with response rate of 81%) – Leading g data source employer p y offers,, taketake– – – – up, employer/employee premiums State level estimates D Data released l d iin tabular b l fform Limited public access to data files at Census Data Centers Most models use MEPSMEPS-IC estimates to benchmark premiums in simulation models based on other data (e.g., ( Kaiser/HRET) / ) StatisticallyStatistically y-Linked IC IC--HC Data “Holy Grail”: information on all establishment employees and their families (e.g., (e g administer HC to all employees at IC establishments) – Do workers have spouses with offers? Children with public eligibility? – Health status of workers and their families – Family income (all sources) and marginal tax rates Next best: statistical match of HC data to IC establishments, t bli h t aligning li i th the synthetic th ti workforces to IC workforce characteristics – Used for tax subsidy estimates in Selden and Gray (Health Affairs Affairs, 2006) – Updated model under construction MEPS--IC: Employer MEPS p y _SIM Selden & Gray (HA (HA,, 06) “populated” populated establishments with HC workers using statistical matching and raking post--stratification post – Enabled estimates of tax subsidy by estab characteristics Under new initiative at Census, we gain access to MEPSMEPS S-IC C data to recreate this data resource – – – – Tax subsidy estimates Estimates of p premiums facing g workers who do not take up p offered coverage Microsimulation of reforms Responses to capped subsidies Average Subsidy per Plan, by y Type yp ((2006)) 2006 $ 4000 3500 3000 2500 2000 1500 1000 500 0 l l A e l ng i S il y m a F MEPS IC and HC: Selden & Gray, Health Affairs 2006 10 00 > 99 -9 10 0 -9 9 25 10 0 -2 4 2000 1800 1600 1400 1200 1000 800 600 400 200 0 -9 2006 6$ Average Subsidy per Worker y Firm Size ((2006)) by Firm Size MEPS IC and HC: Selden & Gray, Health Affairs 2006 Average Subsidy per Worker by Establishment Wage Mix (2006) 3000 2500 2006 $ 2000 1500 1000 500 0 Low d le Mid h Hig Oth er Predominant Wage Level MEPS IC and HC: Selden & Gray, Health Affairs 2006 Other Applications pp Updated tax subsidy estimates Best data source for certain policy- relevant estimates – e.g., average employee premium contribution among workers turning down offered coverage Database for policy reform simulations Behavioral B h i l research h iinto t d determinants t i t off firm offers, “crowd-out”, and more Conclusion MEPS data are critical for most microsimulation models of health reform AHRQ supports policy analyses based on MEPS through g various activities: – – – – Public use files, Enhanced databases, linkages and other tools Basic research and reporting reporting, Micro--simulation models Micro Future work includes – – – – Statistical linkage between HC & IC Enhanced data files Basic behavior research on parameters used in modeling Mi Microsimulation i l ti model d ld development l t Medical Expenditure Panel Survey DISSEMINATION OF INFORMATION AND DATA PRODUCTS O UC S MEPS Dissemination An onon-line interactive statistical computer system (MEPS (MEPS--NET) Data center for use of nonnon-public data Website Workshops MEPS Website www meps ahrq gov www.meps.ahrq.gov Overview of MEPS and Frequently Asked Questions (FAQs) ( Qs) Staff Reports using MEPS Findings/Statistical Briefs/Chart books Data Tables of Estimates Public Use Files (microdata) MEPSnet Interactive Query Tool Survey Methodology Reports Survey Questionnaires and Other Collection Materials Data product availability and ordering information MEPS data workshop information and schedule Mailing list list, List server and e e--mail for technical assistance Data Center Information Greater Access to AHRQ Restricted Data Use of Census Bureau Research Data Centers (RDC (RDC)) to improve accessibility of non--public AHRQ data non Examples of off off--site approved projects in RDC’s: Columbia University - Department of Health Policy and Management Sherry Glied – “The Tax Treatment of Health Insurance Revisited” University of Michigan - Economic Research Initiative on the Uninsured, – Matthew Rutledge – “Estimation of Adverse Selection & Moral Hazard in Health Insurance” Insurance Growing utility of AHRQ Data Center MEPS HC Data Also Accessible at Census Bureau RDC’s RDC s Research Data Files will be accessible at the 9 regional Census Bureau RDC’s ((NY,NC, , , MI,, IL,, MD,, CA,, MA)) AHRQ will approve projects Will require Census Bureau Special Sworn Status Census user fees will apply Presentation Summary y MEPS overview and analytic capacity Program outreach and impact Research Update Modeling efforts to inform health initiatives MEPS Data Products and Dissemination