The Shortest Path to Destruction: A Floral Shop Kathedra Burton

advertisement

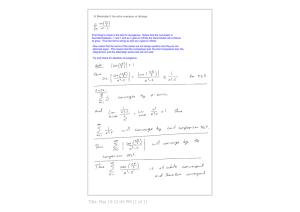

The Shortest Path to Destruction: A Floral Shop Operations Research I: Linear Programming Project Kathedra Burton Mari Juno Casey Haley December 6, 2004 “On my honor, as an Aggie, I have neither given nor received unauthorized aid on this academic work.” __________________________ __________________________ ___________________________ Signature of Each Group Member 1 Contents 1.0 Executive Summary ........................................................................................ 2 2.0 Problem Description........................................................................................ 4 2.1 Problem 1 Grummins Engine Truck Production ................................... 4 2.2 Problem 2 Wheat Stock........................................................................ 5 2.3 Problem 3 Floral Dilemma.................................................................... 7 3.0 Computational Results.................................................................................... 9 3.1 Problem 1 Grummins Engine Truck Production ................................... 9 3.2 Problem 2 Wheat Stock...................................................................... 12 3.3 Problem 3 Floral Dilemma.................................................................. 15 4.0 Conclusions & Recommendations ................................................................ 21 5.0 References.................................................................................................... 23 6.0 Appendix ....................................................................................................... 24 2 1 Executive Summary The purpose of this project was to take 3 situational problems and solve each one using linear programming methods. The problems addressed are 1) Multi-period Inventory, 2) Multi-period Work Scheduling and 3) Floral Buying and Scheduling. All problems were solved using the LINDO optimization software. In the Multi-period inventory problem, Grummins Engine must decide how many trucks to produce in a three-year period to both maximize profit and satisfy a government imposed pollution constraint. Grummins will produce according to the following schedule and realize a profit of $3,600,000. Table 1—Optimal Solution for Grummins Year 1 2 3 Truck Type Produced Sold Inventoried 1 100 100 0 2 200 200 0 1 180 180 0 2 100 100 0 1 170 170 0 2 150 150 0 Recommendations for Grummins: 1. Study customers to see if they will accept an increase in selling price. 2. Look into better manufacturing practices to reduce manufacturing cost. In the multi-period work scheduling problem, a wheat warehouse must decide on how much wheat to sell and purchase according to an initial monthly inventory and a storage constraint of 20,000 bushels. The maximum profit is $162. The optimal solution is shown below and is in 1000 bushels. Table 2—Optimal Solution for Wheat Warehouse Month Initial Stock Wheat Sold Wheat Bought 1 6 0 0 2 6 0 0 3 6 6 20 3 4 20 0 0 5 20 0 0 6 20 20 20 7 20 20 0 8 0 0 20 9 20 20 0 10 0 0 0 Recommendations: 1. Try to increase selling price. 2. Look for a different retailer to buy wheat at a lower price. 3. If 1 and 2 can be done, look into increasing storage space. The third problem looks at a floral shop. The florist buys five different colors of flowers between the months of February and September. She has to decide on what color to buy each month and how many while minimizing her total cost. LINDO provided an optimal solution with a total cost of $ 20,500. Table 3—Optimal Solution for Floral Shop Color Feb Mar Apr May June 500 Red July Aug 500 500 White 500 500 Pink Sep 500 500 Yellow Purple 500 Recommendations: 1. Look for other suppliers. 2. Study customer demand to see if cheaper alternatives can be found such as underused colors that can be bought at reduced prices. 4 2.1 Problem 1 : Grummins Engine Diesel Truck Production Grummins Engine produces diesel trucks. New government emission standards have dictated that the average pollution emissions of all trucks produced in the next three years cannot exceed 10 grams per truck. Grummins produces two types of trucks. Each type 1 truck sells for $20,000, cost $15,000 to manufacture, and emits 15 grams of pollution. Each type 2 sells for $17,000, cost $14,000 to manufacture, and emits 5 grams of pollution. Production capacity limits total truck production during each year to at most 320 trucks. Grummins knows that the maximum number of ach truck type that can be sold during each of the next years is given in Table 62. Demand can be met from previous production or the current year’s production. It costs $2,000 to hold 1 truck (of any type) in inventory for one year [1, p117]. Assumptions: 1. There will be no trucks left over from year three. 2. The divisibility assumption is not valid. 3. All variables are nonnegative. Table 62 [1] Year Type 1 Type 2 1 100 200 2 200 100 3 300 150 Decision Variables: Xij = number of trucks made Yij = number of trucks sold Zij = number of trucks in inventory and carried over where i = year made from 1to 3 and j = type of truck 1 and 2 5 Objective Function: Maximize 20000y11 + 20000y21 + 20000y31 + 17000y12 + 17000y22 + 17000y32 – 15000x11 – 15000x21 – 15000x31 – 14000x12 – 14000x22 – 14000x32 2000z11 – 2000z12 - 2000z21 - 2000z22 s.t. y11 < 100 y12 < 200 x11+x12 < 320 x11-y11-z11 = 0 x12-y12-z12 = 0 x21+x22 < 320 z11+y21 < 200 z12+y22 < 100 x21+z11-y21-z21 = 0 x22+z12-y22-z22 = 0 x31+x32 < 320 z21+y31 < 300 z22+y32 < 150 x31+z21-y31 = 0 x32+z22-y32 = 0 5y11+5y21+5y31-5y12-5y22-5y32 < 0 2.2 Problem 2: Wheat Stock You own a wheat warehouse with a capacity of 20,000 bushels. At the beginning of month 1, you have 6,000 bushels of wheat. Each month, wheat can be bought and sold at the price per 1000 bushels given in table 46. The sequence of events during each month is as follows: 1. You observe your initial stock of wheat. 2. You can sell any amount of wheat up to your initial stock at the current month’s selling price. 3. You can buy (at the current month’s buying price) as much wheat as you want, subject to the warehouse size limitation. *Everything shown in per thousand bushels [1, 112] Assumptions: 1. All variables are nonnegative. Table 46 [1] Month Selling Price ($) Purchase Price ($) 1 3 8 6 2 6 8 3 7 2 4 1 3 5 4 4 6 5 3 7 5 3 8 1 2 9 3 5 10 2 5 Decision Variables: Xi = initial stock of wheat Yi = amount of wheat sold Zi = amount of wheat bought Objective Function: Maximize 3y1 + 6y2 + 7y3 + y4 + 4y5 + 5y6 + 5y7 + y8 + 3y9 + 2y10 - 8z1 - 8z2- 2z3 3z4 - 4z5 - 3z6 - 3z7 - 2z8 - 5z9 - 5z10 s.t. x1 = 6 y1-x1 < 0 z1+x1-y1 < 20 x2-z1-x1+y1 = 0 y2-x2 < 0 z2+x2-y2 < 20 x3-z2-x2+y2 = 0 y3-x3 < 0 z3+x3-y3 < 20 x4-z3-x3+y3 = 0 y4-x4 < 0 z4+x4-y4 < 20 x5-z4-x4+y4 = 0 y5-x5 < 0 z5+x5-y5 < 20 x6-z5-x5+y5 = 0 y6-x6 < 0 z6+x6-y6 < 20 x7-z6-x6+y6 = 0 y7-x7 < 0 z7+x7-y7 < 20 x8-z7-x7+y7 = 0 7 y8-x8 < 0 z8+x8-y8 < 20 x9-z8-x8+y8 = 0 y9-x9 < 0 z9+x9-y9 < 20 x10-z9-x9+y9 = 0 y10-x10 < 0 z10+x10-y10 < 20 2.3 Problem 3: Florist Dilemma A flower shop owner must buy bundles of flowers to make bouquets. She buys five different colors of flowers between the months of February and September. She must buy at least 500 bundles of flowers a month. The nursery where she buys them can only provide her with 1000 of each color of flower during these months. Below in Table 1 are the prices of each color flower for each month. Table 4: Flower Prices Color Feb Mar Apr May June July Aug Sep Red 15 14 5 2 4 2 9 14 White 14 9 4 5 1 4 6 12 Pink 16 4 3 3 3 7 5 10 Yellow 13 10 7 1 2 6 7 16 Purple 12 11 8 4 6 5 15 13 Assumptions: 1. All variables are nonnegative. Decision Variables: xij = number of bundles of flowers purchased each month where i = color of flower (from 1 to 5) and j = month purchased (from 1 to 8) 8 Objective Function: Min z = 15x11 + 14x12 + 5x13 + 2x14 + 4x15 + 2x16 + 9x17 + 14x18 + 14x21 + 9x22 + 4x23 + 5x24 + 1x25 + 4x26 + 6x27 + 12x28 + 16x31 + 4x32 + 3x33 + 3x34 + 3x35 + 7x36 + 5x37 + 10x38 + 13x41 + 10x42 + 7x43 + 1x44 + 2x45 + 6x46 + 7x47 + 16x48 + 12x51 + 11x52 + 8x53 + 4x54 + 6x55 + 5x56 + 15x57 + 13x58 s. t. x11 + x21 + x31 + x41 + x51 >= 500 x12 + x22 + x32 + x42 + x52 >= 500 x13 + x23 + x33 + x43 + x53 >= 500 x14 + x24 + x34 + x44 + x54 >= 500 x15 + x25 + x35 + x45 + x55 >= 500 x16 + x26 + x36 + x46 + x56 >= 500 x17 + x27 + x37 + x47 + x57 >= 500 x18 + x28 + x38 + x48 + x58 >= 500 x11 + x12 + x13 + x14 + x15 + x16 + x17 + x18 <= 1000 x21 + x22 + x23 + x24 + x25 + x26 + x27 + x28 <= 1000 x31 + x32 + x33 + x34 + x35 + x36 + x37 + x38 <= 1000 x41 + x42 + x43 + x44 + x45 + x46 + x47 + x48 <= 1000 x51 + x52 + x53 + x54 + x55 + x56 + x57 + x58 <= 1000 9 3.1 Problem 1: Grummins Engine Diesel Truck Production In the Grummins problem, LINDO found the optimal solution in 10 iterations with an objective function value of $3,600,000. Table 1 shows the number of trucks produced, sold, and in inventory each year. Table 5: Optimal Solution Year Truck Type Number Number Sold Number Produced 1 2 3 Inventoried 1 100 100 0 2 200 200 0 1 180 180 0 2 100 100 0 1 170 170 0 2 150 150 0 The data shows that every truck Grummin produces in each year is sold that same year so no storage costs are accrued. The sensitivity analysis for this problem is shown below along with the right-hand side analysis in Tables 6 and 7. Table 6: Sensitivity Analysis Variable Current Coefficient Range X11 -15000 -15000 to -13000 X21 -15000 -17000 to -15000 X31 -15000 -15000 to -10000 X12 -14000 -22000 to -4000 X22 -14000 -19000 to -4000 X32 -14000 -19000 to ∞ Y11 20000 20000 to ∞ Y21 20000 0 to 20000 Y31 20000 20000 to 40000 10 Y12 17000 9000 to ∞ Y22 17000 9000 to ∞ Y32 17000 9000 to ∞ Z11 -2000 -∞ to 0 Z21 -2000 -∞ to 0 Z12 -2000 -∞ to 8000 Z22 -2000 -∞ to 8000 Table 7: Right Hand Side (RHS) Sensitivity Analysis Row Current RHS Allowable Range 2 100 80 to 120 3 200 20 to 220 4 320 300 to ∞ 5 0 -100 to 20 6 0 -200 to 20 7 320 280 to ∞ 8 200 180 to ∞ 9 100 0 to 120 10 0 -180 to 40 11 0 -100 to 40 12 320 300 to 450 13 300 170 to ∞ 14 150 50 to 160 15 0 -130 to 20 16 0 -130 to 20 17 0 -900 to 100 The sensitivity report gives the range in which each variable can change without altering the optimal solution. For values in the objective function, the sensitivity analysis shows the selling price of type 1 (all sold at $20,000) trucks produced in year 1 can increase to infinity but cannot decrease without changing 11 the optimal solution. For the same type of trucks produced in year 2, the price cannot increase but can decrease to $18,000 while trucks produced in year 3 exhibit the exact opposite behavior. The price cannot decrease but will allow for an increase of $2,000 to $ 22,000. All type 2 trucks (all sold at $17,000) show the same behavior. The selling price can increase to infinity as well as decrease to $9,000 meaning the company would take a $5,000 loss. The storage fee for inventory ($2,000) on type 1 trucks can increase to $4000 and decrease to infinity before the optimal solution is affected. The fee on type 2 trucks can only increase to $3,000 but can decrease to infinity as well. The cost of production for type 1 trucks ($15,000) produced in year 1 can increase to $17,000 but cannot fall below $15,000. For trucks produced in year 2, the price cannot increase but can decrease by $2,000 to $13,000. In year 3, the price of production can increase to infinity but can only decrease to $10,000. For type 2 trucks, the cost of production ($14,000) can increase to $24,000 and decrease to $6,000 for trucks produced in year 1. In year 2, the price can also increase to $24,000, but can only decrease to $9,000. In year 3, production price can increase to infinity but can only decrease to $9,000. The sensitivity analysis also studied the right-hand side (RHS) of the constraints to determine how widely they could vary before a change occurred in the optimal solution. The year 1 demand for type 1 trucks can vary from 80 to 120 and for type 2 it can vary from 20 to 220. For year 1, total truck production can vary from 300 to infinity without changing the solution. Total truck production for year 2 can vary from 280 to infinity and truck production in year 3 can vary from 300 to 450. The inventory from year1 on type 1 and type 2 trucks can be in the range of -100 to 20 and -200 to 20, respectively. The number of type 1 trucks sold in year 2 can vary 160 to infinity and for type 2 it can vary from 0 to 120. Type 1 trucks inventoried in year 2 have a range of -180 to 40 and type 2 trucks have a range of -100 to 40. The number of type 1 trucks sold in year 3 can vary from 170 to infinity and the number of type 2 trucks can be in the range of 60 to 160. The amount of trucks left over after sales in year 3 for type 1and type 2 can 12 both vary from -130 to 20 trucks. The average amount of pollution can vary from -900 to 100 grams. 3.2 Problem 2: Wheat Stock LINDO found the optimal solution to this problem in 20 iterations. The wheat warehouse will realize a profit of $162. The table below shows how much wheat you initially have, how much is sold and how much is bought each month (all shown in 1000s of bushels). Table 7: Optimal Solution Month Initial Stock Wheat Sold Wheat Bought 1 6 0 0 2 6 0 0 3 6 6 20 4 20 0 0 5 20 0 0 6 20 20 20 7 20 20 0 8 0 0 20 9 20 20 0 10 0 0 0 The sensitivity analysis for the problem is shown below in Table 8. Table 8: Sensitivity Analysis Variable Current Coefficient Allowable Range X1 0 -∞ to ∞ X2 0 -4 to 1 X3 0 -1 to 1 X4 0 -1 to 1 X5 0 -2 to ∞ X6 0 -1 to ∞ 13 X7 0 -2 to ∞ X8 0 -∞ to 1 X9 0 -1 to ∞ X10 0 -∞ to 1 Y1 3 -∞ to 7 Y2 6 -∞ to 7 Y3 7 6 to 8 Y4 1 -∞ to 2 Y5 4 2 to 4 Y6 5 4 to ∞ Y7 5 3 to ∞ Y8 1 -∞ to 2 Y9 3 2 to 5 Y10 2 0 to 3 Z1 -8 -221e to -7 Z2 -8 -221e to -7 Z3 -2 -3 to -1 Z4 -3 -∞ to -2 Z5 -4 -∞ to -4 Z6 -3 -5 to ∞ Z7 -3 -5 to -2 Z8 -2 -3 to -1 Z9 -5 -∞ to -3 Z10 -5 -∞ to 0 The SA shows that the selling price of wheat in month 1 and 2 can vary from negative infinity to $7 per 1000 bushels without altering the optimal solution. In month 3, it can vary from $6 to $8 per 1000 bushels. The selling price can vary from negative infinity to $2 per 1000 bushels in month 4. Month 5 can only decrease to $2 with no increase over the current $4 per 1000 bushels price. The price can rise to an infinite leveling months 6 and 7 but the lower limit is $4 and 14 $3, respectively. In month 8, the amount can fluctuate from negative infinity to $2. In months 9 and 10, the amount can be in the ranges $2-$5 and $0-$3, respectively. In months1and 2, the price wheat is bought at can vary from negative infinity to $9 without affecting the solution. The price in months 3 and 4 can be in the ranges of $1-$3 and infinity-$4, respectively. In month 5, the price can be anywhere from negative infinity to $4. In months 6 and 7, the range is $1-infinity and $1-$4, respectively. The ranges for months 8, 9, and 10 are $1-$3, negative infinity-$7, and negative infinity-$10. Once again, as long as the prices stay in the allowable ranges a new solution will not have to be found. The initial stock (xi) has no price on it so it does not appear in the objective function, but there is still an allowable range for it. The stock in months 1 and 2 can be in the ranges infinity and -4000 to 1000 bushels, respectively. In months 3 and 4, the range is -1000 to 1000 bushels. The ranges for bushels in months 5, 6, and 7 are -2000 to infinity, -1000 to infinity, and -2000 to infinity. In months 8, 9, and 10, the ranges are infinity to 1000 bushels, -1000 bushels to infinity, and infinity to 1000 bushels. As far as the right-hand side analysis (RHS), SA provided the following information presented in Table 9. As long as the constraints’ RHS stay within the lower and upper limit, the optimal solution will stay optimal. Table 9: RHS Ranges Constraint Current (bushels) Lower Limit Upper Limit Initial Stock 6000 0 20000 First Month’s Sell 0 0 Infinity First Month’s Buy 20000 6000 Infinity Initial Stock (Month 2) 0 -6000 14000 Second Month’s Sell 0 -6000 Infinity Second Month’s Buy 20000 6000 Infinity Initial Stock (Month 3) 0 -6000 Infinity Third Month’s Sell 0 -6000 Infinity Third Month’s Buy 20000 20000 Infinity 15 Initial Stock (Month 4) 0 0 20000 Fourth Month’s Sell 0 -20000 Infinity Fourth Month’s Buy 20000 20000 20000 Initial Stock (Month 5) 0 0 Infinity Fifth Month’s Sell 0 -20000 Infinity Fifth Month’s Buy 20000 0 20000 Initial Stock (Month 6) 0 -20000 Infinity Sixth Month’s Sell 0 -20000 Infinity Sixth Month’s Buy 20000 0 Infinity Initial Stock (Month 7) 0 -20000 Infinity Seventh Month’s Sell 0 0 Infinity Seventh Month’s Buy 20000 0 Infinity Initial Stock (Month 8) 0 -20000 0 Eighth Month’s Sell 0 0 Infinity Eighth Month’s Buy 20000 0 Infinity Initial Stock (Month 9) 0 -200000 Infinity Ninth Month’s Sell 0 0 Infinity Ninth Month’s Buy 20000 0 Infinity Initial Stock (Month 10) 0 -20000 0 Tenth Month’s Sell 0 0 Infinity Tenth Month’s Buy 0 0 Infinity 3.3 Problem 3: Florist Dilemma The optimal solution was found in 16 iterations. The minimum cost is $20,500. The table below shows how the florist should purchase the flowers. Table 10: Optimal Solution for Floral Shop Color Feb Mar May June 500 Red 500 July Aug Sep 500 500 White Pink Apr 500 500 16 500 Yellow Purple 500 The sensitivity analysis and right-hand side analysis is shown below in Tables 11 and 12. Table 11: Sensitivity Analysis Variable Current Coefficient Allowable Range X11 15 12 to ∞ X12 14 7 to ∞ X13 5 0 to 5 X14 2 1 to ∞ X15 4 2 to ∞ X16 2 0 to 5 X17 9 7 to ∞ X18 14 13 to ∞ X21 14 11 to ∞ X22 9 6 to ∞ X23 4 4 to ∞ X24 5 0 to ∞ X25 1 -1 to 1 X26 4 1 to ∞ X27 6 -1 to 6 X28 12 12 X31 16 9 to ∞ X32 4 -3 to 7 X33 3 2 to ∞ X34 3 -2 to ∞ X35 3 -1 to ∞ X36 7 -1 to ∞ X37 5 4 to ∞ 17 X38 10 7 to11 X41 13 12 to ∞ X42 10 7 to ∞ X43 7 5 to ∞ X44 1 0 to 2 X45 2 2 to ∞ X46 6 2 to ∞ X47 7 7 to ∞ X48 16 13 to ∞ X51 12 0 to 13 X52 11 7 to ∞ X53 8 5 to ∞ X54 4 1 to ∞ X55 6 2 to ∞ X56 5 2 to ∞ X57 15 7 to ∞ X58 13 13 Table 12: Right-Hand Side (RHS) Sensitivity Analysis Row Current RHS Allowable Range 2 500 0 to 1000 3 500 500 to 1000 4 500 0 to 500 5 500 0 to 1000 6 500 500 7 500 0 to 500 8 500 500 9 500 500 to 1000 10 1000 1000 to ∞ 11 1000 1000 18 12 1000 500 to 1000 13 1000 500 to ∞ 14 1000 500 to ∞ By looking at the sensitivity analysis we can see that the price of red flowers bought in February can increase to infinity or decrease by 3 from $15 to $12 before the optimal solution changes. The price of red flowers bought in March can increase to infinity or decrease by 7 from $14 to $7 and the price of red flowers bought in April can’t increase at all, but can decrease by 5 from $5 to $0 before the optimal solution changes. The price of red flowers bought in May can increase to infinity or decrease by 1 from $2 to $1 and the price of red flowers bought in June can increase to infinity or decrease by 2 from $4 to $2 before the optimal solution changes. The price of red flowers bought in July can increase by 3 from $2 to $5 or can decrease by 2 from $2 to $0 before the optimal solution changes. The price of red flowers bought in August can increase to infinity or decrease by 2 from $9 to $7 and the price of red flowers bought in September can increase to infinity or decrease by 1 from $14 to $13 before the optimal solution changes. By looking at the sensitivity analysis we can see that the price of white flowers bought in June can increase to infinity or decrease by 3 from $14 to $11 before the optimal solution changes. The price of white flowers bought in March can increase to infinity or decrease by 3 from $9 to $6 and the price of white flowers bought in April can increase to infinity, but can’t decrease by any before the optimal solution changes. The price of white flowers bought in May can increase to infinity or decrease by 5 from $5 to $0 and the price of white flowers bought in June can’t increase at all, but can decrease by 2 before the optimal solution changes. The price of white flowers bought in July can increase to infinity or decrease by 3 from $4 to $1 before the optimal solution changes. The price of white flowers bought in August can’t increase at all, but can decrease by 7, while the price of white flowers bought in September can’t increase at all and can’t decrease at all before the optimal solution changes. 19 By looking at the sensitivity analysis we can see that the price of pink flowers bought in June can increase to infinity or decrease by 7 from $16 to $9 before the optimal solution changes. The price of pink flowers bought in March can increase by 3 from $4 to $7 or can decrease by 7 and the price of pink flowers bought in April can increase to infinity but can decrease by 1 from $3 to $2 before the optimal solution changes. The price of pink flowers bought in May, June July, and August can all increase to infinity before the optimal solution changes. The price of pink flowers bought in May, June, and July can all decrease to zero, while the price of pink flowers bought in August can decrease by 1 from $5 to $4 before the optimal solution changes. The price of pink flowers bought in September can increase by 1 from $10 to $11 or decrease by 3 from $10 to $7 before the optimal solution changes. By looking at the sensitivity analysis we can see that the price of yellow flowers bought in June can increase to infinity or decrease by 1 from $13 to $12 before the optimal solution changes. The price of yellow flowers bought in March can increase to infinity or decrease by 3 from $10 to $7, the price of yellow flowers bought in April can increase to infinity or can decrease by 2 from $7 to $5 before the optimal solution changes. The price of yellow flowers bought in May can increase by 1 from $1 to $2 or decrease by 1 from $1 to $0, while the price of yellow flowers bought in June can increase to infinity, but can’t decrease at all before the optimal solution changes. The price of yellow flowers bought in July can increase to infinity or can decrease by 4 from $6 to $2 before the optimal solution changes. The price of yellow flowers bought in August can increase to infinity, but can’t decrease at all, while the price of yellow flowers bought in September can increase to infinity or decrease by 3 from $16 to $13 before the optimal solution changes. By looking at the sensitivity analysis we can see that the price of purple flowers bought in June can increase by 1 from $12 to $13 or decrease by 12 from $12 to $0 before the optimal solution changes. The price of purple flowers bought in March can increase to infinity or decrease by 4 from $11 to $7, while the price of purple flowers bought in April can increase to infinity or decrease by 20 3 from $8 to $5 before the optimal solution changes. The price of purple flowers bought in May can increase to infinity or decrease by 3 from $4 to $1, while the price of purple flowers bought in June can increase to infinity or decrease by 4 from $6 to $2 before the optimal solution changes. The price of purple flowers bought in July can increase to infinity or decrease by 3 from $5 to $2 before the optimal solution changes. The price of purple flowers bought in August can increase to infinity or decrease by 8 from $15 to $7, while the price of purple flowers bought in September cannot increase or decrease at all before the optimal solution changes. The right-hand side ranges are the ranges for which the current basis remains optimal. From the analysis we see that for the months of February and May the number of flower bundles purchased can increase by 500 from 500 to 1000 or can decrease by 500 from 500 to 0 before the current basis is no longer optimal. For the months March and September the number of flower bundles purchased can increase by 500 from 500 to 1000, but cannot decrease at all before the current basis is no longer optimal. For the months of April and July the number of flower bundles purchased cannot increase at all, but can decrease by 500 from 500 to 0 before the current basis is no longer optimal. For the months of June and August the number of flower bundles purchased cannot increase or decrease at all before the current basis is no longer optimal. From the right-hand side analysis we can also see that the number of red flower bundles purchased can increase to infinity, but cannot decrease before the current basis is no longer optimal. The number of white flower bundles purchased cannot increase or decrease before the current basis is no longer optimal. The number of pink flower bundles purchased cannot increase, but can decrease by 500 from 1000 to 500 before the current basis is no longer optimal. The number of yellow and purple flower bundles purchased can each increase to infinity or decrease by 500 from 1000 to 500 before the current basis is no longer optimal. 21 4 Conclusions & Recommendations Grummins Engine will have a profit of $3,600,000. The optimal solution provided by LINDO is shown below. Year 1 2 3 Truck Type Produced Sold Inventoried 1 100 100 0 2 200 200 0 1 180 180 0 2 100 100 0 1 170 170 0 2 150 150 0 Grummins should take the following recommendations under consideration: 1. Study customers to see if they will accept an increase in selling price. 2. Look into better manufacturing practices to reduce manufacturing cost. Wheat warehouse will earn a profit of $162. The optimal solution is shown in the table below. Month Initial Stock Wheat Sold Wheat Bought 1 6 0 0 2 6 0 0 3 6 6 20 4 20 0 0 5 20 0 0 6 20 20 20 7 20 20 0 8 0 0 20 9 20 20 0 10 0 0 0 The wheat warehouse is given the following recommendations: 1. Try to increase selling price. 2. Look for a different retailer to buy wheat at a lower price. 3. If 1 and 2 can be done, look into increasing storage space. 22 The floral shop’s minimum cost is $20,500. The optimal solution is below. Color Feb Mar Apr May June 500 Red July Aug 500 500 White 500 500 Pink Yellow Sep 500 500 Purple 500 The floral shop is presented with the recommendations below: 1. Look for other suppliers. 2. Study customer demand to see if cheaper alternatives can be found such as underused colors that can be bought at reduced prices. 23 5 References [1] Winston, W.L. and M. Venkataramanan, Introduction to Mathematical Programming, 4th Edition, Duxbury Press, Belmont, CA, 2003. 24 APPENDIX