OPEN BOOK, INCLUDING LAPTOP

advertisement

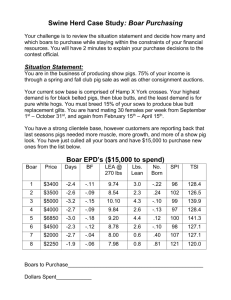

OPEN BOOK, INCLUDING LAPTOP 1) A swine breeder wants to increase growth rate by selecting boars and sows for lower age to reach a 100 kg market weight (AGE, in days). Sows farrow (i.e. produce a litter) twice per year. Any given half year, a total of 60 sows farrow, of which 25 are 1 year old, 20 are 1.5 years old, and 15 are 2 years old. Removal of sows from the breeding herd is for reproduction, which is uncorrelated with growth rate. From each litter, on average 6 piglets are weaned (3 males and 3 females). Two males from each litter are sent to a test station and recorded for AGE. Each half year, the required number of gilts to replace culled sows are selected from the 180 available 6 month-old gilts. Selection of replacement gilts is based on the AGE at 100 kg of the two tested full brothers. The sows available for breeding in a given half-year period are mated to 6 boars. The boars are used for breeding for only one half-year period. Their progeny are born when boars are 1 year old. The 6 boars are selected from the 120 boars that are tested in the station each half-year period. Trait averages in the test station and population parameters are given below (for AGE as well as Back Fat (BF), which will be considered later): Trait AGE BF Current station average 158 days 12.3 mm Phenotypic st. dev. 10 days 2.1 mm Heritability 0.30 0.50 The phenotypic correlation between BF and AGE is +0.20 The genetic correlation between BF and AGE is +0.10 a) Predict the asymptotic rate of response for AGE from this breeding program (you can ignore the Bulmer effect and use large population selection intensities) b) Based on your answer to a), what would you expect the average AGE in the test station to be after 5 years of selection. c) List and discuss all possible reasons why the actual response after 5 years of selection may be different from what you have calculated under b). Although the breeding program described above only considered selection for reduced AGE, BF is another trait of economic importance for growing pigs; hog producers are paid per kg of live weight, with a price differential based on backfat thickness (lower price for higher BF). d) Compute the expected genetic level for backfat in this population after 5 years of selection (you can use asymptotic responses to selection). The table below shows economic parameters that apply to BF and AGE. Feed costs per day per pig $0.15 Overhead costs per day per pig (labour, facilities) $0.30 Price deduction per kg live weight per mm increase in backfat $0.01 Extra feed costs per mm backfat per slaughter pig $0.50 e) Set up the breeding goal for a genetic improvement program for profitability based on AGE and BF and compute the economic values. f) Compute the expected genetic improvement in profit per year from the breeding program for reducing AGE (i.e. single-trait selection) you considered above. g) Derive the optimal index that could be used to select boars for profitability based on their own performance for AGE and BF (ignore the Bulmer effect). h) Derive the index that could be used to select sows based on AGE and BF of two tested full brothers of each sow. i) Predict the annual response to selection for profit in the breeding program described at the start of this question but now with selection of sows and boars based on the indexes you derived above. j) Consider the phenotypic records of the following two boars that have just completed their test: Boar AGE (days) BF (mm) A 162 12.0 B 155 13.2 What is the expected difference in profit between progeny of A and B, assuming they are mated to sows of equal genetic merit. 2) You manage a farrow to finish swine operation, in which you maintain your own herd of sows for breeding through a 2-breed rotation program involving Yorkshire and Landrace, which are then bred to a Duroc terminal sire line for their second and later parities to produce crossbred piglets for market. You have $5,000 to invest and can use that either to: i) Purchase semen from boars from a Duroc terminal sire line that on average have a 50 g/d higher EBV for growth rate than the normal Duroc boars you use to produce crossbred piglets for market. With $5,000 you can replace all the terminal semen you use in a 6-month production cycle with semen from the better boars. ii) Purchase semen from boars from a Yorkshire line that on average have a 60 g/d higher EBV for growth rate than the normal Yorkshire boars for use in the 2-breed rotation program. With $5,000 you can replace all the Yorkshire semen used in the sow herd during a 6-month production cycle. iii) Purchase a growth promoter for use on the terminal crossbred pigs that is expected to increase growth rate by 30 g/d. With the $5,000 you can purchase enough growth promoter to treat all terminal pigs in a 6-month production cycle. Describe how you would go about quantifying the benefits of each of these alternative investment choices and make a decision on which of these options to pursue. Without detailed calculations, discuss how you would expect these three options to rank. Make additional assumptions as needed. When comparing these options, you can assume that performance for all other traits of economic importance is unaffected and that extra feed needed to get 1 g/d extra growth in the terminal pigs is the same for all three strategies. 3) Consider single-trait selection of dairy AI bulls for milk yield. Heritability = 0.25 and the phenotypic SD = 1000 kg/lactation. A New York investor purchases 500 bull calves without pedigree information, genotypes them with the 50k SNP chip, obtains Genomic Selection EBV (GEBV) for milk yield on them with an accuracy of 0.7, uses these GEBV to select the top 100 bull calves and enters these 100 into a progeny-testing program, aiming to get 50 daughter records per bull tested. She then selects the top 5 progeny-tested bulls, using all available information (GEBV and progeny-test information), and markets these as AI sires for the industry. a) Predict the average genetic value of the 5 AI bulls that are selected through this 2-stage selection process (relative to an average genetic value of 0 for the 500 bull calves). Consider the reduction in variances due to selection in the first stage. b) You are hired by the New York investor to develop a business plan for the above selection strategy, aiming to maximize the average genetic level of 5 progeny-tested bulls that result from the 2-stage selection strategy. You have a fixed budget available to you and can rent barns to house whatever number of bulls that you think you need. Describe how you would go about developing this strategy and what results you would show to convince the investor that this is a worth-while investment and the best use of her $$ (no calculations needed). Specify any numbers/figures/parameters that you would need to develop and document this strategy.