Document 11590433

advertisement

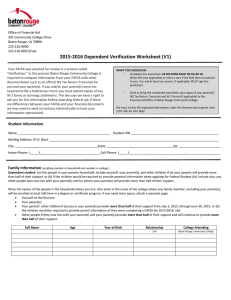

Office of Financial Aid 201 Community College Drive Baton Rouge, LA 70806 225-216-8000 225-216-8010 (Fax) 2016-2017 Untaxed Income Verification Worksheet (V6) Your FAFSA was selected for review in a process called “Verification.” In this process Baton Rouge Community College is required to compare information from fdfdfdfdf your FAFSA with other documentation such as an official IRS Tax Return Transcript for you and your parent(s). If you and/or your parent(s) were not required to file a federal tax return you must submit copies of any W-2 forms or earnings statements. The law says we have a right to ask you for this information before awarding federal aid. If there are differences between your FAFSA and your financial documents we may need to send corrections electronically to have your information reprocessed. WHAT YOU SHOULD DO Complete this worksheet. All SECTIONS MUST BE FILLED IN. Write N/A (not applicable) or enter a zero if the field does not pertain to you. You and at least one parent, if applicable, MUST sign the worksheet. Send or bring the completed worksheet to the Financial Aid Office at Baton Rouge Community College. We must review the requested information under the financial aid program rules (CFR Title 34, Part 668). Student Information Name ____________________________________________________ Student ID# _________________________________________________ Mailing Address: (P.O. Box): _______________________________________________________________________________________________ City: ______________________________________________State: _____________________________________Zip: _______________________ Home Phone: (_____)__________________________________Cell Phone: (_____)___________________________________________________ *All tax filers placed in Verification Tracking Group V6 must submit a copy of their IRS Form W-2 for each source of employment income received for tax year 2015 to verify other untaxed income that was not transferred using the IRS Data Retrieval Tool or that did not appear on the IRS Tax Return Transcript. Non-tax filers who did not and are not required to file a 2015 Federal Income Tax Return must submit an IRS Form W-2 for each source of income reported. Additional Information Student Income $ $ $ $ $ $ $ $ $ $ Do not leave blanks. Enter zeros if no funds were paid Payments to tax deferred pensions & savings plans (paid directly or withheld from earnings) including amounts reported on W-2 Form Box 12a-12d, codes D,E,F,G,H,& S. Child support received for all children. Do not include foster care of adoption payments. Housing, food, & other living allowances paid to members of the military, clergy, & others. Don’t include the value of on base military housing or basic military allowance for housing. Veteran’s non-education benefits such as Disability, Death Pension, or Dependency & Indemnity Compensation (DIC) and/or VA Educational Work-Study allowances Any other untaxed income or benefits, such as worker’s compensation, untaxed portions of railroad retirement benefits, Black Lung Benefits, Refugee Assistance, etc. Don’t include student aid, earned income credit, additional child tax credit, welfare payments, untaxed Social Security benefits, or Supplemental Security Income. Cash received or money paid on your behalf (i.e. bills) not reported on this form. Combat pay or special combat pay. Only enter the amount that was taxable & included in adjusted gross income. Do not enter amount entered on the W-2 (box 12, Code Q). Taxable earnings from need-based employment programs (Federal Work-Study) and need-based employment portions of fellowships & assistantships. Please include earnings from work under a cooperative education program offered by a college. Untaxed portion of IRA Distributions/Untaxed portion of pensions. Tax-exempt Interest Income Student Amount of annual Child Support paid $ Parent $ $ $ $ $ $ $ $ $ $ Parent $ Child Support paid to Name(s) of Eligible Child(ren) If you need more space, attach a separate page. Sign This Worksheet By signing this worksheet, we certify the information reported is complete and correct. At least one parent must sign. Warning: If you purposefully give false or misleading information on this worksheet, you may be fined, be sentenced to jail or both. Student Signature_____________________________________________________________________________Date___________________________________________ Parent/Spouse Signature_______________________________________________________________________ Date___________________________________________