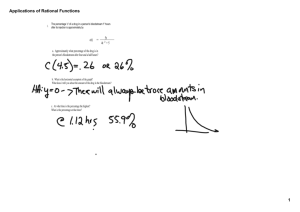

PAPER SIUM SYMPO

advertisement