Providing all global energy with wind, water, and solar power,... Reliability, system and transmission costs, and policies

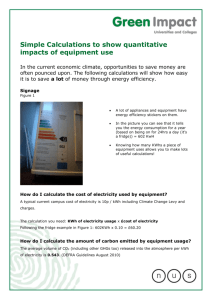

advertisement