Document 11607376

advertisement

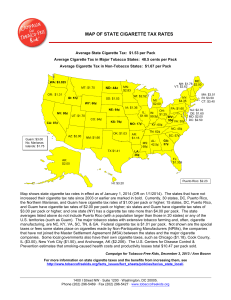

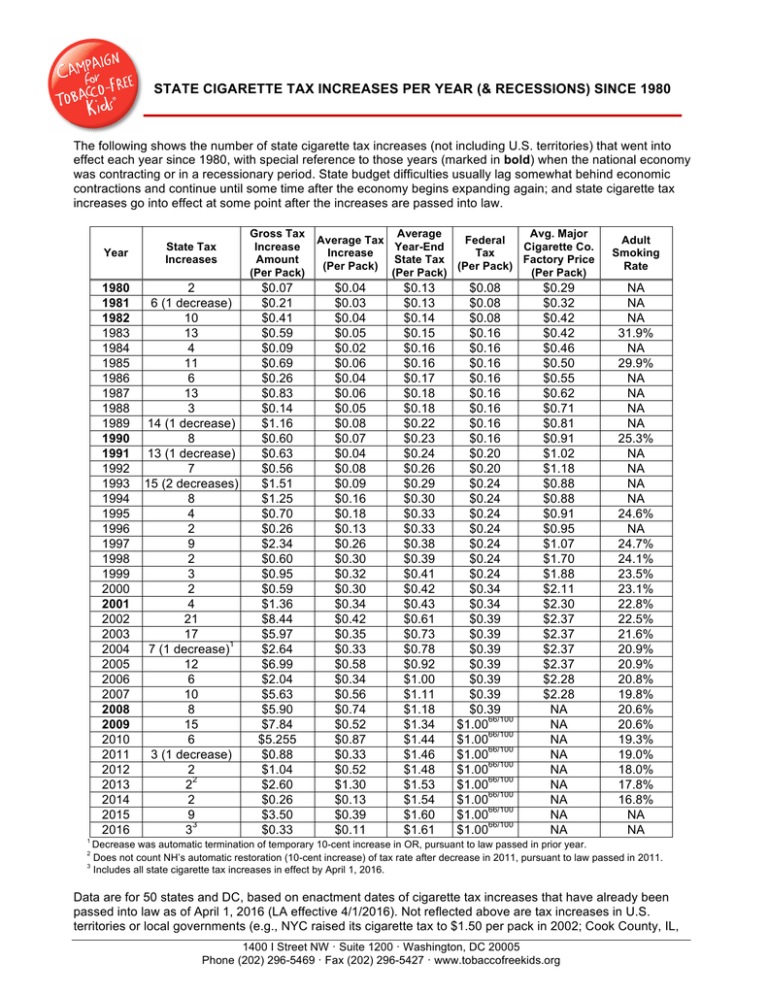

STATE CIGARETTE TAX INCREASES PER YEAR (& RECESSIONS) SINCE 1980 The following shows the number of state cigarette tax increases (not including U.S. territories) that went into effect each year since 1980, with special reference to those years (marked in bold) when the national economy was contracting or in a recessionary period. State budget difficulties usually lag somewhat behind economic contractions and continue until some time after the economy begins expanding again; and state cigarette tax increases go into effect at some point after the increases are passed into law. Year State Tax Increases Gross Tax Increase Amount (Per Pack) 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2 6 (1 decrease) 10 13 4 11 6 13 3 14 (1 decrease) 8 13 (1 decrease) 7 15 (2 decreases) 8 4 2 9 2 3 2 4 21 17 1 7 (1 decrease) 12 6 10 8 15 6 3 (1 decrease) 2 2 2 2 9 3 3 $0.07 $0.21 $0.41 $0.59 $0.09 $0.69 $0.26 $0.83 $0.14 $1.16 $0.60 $0.63 $0.56 $1.51 $1.25 $0.70 $0.26 $2.34 $0.60 $0.95 $0.59 $1.36 $8.44 $5.97 $2.64 $6.99 $2.04 $5.63 $5.90 $7.84 $5.255 $0.88 $1.04 $2.60 $0.26 $3.50 $0.33 Average Avg. Major Average Tax Federal Year-End Cigarette Co. Increase Tax State Tax Factory Price (Per Pack) (Per Pack) (Per Pack) (Per Pack) $0.04 $0.03 $0.04 $0.05 $0.02 $0.06 $0.04 $0.06 $0.05 $0.08 $0.07 $0.04 $0.08 $0.09 $0.16 $0.18 $0.13 $0.26 $0.30 $0.32 $0.30 $0.34 $0.42 $0.35 $0.33 $0.58 $0.34 $0.56 $0.74 $0.52 $0.87 $0.33 $0.52 $1.30 $0.13 $0.39 $0.11 $0.13 $0.13 $0.14 $0.15 $0.16 $0.16 $0.17 $0.18 $0.18 $0.22 $0.23 $0.24 $0.26 $0.29 $0.30 $0.33 $0.33 $0.38 $0.39 $0.41 $0.42 $0.43 $0.61 $0.73 $0.78 $0.92 $1.00 $1.11 $1.18 $1.34 $1.44 $1.46 $1.48 $1.53 $1.54 $1.60 $1.61 $0.08 $0.08 $0.08 $0.16 $0.16 $0.16 $0.16 $0.16 $0.16 $0.16 $0.16 $0.20 $0.20 $0.24 $0.24 $0.24 $0.24 $0.24 $0.24 $0.24 $0.34 $0.34 $0.39 $0.39 $0.39 $0.39 $0.39 $0.39 $0.39 66/100 $1.00 66/100 $1.00 66/100 $1.00 66/100 $1.00 66/100 $1.00 66/100 $1.00 66/100 $1.00 66/100 $1.00 $0.29 $0.32 $0.42 $0.42 $0.46 $0.50 $0.55 $0.62 $0.71 $0.81 $0.91 $1.02 $1.18 $0.88 $0.88 $0.91 $0.95 $1.07 $1.70 $1.88 $2.11 $2.30 $2.37 $2.37 $2.37 $2.37 $2.28 $2.28 NA NA NA NA NA NA NA NA NA Adult Smoking Rate NA NA NA 31.9% NA 29.9% NA NA NA NA 25.3% NA NA NA NA 24.6% NA 24.7% 24.1% 23.5% 23.1% 22.8% 22.5% 21.6% 20.9% 20.9% 20.8% 19.8% 20.6% 20.6% 19.3% 19.0% 18.0% 17.8% 16.8% NA NA 1 Decrease was automatic termination of temporary 10-cent increase in OR, pursuant to law passed in prior year. Does not count NH’s automatic restoration (10-cent increase) of tax rate after decrease in 2011, pursuant to law passed in 2011. 3 Includes all state cigarette tax increases in effect by April 1, 2016. 2 Data are for 50 states and DC, based on enactment dates of cigarette tax increases that have already been passed into law as of April 1, 2016 (LA effective 4/1/2016). Not reflected above are tax increases in U.S. territories or local governments (e.g., NYC raised its cigarette tax to $1.50 per pack in 2002; Cook County, IL, 1400 I Street NW · Suite 1200 · Washington, DC 20005 Phone (202) 296-5469 · Fax (202) 296-5427 · www.tobaccofreekids.org State Cigarette Tax Increases Per Year (& Recessions) Since 1980 / 2 which includes Chicago, increased its tax to $3.00 in 2013; Chicago raised its own cigarette tax to $1.18 in 2014 – with the total state-local tax rate in Chicago now $6.16 per pack; Philadelphia implemented a cigarette tax of $2.00 in 2014; Juneau, AK increased its cigarette tax by $2.00 to $3.00 per pack in 2015). The AR, MT, NV, ND, OR, and TX legislatures are not in session in even-numbered years. KY’s legislature used to meet only every other year but began meeting annually in 2001. National Bureau of Economic Research U.S. business cycle contractions data, http://www.nber.org/cycles.html. Campaign for Tobacco-Free Kids, March 31, 2016 / Ann Boonn