Play The Summer 2012

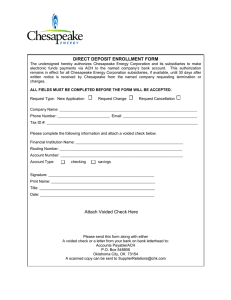

advertisement