Do State Parity Laws Differentially Impact Low Income or High Need Groups?

advertisement

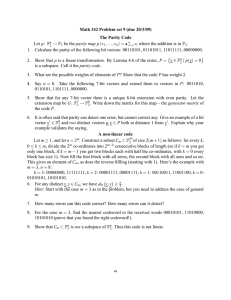

Do State Parity Laws Differentially Impact Low Income or High Need Groups? Colleen L. Barry, Ph.D. Susan H. Busch, Ph.D. Yale School of Medicine June 2006 We gratefully acknowledge support from RWJ HCFO program (grant no. 56465) Motivation • Private insurance is more limited for mental health than for general medical care • Advocates view benefit limits as discriminatory • Economic Explanations: - Moral hazard: health plan incentive to control consumer demand for services - Selection: health plan incentive to compete to avoid ‘bad risks’ • Parity laws aim to address disparity by requiring equivalent coverage - 37 states have enacted parity laws - Federal regulation limited (1996) 2 Previous Research – State Laws • Prior studies found no change in use in response to state parity (Sturm, 2000; Sturm and Bao, 2004) • Puzzling finding -- at least three explanations: 1) Truly no effect of state parity laws on use -- the same people receive the same services post parity 2) Failure to account for ERISA exemption 3) A re-allocation, such that the net effect is no change in service use • If parity impacts important subgroups, but has little impact overall, may still be sound policy 3 Research Objectives 1) Do state parity laws increase utilization for the population not exempt under ERISA? 2) Do state parity laws increase mental health care utilization for low income individuals? 3) Do state parity laws increase mental health care utilization for individuals with poor mental health? 4 1) Why does ERISA matter? • Key explanatory variable - whether the state had a parity law in effect • Employers who self insure exempt from state mandates – Concern ERISA exemption leads to attenuation bias • Limitation not addressed in prior parity research • We don’t know whether employer self-insured, but do know employer size – Our approach: Impute ‘probability subject to parity’ based on employer size, state & year using MEPS-IC 5 2) Why study low income individuals? • Evidence for general health care → low income may be more responsive to cost sharing (RAND HIE) • Low income groups may be at higher risk of not receiving services 6 3) Why study individuals in poor mental health? • Many state policies target SMI • Improved access to care is likely to have greatest impact on health for those with a need for services • Some misallocation of services 7 Allocation of Services • Although prior research indicates that parity does not affect use, allocation may change (i.e., the same people may not be getting services) • Pre-parity relied on demand side constraints • Post-parity may put greater reliance on supplyside constraints (e.g., UR) – managed care • If managed care better at allocating services, we expect those in poor mental health to be more likely to receive services post-parity 8 Misallocation of mental/addictive disorders and service for adults % of population receiving mental health services in one year (15%) % of population with mental/addictive disorders in one year (29%) 20% 6% 9% Diagnosis and no treatment (20%) 9 From: Mental Health, A Report of the Surgeon General (1999) Data • National Survey of America’s Families • Large nationally representative sample (3 cross sections - 1997, 1999, 2002) • Focus on 13 states, 5 of which passed parity legislation between 97-02 • Limit sample to adults with private insurance coverage all of past year 10 Measures • Outcome measure – Any mental health service use (0/1) • Parity measure – Impute ‘probability subject to parity’ from employer size, state and year, based on MEPS-IC data • Mental health status measure – Five-item scale from MOS (Wells, 1996) – Assesses anxiety, depression, loss of behavior/emotional control and psychological well being in the past month on Likert scale – Sum and use cutoff common in literature of 67 – Cannot be tied directly to clinical diagnosis • Income measure – Categorize as low income (<200 % FPL) or non-low income (>200 % FPL) 11 Methods • State and year fixed effect models – State f.e. control for time invariant state characteristics – Year f.e. control for secular trends in treatment • Logistic Regression • Examine effects on: 1) low income and 2) those in poor mental health – Interact parity variable with indicators of above 12 Impact of ERISA exemption: Estimates of percent covered under parity laws, by year % parity (0/1) Probability of parity (PP) 1997 4.6 % 1999 8.3 % 2002 43.8 % 2.1 4.7 26.7 13 Effect of parity law on ‘any visit’ Any mental health visit (parity=0/1) Parity .086 (.098) Any mental health visit (parity=PP); Emp size>50 .280 (.186) N 28747 16994 Control variables include education, race, ethnicity, gender, age, emp size, income, mental health status, and state and year fixed effects 14 Effect of parity laws on low income individuals (1) Any MH visit (2) Any MH visit .280 (.186) .194 (.185) 1.286*** (.392) Poor MH 1.253*** (.099) 1.253*** (.099) 1.201*** (.278) Low income -.465*** (.168) -.586*** (.204) Parity (PP) PP*Low income (3) Any MH visit (Sample limited to low income) .797* (.450) 15 Predicted probabilities of any MH use Low income Non low income No parity Parity 4.6 % 11.2 % 7.9 9.4 16 Effect of parity laws by mental health care need Parity (PP) Poor MH Low income PP*Poor MH (1) (2) Any MH visit Any MH visit (3) Any MH visit (Sample limited to low income) (Sample limited to non-low income) 1.296** (.524) 1.205*** (.325) .203 (.172) .272*** (.112) -.027 (.695) -.095 (.671) .287** (.144) 1.257*** (.113) -.465*** (.169) -.033 (.519) 17 Predicted Probabilities Low Income: Poor MH Good MH Non-Low Income: Poor MH Good MH No Parity Parity 11.5 % 3.6 24.4 % 9.5 18.8 6.3 20.7 7.7 18 Limitations & Next Steps • No direct measure of ‘self-insured’ • No measure of clinical diagnosis • We measure mental health status at a point in time → service use may impact mental health status Next Steps • Examine additional measures of service use → number of visits 19 Conclusions • Parity does increase use for the low income • For our outcome, no re-allocation of services to those with greater need • ERISA exemption and other characteristics of state laws reduce share of state population subject to parity by about half – Suggests an important role of federal policy given limited reach of state laws 20 Policy Implications • We see more elastic demand for low income, suggesting moral hazard more problematic • Increases are similar for those w/ and w/out need – Ideally, would like to see increases only among those w/need – Perhaps not big concern given very low utilization rates • Other studies shows parity does not increase total costs & implication of this research is that parity is welfare enhancing → win-win 21 The end 22 Descriptive results: Full Sample Low income Percent with any visit 5.3 % Non-low income 7.5 % Sample limited to those with poor mental health Percent with any visit Low income 11.7 % Non-low income 19.6 % 23 Employer-sponsored private insurance limits (2002) • Historically MH coverage has been more limited than general health coverage Inpatient day limits Outpatient visit limit Higher cost sharing Small firm Large firm 58 % 66 % 17 % 67 % 78 % 24 % 24