SuperSure Insurance Plan for Self-Managed Super Funds Supplementary Product Disclosure Statement

advertisement

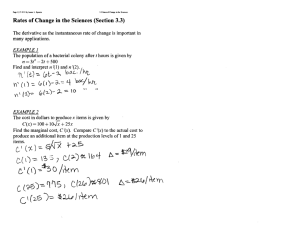

SuperSure Insurance Plan for Self-Managed Super Funds Supplementary Product Disclosure Statement 16 February 2015 TAL Life Limited ABN 70 050 109 450, AFSL 237848 (TAL) is the issuer of this Supplementary Product Disclosure Statement (SPDS) dated 16 February 2015 which updates and modifies the information in the SuperSure Insurance Plan for Self-Managed Superannuation Funds Product Disclosure Statement (PDS) dated 3 May 2013. You must read this SPDS together with the PDS. Definitions Terms defined in the PDS have the same meaning when used in this SPDS. New name All companies in the WHK Group, including WHK Financial Planning Pty Ltd, have changed name since the date of the PDS as follows: WHK Financial Planning Pty Ltd ACN 060 092 631 is now Crowe Horwath Financial Advice Pty Ltd ACN 060 092 631; and WHK Group is now the Crowe Horwath Group. The following references made in the PDS are updated as follows: The acronym WHK is replaced by CHF; and The acronym WHK Group is replaced by CHF Group. On 6 January 2015 the Crowe Horwath Group became part of the Findex Group of companies when it was acquired by Findex Australia Pty Ltd ACN 128 588 714. New contact details for CHF The address for CHF and its related companies (as specified on pages 3 and 13 of the PDS) are deleted and replaced by: Level 17, 181 William Street Melbourne VIC 3000 In addition, the website address for CHF (as detailed on page 13 and the back cover of the PDS) is now: www.crowehorwath.net/au Appointment of a custodian On 8 December 2014, CHF appointed Equity Trustees Limited ACN 004 031 298 (EQT), a provider of custodial services, to hold the Policy on CHF’s behalf as custodian (Custodian). Appointing the Custodian will not affect: the amount of Your insurance premium; the insurance cover available to You as trustee of a SMSF, in respect of members of Your fund, as per the terms of the Policy; or the way in which You make a claim. The Custodian must only act on the instructions of CHF and CHF remains the beneficial owner of the Policy. EQT is not responsible for the issue of the PDS or of this SPDS and takes no responsibility for the accuracy or truth of any statement in the PDS or this SPDS. The diagram on page 5 of the PDS which explains how the Policy works is replaced with the following diagram: 1. How it Works Your cover is provided under a 'group' life policy with TAL, Australia's largest specialist life insurer. The Policy is held by EQT, in its capacity as custodian for Crowe Horwath Financial Advice Pty Ltd, for the benefit of the Crowe Horwath Group's SMSF clients. This is represented diagrammatically as follows: TAL Life Limited is the Insurer EQT is the Policy Owner as custodian for Crowe Horwath Financial Advice Pty Ltd Your SMSF Trustee/Member 1 Trustee/Member 2 Trustee/Member 3 Trustee/Member 4 (Insured Person) (Insured Person) (Insured Person) (Insured Person) 2 General information The information provided in this SPDS is general in nature and has been prepared without taking into account Your objectives, financial situation or needs. Therefore, before making a decision, You should consider the appropriateness of the product, having regard to Your objectives, financial situation or needs. The PDS and this SPDS have been prepared based on TAL's interpretation of the relevant legislation as at the date of issue. TAL may change any of the terms and conditions set out in the PDS at any time, where permitted to do so under law. Changes to PDS and SPDS As stated in the PDS, information in the PDS (and this SPDS) may change from time to time. Where changes are materially adverse, or otherwise required by law, We will replace this PDS or issue a further SPDS and give You notice as required or permitted by law. 3 SuperSure Insurance Plan for Self-Managed Superannuation Funds Product Disclosure Statement 3 May 2013 Product Issuer and Insurer TAL Life Limited ABN 70 050 109 450 AFSL 237848 Policy Owner WHK Financial Planning Pty Ltd ABN 51 060 092 631 AFSL 238244 better advice for a better life The simplest way to obtain life insurance for your SMSF SuperSure understands that Australians are concerned with the amount of superannuation and providing financial security to their loved ones. Through the SuperSure Insurance Plan, you can receive death and Total and Permanent Disablement cover – in many cases automatically, without medicals or time-consuming applications. Some unique features of the SuperSure Insurance Plan are: • automatic death and Total and Permanent Disablement cover up to $750,000 without medicals; • the ability to increase your automatic cover at significant times in your life via a simple process; • competitive insurance premiums. | 2 Important Information This Product Disclosure Statement (PDS) provides important information about the SuperSure Insurance Plan (Plan) for Self-Managed Superannuation Funds (SMSF). The Plan provides insurance for members of SMSFs who engage the services of a WHK Group firm in relation to their SMSF. Please note the following important terms used throughout this PDS: WHK Group includes WHK Group Limited ABN 93 006 650 693 and its related bodies corporate (as defined under the Corporations Act 2001 (Cth)). ‘Policy’ means the insurance Policy issued by the Insurer; A Group Life Insurance Policy (“Policy”) for death and Total and Permanent Disablement (TPD) has been issued by TAL Life Limited (“TAL”) to WHK Financial Planning Pty Ltd (“WHK”) for the benefit of the WHK Group’s SMSF clients. WHK acts as a trustee for SMSF trustee/s (“Trustees”) who receive cover under the Policy for the benefit of their SMSF Members. The premium payable by the Trustees is a life insurance premium. Trustees will be provided with a Certificate of Insurance in their name when cover commences which Trustees may provide to the SMSF Auditor for the Superannuation Fund Audit requirements. The Policy terms and conditions will be governed by the life insurance Policy issued by TAL to WHK. The Insurer is the issuer of this PDS and takes sole responsibility for its content. This PDS was prepared based on the Insurer’s interpretation of the relevant legislation as at the date of issue. The Insurer may change any of the terms and conditions set out in the PDS at any time where permitted to do so under law. TAL has outsourced the administration, promotion and distribution of the Plan to a dedicated team at Prescott Securities Ltd (SuperSure Administrator). Full details of the Insurer, Policy Owner, and SuperSure Administrator of the Plan are found below: Insurer Policy Owner SuperSure Administrator TAL Life Limited WHK Financial Planning Pty Ltd (part of WHK Group) Prescott Securities Ltd (member of WHK Group) ABN 51 060 092 631 ABN 12 096 919 603 AFSL 238244 AFSL 228894 Level 9, 473 Bourke Street Melbourne VIC 3000 245 Fullarton Road Eastwood SA 5063 ABN 70 050 109 450 AFSL 237848 PO Box 142, Milsons Point NSW 1565 www.tal.com.au T: 1300 791 120 E: whksupersure@ prescottsecurities. com.au Please send all correspondence to the SuperSure Administrator. Insurance under the Plan is only available to members of an SMSF receiving the offer from a servicing WHK Group firm who make an application within Australia. It is not an offer, invitation or recommendation by the Insurer to purchase cover under the Plan in any other jurisdiction. Applications from outside Australia will not be accepted. The Insurer is also not bound to accept any application. ‘Plan’ means the SuperSure Insurance Plan for Self-Managed Superannuation Funds (SMSF); ‘Member’ means the member(s) of the SMSF of which You are a Trustee or a director of a corporate Trustee; ‘You’ and ‘Your’ means the Trustee or a director of a SMSF who participates in the Plan for SMSFs; and ‘We’, ‘Us’, ‘Our’ or ‘the Insurer’ means TAL Life Limited, the product issuer and Insurer. You will see that in addition to the above, there are a number of words in this PDS which are capitalised. These words have a particular definition when used in this PDS and the definitions are found in section 17 under the Insurance Glossary on pages 14–17 of this PDS. It is important that You read the definitions carefully because their meanings are relevant to the cover You will have the benefit of or Your decision to apply for and keep this product. This PDS should be read before making a decision in relation to any insurance cover. It is intended to help You decide whether the product will meet Your needs and may assist You in comparing its features with other products You may be considering. This PDS has been prepared with the intention of providing You with general information only about the product. Any financial product advice contained in this PDS is of a general nature only and has been prepared without taking into account Your objectives, financial situation or needs. Therefore, before making a decision, You should consider the appropriateness of the product, having regard to Your objectives, financial situation or needs. Information in this PDS may change from time to time. Where changes are materially adverse, or otherwise required by law, We will replace this PDS or issue a supplementary PDS and give You notice as required or permitted by law. Anyone making the PDS available to another person must provide them with the entire electronic file or printout. You can also obtain a paper copy of the PDS on request without charge by contacting Your servicing WHK Group firm or the SuperSure Administrator. We have a formal complaints procedure (see section 16 on page 13 of this PDS for more information). All parties named in the PDS have consented to be named in the form and context in which they have been named and have not withdrawn their consent prior to the issue of this PDS. This PDS is only a summary of the Policy terms. Information about death and Total and Permanent Disablement insurance cover is based on information contained in the Policy issued by Us. While every effort has been made to ensure that the contents of this PDS are consistent with the Policy, if there are any discrepancies between this PDS and the Policy, the Policy will prevail. We reserve the right to replace the Policy and to alter the terms and conditions of the Policy, including the cover and the premiums. You may request a copy of the Policy from either Your servicing WHK Group firm or the SuperSure Administrator. | 3 Table of Contents 1. How it works 5 2.Insurance Benefits 6 3.Eligibility Criteria 6 4.Automatic Cover 6 5. Voluntary Cover 7 6.Option of an ‘Own Occupation’ TPD definition 8 7.Cost of Cover 8 8.Individual transfer terms – transfer of other insurance into the Plan 9 9.Increasing Your cover due to a Life Event 9 10.Interim Accident Cover 10 11.Automatic indexation of the Sum Insured 10 12. Benefits Payable 10 13.Cessation of cover 11 14.Reduction or cancellation of cover 11 15. General Terms and Conditions 11 16.Other Important information 12 17.Insurance Glossary 14 | 4 1. How it works Your cover is provided under a ‘group’ life policy with TAL, Australia’s largest specialist life insurer, that is held by WHK Financial Planning for the benefit of the WHK Group’s SMSF clients. TAL Life Limited is the Insurer WHK Financial Planning is the Policy Owner Your SMSF Trustee/Member 1 Trustee/Member 2 Trustee/Member 3 Trustee/Member 4 (Insured Person) (Insured Person) (Insured Person) (Insured Person) | 5 SuperSure Insurance Plan exclusively for WHK 2.Insurance Benefits 4. Automatic Cover The Plan offers automatic and extra insurance cover for all members of SMSFs which are serviced by a WHK Group firm. The Insurance cover provided, up to the Maximum Benefit Limit under the Plan, is as follows: Automatic Cover is provided for all eligible trustees/members of a SMSF using a WHK Group firm as a provider of services to their SMSF on an automatic basis without further action from You commencing when You first meet the Eligibility Criteria under section 3 on page 6 of this PDS. Type of cover Maximum Benefit Limit Death cover (including Terminal Illness cover) – providing a lump sum payment upon death (or Terminal Illness) Unlimited (with Terminal Illness cover of up to $3,000,000) Total and Permanent Disablement (TPD) cover – providing a lump sum payment upon becoming TPD $3,000,000 (the amount of TPD cover cannot be higher than the amount of death cover) It is designed to provide Members with a basic level of protection for death and TPD without the need for medicals or applications (referred to as Underwriting). Amount of Automatic Cover The amount of Automatic Cover will be based on Your age next birthday as at the day You joined the Plan according to the table below: Age next birthday Automatic death and TPD Sum Insured 16-25 $750,000 3. Eligibility Criteria 26-35 $750,000 36-55 $750,000 For You to be eligible for cover under the Plan You must: 56-60 $500,000 • be an Australian Resident ordinarily located in Australia when this PDS is issued to You; 61-65 $500,000 • be a client of WHK Group where services by a WHK Group firm are provided to Your SMSF; • be aged 15 to 64 for Automatic Cover or 15 to 69 for extra cover (TPD definitions from age 65 are limited); and • at all times have sufficient funds which are available in Your SMSF to pay for the cost of the insurance. All Automatic Cover decreases for ages (next birthday) 66 to 70 according to the table below: Age next birthday Automatic death and TPD Sum Insured 66* $500,000 67* $400,000 68* $300,000 69* $200,000 70* $100,000 * TPD cover is subject to different rules (only the Activities of Daily Living (ADL) and Permanent Loss TPD definitions apply) – see TPD definition in Insurance Glossary for further information. | 6 Restrictions and Exclusions applying to Automatic Cover The following restrictions and exclusions apply to Automatic Cover: • if You are At Work on the day cover commences, a Three Year Pre-existing Condition Exclusion will apply to Your Automatic Cover. This means that if Your claim was due to something You have or had in the three years prior to Automatic Cover starting, You will not be covered; 5. Voluntary Cover An application to vary Your cover can be made at any time by contacting Your servicing WHK Group firm or the SuperSure Administrator. Any application to increase insurance cover will be subject to Underwriting and written acceptance by Us. As part of the Underwriting requirements, You will need to provide Your health information. In assessing an application to increase insurance cover, We will consider, amongst other things, Your health condition, financial situation and occupation. These factors will help Us determine whether or not We will provide the cover You are applying for and, if so, any restrictions or insurance loadings We may apply to Your cover. • if, from the commencement of Your Automatic Cover, You have been covered continuously for three years, and You were At Work on the expiry date of the three year period, the Three Year Pre-existing Condition Exclusion will expire; • if You are not At Work on the expiry date, due to Illness or Injury, then the exclusion will continue to apply until You are At Work; • if You are not At Work on the day that cover commences, You will have Limited Cover (You will not be covered for anything you have or had before Automatic Cover started) unless You undergo Underwriting and cover is accepted by Us in writing without Limited Cover applying; • if, at the time Automatic Cover commences, You are entitled to receive either a Terminal Illness or TPD Benefit or have previously received a Terminal Illness or TPD Benefit under this Plan, or any other life insurance policy (whether issued by Us or any other life insurer), then when Automatic Cover commences under this Plan, Limited Cover applies to the Terminal Illness or TPD cover; and If You wish to apply for death and TPD insurance cover on Your behalf, please contact Your servicing WHK Group firm or the SuperSure Administrator to obtain a Personal Statement or to arrange a tele-interview. if the Illness or Injury which is the subject of a claim under the Plan arose out of Your intentional self-inflicted act or suicide or attempted suicide, no Benefit will be paid for death during the first 13 months from the commencement of cover or for TPD at any time. Your answers will be assessed by Us. In some circumstances, We may require You to provide additional medical or financial information about You, or ask You to undergo medical testing. Where this is the case, You will be advised of the additional requirements. • If We accept Your application for voluntary cover through Underwriting without exclusions or loadings and You have existing Automatic Cover, Your Automatic Cover will change to voluntary cover, and the Three Year Pre-existing Condition Exclusion (if applicable) on Your Automatic Cover will cease to apply effective from the commencement date of the voluntary cover. Application forms Varying Your Automatic Cover Acceptance terms of Underwritten cover You may contact the SuperSure Administrator at any time to: Once Underwriting is completed We will notify the SuperSure Administrator of the outcome. The SuperSure Administrator will then notify You to confirm one of the following in relation to the cover You applied for: • apply for additional insurance cover above the Automatic Cover level (called voluntary cover discussed in section 5 on page 7 of the PDS); • apply to remove the automatic Three Year Pre-existing Condition Exclusion. This is done by way of completing an application for cover and undergoing the Underwriting assessment process • Your insurance cover has been accepted without any special conditions; • a loading has been applied to Your cover in which case You will need to provide Your written acceptance of the loading; • vary Your Automatic Cover by reducing the amount of cover or changing to death only cover; • • apply to consolidate all Your insurance in one place (see section 8 for individual transfer terms on page 9 of this PDS); an exclusion has been applied to Your cover in which case You will need to provide Your written acceptance of the exclusion; or • We have declined the application. • apply to increase Your insurance due to a Life Event (see section 9 on page 9 of this PDS); or Exclusions applying to Voluntary Cover • cancel Your Automatic Cover. No payments will be made under Voluntary Cover if the event giving rise to the claim is caused directly or indirectly by an intentional, self-inflicted act or suicide or attempted suicide (whether sane or not at the time): • within 13 months of the commencement or reinstatement of the voluntary cover for death and Terminal Illness claims; • at any time for TPD claims. | 7 6.Option of an ‘Own Occupation’ TPD definition If information regarding Your Occupational Classification and/or smoking status are not available to the SuperSure Administrator on commencement of Automatic Cover, it will be assumed that the Occupational Classification of Heavy Blue, and smoker status, applies. It is Your responsibility to update Your servicing WHK Group firm or the SuperSure Administrator of Your current Employment and smoker classification at any time by completing the relevant form. If You have cover for TPD, You may be able to apply to vary Your applicable TPD definitions to an Own Occupation TPD definition (please see the TPD definition in the Insurance Glossary on pages 16–17 of this PDS). This is at an additional cost. Your insurance premium will change each year as at the Renewal Date, based on Your age at that date. Please contact Your servicing WHK Group firm or the SuperSure Administrator to obtain the change of TPD definition form. This form will be assessed by Us, and in some circumstances, We may require You to complete a Personal Statement. Loadings (additional insurance costs) may apply to You depending on Your personal circumstances. You will be advised of any additional loadings by Us at the time of application for voluntary cover or transfer of cover. When You are provided with a Certificate of Insurance, You should read it carefully. The Certificate of Insurance will show You the first year’s premium amount or the first instalment premium amount. If We accept Your application to vary Your TPD definition, We will notify the SuperSure Administrator of the outcome. The premium amount will also include any extra amounts charged to You when We accepted Your application or reinstated Your cover. However, please note that after You turn age 65, only the Activities of Daily Living (ADL) and Permanent Loss TPD definitions will apply. We recommend You contact Your financial adviser to obtain an accurate quotation for Your circumstances. 7. Cost of Cover Your insurance premium represents the applicable cost of Your insurance cover, the amount of which will appear on the Certificate of Insurance issued to You by the SuperSure Administrator. The insurance premium will be deducted by the SuperSure Administrator on WHK’s behalf directly from Your SMSF nominated account, or an alternative SMSF account specified to the SuperSure Administrator by You, at the end of each month. Your insurance premium of cover depends on a range of factors, including: If You have Automatic Cover and You provide written notification that You wish to cease Your Automatic Cover to the SuperSure Administrator within 30 days of the Automatic Cover commencing, the cover will cease effective from the cover commencement date and no premiums will be charged. All premiums are payable by You monthly in arrears or annually in advance, by the due date shown on Your Certificate of Insurance (unless otherwise advised). If You choose to pay annually in advance, rather than monthly in arrears, a discount of 2.9 per cent will apply to the applicable insurance premiums. For subsequent years, the SuperSure Administrator will advise You of Your new premium before each Renewal Date. • premium rates; • the type of cover (i.e. death only or death and TPD); Variations in the cost of cover • the amount of cover; • Your age and gender; • whether or not You smoke; We may vary the premium rates at any time. If We increase the premium rates, You will be given 30 days’ prior notice of the increase. • whether You are paying the insurance premiums monthly in arrears or annually in advance; • government duties and charges; • Your Occupational Classification; and • the relevant TPD definition. | 8 8.Individual transfer terms – transfer of other insurance into the Plan Individual transfer terms are the ability to increase Your cover by consolidating cover You have elsewhere without the need for full medical Underwriting. You may apply to transfer Your insurance cover from within another superannuation fund or that is with another insurer (separate to the Plan) into the Plan via a simplified application process by completing the SuperSure Transfer Form. To be eligible to transfer Your existing cover into the Plan at the date of Our acceptance of the transfer: • You cannot transfer any of Your non-SuperSure insurance to any superannuation fund or individual insurer other than SuperSure; • Your acceptance of all other conditions of cover required by Us; and • transferred cover is subject to acceptance by Us. 9.Increasing Your cover due to a Life Event Life Events cover gives You the option to increase Your cover if: • You marry; • Your child is born; • You must be under age 60; • You adopt a child; • a maximum level of transferred cover of $1,500,000 for death only or death and TPD; • Your child starts secondary school; or • You take out a new mortgage to purchase Your primary residence, or increase an existing mortgage to renovate Your primary residence; • total cover after the transfer cannot be greater than $3,000,000 for death only or death and TPD; • the same or equivalent insurance loadings, restrictions, exclusions and limitations that applied under the previous insurance policy for Your other insurance, as agreed by Us; • the terms and conditions set by Us for Your cover transferred to the Plan (refer to the insurance transfer form) will apply; • You must not be engaged in a Hazardous Occupation; • You must be At Work and be not prevented by Illness or Injury to perform all of the duties of Your usual occupation on a full-time basis (for at least 30 hours per week) even if Your actual Employment may be full-time, part-time or casual; • • You must not have been diagnosed with, or must not suffer from, an Illness that may cause a Terminal Illness or permanent inability to work; You must not have had an application for death, total and permanent disablement or income protection cover declined or offered on alternate terms; and not have previously been paid, are not eligible to be paid, have not claimed, and are not eligible to claim or in the process of claiming, for an Illness or Injury through the Plan, Workers’ Compensation, other Government benefits (including sickness benefits and invalid pensions) or any insurance policy providing total and permanent disablement, income protection, accident or sickness cover. The transfer of Your existing insurance is subject to acceptance by Us and the following requirements must be met in addition to the eligibility requirements under section 3 on page 6 of this PDS: • You must cancel their non-SuperSure insurance immediately after the date of acceptance of the transfer; • You cannot exercise any continuation option or reinstate any cover under the insurance policy for their nonSuperSure insurance; without the need for full medical Underwriting. You may apply within 60 days after the occurrence of a Life Event to increase Your existing death only or death and TPD cover via a simplified application process by completing the SuperSure Life Events Insurance Application form. Any increase is subject to acceptance by Us and to be eligible to apply for an increase in cover due to a Life Event, You must, at the date of Our acceptance of the increase: • be under age 60; • apply for a maximum increase that will be the lesser of 25% of the Sum Insured and $200,000; • not be working in a Hazardous Occupation; • not have been accepted for a Life Event insurance increase (whether for the same type of Life Event or not) in the 12 months prior to the acceptance date; • be At Work and not prevented by Illness or Injury from performing all of the duties of Your usual occupation on a full-time basis (for at least 30 hours per week) even if Your actual Employment may be full-time, part-time or casual; • not have been diagnosed with, or do not suffer from, an Illness that may cause a Terminal Illness or permanent inability to work; • not have had an application for death, total and permanent disablement or income protection cover declined or offered on alternate terms; and • not have previously been paid, are not eligible to be paid, have not claimed, and are not eligible to claim or in the process of claiming, for an Illness or Injury through the Plan, Workers’ Compensation, other Government benefits (such as sickness benefits, and, but not restricted to invalid pensions) or any insurance policy providing total and permanent disablement, income protection, accident or sickness cover (whether with Us or any other life insurer). | 9 10.Interim Accident Cover If You apply for voluntary cover or an increase to Your existing insurance cover (other than through Life Events or individual transfer terms), You may be entitled to Interim Accident Cover for the type and amount of cover You have applied for, subject to the terms and conditions of the Policy. You may be entitled to a Benefit upon death or TPD, if such event: • is caused solely and directly by an Accident, and independently of any other cause; and • occurs within 365 days of the Accident. Commencement of Interim Accident Cover If You are eligible, Interim Accident Cover commences from the date Your fully completed insurance application and Member’s Personal Statement form are received by Us. Amount of Interim Accident Cover For death and TPD cover, the amount of cover provided under the Interim Accident Cover is the lesser of: • the amount applied for; and • $750,000 less any existing cover under the Policy. Exclusions that apply to Interim Accident Cover Interim Accident Cover is not payable for death or TPD if: • the claim is due to a Pre-existing Condition; • the claim is due to any event or condition We would have excluded or placed a limitation on the cover being applied for had full Underwriting been completed; • We would have declined Your application for cover had full Underwriting been completed; • the claim arose out of Your intentional self-inflicted act, suicide or attempted suicide; or • You failed to comply with Your disclosure obligations when applying for cover. Cessation of Interim Accident Cover The Interim Accident Cover ceases on the earliest of: • 90 days from the date We receive Your fully completed Personal Statement; • the date that We accept or decline Your application; • the date of Your written acceptance of Our conditional offer for Your cover; • the earlier of the date the SuperSure Administrator or Us receives Your written notification withdrawing Your application; • the termination of all cover(s) under the Policy; • the date Your Interim Accident Cover has ceased; or • the date You cease to be an Eligible Person. 11.Automatic indexation of the Sum Insured To ensure Your level of cover remains in line with inflation, Your Sum Insured will be automatically increased each Renewal Date by five per cent or by the percentage increase of the Consumer Price Index (CPI) – whichever is less and premiums will increase accordingly. 12. Benefits Payable Any Benefit payable whilst You are covered will be subject to the terms and conditions of the Policy. The amount payable will be the lesser of: • Automatic Cover plus any voluntary cover; and • the Maximum Benefit Limit (see section 2 Insured Benefits on page 6 of this PDS). Payment of a death Benefit If You die while covered under the Policy, We will pay Your Sum Insured for death calculated as at the date of Your death. When We become liable to pay a death Benefit, all cover ceases. Payment of a Terminal Illness Benefit If You become Terminally Ill while covered under the Policy, We will pay a Terminal Illness Benefit equal to the amount of death cover, subject to the Maximum Benefit Limit, applicable at the date You are certified as suffering from a Terminal Illness. When We become liable to pay a Terminal Illness Benefit, all cover ceases if Your Terminal Illness Benefit is equal to the amount of death cover. If the amount of death cover exceeds Your Terminal Illness cover, the difference will continue as death only cover provided You continue to pay Your premiums and meet the other terms and conditions of the Policy. Payment of a TPD Benefit If You become TPD while covered under the Policy, We will pay You the Sum Insured for TPD calculated as at the Date of Disablement. When We become liable to pay a TPD Benefit: • all cover ceases if TPD cover is equal to Your death cover; or • if the amount of death cover exceeds Your TPD cover, the difference will continue as death only cover provided You continue to pay Your premiums and meet the other terms and conditions of the Policy. | 10 Claims In the event of a claim, claim forms can be accessed from, and submitted to, the SuperSure Administrator as soon as reasonably possible after the occurrence of the event giving rise to the claim. Either the SuperSure Administrator or We may request any information We may reasonably require for the purposes of considering the claim. In the case of TPD, You may be required to undergo medical examinations or tests. Cost for claims You are responsible for any costs associated with completing and providing Your claim forms and associated documents that We may reasonably require for the assessment of a claim. You may also be asked to provide, at Your expense, other evidence that We may reasonably require to substantiate Your claim. We may require You to undergo an examination by a Medical Practitioner or other relevant professional of Our choice at Our expense. However, if You fail to attend any pre-arranged medical examination or provide insufficient notice of an inability to attend, You will be liable to pay any fees incurred. 14.Reduction or cancellation of cover You may reduce or cancel Your insurance at any time by giving notice in writing to the SuperSure Administrator. Any reduction or cancellation of cover will be effective from the date that the SuperSure Administrator receives Your written advice that Your cover is to reduce or cease. 15.General Terms and Conditions Worldwide cover Overseas claims If You make a claim while You are outside Australia, We may require You to return to Australia at Your expense for the assessment of any claim. Cover applies 24 hours a day, 7 days a week anywhere in the world, provided that sufficient contributions are made to cover the insurance premiums and other relevant terms and conditions of the Policy are met. Cover whilst on leave without pay 13. Cessation of cover Your cover ceases on the earliest of: • the date the Policy is terminated; • the date You cease to be an Eligible Person; • the date the SuperSure Administrator receives Your written notification to cancel Your cover; • the expiry of the three year period as outlined in the ‘Employment overseas cover’ section under clause 15; • the date You do not satisfy the definition of an Insured Person under the Policy; • the date We pay the total insured Benefit under the Policy; • the date You attain age 70; • 30 days after the end of the month during which Your account balance had insufficient funds to meet the required insurance cost; or • the date of Your death. While on employer approved leave without pay (including maternity leave and parental leave), and provided premiums continue to be paid and You remain an Eligible Person and meet the other terms and conditions of the Policy: • death cover will continue subject to section 13 on page 11 of this PDS; and • TPD cover will continue. However: –for the first 24 months of leave without pay or up to the expiry of employer approved unpaid leave (whichever is shorter), and, in the event that You submit a claim, You will have Your claim assessed in accordance with the TPD definition that applied to You immediately before the leave; otherwise –only the Permanent Loss or Activities of Daily Living definitions of TPD will apply. You do not need to notify the SuperSure Administrator of this leave. Employment overseas cover The Plan provides insurance for members of SMSFs who engage the services of a WHK Group firm in relation to their SMSF. If You are an Insured Person, temporarily residing and Gainfully Employed overseas, cover can continue under the Policy while You reside overseas for up to three years, provided premiums continue to be paid and meet the other terms and conditions of the Policy. After the expiry of the three year period, Your cover under the Policy ceases unless this period has been extended with Our prior written approval, i.e. before the expiry of the three year period. | 11 16.Other Important information Risks associated with insurance There are a number of risks associated with insurance that You should be aware of. These include a risk that the insurance cover will cease if Your account balance is insufficient to meet the cost of premiums and the risk that the level of insurance cover is not adequate in the event of Your death, Injury or Illness. There is also a risk that We could refuse to pay the insured benefit if You do not comply with Your duty of disclosure or any other requirements under the Policy or the relevant legislation. Lapse and reinstatement If Your cover lapses, You may apply to reinstate cover, subject to Our acceptance, upon supplying such proof as We may require of Your: • continued good health; • eligibility for insurance; and • payment of the unpaid premium as determined by Us and notified to You by the SuperSure Administrator. The Policy may be cancelled by Us in accordance with the terms of the Policy and provisions of the Life Insurance Act 1995 (Cth) or any other relevant legislation. Inability to obtain an increase in cover You may not be able to obtain an increase in cover because of Your health or other circumstances, now, or in the future. You should therefore ensure You do not allow Your existing cover to lapse or to be cancelled until new insurance cover is in place. Cooling Off Period A 30 day cooling off period applies to Your Automatic Cover. The cooling off period commences from the date Your Automatic Cover commences. If You are not satisfied with the Benefits provided, then You may request the SuperSure Administrator to cancel Your cover in writing within 30 days of the date Your initial cover commenced. Any premiums You have paid will be refunded. Taxation The tax implications of insurance Benefits and premiums under non-superannuation and superannuation policies will differ depending on individual circumstances and You should always consider all potential taxation consequences that will apply to the premiums and Benefit payments under any group life insurance policy. Your specific circumstances may be different and have not been taken into account in providing this information. Therefore, it is important that You seek professional and independent taxation advice specific to Your circumstance regarding any taxation implications of purchasing a group life insurance policy. Duty of Disclosure Before entering into a contract of life insurance with Us, an Insured Person has a duty under the Insurance Contracts Act 1984 (Cth), to disclose to Us every matter that they know, or could reasonably be expected to know, that may be relevant to Our decision whether to accept the risk of insurance and, if so, on what terms. You have the same duty to disclose those matters to Us before You extend, vary or reinstate a contract of life insurance. Your duty however, does not require disclosure of a matter: • that diminishes the risk to be undertaken by Us; • that is of common knowledge; • that We know or, in the ordinary course of Our business, ought to know; or • the disclosure of which is waived by Us. The duty of disclosure applies even after Your application for cover is completed until Our acceptance of insurance is issued in writing. If You fail to comply with Your duty of disclosure and We would not have entered into the contract on any terms if the failure had not occurred, We may avoid the contract within three years of entering into it. If Your non-disclosure is fraudulent, We may avoid the contract at any time. If We are entitled to avoid a contract of life insurance, We may, within three years of entering into it, elect not to avoid it but to reduce the sum that You have been insured for in accordance with a formula that takes into account the premium that would have been payable if You had disclosed all relevant matters to Us. Cancelling Your cover You are allowed to cancel Your cover under the Policy at any time. There is no refund of premiums unless Your written request to cancel Your cover is within the cooling off period. | 12 Privacy Notices The way in which We, WHK Group, or the SuperSure Administrator, collect, use, and disclose Your personal and sensitive information is explained in our respective Privacy Policies. These are available at http://www.tal.com.au/ privacy.aspx and http://www.whk.com.au/images/stories/ whk_aus-privacypolicy.pdf and are free of charge on request. If You would like a copy, or if You have any questions about the way in which We manage Your information, please contact Us using the details below: Any notice that We give to You or You give to Us, must be: TAL Privacy Officer TAL Life Limited PO Box 142 Milsons Point NSW 1565 WHK Group Privacy Officer WHK Group Limited Level 9, 473 Bourke Street Melbourne VIC 3000 Personal and sensitive information will be collected from or in respect of You to enable Us to provide or arrange for the provision of insurance products and services. We may request further personal information in the future, for example, if You want to make a claim. If You do not supply the required information, We may not be able to assess or pay the claim. In processing and administering Your insurance (including at the time of Underwriting or claim) We may disclose Your personal information to other parties such as reinsurers, organisations to whom We outsource mailing and information technology, Government regulatory bodies, superannuation funds, administrators for superannuation funds, employers of individual members, Our related bodies corporate, and accountants (if applicable). We may also disclose Your personal information (including health information) to other bodies such as investigators, lawyers, external complaints resolution bodies and as required by law. We rely on the accuracy of the information You provide. If You think that We hold information about You that is incorrect, You may contact Us. Under the Australian Privacy Principles, You are generally entitled to access the personal information We hold about You. To access that information, You can simply make a request in writing. This process enables Us to confirm Your identity for security reasons and assists in protecting Your personal information from being sought by a person other than You. • in writing, by email or facsimile; and • to the address most recently advised by You or Us, as relevant. A notice which is delivered personally, electronically (email) or sent by facsimile is treated as being given on the day it was received and a notice which is posted is treated as being given three days from the date of posting. If You advise Us that You have appointed an agent or broker to act on Your behalf in respect of the Policy, We will give notices to that person, including premium notices, and they will be deemed to have been given to You. Any notice provided to Us by an agent or broker purporting to act on Your behalf will be deemed to have been given by You. Complaints If You have a complaint in relation to the Policy, You can write to: Prescott Securities Ltd 245 Fullarton Road Eastwood SA 5063 We will attempt to resolve Your complaint within 45 days of the date it is received by Us. If We are unable to resolve Your complaint within that period, We will inform You of the delay and ask for Your consent to resolve the complaint within 90 days of the date it was received. If Your complaint has not been resolved to Your satisfaction within 45 days of receiving Your initial complaint to Us (or, if You have agreed, within 90 days) You may contact the Financial Ombudsman Service (FOS). FOS is an industry funded scheme that provides free advice and assistance to consumers with complaints against financial services companies. FOS is an independent and impartial body. Decisions made by FOS are binding on Us. FOS can be contacted as follows: Financial Ombudsman Service (FOS) GPO Box 3 Melbourne VIC 3001 Telephone: 1300 780 808 Fax: (03) 9613 6399 Email: info@fos.org.au If for any reason We decline Your request to access and/or update Your information, We will provide You with details of that reason. | 13 17. Insurance Glossary Insurance terms Definition Accident means an unforeseen violent, external and visible event that occurs accidentally during the period of cover under the Policy. At Work means; 1. for a person who is: • employed with an employer: the person is actively performing or capable of actively performing all of the duties and work hours (for at least 30 hours per week) of their usual occupation with their employer free from any limitation due to Illness or Injury. A person who is on employer approved leave for reasons other than Illness or Injury, who would otherwise be capable of performing their usual occupation, will be considered as having met the requirements of this definition; or •Self-employed: the person is actively performing or capable of actively performing all of the duties and work hours (for at least 30 hours per week) of their usual occupation free from any limitation due to Illness or Injury; or • unemployed: is capable of actively performing all of the duties and work hours (for at least 30 hours per week) of their usual occupation prior to becoming unemployed, free from any limitation due to Illness or Injury; or • engaged exclusively in unpaid Domestic Duties: the person is actively performing or capable of performing all of their fulltime unpaid Domestic Duties free from any limitation due to Illness or Injury; Benefit • •Terminal Illness; as provided under the terms and conditions of the Policy. Certificate of Insurance means a certificate issued to You, by the SuperSure Administrator on behalf of TAL that is used to confirm Your insurance coverage and beneficial ownership thereof, including, but not limited to, the effective date, type and amount of cover, and any exclusions or loadings that may apply. Consumer Price Index (CPI) means the percentage change in the CPI (Weighted Average All Capital Cities) as last published by the Australian Bureau of Statistics prior to the effective date of the calculation under the Policy. If the CPI is no longer published, We will use another index similar to it. If the percentage change in the CPI, or any substitute for it is negative, then the CPI will be taken as zero. Date of Disablement Automatic Cover means cover provided automatically to all eligible new and existing clients of WHK Group where services by a WHK Group firm are provided to those client’s SMSF for the benefit of members of the SMSF. means the later of the following: a)the date an Insured Person is first certified in writing by a Medical Practitioner as being TPD; and b)the date the Insured Person ceases work due to the Illness or Injury that caused TPD. Where a Medical Practitioner examines and gives a written certification under a) and that certification date occurs within seven days after the date the Insured Person ceased work under b), the Date of Disablement will be the earlier date that the Insured Person ceased work under b). Domestic Duties 2. the person is not entitled to, or receiving, income support benefits relating to Illness or Injury, from any source including but not limited to Workers’ Compensation benefits, statutory transport accident benefits and disability income benefits. means an Australian citizen or a person who is the holder of an Australian permanent visa within the meaning of Section 30 of the Migration Act 1958 (Cth) or resides in Australia on a 457 working visa. death; •TPD; or and Australian Resident means any of the following: means the unpaid tasks performed by an Insured Person whose sole occupation is to maintain their family home, including: • cooking of meals for their family; • unassisted cleaning of the home; • shopping for their family’s food; • doing their family’s laundry; and • taking care of dependent children (if applicable); but excludes any tasks performed for salary, reward or profit. Eligible Person means: •a person who meets the Eligibility Criteria in section 3 on page 6; or •a person that We have agreed in writing to insure under the Policy. Employed or Employment means Employed or Self-employed for gain or reward, or in the expectation of economic benefit. Gainfully Employed means working for reward in an occupation (which can include a contract for services) without restriction due to Illness or Injury. | 14 Hazardous Occupation means occupations that include unskilled workers, those involved in hazardous or very heavy manual work and/or presenting particular Underwriting difficulties (e.g. professional divers, interstate truck drivers, linesmen working over 10 metres, those performing unpaid Domestic Duties). If an Insured Person is in a Hazardous Occupation and has Automatic Cover, they will have their TPD definitions restricted to Activities of Daily Living and Permanent Loss definitions of the TPD definition outlined below for TPD cover. Maximum Benefit Limit means the maximum amount of cover an Insured Person can apply for and the maximum amount of Benefit an Insured Person is entitled to be paid under the Policy, as specified in section 2 on page 6 of this PDS. Medical Practitioner means a Medical Practitioner legally qualified and registered to practise in Australia who is not the Insured Person, Policy Owner, or their relatives, business partners, shareholders, employers or employees, unless We agree otherwise. Chiropractors, physiotherapists, psychologists, and alternative therapy providers are not regarded as Medical Practitioners. Insured Persons engaged in unpaid Domestic Duties at the time of claim will have the Domestic Duties TPD Definition (iv) (see below) apply. Underwritten cover will be individually considered. Illness means sickness, disease or disorder. Injury means bodily Injury which is caused solely and directly by external, violent or Accidental means and is independent of any other cause. Insured Person an Eligible Person for whom We have accepted in writing to provide insurance cover under the Policy, excluding persons who are only entitled to Interim Accident Cover under the Policy. Insurer TAL Life Limited ABN 70 050 109 450 (AFSL 237848) Interim Accident Cover means insurance cover provided under the Policy, while an application for additional cover is being assessed by Us, as outlined in section 10 on page 10 of this PDS. Life Event means one of the following events that occurs to the Insured Person for which We may provide additional cover to the Insured Person under the Policy: •an Insured Person’s marriage; •birth of an Insured Person’s child; •adoption of a child by an Insured Person; •an Insured Person’s dependent child starts secondary school; and/or •taking out a new mortgage by an Insured Person to purchase their primary residence, or increase an existing mortgage by an Insured Person to renovate their primary residence. Limited Cover means the Insured Person is only covered for claims arising from: a)an Illness which first became apparent; or b)an Injury which first occurred; on or after the date the insured cover last commenced, recommenced or increased for the insured member, as applicable. NonHazardous Occupation means an occupation that is not a Hazardous Occupation. Occupational Classification means the following Occupational Classifications: •Professional: Occupations that involve no manual duties (e.g. lawyer, accountant). Usually those with a tertiary qualification or registration by a professional body (they must be using these qualifications in their occupation). Includes those well-established senior executives (those with 10 or more years in that role) with incomes in excess of $150,000 per annum, without tertiary qualifications. •White Collar: Clerical, administration and managerial occupations involving office and travel duties. No manual work (e.g. administrator, bookkeeper, computer operator). Includes occupations with tertiary qualifications that involve very light physical work (e.g. osteopath, physiotherapist). •Light Blue Collar: Occupations that involve light manual work, such as certain qualified tradespeople (e.g. electrician), business owners in nonhazardous industries involved in light manual work (e.g. coffee shop owner) and those who may supervise medium blue collar workers (no more than 25% of their work time). Includes occupations that are not limited to office, where travel is an essential part of the job (e.g. field surveyor). •Medium Blue Collar: Occupations that involve manual work, such as qualified skilled tradespeople in non-hazardous industries wholly involved in manual duties (e.g. carpenter, plumber, plasterer, mechanic). •Heavy Blue Collar: Occupations that involve heavy manual work, such as heavy manual workers in non-hazardous industry performing higher risk occupations (e.g. interstate bus driver, warehouse worker, labourer, bricklayer, house removalist). | 15 Our underwriters will consider the specific job duties (including whether they are classifiable as a Hazardous Occupation), length of time in a particular occupation and income levels when considering the Occupational Classification. Own Occupation TPD SuperSure Administrator Prescott Securities Ltd (ABN 12 096 919 603 AFSL 228894). Terminal Illness, Terminally Ill means: means solely because of Illness or Injury, has for at least six consecutive months from the Date of Disablement been absent from their Employment or has been continuously unable to accept Employment, and having provided proof to Our satisfaction, is disabled to such an extent as to render them unlikely to ever again be engaged in their Own Occupation. ‘Own Occupation’ means the occupation in which the Insured Person has spent the majority of their time undertaking immediately prior to the Date of Disablement. Is only available to white collar, professional Occupational Classifications only for an additional cost. a)two Medical Practitioners have certified in writing, that the Insured Person suffers from an Illness, or has sustained an Injury, that is likely to result in the death of the Insured Person within a period (‘the certification period’) within 12 months after the date of the certification; b)at least one of the registered Medical Practitioners is a Specialist Medical Practitioner; and c)for each of the certificates, the 12 months certification period has not expired. Three Year Pre-existing Condition Exclusion A Pre-existing Condition Exclusion applies if Your cause of claim is due to something You have or had in the three years prior to automatic cover commencement or cover recommencement, You will not be covered. Totally and Permanently Disabled or Total and Permanent Disablement (TPD) means a Benefit payable under the Policy when the Insured Person meets any one of the following definitions of TPD applicable to him or her. The definition of TPD applicable to an Insured Person with TPD cover will be determined by Us at the time of claim in accordance with the following criteria: Personal Statement means an application form issued by Us for the purpose of Underwriting an Eligible Person for insurance cover. Policy means the Policy document including its schedules, and any Policy endorsements, as amended from time to time. Policy Owner WHK Financial Planning Pty Ltd (ABN 51 060 092 631 AFSL 238244) a)all Insured Persons with TPD cover are covered under definitions (i) or (iii) below; Pre-existing Condition means any existing Injury or Illness, or a symptom of an Injury or Illness, suffered or sustained by an Eligible Person which at the time of their application for cover under the Policy, they: b)definition (ii) applies to Insured Persons who are under age 65 and have not retired from the workforce and, immediately prior to the Date of Disablement, are Gainfully Employed in a Non-Hazardous Occupation and working at least 15 hours per week; a)were aware of, or a reasonable person in their position should have been aware of; or b)should have sought advice or treatment (conventional or alternative) from a Medical Practitioner or other allied health professional for (in circumstances where a reasonable person in their position would have sought advice or treatment); or c)had a medical consultation for or were prescribed medication or therapy for. c)definition (iv) applies to Insured Persons who, immediately prior to the Date of Disablement, are under age 65 and solely engaged in unpaid Domestic Duties on a full-time basis. ‘Hours per week’ means the hours worked in a week (including weekends) whilst Employed, averaged over the 13 week period immediately prior to the Date of Disablement or such shorter period if Employed for less than 13 weeks immediately prior to the Date of Disablement. Renewal Date means 1 September each year. Selfemployed means the Insured Person is performing activities for remuneration or reward in a business of which they directly or indirectly own all or part. TPD means in Our opinion the Insured Person is under the care of and following the advice of a Medical Practitioner, and; Specialist Medical Practitioner means a Medical Practitioner practicing in an area related to the Illness or Injury suffered by an Insured Person. Solely because of Illness or Injury, has suffered the permanent loss of: Sum Insured means the amount of cover determined by Us for an Insured Person’s Benefit(s), which is in accordance with the tables found under section 4 on page 6 of this PDS, or as agreed by Us in writing. (i)Permanent Loss a)the use of two limbs (where limb is defined as the whole hand or the whole foot); b)the sight in both eyes; or c)the use of one limb and the sight in one eye; or | 16 (ii)Unlikely to work, Any Occupation Solely because of Illness or Injury, has, for at least six consecutive months from the Date of Disablement, been absent from their Employment or has been continuously unable to accept Employment, and having provided proof to Our satisfaction, is disabled to such an extent as to render them unlikely to ever again be engaged in any occupation for which they are reasonably suited by their education, training or experience; Underwriting or Underwritten means the process We undertake to assess an application by an Eligible Person for insurance cover including reference to information concerning their medical, health and Employment. Voluntary Cover means cover provided as a result of an application, including reference to information concerning their medical, health and employment, made by You and accepted by Us. or (iii)Activities of Daily Living Solely because of Illness or Injury, at the Date of Disablement is: 1.unlikely ever to be able to perform at least two of the following five ‘activities of daily living’ without the physical assistance of another person and despite the use of appropriate assistive aids, and has provided proof of this to Our satisfaction: a) Bathing – to shower or bathe; b)Dressing – to dress or undress; c)Toileting – to use the toilet; d) Feeding – to eat and drink; or e)Mobility – to get in and out of bed or chair or move from a place to place without using a wheelchair; and 2.unlikely ever to return to any occupation for which they are reasonably suited by their education, training or experience. or (iv)Domestic Duties Solely because of Illness or Injury: 1.is unable to perform Domestic Duties on a full-time basis; 2.is unable to leave their home unaided; 3.has not been engaged in any Gainful Employment or Domestic Duties for six consecutive months from the Date of Disablement; and 4.at the end of six month period, is disabled to an extent as to render them unlikely to ever be engaged in Domestic Duties or any occupation for which he or she is reasonably suited by their education, training or experience. Automatic Cover is provided for all eligible trustees/members of an SMSF using a WHK Group firm as a provider of services to their SMSF. It is designed to provide You with a basic level of protection for death and TPD without the need for Underwriting. | 17 www.whk.com.au Product Issuer and Insurer TAL Life Limited ABN 70 050 109 450 AFSL 237848 Policy Owner WHK Financial Planning Pty Ltd ABN 51 060 092 631 AFSL 238244