Lecture 14: Macro dynamics of the open economy (cont) Ragnar Nymoen

advertisement

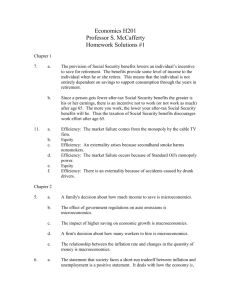

Lecture 14: Macro dynamics of the open economy (cont) Ragnar Nymoen Department of Economics, University of Oslo May 2, 2006 1 Inflation targeting (part 1) Remember the different regimes explained in Lecture11: Foreign exchange rate market exogenous variable Foreign exchange reserves Exchange rate Money market Money supply exogenous Interest rate variable None I III V II IV VI In Lecture 12 we analyzed R-I, a so called money targeting regime, and compared it to the R-VI (Et is targeted) In R-I the instrument of monetary policy is market operations: buying and selling of domestic bonds controls the supply of money in the domestic money market. 2 Remember the “supply of money function” of the open economy: ∆Mt = −∆Bt + Et · ∆Fg,t + ∆Et · Fg,t In R-I ∆Fg,t = 0 and Fg,t = F̄g . Revaluations of the stock of foreign currency F̄g affects ∆Mt somewhat, but according to the theory of R-I, such movements are countered by market operations (∆Bt). Changes in the net supply of bonds can also be used to increase or lower Mt independently of the market for foreign exchange. Hence, monetary policy independence in R-I: the interest rate is determined on the domestic money market. No such independence in R-VI, because the interest rate is determined in the market for foreign exchange. Remember that the discussion of R-I and R-IV was based on the assumption of perfect capital mobility (as in the IAM book). 3 Why consider alternatives to R-I? A full discussion is beyond this course, but in practice R-I failed to live up to the expectations founded in the theory just summarized: It turned out to be difficult to control money supply. Two issues in particular seem to have been important: a) Which money stock measure to target (M1, M2 or M3) b) In practice central banks rode two horses: tried also to intervene in FEX market (dirty float), which affect money supply In any case, R-I was really never considered an alternative when several SOEs started floating their exchange rates in the 1990’s. The alternative most countries settled for is called inflation targeting. In our typology inflation targeting can be seen as an extension of R-III. The interest rate is the used as an instrument to achieve a certain inflation rate (the target). Therefor it is “exogenous in the domestic money market”. However it it is endogenous in the wider setting of our macroeconomic model. We now define the inflation targeting regime 4 Inflation targeting defined We make a short-cut and replace equation (2), page 769 in IAM with the following policy response (equivalent to what IAM also eventually ends up with) f it = it + h(πt − π ∗) h > 0. (Policy response) where π ∗ denotes the inflation target, usually number like 2% or 2.5% (annual rate). f Note: could have coefficient different form 1in front of it as well. Remark to table 25.1: Norges Bank does not acknowledge that it operates with “tolerance bands”. Rather a horizon (1-2 years) over which the target should be achieved. 5 We follow IAM and make the following simplifying assumption π ∗ = π̄ f , target set to a constant foreign inflation From policy response function and expectations: f it = it + h(πt − π̄ f ) which is eq (14) on page 776. We can now augment the AD-AS model with the ’policy rule’. 6 f yt = β0 + β1ert − β2rt + β3gt + β4yt e rt = it − πt+1 f ert = ∆et + πt − πt + ert−1 πt = πte + γ(yt − ȳ) + st f it = it + ee + αe(∆et + et−1) αe < 0 f it = it + h(πt − π̄ f ) mt − pt = m0 − m1it + m2yt, mi > 0, i = 1, 2 (1) (2) (3) (4) (5) (6) Note that (4), is a generalization of eq (9) on page 771. IAM omits ee and et−1, and αe corresponds to −θ in IAM. Skip the discussion on p 772 the774, it represents an internal inconsistency (non zero risk-premium and dirty float even though perfect capital mobility here). Compared to R-I we have one more equation. Hence mt is endogenous in the short-run model of inflation targeting 7 The short-run analysis (inflation targeting) From (4): 1 f ∆et = e (it − it − ee) − et−1 α substitution of it from (5) −1 f 1 f e) − e f )) (i + e + (i + h(π − π̄ t t−1 αe t αe t 1 = e (h(πt − π̄ f ) − ee) − et−1 α We therefore obtain the short-run AD schedule from ½ ¾ 1 f f ) − ee) − e r yt = β0 + β1 (h(π − π̄ + π − π + e t t t−1 t−1 t e α n o f f f e − β2 it + h(πt − π̄ ) − πt+1 + β3gt + β4yt ∆et = We adopt IAM’s assumptions about inflation expectations: e πt+1 = πte = π ∗ = π̄ f 8 (7) (8) hence the model becomes ½ ¾ 1 f f ) − ee) − e r yt = β0 + β1 (h(π − π̄ + π − π + e t t t−1 t−1 t e α n o f f f f − β2 it + h(πt − π̄ ) − π̄ + β3gt + β4yt (9) and πt = π̄ f + γ(yt − ȳ) + st (10) Differentiate (9) to obtain the slope of the R-III short-run AD-curve: ¯ ∂πt ¯¯ −1 = <0 ¯ β ¯ 1 ∂yt AD,rIII β1 + h(β2 − αe ) consistent with β̂1in eq. (15) on page 776 in IAM. ¯ ¯ ¯ ∂πt ¯ ∂πt ¯¯ − >− , when αe < 0 ¯ ¯ ∂yt ¯AD,rV I ∂yt ¯AD,rIII hence the short-run AD schedule is less steep with inflation targeting than in R-VI. 9