Lecture 15: Macro dynamics of the open economy (cont) Ragnar Nymoen

advertisement

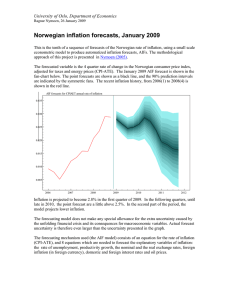

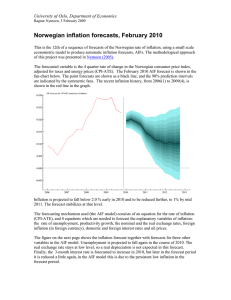

Lecture 15: Macro dynamics of the open economy (cont) Ragnar Nymoen Department of Economics, University of Oslo May 9, 2006 1 Inflation targeting (part 2) The Regime III (inflation targeting) system of equations: f yt = β0 + β1ert − β2rt + β3gt + β4yt e rt = it − πt+1 f πt − πt + ert−1 (1) (2) πt = πte + γ(yt − ȳ) + st f it = it + ee + αe(∆et + et−1) αe < 0 f it = it + h(πt − π̄ f ) mt − pt = m0 − m1it + m2yt, mi > 0, i = 1, 2 Note αe = −θ in IAM. mt is endogenous in the short-run model. Together with yt 2 (3) (4) (5) (6) The short-run analysis (R-III, inflation targeting) From (4): 1 f ∆et = e (it − it − ee) − et−1 α substitution of it from (5) −1 f 1 f e) − e f )) (i + e + (i + h(π − π̄ t t−1 αe t αe t 1 = e (h(πt − π̄ f ) − ee) − et−1 α We therefore obtain the short-run AD schedule from ½ ¾ 1 f f ) − ee) − e r yt = β0 + β1 (h(π − π̄ + π − π + e t t t−1 t−1 t e α n o f f f e − β2 it + h(πt − π̄ ) − πt+1 + β3gt + β4yt ∆et = We adopt IAM’s assumptions about inflation expectations: e πt+1 = πte = π ∗ = π̄ f 3 (7) (8) hence the model becomes ½ ¾ 1 f f ) − ee) − e r yt = β0 + β1 (h(π − π̄ + π − π + e t t t−1 t−1 t e α n o f f f f − β2 it + h(πt − π̄ ) − π̄ + β3gt + β4yt (9) and πt = π̄ f + γ(yt − ȳ) + st (10) Differentiate (9) to obtain the slope of the R-III short-run AD-curve: ¯ ∂πt ¯¯ −1 = <0 ¯ β ¯ 1 ∂yt AD,rIII β1 + h(β2 − αe ) consistent with β̂1in eq. (15) on page 776 in IAM. ¯ ¯ ¯ ∂πt ¯ ∂πt ¯¯ − >− , when αe < 0 ¯ ¯ ∂yt ¯AD,rV I ∂yt ¯AD,rIII hence the short-run AD schedule is flatter in R-III (inflation targeting) than in R-VI. 4 inflation f R-III R-VI R-I y 5 y Interpretation of slope-difference The interpretation of the difference has to do with how the interest rate is determined in the two regimes: When πt increases, y-demand is reduced in both regimes through the real exchange rate, er . But there are additional effects in R-III: The interest rate is increased (monetary policy response) which leads to further reduction in yt. Hence regime III is different from the fixed exchange rate VI, but also from the floating exchange rate regime I (money as the target) where lower demand for money reduces the interest rate in the domestic money market. We have generalized figure 25.3: AD(flex) represent only one sub-category of floating exchange rate regimes. 6 Short-run effect of a supply-shock Consider a positive aggregate supply shock in period t = 1, s1 < 0 (s0 = 0) The impact multipliers: GDP: largest for R-III, smallest for R-I. Inflation: Largest reduction for R-I, smallest reduction for R-III. The fixed exchange rate regime (R-VI) is an intermediate case. If h → ∞ R-III multipliers approach R-VI multipliers (not R-I). 7 Long-run effects of a supply-shock If the reduction in s is temporary: no long run effects. π − π̄ f = 0 from AS (the Phillips curve). Then er = er0 from definition of real-exchange rate. If a permanent reduction of s, then π − π̄ f = s1 < 0 from the AS. In this case e = πte = π ∗ = π̄ f is no longer meaningful. Replace by the assumption of: πt+1 e = πte = π̄ f + s1 for example? Might mean a higher long-run real interest πt+1 e ) in which case er would need to be increased. rate (since r = it − πt+1 ȳ = β0 + β1er − β2r + β3g + β4y f Not clear whether this can be reconciled with the assumed constant inflation target. 8 Short-run effects of a demand shock Use fiscal policy again to represent a demand shock. We already know that R-I and R-VI can be compared by (identical) vertical shifts of the AD curve: However, from (9) ¯ ¯ ¯ dπt ¯¯ β3 dπt ¯ = = >0 ¯ ¯ dgt ¯yt=ȳ,rI dgt ¯yt=ȳ,rI β1 ½ 1 f f ) − ee) − e r yt = β0 + β1 (h(π − π̄ + π − π + e t t t−1 t−1 t e α n o f f f f − β2 it + h(πt − π̄ ) − π̄ + β3gt + β4yt we see that ¯ dπt ¯¯ β3 = ¯ β1 dgt ¯yt=ȳ,rIII β1 + h(β2 − α e) ¾ so (unless the trivial case of h = 0) a vertical shift are not comparable (IAM p 782) 9 However, note that for a given π: ¯ dyt ¯¯ = β3 ¯ ¯ dgt πt=π̄,rIII since there are no indirect demand side effects of a change in y in this regime (yt is not included in the policy response function). The same is true in R-VI where the interest rate is determined on the FEX marked. Hence, from n we have o f r yt = β0 + β1 πt − πt + et−1 n o f f e e e − β2 it + e + α (∆et + et−1) − πt+1 + β3gt + β4yt ¯ dπt ¯¯ = β3 ¯ ¯ dgt πt=π̄,rV I hence, we can make a comparison of regime III and VI with the aid of a horizontal shift of the AD schedule. See IAM p 782 for the algebraic analysis. 10 The impact multipliers (of a change in gt): GDP: larger for R-VI than for R-III. Inflation: larger for R-VI than for R-III. Hence there is no clear cut answer to which monetary policy regime give most automatic stabilization to shocks. Relative frequency of demand and supply shocks is one aspect. This theme is developed further in IAM ch 26.1-26.2, in different directions, which we leave for self-study. 11 Operational inflation targeting (Case of Norway) Charateristics of the regime 1. A floating exchange rate regime 2. The target of monetary policy is low and stable inflation 3. The operational target is the forecasted rate of inflation (1, 2 or 3 years ahead) 4. The instrument is the interest rate that the Central Bank sets as the loan rate in the domestic short-term money market. The interest rates offered to the public are higher but they are highly correlated with the CB’s sight deposit rate (’foliorente’). 5. The CB’s interest rate setting is forward looking. There are two reasons given 12 (a) Signaling, and building up of credibility: By acting on the macroeconomic prospects (in practice the CB’s own forecasts) rather than observed realities, monetary authority can signal a commitment to the target of low and stable inflation. The CB hopes that this will influence inflation anticipations among households and firms, which will in turn make goal achievement easier (b) The transmission mechanism is dynamic: For it takes time before a change in the instrument affects the rate of inflation. Hence by acting “now” the costs of achieving the target is less than by waiting until a too high/low inflation rate becomes a reality. 6. Inflation targeting is flexible when the target horizon is long, so that interest rate adjustments can be gradual. 13 A premise is of course the interest rate has an effect on the rate of inflation. What does the evidence say? Consider the Norwegian Aggregate Model for example. 14 Deviation INF WINF .000 .000 -.001 -.001 -.002 -.002 -.003 -.003 -.004 -.004 -.005 -.005 PBGR .000 -.002 -.004 -.006 -.008 1998 1999 2000 2001 2002 2003 -.010 -.012 1998 1999 LOGCPIVAL 2000 2001 2002 2003 1998 1999 2000 LOGCREX .00 2001 2002 2003 2001 2002 2003 2002 2003 RL .00 .011 .010 -.01 -.01 .009 -.02 -.02 .008 -.03 .007 -.03 -.04 .006 -.04 -.05 .005 -.05 -.06 1998 1999 2000 2001 2002 2003 .004 1998 1999 LOGCR 2000 2001 2002 2003 1998 1999 LOGYF .01 2000 UR2 .000 .0032 .00 .0028 -.004 -.01 .0024 -.02 .0020 -.008 -.03 .0016 -.04 -.012 .0012 -.05 -.06 .0008 -.016 .0004 -.07 -.020 -.08 1998 1999 2000 2001 2002 2003 .0000 1998 1999 2000 2001 2002 2003 1998 1999 2000 2001 Figure 1: The response to a permanent increase in the money market interest rate by 1 percentage point. Interim multipliers of Norwegian Aggregate Model, together with 95% confidence intervals 15(marked by dashed lines). The implications from this set of multipliers are: 1. The interest rate affects inflation through a complicated causal chain. 2. Small and temporary interest rate changes will work no wonders for the rate of inflation 3. The most lasting, and over time strongest, influece is through demand. 4. Flip of the coin of 3. is that i adjusments are best suited to offset demand shocks. Large supply shocks represent a challenge. 16 Inflation forecasting and targeting Inflation targeting: the operational target variable is the forecasted rate of inflation, π̂T +H|T . Interest rate set so that it bring the forecasted inflation rate in line with target, π∗ Flexibility: related to the length of the forecasting horizon, H (as well as of other aspects of the “utility function”). However, a inflation forecast is uncertain, and might induce wrong use of policy. Hence, a broad set of issues related to inflation forecasting is of interest for those concerned with the operation and assessment of monetary policy. 17 A favourable situation occurs when it can be asserted that the bank’s forecasting model is a reasonably correct representation of the true inflation process of the economy. In this case, forecast uncertainty can be represented by conventional forecast confidence intervals, or by the fan-charts preferred by best practice inflation targeters. However an assumption of model correctness is not a practical basis for economic forecasting, as proven by the high incidence of forecasts failures. A characteristic of a forecast failure is that forecast errors turn out to be larger, and more systematic, than what is allowed if the model is correct in the first place. In other words, realizations which the forecasts depict as highly unlikely (e.g., outside the confidence interval computed from the uncertainties due to parameter estimation and lack of fit) have a tendency to materialize too frequently. 18 As stated: forecast properties are closely linked to the assumptions we make about the forecasting situation. One possible classification, is: A The forecast model coincides with actual inflation in the econometric sense. The parameters of the model are known and true constants over the forecasting period. B As under A, but the parameters have to be estimated. C As under B, but we cannot expect the parameters to remain constant over the forecasting period–structural changes are likely to occur somewhere in the .system. D We do not know how well the forecasting model corresponds to the inflation mechanism in the forecast period. A is a very idealized description of the assumptions of macroeconomic forecasting. Nevertheless, there is still the incumbency of inherent uncertainty–even under A. 19 Situation B represents the situation most econometric textbooks conjures up, The properties of situation A will still hold–even though the inherent uncertainty will increase. The theory of inflation targeting also seems stuck with B. In real life we of course do not know what kind of shocks that will hit the economy, or the policy makers during, the forecasting period, which is the focus of situation C. Structural breaks and regime changes are the most important source of forecast failure. Situation D finally leads us to a realistic situation, namely one of uncertainty and professional discord regarding what kind of model best representing reality. This opens up the whole field of model building as well as the controversies regarding econometric specification, so we will leave that subject here. 20 A forecast failure effectively invalidates any claim about a “correct” forecasting mechanism (Situation A or B). Upon finding a forecast failure, the issue is whether the misspecification was detectable or not, at the time of preparing the forecast. Given that regime shifts occur frequently in economics, and since there is no way of anticipating them, it is unavoidable that after forecast structural breaks damage forecasts from time to time. The task is then to be able to detect the nature of the regime shift as quickly as possible. Hence in there is a premium on adaptation in the forecasting process, in order to avoid sequences of forecast failure. Lack of adaptation will make the forecast susceptible also to before forecast structural break leading to unnecessary forecast failure. 21 Relevance for inflation targeting? Forecast quality per se becomes of interest in this policy regime. The rate of inflation, being a nominal growth rate, is particularly susceptible to forecast failure (shifts in means of nominal variables in particular are notorious). If central bank’s do as they claim, and set interest rates to affect the inflation forecast, then regime shifts will not only damage the inflation forecasts, but will also interest rate setting. But in which way (with what consequences) depends on the operational aspects of inflation targeting. 22 As an illustration, suppose that the following reduced form model—derived from a structural model (AD-AS for example)– is used for forecasting πt = δ + απt−1 + β1it + β2it−1 + εt, t = 1, 2, 3..., T, (11) −1 < α < 1, β1 + β2 < 0, πt is the rate of inflation, and it is the interest rate. Suppose, for simplicity, that the central bank have chosen a 2 period horizon. The forecasts are prepared conditional on period T information, so π̂T +1|T = δ + απT + β1iT +1|T + β2iT |T (12) π̂T +2|T = δ(1 + α) + α2πT + αβ1iT +1|T + αβ2iT |T + β1iT +2|T + β2iT +1|T (13) There are 2 degrees of freedom if the bank chooses to attain the target π ∗ in period 2 (inflation targeting is flexible), and iT +1|T and/or iT |T can be set to (help) attain other priorities. 23 For simplicity, set iT +1|T and iT |T to some autonomous level, represented by 0 (hence let it be a deviation from its mean, the period 1 interest rate is equal to the mean interest rate). Hence, the interest rate path in this case is iT |T = 0 iT +1|T = 0 o 1 n 2 ∗ −μ + α (μ − πT ) + π iT +2|T = β1 where μ denotes the long run mean of inflation. 24 (14) In a constant parameter world, this path will secure that πT +2|T is equal to π ∗ on average. But if μ increases in period T + 1 and T + 2, i.e,, a regime shift, both π̂T +1|T and π̂T +2|T will be too low, possibly representing a forecast failure. However, only iT +2|T is affected by the forecast failure, and can replaced by iT +2|T +1 in the next forecast round. With a different operational procedure, designed to move π̂T +1|T “in the direction” of the target, iT |T may be contaminated by regime shifts in the transmission mechanism. 25 The Norwegian Central Bank, in particular, has announced that interest rate changes, will as a rule be gradual. We can model this by setting: iT +j−1|T = γiT +j|T , j = 1, 2, ...H, 0 ≤ γ < 1 which gives o γ2 n 2 ∗ iT |T = −μ + α (μ − πT ) + π Bn o γ 2 ∗ iT +1|T = −μ + α (μ − πT ) + π (15) B o 1n 2 ∗ iT +2|T = −μ + α (μ − πT ) + π B where B < 0 is function of α, β1, β2 and γ. With gradual interest rate adjustment, regime-shifts and forecast failures are more serious, since interest rates today are affected. 26 Norges Bank’s recent inflation forecasts Inflation forecasts are published in the bank’s inflation reports, IRs. The details of the process leading up to the published forecast is unknown to the outsider, but the bank’s beliefs about the transmission mechanism between policy instrument and inflation, represents a main premise for the forecasts, and secures consistency in the communication of the forecasts from one round of forecasting to the next. For simplicity, we refer to the systematized set of beliefs about the transmission mechanism as the Bank Model–BM for short. 27 A main feature of BM is that the joint contribution of all interest rate channels secures a sufficiently strong and quick transmission of interest rate changes on to inflation to justify a 2 year policy horizon. This view of the transmission mechanism has left its mark on the published inflation forecasts, which typically revert to the target of 2.5% within a 2-year forecast horizon. But in the summer of 2004, this view was changed. 28 There is a trade-off between the wish to provide useful forecast, and the wish to avoid forecast failure. Forecasts with high information content come with narrow uncertainty bands. Conversely, the wider the uncertainty bands are, the less information about future outcome is communicated by the forecast. A simple indication of the information content of the inflation forecast is therefore to compare the width of the uncertainty bands with the variability of inflation itself (measured by the standard deviation over, say the last 5 or 10 years). If the forecast confidence region is narrow compared to the historical variability, the central bank forecasts can be said to have a high intended information value, see figure 2. 29 0.030 0.025 Inflation 0.020 0.015 IR 1/02 IR 1/04 IR 1/05 IR 1/03 0.010 0.005 2002 2003 2004 2005 2006 2007 2008 Time Figure 2: Uncertainty measures of Norges Bank’s inflation forecasts in Inflation Reports 1/02, 1/03 and 1/04. The lines show the width of the the approximate 90% confidence region (the difference between the upper and lower 90% band 30 in the fan-charts), for the 12 month growth rate of CPI-ATE. 1. Norges Banks believes in low forecast uncertainty. High information content in forecast for the first couple of quarters. 2. Maximum uncertainty is reached fast- Hence Norges Bank acknowledges that there is a strict limit to the predictability of inflation? 3. Forecast uncertainty is increased in IR 1/04. Reflects how calculated uncertainty is based on part errors. A sign of adaptation. But enough? 31 0.04 IR 1/02 IR 2/02 0.04 forecast forecast 0.02 0.02 actual actual 0.00 0.00 2001 0.04 2002 2003 2004 2005 2006 2007 IR 3/02 2001 forecast 2003 2004 2006 2007 forecast 0.02 actual actual 0.00 0.00 2001 2002 IR 2/03 0.04 2003 2004 2005 2006 2007 2001 2002 2003 2004 2005 2006 2007 2006 2007 2006 2007 IR 3/03 0.04 forecast forecast 0.02 0.02 actual actual 0.00 0.00 2001 0.04 2005 IR 1/03 0.04 0.02 2002 2002 2003 2004 2005 2006 2007 IR 1/04 2001 0.04 2002 actual 2005 forecast 0.02 0.00 0.00 2001 2004 actual forecast 0.02 2003 IR 2/04 2002 2003 2004 2005 2006 2007 2001 2002 2003 2004 2005 Figure 3: Norges Bank’s inflation forecasts, 90% confidence regions and the actual rate of inflation. 32 6 of 8 graphs show clear evidence of forecast failure. In the IR 2/02 forecasts the first four inflation outcomes are covered by the forecast confidence interval, but the continued fall in inflation in 2003 constitutes a forecast failure. Specifically, the forecast confidence interval of IR 3/03 doesn’t even cover the actual inflation in the first forecast period. The 7th panel shows that the forecasted zero rate of inflation for 2004(1) in IR 1/04 turned out to be accurate. The forecasts have been substantially revised from IR 3/04. Whether this will prove enough to end the sequence of poor forecasts, remains to be seen. The next section contains an evaluation by way of presenting ex post forecasts based on information which were available to the forecasters at the time of preparing the IR forecasts. 33 How avoidable was the forecast failure? As pointed out, poor forecasts due to after forecast structural breaks are unavoidable in economics. Given that fact, there is a premium on having a robust and adaptable forecasting process. Allowing relevant historical shocks to be reflected in forecast uncertainty calculations contributes to robustness in the forecasts, avoid too narrow forecast confidence intervals. This may have some relevance for the recent forecasts, since the low and stable inflation rates of the late 1990s may have lead some forecasters to down-play uncertainty. 34 Yet, as any nominal variable, inflation mat be subject to frequent changes in mean, exactly the type of shocks that will damage forecasts. Adaptable forecasting mechanisms have the ability to adjust the forecasts when a structural change is in the making, or at the latest, when a forecast failure has manifested itself. 35 The forecast failures also give rise to the question whether the sequence of poor forecasts was avoidable at the time of preparing the forecasts. This is a complex issue which needs to be analyzed from several angles. Here we follow an on-looker’s approach, and set up a forecasting mechanism which features at least two elements which logically must be present in the forecasting process in the bank: 1. All explanatory variables of inflation are themselves forecasted. Hence, our ex-post forecasts do not condition on variables that could not have been known also to the forecasters at the time of preparing the different inflation reports. 2. Just like in a practical forecasting situation, the forecasts are updated: model parameters are re-estimated as new periods are included in the historical sample, and, more importantly for the forecasts themselves, the initial conditions are changed as we move forward in time. 36 Note that in our ex post forecasts, the up-dating of the forecasts is automatized. In real life forecasting, the revision of the forecasts from one inflation report to the next is done by experts. In comparison, our econometric forecasts are naive. In general, naive econometric forecasts are not particularly adaptive, but are prone to failures themselves. The set of forecasting equations was estimated on a quarterly data set which starts in 1981(1). Figure 4 shows the sequence of model forecasts. 37 0.04 AIR 1/02 0.04 0.02 0.02 0.00 0.00 2001 0.04 2002 2003 2004 2005 AIR 3/02 2001 0.04 0.02 0.02 0.00 0.00 2001 0.04 2002 2003 2004 2005 AIR 2/03 0.04 0.02 0.00 0.00 0.04 2002 2003 2004 2005 AIR 1/04 0.02 0.02 0.00 0.00 2001 2002 2003 2004 2005 2003 2004 2005 2002 2003 2004 2005 2002 2003 2004 2005 2002 2003 2004 2005 AIR 3/03 2001 0.04 2002 AIR 1/03 2001 0.02 2001 AIR 2/02 AIR 2/04 2001 Figure 4: Dynamic forecasts from an econometric model of inflation, where we have emulated the (real time) forecast situation of the Norges Bank inflation forecasts. The forecasted variable is the annual change in the logarithm of the 38are shown as bars. CPI-ATE. Forecast confidence intervals 1. The confidence bands of the forecasts are wider in “IR 1/02”, both for the one and eight quarter ahead forecasts. 2. Even though the second year forecasts in “IR 1/02” show too high inflation, there is in fact a forecasted weak tendency towards lower inflation in 2003. 3. Since the second year actual inflation rates are within the corresponding confidence bars, these outcomes do not represent forecast failure in Figure 4, while they do in the Norges Bank forecast. 4. In the panel, labeled “IR 3/02”, the impact of conditioning on 2002(2) shows up in narrower confidence bands for 2003, which in fact almost makes the realized inflation rate in 2003(4) a forecast failure. 5. The next three panels in Figure 4 show an even more market difference from the Norges Bank forecasts. 39 A subjective assessment In the period 2001-2005 monetary policy in Norway has been hampered by several problems and mistakes 1. Overestimation of the effect of the interest rate on inflation (the interim multipliers) by Norges Bank. 2. Underestimation of the period of adjustment and of the forecast uncertainty. 3. Very slow identification of the nature of the drop in the rate of inflation that started in 2003 (relative weight on supply and demand factors, an on domestic and foreign). 4. Exceptionally slow adaptation of the forecasts. 40 5. Interest rate decisions might have suffered. Time will show if these are still only teething problems. 41