Lecture 13: Macro dynamics of the open economy (cont) Ragnar Nymoen

advertisement

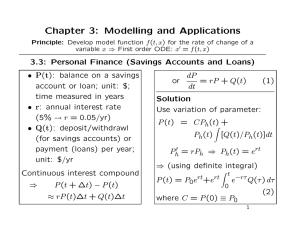

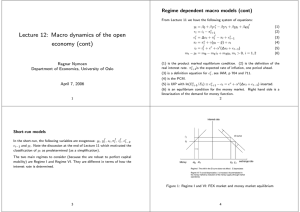

Lecture 13: Macro dynamics of the open economy (cont) Ragnar Nymoen Department of Economics, University of Oslo Corrected version (2. May) 1 Recapitulation from lecture 12 From Lecture 11 and 12 we have the following system of equations: f yt = β0 + β1ert − β2rt + β3gt + β4yt e rt = it − πt+1 f ert = ∆et + πt − πt + ert−1 πt = πte + γ(yt − ȳ) + st f it = it + ee + αe(∆et + et−1) mt − pt = m0 − m1it + m2yt, mi > 0, i = 1, 2 (1) (2) (3) (4) (5) (6) We analyzed the short-run and long-run effects of a permanent change in gt in two exchange rate regimes: Float with money supply as exogenous target variable, and fixed with Et as exogenous target variable and i as instrument. 2 Main conclusions: 1. The regimes can be graphically represented in one graph: the slopes of the AD lines are different. Steeper in the floating ex-rate regime 2. Short-run effect of fiscal policy expansion largest in case of fixed ex-rate regime 3. No long-run effects on y in either regime. The new long run equilibrium level of ert is lower than before the shock. Nominal appreciation in the case of float. Increased P in the fixed exchange rate regime. 3 More on fiscal policy in the fixed exchange rate regime The above is based on fixed and exogenous inflation and a permanent policy change. We now relax these assumptions, and we also want to say something about dynamics. a. Change in gt is permanent and πte and πte are constant Short-run: AD curve shifts. Dynamics: AD curve shift gradually back again. e = πte = π f The economy is “gliding” back to initial equilibrium point (πt+1 and yt = ȳ). Gradually ert is reduced. e = b. As in case a) but inflation expectations are rational in the sense of πt+1 πte = π f , see page 739 in IAM. Same analysis! 4 Formal analysis of dynamics and stability See 739-741 in ch 24.3 of IAM. So far we have implitely assumed that the dynamic process which is triggered by the raise in gt is stable, so that a new long-run equilibrium is reached. Intuitively, the dynamics are in fact stable, since a process of real currency appreciation is begins as a result of the shock. As an exercise, this can be shown formally. Fixed ex-rate sssumptions: e πt+1 = πte = π f eet+1 − et = 0 ∆et = 0 5 The model can be written in somewhat more compact form as f yt − ȳ = β̂0 − β1(πt − πt ) + β1ert−1 + β3gt + dt, f f f dt = −β2(it − πt ) + β4yt − ȳ f πt − πt = γ(yt − ȳ) + st f ert = −(πt − πt ) + ert−1 (7) (8) (9) f Use (7) and (8) to express for ert−1 by yt − ȳ (e.g. by substitution for (πt −πt )): 1 β3 dt β̂0 r − et−1 = (1 + β1γ)(yt − ȳ) + st − gt − β1 β1 β1 β1 which is equation (17) page 739. We also have: 1 β3 dt+1 β̂0 r et = (1 + β1γ)(yt+1 − ȳ) + st+1 − gt+1 − − β1 β1 β1 β1 Using these two expressions in (9), together with (8), gives the following ADL model for (yt+1 − ȳ): 1 β3 (yt+1 − ȳ) = (yt − ȳ) + ∆gt+1 + .... 1 + β1γ (1 + β1γ) 6 or, for yt : (yt − ȳ) = 1 β3 (yt−1 − ȳ) + ∆gt + .... 1 + β1γ (1 + β1γ) (10) We can now apply what we have learnt about stability earlier, namely that (yt − ȳ) is dynamically stable if 1 <1 1 + β1γ which holds since β1γ > 0. 7 Temporary versus permanent fiscal policy shocks (IAM p 24.3) We can also use (10) to analyze the different responses to permanent and temporary fiscal policy shocks. A permanent shock amounts to ∆g1 > 0, for example ∆g1 = 1, and ∆g2 = ∆g3 = ... = 0. A temporary shock amounts to ∆g1 = 1, ∆g2 = −1, for example, and ∆g3 = 8 ∆g4 = ... = 0. perm temp impact β3 (1+β1γ) β3 (1+β1γ) 2nd β3 (1+β1γ)2 −β1γβ3 (1+β1γ)2 3rd β3 (1+β1γ)3 −β1γβ3 (1+β1γ)3 ... 0 ... 0 Hence the temporary leads to a short expansion, and then a longer period where yt − ȳ < 0. So far we have considered unsystematic fiscal policy, An example of systematic fiscal policy is: gt − ḡ = a(ȳ − yt), 9 a > 0. (11) Intuitively, in this model, systematic fiscal policy leads to a steeper short-run AD schedule. A real appreciation leads to less reduction in y in the case of a > 0, than a = 0, see fig 24.4. Effects of negative demand shocks are smothered. The speed of adjustment is reduced. 10