Money demand in the Yugoslavian hyperinflation 1991-1994 Oslo, 6 May 2005

advertisement

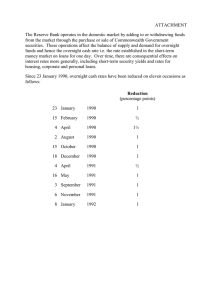

Money demand in the Yugoslavian hyperinflation 1991-1994 Oslo, 6 May 2005 Cagan’s economic model: 1. Money demand 2. Inflation tax 3. Continuous time model Problems in empirical analysis of Cagan’s model: 1. 2. 3. 4. Discrete time data (monthly) Inability to model the data to the end Difficulties in making congruent model Discrepancy between “optimal” and “actual” inflation tax Methodology: 1. Review of economic theory 2. General-to-specific analysis of data 1 Outline: 1. 2. 3. 4. 5. Theory and past empirical results Data and institutional background Model 1: m, p, s • • Model 2: m − p, p, s Conclusion 2 1 Theory and past empirical results Cagan’s (1956) Continuous time economic model: mt −¶pt = −αEt − γ, µ ∂E = β (Ct − Et) . ∂t t mt = log(Mt) is log money in bank notes pt = log(Pt) is log prices Et adaptive expectation of Ct = ∂pt/∂t Empirically: Discretization: Assume Ct constant within each period Data 1920:9 to 1923:7 - but hyperinflation ends 1923:11 α̂ = 5.76 Seignorage or inflation tax: 1/α maximises revenue under additional assumptions. Empirical results: Germany: α̂−1 = 0.183 corresponding to exp(α̂−1) − 1 = 20% Compare with average monthly rate of inflation, ∆Pt/Pt−1, of 322%. 3 • Sargent (1977) • Taylor (1991): Assume: mt, pt ∼ I(2) • • • • so mt − pt, ∆pt ∼ I(1) mt − pt = −α∆pet+1 + ζ t, ∆ept+1 = ∆pt+1 − εt+1, where ∆ept+1 is (rational/adaptive/extrapolative) expectation of inflation. So ¡ ¢ 2 −1 −1 ∆ pt+1 = −α (mt − pt + α∆pt) + εt+1 − α ζ t . Frenkel (1977) Engsted (1996) Abel, Dornbusch, Huizinga and Marcus (1979) Juselius and Mladenović (2002): Vector autoregression with an explosive root and unit roots. 4 2 Data and institutional background 60 (a) log prices 3 40 2 20 1 1991 60 1992 1993 1994 (b) changes in log prices 1991 (c) log money 1992 1993 (d) changes in log money 3 40 2 20 1 0 1991 60 1992 1993 1994 1991 (e) log exchange rate 4 1993 (f) changes in log exchange rate 3 40 2 20 1 0 1991 1992 1992 1993 1994 1991 5 1992 1993 2.0 (a) log real money: m t −p t 1.5 1.0 0.5 0.0 3 1991 1992 1993 1991 1992 1993 (b) growth of log prices: ∆p t 2 1 6 2.00 Cross−plot: m t −p t against ∆p t 1.75 1.50 1.25 1.00 0.75 0.50 0.25 93:10 0.00 93:6 −0.25 0.00 0.25 0.50 0.75 1.00 1.25 1.50 7 1.75 2.00 2.25 2.50 2.75 3.00 3 Model 1: Variables in levels Unrestricted vector autoregression: Consider Xt = (pt, mt, st) for 1990:12 to 1993:10 Xt = 3 X Aj Xt−j + µc + µl t + εt. j=1 Test p χ2normality (2) 1.3 [0.53] FAR(1)(1, 20) 1.8 [0.19] FAR(3)(3, 18) 0.6 [0.62] FARCH(3)(3, 15) 0.1 [0.94] m 6.0 [0.05] 1.0 [0.32] 0.8 [0.53] 0.2 [0.92] s Test 4.5 [0.11] χ2normality (6) 0.1 [0.82] FAR(1)(9, 39) 0.3 [0.81] FAR(3)(27, 29) 0.1 [0.93] (p, m, s) 3.1 [0.79] 1.5 [0.20] 1.1 [0.44] Characteristic roots Re(z) 1.21 -0.42 -0.42 0.02 0.02 0.75 0.75 -0.31 0.09 Im(z) 0 0.84 -0.84 0.90 -0.90 0.33 -0.33 0 0 |z| 1.21 0.94 0.94 0.90 0.90 0.81 0.81 0.31 0.09 8 Cointegration/Co-explosive analysis: 0 ∗ ∆1∆ρXt = α1β ∗0 1 ∆ρ Xt−1 + αρ β ρ ∆1 Xt−1 + ψ∆1 ∆ρ Xt−1 + µc + εt Granger-Johansen representation: t t X X εs + Cρ ρt−sεs + stationary + τ c + τ l t + τ ρρt Xt ≈ C1 s=1 s=1 β 01C1 = 0 Results: H (r) : H1: Hρ: and β 0ρCρ = 0 ¢ ¡ = 1, rank α1β ∗0 1 β ∗0 X = pt − 0.35mt − st + 0.065t, ¡ 1 0 ¢t rank αρβ ρ = p − 1 = 2, µ ¶ 1 0 −1 β 0ρ = . 0 1 −1 Summary: m − p, m − s, p − s ∼ I(1) ∆p, ∆m, ∆s ∼ I(x) 9 4 Model 2: transformed variables µ ¶ ∂Pt 1 ∂pt = by ∆pt Cagan approximates Ct = ∂t ∂t Pt Another measure for cost of holding money is Pt−1 ct = 1 − = 1 − exp (−∆pt) . Pt Motivation: Nominal money stock grows as Mt = Mt−1 + δ t, Divide through by Pt: When ∆pt = pt − pt−1 µ ¶ δt Mt Mt−1 Pt−1 + = Pt Pt−1 Pt Pt = log(Pt/Pt−1) then: ct = 1 − exp (−∆pt) ≈ ∆pt 10 for small ∆pt. (a) m t −p t 1.00 4 (b) c t 0.75 2 0.50 0 0.25 −2 1991 (c) m t −s t 1992 1993 1994 1.00 1991 (d) d t 1992 1993 1994 1991 1992 1993 1994 8 0.75 6 0.50 0.25 4 1991 1992 1993 1994 ct = 1 − exp (−∆pt) ≈ ∆pt for small ∆pt dt = 1 − exp (−∆st) Measurement error in ∆pt eliminated as ct then ≈ 1 11 Unrestricted vector autoregression: Consider Xt = (m − s, ct, dt) for 1990:12 to 1994:1 3 X Xt = Aj Xt−j + µc + εt. j=1 (a) fit: m−s 8 6 4 1991 1992 1993 1994 (e) fit: c 1.0 0.5 1991 1992 1993 1994 (i) fit: d 1.0 0.5 1991 1992 1993 1994 (m) fit: d−c 0.2 0.0 −0.2 1991 1992 1993 1994 2 1 0 −1 (b) residuals: m−s 2 1 0 −1 1991 1992 1993 1994 (f) residuals: c 2 1 0 −1 −2 1991 1992 1993 1994 (j) residuals: d 2 1 0 −1 −2 1991 1992 1993 1994 (n) residuals: d−c 2 (c) QQ plot: m−s 0 −2 −2 1991 1992 1993 1994 12 −2 (d) Chow: m−s 0.5 −2 −1 0 1 (g) QQ plot: c 2 1 0 −1 −2 −2 −1 0 1 (k) QQ plot: d 2 1 0 −1 −2 −2 −1 0 1 (o) QQ plot: d−c 2 0 1.0 2 1.0 (h) Chow: c 1994 0.5 2 1.0 (l) Chow: d 1994 0.5 2 1.0 (p) Chow: d−c 1994 0.5 −1 0 1 2 1994 Cointegration analysis: Hypothesis H(0) H(1) H(2) H(3) Test 60.1 [0.00] 15.5 [0.20] 4.2 [0.40] Likelihood 80.03 102.31 107.97 110.06 Cointegrating relation: = 1 (mt − st) + 3.26ct − 10.27(dt − ct) − 8.48 . ecm √ t ( LR) (2.8) (2.0) Seigniorage α b = 3.26 =⇒ α b −1 = 36% Average of ct is 42.6% for full period. rather than average of ∆Pt/Pt−1. Weak exogeneity c − d is weakly exogeneous [p = 0.47]. 13 (5.7) (−2.7) Parsimonious vector autoregression: ∆(m − s)t = 0.33 ecmt−1 − 0.86 ∆(m − s)t−1 + 1.1 ∆ct−2 (0.05) (0.18) (0.5) −1.9 ∆(d − c)t−1 + 1.6 ∆(d − c)t−2 + 0.20ε̂t. (0.4) (0.3) ∆ct = −0.090ecmt−1 + 0.10 ∆(m − s)t−1 + 0.20 ∆(m − s)t−2 (0.013) (0.04) (0.04) +0.60 ∆ (d − c)t−1 − 0.23 ∆ (d − c)t−2 + 0.046ε̂t, (0.11) ∆ (d − c)t = (0.06) −0.25 ∆(m − s)t−1 (0.08) −0.47 ∆ (d − c)t−1 − 0.42 ∆ (d − c)t−2 + 0.14ε̂t (0.14) (0.14) 14 5 Discussion Methodology: 1. Review of economic theory 2. General-to-specific analysis of data Addressed problems: 1. Inability to model the data to the end 2. Difficulties in making congruent models 3. Discrepancies between “estimated” and “actual” inflation tax Solution: 1. Cagan’s continuous time economic model kept 2. Cagan’s discretization altered using ct = 1 − exp (−∆pt) Future research: 1. Comparative analysis (Germany etc) 2. Augmenting Cagan’s model (a) Real variables? (b) When and how do hyperinflations end? (c) Expectations? Bonus: Econometric theory for explosive processes 15