Determinants of Land-Use Change In the United States 1982-1997 Robert N. Stavins

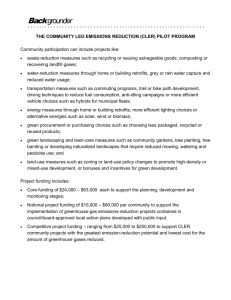

advertisement