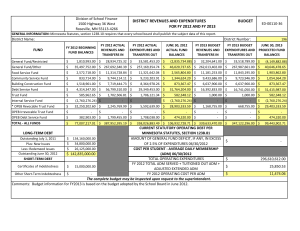

Adoption Budget Chabot–Las Positas Community College District

advertisement