PAPER SIUM SYMPO

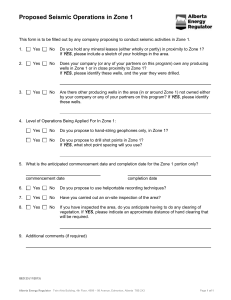

advertisement