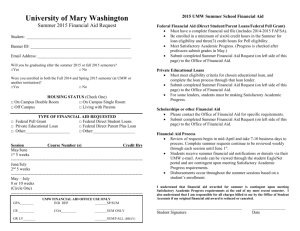

Lifetime Pell Grant Eligibility WVNCC Financial Aid Updates Effective 2012-2013 School Year

advertisement

WVNCC Financial Aid Updates Lifetime Pell Grant Eligibility March 2012 Effective 2012-2013 School Year Special points of interest: 2012-2013 Pell Grant Changes Federal Direct Loan Changes effective July 1, 2012 2012-2013 FAFSA on the Web Workshops Financial Aid Satisfactory Academic Progress Reminders (SAP) Summer Aid In December 2011, President Obama signed into law the Consolidated Appropriations Act, 2012 (Public Law 112-74). This law has significantly impacted the Pell Grant Program. Beginning in Fall 2012, Students are now limited to 12 semesters (or 600%) of Pell Grant eligibility during their lifetime. This change affects all students regardless of when or where they received their first Pell Grant. Students that are currently receiving the Pell Grant in the academic year 2011-2012 and have already used 600% of their Pell Grant eligibility will no longer be eligible to receive a Pell Grant starting Fall 2012. Who does this affect? – Everyone! If you have attended college for *4 years or longer,* receiving the Pell Grant each year, you are likely to exhaust or have already exhausted your lifetime limit of 12 semesters of Pell Grant eligibility during the 2012-2013 school year.** If you have attended college and received the Pell Grant for *3 years or less* you will likely not surpass the lifetime limit during the 2012-2013 school year.** Whether you have used all of your Pell Grant eligibility or only half, please be conscious about the lifetime limit of the Pell Grant when changing majors and/or scheduling classes. Inside this issue: Pell Grant Questions 2 Financial Aid Office Contacts 2 Student Loan Changes 3 **Please remember that if you received Year Round Pell in the 2009/2010 or 2010/2011 school years, you may have used 200% in one year, or 400% between the 2 years. Need HELP completing the 2012-2013 FAFSA? Attend one of the following FAFSA on the Web Workshops! Lifetime Loan Limits 3 Summer Aid 4 Verification Changes 4 Satisfactory Academic Progress 4 Weirton Wheeling New Martinsville April 2 Rm 134 11:30 a.m.—3:30 p.m. April 4 Rm 219B 10 a.m.—12 p.m. Rm 418E 3 p.m.—5 p.m. April 5 Rm 210 10 a.m.—12 p.m. 1:30 p.m.—3:30 p.m. Remember to bring the following documents: 1) 2) Student and spouse/parents’ (if applicable) 2011 IRS Tax Forms and W-2s; Student and spouse/parents’ (if applicable) 2011 documentation of any untaxed income; Don’t Forget Student and Parent (if applicable) PIN numbers to Sign Your FAFSA Electronically! * PIN numbers can be obtained at www.pin.ed.gov Page 2 Pell Lifetime Eligibility continued…. Questions Can I see my lifetime Pell Grant used? You may view your Pell Grant used by logging into www.NSLDS.ed.gov. The National Student Loan Data System has information about your federal student loans and Pell Grant awards. Below is a sample screen shot of NSLDS: How is the percentage used calculated? The percentages are based off the annual award at fulltime enrollment status. For students with an annual award for 2011-2012 academic year, at the maximum award, $5,550 and attended 12 or more credits each semester (Fall and Spring for example), the percentage used for the 2011-2012 academic year is 100%. If you only attended 9 credits each semester, your percentage used for the academic year is 75%. I have questions about this, who do I call? Our Financial Aid Office Staff or your Campus Counselor are available to discuss the change in the lifetime Pell Grant eligibility with you. Please call or e- How to Contact the WVNCC Financial Aid Office New Martinsville Campus: 304-455-4684 Ext. 8844 Weirton Campus: 304-723-2210 Ext. 8844 Wheeling Campus: 304-233-5900 Ext. 8844 E-mail: finaid@mail.wvncc.edu Janet Fike, VP of Student Services/Director of Financial Aid, jfike@wvncc.edu Alicia Frey, Associate Director of Financial Aid, afrey@wvncc.edu Kelly Herr, Project Coordinator, kherr@wvncc.edu Kim Hart, Financial Aid Assistant, khart@wvncc.edu Sarah Griffith, Financial Aid Assistant, sgriffith@wvncc.edu Page 3 Federal Direct Loan Changes Students who receive subsidized Student Loans on and after July 1, 2012, and prior to July 1, 2014, must pay interest that accrues during the sixmonth grace period. If not paid, the accrued interest will be capitalized (added to the principal balance of the loan). What does this mean? Many students will enter repayment with higher loan balances based on the capitalization of interest accrued during the grace period. Effective for loans first disbursed on or after July 1, 2012, the law eliminates the authority of the Department of Education to offer any repayment incentives to Direct Loan borrowers to encourage on-time repayment of loans, including any reduction in the interest rate or origination fee. As a result, the up-front interest rebate that has been provided to Direct Loan borrowers at the time of loan disbursement will not be offered on any Direct Loan with a first disbursement date that is on or after July 1,2012. The law continues to authorize the De- partment to offer interest rate reductions to Direct Loan borrowers who agree to have payments automatically electronically debited. Federal Direct Loan Interest Rate for 2012-2013: 6.8% Fixed Subsidized and Unsubsidized “The average Aggregate (Lifetime) Loan Limits There are limits on the maximum amount you are eligible to receive in total (aggregate loan limits) as an undergraduate* student. The actual amount you can borrow each year depends on your year in school, whether you are a dependent or independent student, and other factors. Check NSLDS** to see what you have borrowed before you complete your next loan application! Aggregate Loan Limits Dependent Students $31,000 Independent Students $57,500 undergraduate *Definition of an Undergraduate: a student at a college or university who has not yet received a bachelor's-level degree. leaves college with $24,000 in debt—that’s $276 a month out of every paycheck for If your goal is to obtain a Bachelor’s degree and you are close to or have already exceeded these limits, you may have to pay out of pocket to finish your degree. 10 years.” - Bill Pratt”s Extra Credit: The 7 Things Every College Student Needs to Know About Credit, Debt & Cash (2nd Edition, 2008) NSLDS—National Student Loan Data System www.nslds.ed.gov The National Student Loan Data System has information about your federal student loans and Pell grant history. To review your information, you will need: Social Security Number First 2 letters of your last name Your date of birth Personal Identification Number (PIN) The Pin assigned to you when you completed the FAFSA NSLDS Disclaimer: Information contained on these pages reflects the most current data in the NSLDS database. The data contained on this site is for general information purposes and should not be used to determine final eligibility, loan payoffs, overpayment status, or tax reporting. Please consult the Financial Aid Officer at your school or the specific holder of your debts for further information. Applications available on-line, Campus Service Centers, or the Financial Aid Office 2012-2013 Scholarship Applications are available Financial Aid Available for Summer 2012 If you are a West Virginia resident with at least a 2.00 GPA and will be part-time for the Summer 2012 semester you may qualify for the WV HEAPS Grant. This specific grant will cover tuition only. Applications are available at all three campus Service Centers and the Financial Aid Office. If you have already submitted a WV HEAPS Grant application for the 2011-12 school year you do not need to submit an additional application. Scholarships are still available for the Summer semester. You need to submit the 20112012 scholarship application, a letter of reference, and an essay described within the application. The scholarship application is available at all three campus Service Centers and the Financial Aid Office. If you were a Pell Grant recipient for the 2011-12 school year and were full-time Fall 2011 and Spring 2012 you will not have Pell Grant available for the Summer 2012 semester. If you were a part-time student during the Fall 2011 and/or Spring 2012 semesters, then you may have Pell grant eligibility for the Summer semester. We will automatically set up any Summer grant eligibility once you register for Summer classes but you may inquire with the Financial Aid Office. Verification Changes for the 2012 -13 School Year (Only required if selected for verification) If you are selected for verification for the 2012-13 school year and did not use the IRS Data Retrieval Tool on the 2012-13 FAFSA, you are required to submit a 2011 IRS Tax Return Transcript. To request the IRS Tax Transcript you have three options: Online: www.irs.gov Telephone: 1-800-908-9946 Download and mail IRS Form 4506T-EZL: www.irs.gov/pub/irs-pub/ f4506tez.pdf Submission of your 2011 Federal Tax Form (1040, 1040A, 1040EZ) is no longer acceptable for verification purposes. Satisfactory Academic Progress (SAP) Reminders To receive financial aid semester after semester you must continuously maintain the following requirements: 1) Maintain a cumulative (overall) GPA of a 2.0, 2) Successfully complete 67% of all attempted coursework hours, and 3) Progress towards completing your degree within the 150% maximum time frame*. Appeals are available if not meeting SAP *150% Maximum Time Frame If working on a Certificate program, you can attempt 45 credit hours. If working on an Associates degree, you can attempt 90 credit hours. Remember, when receiving financial aid, you can only take courses that are required for your program based on the catalog year you began your program.