Theory Econom/c Insurance monopoly and renegotiation* Geir B. Asheim and Tore Nilsscn

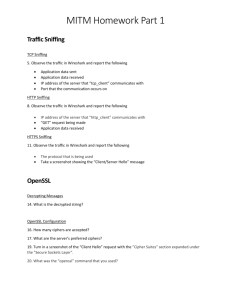

advertisement

EconomicTheory 9, 341-354(1997)

Econom/c

Theory

9 Springer-Verlag 1997

Insurance monopoly and renegotiation*

Geir B. Asheim and Tore Nilsscn

Department of Economics,University of Oslo, N-0317 Oslo, NORWAY

Received:March 1, 1994;revised version September 16, 1995

Summary. The mechanism design problem of a monopoly i n s u r e r - faced

with privately informed insurees - is considered. It is assumed that the insurer

cannot commit not to renegotiate (by using the information that customer

separa-tion reveals) before contracts are put into force. A solution is offered by

modeling renegotiation-proofness in a framework inspired by Greenberg's

theory of social situations. Maximizing profit within the set of renegotiationproof outcomes always leads to a semi-separating outcome (i.e. neither full

pooling nor full separation can occur) and may leave all low-risks as well as

some of the high-risks self-insured.

J E L Classification Number: D42.

1 Introduction

Most of the literature on renegotiation among asymmetrically informed

parties has been concerned with the design of long-term contracts when the

contracting parties are unable to commit not to renegotiate contracts as the

relationship develops and new information arrives; see Dewatripont and

Maskin (1990) for a survey and Dionne and Doherty (1994) for a contribution

in the context of insurance. This line of work restricts renegotiation to take

place only after the contract has been put into force. In contrast, in the present

* This work originated with Asheim and Nilssen (1991). The authors thank Paul Beaudry,

Mathias Dewatripont, John Hillas, Terje Lensberg, Georg N61deke, Trond Olsen, Michel

Poitevin, Eric van Damme,and especiallyJoseph Greenberg, as well as participants at seminarsin

Bergen, Cambridge, Florence, Helsinki, London, Mons, Montreal, Oslo, Stony Brook, and

Tilburg for helpful comments and discussions. Asheim thanks Tilburg (CentER), McGill and

Humboldt Universities for their hospitality and acknowledges support from the Norwegian

Research Centre in Organization and Management and the Norwegian Research Council.

Nilssen acknowledges support from Norges Bank and the Norwegian Research Council for

Science and the Humanities.

Correspondence to: G. B. Asheim

342

G.B. Asheim and T. Nilssen

paper we want to consider the effect of allowing renegotiation to take place

before contracts are put into force.

For renegotiation to take place, new information must arrive. One important piece of information that does indeed arrive before contracts are put into

force is the informed agent's choice of contract. The present analysis extends

the theory of mechanism design to the case where contracts can be renegotiated after they are signed but before they are put into force. The basis for

our discussion is Stiglitz's (1977) model of an insurance monopoly; see Kreps

(1990, Sec. 18.1) for an exposition. Like in Stiglitz, therefore, our model is

one-period. By allowing renegotiation before contracts are put into force, we

can do without the restriction in the aforementioned literature, that renegotiation be allowed only after one period has elapsed.

To deal with renegotiation in a one-period model of mechanism design, we

provide a concept of renegotiation-proofness that is governed by two principles: First, from an outcome that is deemed not to be subject to renegotiation

there should be no scope for profitable renegotiation if such renegotiation is

restricted to end with an outcome from which no further renegotiation will

take place. Second, from an outcome which is deemed to be subject to

renegotiation there should be scope for profitable renegotiation even if such

renegotiation is restricted to end with an outcome from which no further

renegotiation will take place.

With these principles, which are closely tied to von Neumann-Morgenstern stability and Greenberg's (1990) 'theory of social situations', we are able

to completely characterize the set of outcomes that are renegotiation-proof

under the assumption of constant relative risk aversion (Proposition 2). We

then go on to discuss how a profit maximizing insurance monopolist will

choose among the elements in this set. We find - contrary to Stiglitz's analysis,

but in line with the renegotiation l i t e r a t u r e - t h a t there will never be full

separation. Nor will there be full pooling. Like Stiglitz, we find that the

low-risks may be left self-insured. However, in contrast to Stiglitz, we find that

even some of the high-risks may be left self-insured in optimum.

In the formal analysis we model renegotiation atemporally. Thus, in

contrast to the numerous recent applications of non-cooperative extensive

form games, our general approach is more related to cooperative game theory,

one advantage being that the analysis becomes less dependent on the details of

the specified structure. We relate particularly closely to studies that incorporate the core, or a modification thereof, in analyses of economies with asymmetric i n f o r m a t i o n - s e e Boyd, Prescott, and Smith (1988), Marimon (1990),

Berliant (1992), and Lacker and Weinberg (1993, 1994). 1

Previous analyses of renegotiation before contracts are put into force

include Hillas (1987), Hosios and Peters (1988), and Beaudry and Poitevin

(1993, 1995). The work of Hillas is particularly relevant. Also he studies the

i Ofrelated interest is the work of Hamilton, MacLeod, and Thisse (1991). They also motivate the

use of cooperative game theory out of a need to become less dependent on the details of the

structure of the game.

Insurance monopoly

343

case of insurance (see his Ch. 5) and his discussion parallels ours in some

important respects. However, contrary to us, Hillas does not provide conditions ensuring the existence of renegotiation-proof outcomes. The analysis of

Hosios and Peters differs from ours as well as that of the other literature by

viewing renegotiation outcomes as being non-verifiable. Beaudry and

Poitevin (1993) consider renegotiation in a signaling model and let the

informed agent have all the bargaining power during renegotiation. Beaudry

and Poitevin (1995) discuss a financial market where informed borrowers,

after having entered into one or more previous contracts and before these

contracts are put into force, may enter into additional contracts with other

uninformed financiers. Like us, then, they discuss a screening model.

However, the screening is competitive, whereby the informed party ends up

with all the bargaining power. While our model allows the agent to renegotiate with the monopoly insurer only, Beaudry and Poitevin (1995)

consider recontracting with new uninformed parties. They allow for an

infinite number of recontracting rounds before contracts are put into force.

Since the recontracting does not take place in real time (i.e., there is no

time cost), this difference from our model is, however, more apparent than

real.

This paper is organized as follows. Section 2 includes some preliminary

notation and terminology. Section 3 defines the concept of a renegotiationproof group, a concept which is completely characterized in Section 4 under

the assumption of constant relative risk aversion. In Section 5 we characterize

the choices of a profit maximizing monopolist who is not able to commit not to

renegotiate, while Section 6 concludes. The proof of Proposition 2 - the main

characterization result - is contained in an appendix.

2 Preliminaries

Consider a continuum of individuals uniformly distributed on the unit line

[0, 1]. Each individual faces two possible states of nature: In state 1, no

accident is experienced and his endowment is w01. In state 2, an accident is

experienced and his endowment is Wo2, with w01 > Wo2 > 0. The individuals

are identical except for the probability of an accident. The high-risk (H) type

has probability PH, the low-risk (L) type has probability PL, with

0 < PL < PH < 1. The proportion of K-type individuals, #oK, where Ke{H, L},

is given by #o -- (#oH, #oL) >> 0, 2 where #o~ + #0/~ = 1. There is a risk-neutral

monopoly firm that offers insurance.

If an individual buys insurance, then the endowment w o = (w01 , w02) is

traded for another state-contingent allocation w = (wl, w2) >>0. If w 1 -- w2,

then w provides full insurance, if w 1 > w 2, then w provides partial insurance.

We assume that moral hazard prevents w 1 < w2, implying that w is feasible if

2 The following notation for vector inequalities is used: a _>b if all elements of a - b are

non-negative,a > b if all elements of a - b are non-negativeand some are positive, and a >>b if all

elements of a - b are positive.

344

G.B. Asheim and T. Nilssen

and only if w a > w 2 > 0. A feasible allocation w is evaluated by a K-type

individual according to the expected utility uK(w):= pKv(wl) + (1 -pK)v(w2),

where v is a strictly increasing, twice continuously differentiable, and strictly

concave von N e u m a n n - M o r g e n s t e r n ( v N - M ) utility function.

W h e n the firm has signed up individuals with one or more state-contingent

allocations, its customers are distinguished by the allocations that they are

signed up with. F o r each of these allocations, the firm has beliefs a b o u t the

mixture of H-type and L-type individuals. We want to establish under what

conditions the firm does not want to renegotiate with any of these groups of

customers. Therefore, assume to the contrary that the firm enters into renegotiation with one of these groups. 3 Let w denote the allocation that the individuals in this group was signed up with when renegotiation was entered into. Then,

w is the fall-back allocation for the insurees in the subsequent renegotiation.

Let # = (#H, ~L) denote the type profile of individuals that the firm believes the

group consists of. Then, G --- (w, #) describes the group of individuals that the

firm enters into renegotiation with - as well as the position of the renegotiating

firm - by the fall-back allocation w and the type profile #. The set of g r o u p F is

given as F : = {G = (w, #)]w 1 >_ w 2 > 0 and 0 < # = (#H, #L) --<#0}.

In principle we allow for the possibility that further renegotiation can

occur after the g r o u p G t h r o u g h renegotiation has been signed up with a new

(pair of) allocation(s). However, we assume that the firm and the group

G perfectly foresee what will be the final o u t c o m e of the present and further

renegotiation. Hence, the renegotiation between the firm and the g r o u p G will

be completed only if an o u t c o m e has been reached from which no further

renegotiation will take place.

W h a t are necessary conditions for such final outcomes in the renegotiation

between the firm and the group G = (w, #)? I.e., what final allocations can the

firm sign the individuals in the g r o u p up with, given that their fall-back

allocation is w and their type profile is #? With two types, it will not be possible

for the firm to separate the group into more than two subgroups given that no

further renegotiation shall occur.'*

Hence, a feasible final o u t c o m e when the firm's position is G = (w, #) is in

general a pair of subgroups (G h, G l) - ((w h, #h),(Wl, #1))eF x F such that

(1) (Exhaustiveness) G h and G z exhaust G; i.e., their type profiles sum to the

h

h

1

type profile of G: #h + #z -=- (#n,

#L)

+ (#~, #L)

= (#U, #L) = #"

(2) (NO domination) w h does not dominate w I or vice versa; i.e., w h and w I can be

labeled such that un(w h) >_un(w l) and UL(Wl) > UL(wh).

3 Note that if the firm profits by renegotiating with more than one group, it can also profit by

renegotiating with one of the groups separately.

4 The argument is simple: If the group is separated into three or more distinct and non-empty

subgroups, then - since we cannot have one allocation dominating another (in the sense of being

preferred by both types of insurees)- it follows from incentive compatibility constraints that at

least one subgroup is given partial insurance and contains only one type of insurees. Such a group

cannot be renegotiation-proof.

Insurance monopoly

345

(3) (Incentive compatibility) high-risk individuals choose w~, and low-risk

individuals choose w h, only if indifferent between w h and w~; i.e., #~ = #~ if

un(w h) > un(w z) and #tr = #L if uL(w l) > NL(Wh).

(4) (Individual rationality) the allocation w k is at least as good as w when

evaluated by K-type individuals; i.e., un(w h) > urn(w) if/~n > 0 and UL(W~) >_

UL(W) if/~L > 0.

If the group G is separated into two distinct subgroups (i.e., w h r W~), then

(G h, G ~) =_((wh, #h), (Wt, #~)) is called semi-separating. The term 'semi' reflects the

fact that types are fully separated only if/~h = (/~rt, 0) and #~ = (0,/~L), which is

not in general the case. Otherwise, the o u t c o m e ( G h, G l) :~ ( (Wh, klh), (W l, ]11)) is

called pooling, in which case we slightly abuse notation by writing

(G h, G l) : G d -- (w d,/ze), where we = w h = w I and/l d =/~h + #I =/~.

Let X: F ~ F x F be a correspondence that for any group assigns the set

of feasible final outcomes in the group. In particular, the set of feasible final

outcomes for the group G is denoted X(G), being the set of outcomes satisfying

conditions (1)-(4), given G = (w, #). If (G h, G l) is a pooling outcome, then we

Slightly abuse notation by writing (G h, G ~) = GdeX(G). Define ~z:F--~ N by

rc(G):= ~/c =m/~/~K[(1 - pK)(w ~ - wl) + pK(w ~ - w2)]. Hence, ~(G) is the profit

earned by the firm on the group G = (w, #) before entering into renegotiation.

The profit that the firm earns after having concluded the renegotiation with

the semi-separating outcome (G h, G~)eX(G) is equal t o 7c(G h) + ;rc(Gl). If the

renegotiation ends with the pooling outcome (G h, G l) = Gd~X(G), then its

profit equals 7c(G h) -[- lr(G 1) = 7r(Ge). In any case, the renegotiation is profitable

for the firm if and only if ~(G h) + ~z(Gz) exceeds ~(G).

3 Definition of renegotiation-proofness

Some outcomes in X(G) may invite further renegotiation and cannot therefore

be final outcomes of the renegotiation between the firm and the group G. In

other words, X(G) is a set of outcomes satisfying certain conditions that are

necessary but not sufficient to ensure that no further renegotiation will take

place. Therefore, let a: F ~ F • F be a standard of behavior (SB) that for each

group G assigns a set of outcomes a(G)~ X(G) from which no further

renegotiation will take place. If (G h, G t) is a pooling outcome, then we slightly

abuse notation by writing (G h, G l) = Gd~a(G).

We require that an SB a satisfy: If (G h, G~)~a(G) is semi-separating, then

there does not exist (~h ~l)~a(Gk), k = h or l, such that 7r(Gh) + ~(~t) > :r(Gk). If

( G h, G l) = Gd ~ a( G) is pooling, then there does not exist ( ~h, ~l)~ a( Gd) such that

7r(Gh) + rc(GI) > ~(Gd). This is called internal stability (IS): If there is no scope

for further renegotiation from an outcome, it must be because the firm cannot

profit from entering into renegotiation with one of the groups that the

outcome consists of if constrained to suggesting to this group a new outcome

from which no further renegotiation will take place.

Conversely, we also require that an SB a satisfy: If (G h, GZ)~X(G)\a(G) is

semi-separating, then there does exist (~h, ~t)Eo,(Gk), k = h or l, such that

346

G.B. Asheim and T. Nilssen

n(G h) + n(G l) > n(Gk). If (G h, G l) = Ga~X(G)\a(G) is pooling, then there does

exist (~h, ~I)E6(Ga ) such that 7c(Gh) + n(G l) > n(Ga). This is called external

stability (ES): If there is scope for further renegotiation from an outcome, it

must be because the firm can profit from entering into renegotiation with one

of the groups that the o u t c o m e consists of even if constrained to suggesting to

this g r o u p a new o u t c o m e from which no further renegotiation will take place.

If the SB cr is both internally and externally stable, it is called (yon

Neumann-Morgenstern) stable, yon N e u m a n n - M o r g e n s t e r n stability has recently been used by Greenberg (1990) as one of two general solution concepts

in the alternative a p p r o a c h to game theory presented t h r o u g h his theory of

social situations. 5 The above definition a m o u n t s to a core-like concept: The

monopolist together with the insurees of one of the groups can block an

outcome if and only if they can find an o u t c o m e of the subgame formed by the

m o n o p o l y insurer and the insurees of this g r o u p that yields the monopolist

a higher profit, while satisfying the individual-rationality and incentivecompatibility constraints of the insurees of the group. 6 This concept is, in fact,

the modification of the core that has been suggested by Greenberg (1990;

Section 6.1) and called the coalition-proof core by Lacker and Weinberg (1994):

Only outcomes in the coalition-proof core of the subgame formed by the

m o n o p o l y insurer and the insurees of the g r o u p can be used for blocking, not

any o u t c o m e ] As discussed at the end of Section 4, this modification of the

core is of major importance in the present application to a game of asymmetric

information.

The concept of a coalition-proof core is used in the context of models of

asymmetric information also by Lacker and Weinberg (1993, 1994). As

pointed out in their 1993-paper, the coalition-proof core bears the same

relation to Bernheim et al.'s (1987) concept of a C o a l i t i o n - P r o o f equilibrium as

does the core to A u m a n n ' s (1959) concept of a Strong Equilibrium. In

a strategic matching game without enforceable contracts, K a h n and M o o k herjee (1995) apply the concept of a C o a l i t i o n - P r o o f equilibrium to a competitive insurance economy. In addition to differences concerning the underlying

situation (e.g. competition vs. monopoly), the present paper differs at a formal

s Greenberg(~99~referst~v~nNeumann`M~rgensternstabi~ityas~timis~icstabi~ity;the~ther

solution concept he uses is referred to as conservative stability. The present analysis (in Sections

3 and 4) of renegotiation-proofnessin an insurance market draws heavily upon Greenberg's (1990)

theory of social situations and can, at a notational cost, be properly embedded in this theory, as we

did in Asheim and Nilssen (1991). This application of Greenberg's theory to a problem of

asymmetric information seems to be a novelty. Note that what is here referred to as a group of

individuals corresponds to a position in Greenberg's (1990) framework.

6 Note that it is not an effectivelimitation that an outcome cannot be blocked by the monopolist

combined with both groups that the outcome consists of, since if the firm profts by renegotiating

with both group simultaneously, it can also profit by renegotiating with one of the groups

separately.

7 A variant of this modification, called the 'modified core', has been defined and analyzed by Ray

(1989), Greenberg (1990, Theorem 6.1.3) and Ray (1989) show that their modifications do not

expand the core in finite cooperative games (of complete information).

Insurance monopoly

347

level by presenting a cooperative game where contracts between the firm and

its insurees are enforceable if at least one party insists.

In general, yon Neumann-Morgenstern stability does not yield a unique

stable set. In our application it is indeed the case that there exist multiple

SBs o- that are internally and externally stable. Therefore, define an outcome

to be renegotiation-proof if there exists some stable SB o- that admits the

outcome.

(~){~isstable}

Definition 1. Z(G):=

a(G) is the set of renegotiation-proof outcomes

in the renegotiation with the group G.

The following lemma enables us to defne renegotiation-proof groups.

(Gh, Gt)~X(G) is a semi-separating outcome, then (G h, GI)~Y, (G) if

and only if Ghe y~ (G h) and Gt ~ Y, ( Gl). If ( Gh, G ~)= Gd~ X (G) is a pooling outcome,

then Gdey,(G) if and only if Gd~Z(Gd).

Lemma 1. If

Proof. Let (Gh, GI)eX(G) be a semi-separating outcome. Consider some stable

a. Suppose Gkq~a(Gk), k = h or I. By ES, there exists (~h, ~t)~a(Gk), k = h or l,

such that rc(Gh) + ~(G~) > ~z(Gk). Hence, by IS, (Gh, G1)r

establishing the

necessity part of the lemma. Conversely, suppose (G h, GI)(~a(G). By ES, there

exists (~h, ~l)ea(Gk), k = h or l, such that rc(Gh) + zc(Gl) > ~(Gk). Hence, by IS,

Gk(~a(Gk), k = h or l, establishing the sufficiency part of the lemma. Repeat the

argument for the case where (Gh, G ~)= Gd~X(G) is pooling. []

Definition 2. A group G is renegotiation-proofif and only if GE22 (G).

The next section is devoted to the study and characterization of renegotiationproof groups. Note that Lemma 1 implies that a stable SB a is fully determined

if, for each Gs_F, it is known whether Gca(G). We end this section by noting

the following useful result.

Lemma 2. If the standard of behavior a is stable, then X(G')~_ X(G) implies

~( G') =_~( G).

Proof. By the proof of Lemma 1, if (G h, Gl)~a(G ') ~_ X(G') ~_ X(G) is semiseparating, then Gh~a(Gh), Gt6a(Gl), and (G h, Gl)~a(G). Repeat the argument

for the case where (Gh, G l) = Gd~a( G') ~ X ( G') ~_ X ( G) is pooling. []

4 Characterization of renegotiation-proof groups

For any feasible state-contingent allocation w at which the low-risk indifference curve is steeper than the high-risk isoprofit curve, let ~L(w)~ [0, ~ ) be the

ratio of high-risks to low-risks that makes the isoprofit curve for the mixture

tangent to the low-risk indifference curve at the allocation w. For other feasible

allocations, let QL(w)= ~ . The following observation is provided without

proof.

Lemma 3. ~L(w)> 0 if and only ifw provides partial insurance (i.e., w1 > w2).

It is straight-forward to establish that a group G = (w, #) is not renegotiationproof if the isoprofit curve for the mixture # -- (/~H,/~L) is steeper than the

348

G.B. Asheim and T. Nilssen

low-risk indifference curve at the allocation w (which includes the case where

# = (0, #L) is given partial insurance) or if# = (#~t, 0) is given partial insurance.

Proposition 1. G = (w,#) is not renegotiation-proof if #H/#L < QL(w) or if

# = (#~,0) and w 1 > w 2.

Proof. s We need to establish that there does not exist a stable a such that

G~a(G) in each of the two cases. Suppose to the contrary that there exists

a stable ~ such that G~a(G) where #~/#L < •L(W) 9 By L e m m a 3, w 1 > w 2.

Hence, there exists w' with w'1 >_ w 2 satisfying un(w' ) > u~i(w) and UL(W') =

UL(W). We have that G'~X(G')c_ X(G) for the pooling outcome G ' = (w',#).

Furthermore, since #tl/#r < ~L(W), ~(G') > re(G) if w' is chosen sufficiently near

w. Therefore, by IS of ~, G'(s~(G). This implies by ES of a that there exists

(G h, Gl)ea(G ') such that 7c(Gh) + ~z(Gl) > ~(G'). However, since X(G') c X(G), it

follows from L e m m a 2 that (Gh, Gz)Ea(G). Since 7c(Gh) + rc(Gl) > rc(G') > re(G),

this is in conflict with IS ofa. Suppose next that there exists a stable a such that

G~a(G) where # = (#~, 0) and w 1 > w 2. Then there exists w' with w't _> w~

satisfying u~(w') = ua(w ), and such that G'~X(G') ~_ X(G) and rc(G') > re(G) for

the pooling outcome G' = (w', #). Repeat the argument of the first part of the

proof. []

It is somewhat harder to establish that a group G = (w,#) is renegotiationproof if and only if w provides full insurance or the isoprofit curve for the

mixture # = (#H, #L) is not steeper than the low-risk indifference curve at the

allocation w. In particular, to establish the following complete characterization of renegotiation-proof groups, it is assumed that the v N - M utility

function v satisfy constant relative risk aversion (CRRA), or equivalently, that

the preferences on state-contingent allocations be homothetic. Such

homotheticity implies that QL(') is homogeneous of degree zero.

Proposition 2. Under the assumption of constant relative risk aversion, G =

(w, #) is renegotiation-proof if and only if w 1 = w 2 or 0 < QL(w) <_#H/#L < oe.

Proof. See the Appendix.

[]

The proof of Proposition 2 uses the assumption of CRRA by constructing

a stable SB ~ such that if G ' = (w', #')~a(G'), then GE~(G) for any G = (w, #)

with w'~/w'2 = wl/w 2 and #~/#k = #~/#L" Whether the same characterization

can be obtained for general v N - M utility functions is an open question.

Note that for any G' = (w', #') with 0 < ~L(W') _< #~/#~ < OO,there exists an

SB a such that G'~a(G'). In particular, any group consisting of a partial

insurance allocation and a type profile with a high fraction of high risks

(such that the isoprofit curve for the mixture is less steep than the lowrisk indifference curve) is also renegotiation-proof. The next section establishes that such a group will, however, never be chosen by a profit maximizing

firm.

s We thank Joseph Greenberg for suggesting this proof.

Insurance monopoly

349

If we in our definition of renegotiation-proofness had allowed the firm to

choose any feasible o u t c o m e in the set X(G) when renegotiating with the g r o u p

G, 9 then the only r e n e g o t i a t i o n - p r o o f outcomes would be pooling outcomes

yielding full insurance. T o see this, note that if G' = (w', #') satisfies 0 < OL(w') <_

#~t/#~ < 0% then there exists - using the n o t a t i o n and a r g u m e n t of the p r o o f of

Proposition 2 - (Gh, G~)eX+(G ') such that rc(Gh) + rc(G z) > 7c(G'), while the

corresponding a r g u m e n t is straight-forward for the cases covered by Proposition 1. Hence, restricting the firm, when renegotiating, to choose outcomes

from which no further renegotiation will take place therefore yields a m a j o r

expansion of the set of renegotiation-proof outcomes.

T h e rationale behind restricting the firm to renegotiate to an o u t c o m e from

which no further renegotiation will take place, is that the firm and the g r o u p

with which it renegotiates perfectly foresee what will be the final o u t c o m e of

the present and future renegotiation. Hence, by construction, our a p p r o a c h

seems to be i m m u n e against a criticism of lack of farsightedness, as levied

against the concept of yon N e u m a n n - M o r g e n s t e r n stability by H a r s a n y i

(1974) and, m o r e recently, Chwe (1994).

Still, for the sake of the argument, suppose that first the firm and the g r o u p

G'=(w',#')~a(G') with O<OL(W')<#'U/#'L<oO renegotiate to (Gh,Gl)~

X+(G')\a(G ') with ~(G h) + ~(G I) > 7r(G'), and that next the firm and the g r o u p

GIr

l) renegotiate to (~h, ~l)~a(G1 ) with ~ ( ~ h ) + rC(~l)> rc(Gl). This twostage renegotiation splits the original g r o u p G' into three new groups, Gh, ~h

and G~, with all the high-risks being better off, with all the low-risks being as

well off, and the firm earning a higher profit. Note, however, that the high-risks

being separated out into the group Gh in the first stage are left at a lower utility

level than the high-risks in the groups ~h and Gt. We argue that such two-stage

renegotiation will not come a b o u t because no high-risks will want to enter the

group G h when not doing so will lead to an even higher utility level. 1~

5 Profit maximization without commitment

W h a t is the profit maximizing o u t c o m e when a m o n o p o l y firm offers insurance to the group of insurees G o = ( W o , # o ) given by W o l > W 0 2 > 0 and

#o = (#oH, #oL) >> 0? O u r basic a s s u m p t i o n is that the m o n o p o l y firm cannot

c o m m i t to the pair of allocations that the individuals are signed up with.

Hence, we raise the p r o b l e m of credibility which has been formulated in Kreps

(1990, pp. 677-9). This implies that the firm is restricted to finding an o u t c o m e

9 This would have corresponded to the unmodified core; see the discussion in Section 3.

lo Alternatively, as suggested to us by John Hillas, the firm could make an additional, fullinsurance offer w" - preferred to w' by high-risks only - while retaining w'. For the firm, making

such an offer weakly dominates not making the oiler. If some high-risks accept w", the resulting

two-stage renegotiation increases the firm's profit and leaves high-risks at two different utility

levels. Since at most a 'small' amount of high-risks would want to be left at the lower level, the

firm's increase in profits is, by Proposition 2's construction of stable SBs, at most negligible. We

claim that the firm - lacking a strict incentive - does not behave irrationally by not making the

offer w".

350

G.B. Asheim and T. Nilssen

in X(Go) - the set of renegotiation-proof outcomes - that maximizes the firm's

profit.

This problem will be analyzed under the general assumption of CRRA

such that Proposition 2 applies. By adapting the analysis of Stiglitz (1977) to

the present case, the first result of this section establishes that full separation

never occurs.

Proposition 3. I f (G h, G t) ~ ((w h, #h), (Wl, #1)) maximizes rc(a h) + g(G l) over all

elements in N ( ao), where G o = (W o, #o), then wh ---- wh2' UH(wh) = UH(Wl)' UL(wl) =

u L ( w o ) , #L~ - -- #OL, and # ~~ / # L' = er(wZ) 9

Proof. By Proposition 1 and Lemma 1, (G h, Gt)(~Z,(Go) if

" #~/#L

l t < 0c(Wt)- By

Proposition 2 and the assumption ofCRRA, ( G n, GZ)~ Z, (GO) lf#~/#

. l L = 0L(w~).

The proposition follows by adapting the analysis of Stiglitz (1977). []

Let e = w] = Wh2 and determine e and 0 by uR(e,e ) = uH(wo) and UL(6,0)=

UL(Wo). Proposition 3 simplifies the firm's problem to a one-dimensional one,

viz. finding e~[e, ~] that maximizes the firm's profit. For the analysis of this

problem, let e ~176denote inf{e'>0[~w'>>0 such that u~(e',e')=utt(w'),

UL(W') = UL(Wo), and 0L(W')< oe}, noting that e ~ < _eif and only if r

< oO.

Define the function f(.): (e ~ ~] --~ ~+ as follows: f(e) equals the profit gained

by moving a unit of L-type individuals from wl, determined by uti(e, e) = u~(w t)

and UL(Wl) = UL(Wo), to (~, e-), and 0L(W~)units of H-type individuals from wz to

(e,e). Let ~)o:= #0~/#OL. Then #or-[00-(g--e)- f(e)] is the profit gained by

moving the type profile #0 = (#o~, #0L) from the pooling outcome ((~, ~), #o) to

the outcome described in Proposition 3. Note that feasibility requires 0o ->

0L(WZ).The following two lemmas describe the properties of the correspondence E(-): ~+ --~ [_e,~], assigning to each 0 the set of values of e that maximize

the firm's profit given ~); i.e., E(-) is defined by E(O):= argmaxe~Ee,e?~(~%~lO'

(~ - - e) - f (e).

Lemma 4. e~E(Q) implies Q > QL(WZ), where w I is determined by uu(e, e) -= utt(w l)

and UL(Wl) = UL(Wo).

Proof. Let wQbe determined by 0 = OL(w~) and UL(W o) = UL(Wo). (If no such w ~

exists, then the lemma is immediate.) Furthermore, let e-~be determined by

un(e ~, e ~) = u~(w~~ Ire > eQis chosen sufficiently close to e ~, then it follows from

the envelope theorem that 0"(~- e) - f ( e ) > o ' ( e - e ~) - f ( e ~ the first order

gain consisting of H-type individuals being moved from partial to full insurance. The lemma follows since it is straight-forward to check that 0'(~ - e) f(e)<o'(O-e~

f(e~

~ []

Lemma 4 establishes that feasibility is ensured; i.e., that the amount of highrisks that are signed up with w*is smaller than the total amount of high-risks.

Lemma 5. (a) E(') is an upper hemi-continuous correspondence of o. (b) ~ E ( o) if

and only if 0 = O. (c) I f OL(Wo) < 0% then _e~E(o) if and only if 0 >- ~ f o r some

0 > O. (d) IfoL(Wo) = o% then Ve > O, ~0~ < oe such that 0 > O~ and e e E ( o ) imply

0 < e - e ~ < e. (e) E(.) is strictly monotone on [0, 0] (i.e., if 0 <_ ~' < ~" <_ ~,

Insurance monopoly

351

e' ~E(o'), and e"6E(o'), then e' > e"). ( f ) E(O) = {_e} for 0 > 0 if OL(w~ < oo;

if oL(w ~ = o% then eCE(~) for all 6.

Proof. This lemma follows from Lemma 4 since (i) f(.) is continuous and

smooth on [max {_e,e~ 0J (with e ~ defined as in the proof of Lemma 4), (ii)

f(O) = O, f(e) > 0 otherwise, (iii) the left derivative of f(-) at e = ~ exists and

equals 0, (iv) f(.) is Lipschitz on [-_e,g] if OL(Wo)< o% and (v) e ~ ~ as

Q--, ~ . []

Lemma 5 entails both that full pooling never occurs (i.e. 6~E(~ ~ is impossible) and that all the low-risks together with some of the high-risks may

remain self-insured (i.e. _e~E(~)~ is possible). These findings are stated as

Proposition 4.

Proposition 4. I f (G h, G l) ~ ((w h, #h), (wl #1)) maximizes 7c(Gh) -b 7z(Gl) over all

elements in ~, ( Go), where G O= (Wo, #o), then: (i) ( G h, G l) is not a pooling outcome.

(ii) I f Oi.(Wo) < co, then there exists ~ > 0 such that (G h, G l) = ((w h, #h), (Wl, #l))

with w h = wh2' UH(wh)=un(wo), #~ = #OL, and # u1/ # rI = PL(Wo) if and only if

#or~/#oL > O.

Proof. The first part follows from Lemma 5(b) since ~9o= #o/J#oL > 0. The

second part follows from Lemma 5(c). []

How do our results relate to those of Stiglitz (1977)? In both models, the

optimal outcome is restricted by the low-risks' incentives to self-insure and by

the high-risks' incentives to mimic the low-risks. In both models, it includes

a full-insurance allocation that only high-risks buy and a partial-insurance

allocation that all the low-risks buy. The difference is that, in our model, some

high-risks mimic the low-risks and buy the partial-insurance allocation so that

semi-separation prevails, whereas in the Stiglitz model, only low-risks buy

partial insurance and there is full separation.

The reason for this difference is, of course, that, in our model, the firm is not

able to commit not to renegotiate. However, if the ratio between high-risks

and low-risks signing up for the partial-insurance allocation is not too low, the

allocation is viable and will not be renegotiated. Ensuring renegotiationproofness this way, by having some high-risks buy partial rather than full

insurance, is costly to the monopolist, so that, clearly, the introduction of

renegotiation-proofness reduces its profit. The low-risks are equally well off in

both cases, obtaining their self-insurance utility level. It is more involved to see

how the high-risks are affected by the introduction of renegotiation. However,

under our assumption of CRRA, it turns out that they are better off when

renegotiation is allowed, given that the low-risks are not left at their selfinsurance allocation in both cases.

6 Concluding remarks

This analysis has shown how the Stiglitz model of insurance monopoly can be

extended to include a concept of renegotiation. Our results reinforce the

352

G.B. Asheim and T. Nilssen

lessons from the earlier renegotiation literature: that full separation is not to be

expected, or more generally, that individuals with different characteristics

have identical behavior.

The restriction to CRRA is a short-coming. Although the present work

may provide us with an intuition for how renegotiation-proof outcomes may

include partial insurance, it seems hard to extend our results to a more general

class of preferences. We leave for future research to determine whether such an

extension can be established.

In Asheim and Nilssen (1996) we combine competition in an insurance

market with renegotiation where the firm is unable to discriminate between

its various groups. This corresponds to employing the Stiglitz monopoly

model as a building block for the study of insurance market competition.

Hence, renegotiation between firms and insurees is based only on the information provided by the insurees' choice of firms, not their choice of contracts.

Sub- stituting the present model for that of Stiglitz would yield an analysis

where renegotiation could be based also on the information that customer

separation reveals. Such an analysis is, however, outside the scope of the

present paper.

Appendix

Proof of Proposition 2. Consider any G' = (w', #') with 0 < ~L(w') _< #~/#~ < Go.

By Proposition 1, it suffices to show that there exists a stable a such that (i)

G'sa(G') and (ii) G~a(G) for any G = (w, #) with w 1 = w2.

By Lemma 3, w'1 > WE" Consider

X +(G,):= {(G h, G l) = ((w h, #h), (W ~,#I))~X(G,)I w h = w2h ' uL(w') = uL(w'),

wl c w ' , # ~ = # r ,'a n d

# ~I/ # L l = QL(w~)} 9

Note that incentive compatibility and individual rationality imply ui~(w h) =

un(w l) > un(w') and that exhaustiveness implies #h = #, _ #l = (#~, 0) > 0. If

(G h, GI)eX+(G ') and w1is sufficiently close to w', then n(G h) + n(G z) > n(G'). If

(G h, GI)~X +(G') and w h = w l, then (G h, G l) is pooling (and yields full insurance)

and n(G h) + n(G l) = n(G d) < n(G'). By continuity, there exists (~h, ~ ) = ((#h, fib),

(#I,/~z))~X+(G') (if not unique, choose #l nearest to w') such that n(G h) +

n(G l) = n(G'). Note that n(@) < n(w', ft h) and n(G l) > n(w', ftt).

Also consider

F - ( ~ z ) : = {G = (w, #)eFI3G h such that (G h, Gt)~X(G), n(G h) + n(G t) = n(G),

wh

~h, UL(~l)

=

UL(W),W~r

W

- I = #r, and

, #r

0 < Q~(w) <_ #i~/#L < 0o}.

Write G ~ = (w ~, #~):= G~. If it exists, let Go = (w ~

denote an element of

F - ( G 1) satisfying QL(w o) = l~n/#

o Lo (if not unique, choose w~ nearest to wl). If

such an element does not exist, choose w ~ such that ~)r(w~ = oe and

UL(W~)=UL(wO). Note that, by the construction of G 1, G = ( w , # ) e F - ( G 1)

implies w l / w ~ < wz/w 2 < w~176 in fact, n(G h) < n(w,#h). For w satisfying

Insurance monopoly

353

wl/w

2 i 1 < wi/w 2 <_W~ ~ let G = (w, #)e~r(G) if and only if G e F and there exist

~ , t > 0 such that (c~w,tl~)eF -(G1).

Start an infinite induction towards full insurance by, for each n > 1,

constructing X+(G"), determining G "+ 1, and letting (for w satisfying w n+

a l/

n+l

n

n

w 2 < wl/w 2 < Wl/W2) G = (w,#)ea(G) if and only if G ~ F and there exist

e , t > 0 such that (c~w,t#)eF-(G'+l).

Start a finite induction towards even more partial insurance by, for each

n <_ 0, constructing F -(G"), letting (for w satisfying W]/wn2 < Wl/W2 < W]- i~

w n2- 1 ) G = (w,#)ea(G) if and only if G e F and there exist ~, t > 0 such that

(ew, tilt) e F - (G"), and determining, if it exists, G"- 1.

Let G = (w,#)ea(G) ifw 1 = w 2, and let G = (w, lO(~a(G) if ~gL(W) = 00.

Internal stability of a follows by construction due to the CRRA.

External stability of a is established as follows due to the CRRA:

(a) If W l > W 2 and # = ( # ~ , 0 ) , then G=(w,#)(~a(G), and G = ( # , # ) , with

W1 = 1'~2 and uH(# ) = uH(w), satisfies Gea(G) and n(G) > n(G).

(b) Consider G = ( w , # ) with Wl,+1./w2, + i < wl/w2 <- wl/w2

, , for some integer

n and ~gL(w) _< #~/#r < 00.

(i) If #H/#/~ > / ~ / / 2 L for some G = (w,/~)ea(G), then G(~a(G) and there

exists (G h, G) = ((w h, #h), (W,/~))ea(G), with wh ----wh2, UL'(wh) = UH(W),

and/~r = #L, satisfying rc(Gh) + ~(G) > re(G).

(ii) Otherwise, if G(~a( G), then there exists (G h, G I) = ( (w h, t~h),(w l, #l) )c a( G)

with Whl - 2 ' l.iH(Wh)=!.tH(W1), WI /WI2 = wln+ I,/w 2n+ l, UL(WI)=UL(W),

l l = QL(),

W l satisfying re(G") + 7r(Gz) > lr(G).

#L[ __

--/~L, and #n/#L

(c) If #H/#L < QL(W), then G = (w,#)(~-a(G). Determine G = (~,#) by UL(V~) =

UL(W) and #H/#L = QL(VV)- N o t e that a(G) _~ a(G) by L e m m a 2, and that

lr(G) > ~r(G) by the definition of ~ ( ' ) . By (b), there exists (G h, Gl)~a(G) ~_

o-(G) such that 7r(Gh) + rc(G1) >_~z(G) > zc(G). []

References

Asheim, G. B., Nilssen, T.: Renegotiation in an insurance market. Working paper 91/10,

Norwegian Research Centre in Organization and Management 1991

Asheim, G. B., Nilssen, T.: Non-discriminating renegotiation in a competitive insurance market.

Forthcoming in European Econ Rev. 1996

Aumann, R.: Acceptable points in general cooperative n-person games. In: Contributions to the

theory of games, IV. Princeton: Princeton University Press 1959

Beaudry, P., Poitevin, M.: Signalling and renegotiation in contractual relationships. Econometrica 61, 745-782 (1993)

Beaudry, P., Poitevin, M.: Competitive screening in financial markets when borrowers can

recontract. Rev. Econ. Stud. 62, 401-423 (1995)

Berliant, M.: On income taxation and the core. J. Econ. Theory 56, 121-41 (1992)

Bernheim, D., Peleg, B., Whinston, M. D.: Coalition-Proof Nash equilibria; I. Concepts. J. Econ.

Theory 42, 1-12 (1987)

Boyd, J. H., Prescott, E. C., Smith, B. D.: Organizations in economic analysis. Can. J. Econ. 21,

477 91 (1988)

Chwe, M. S.-Y.: Farsighted coalitional stability. J. Econ. Theory 63, 299-325 (1994)

Dewatripont, M., Maskin, E.: Contract renegotiation in models of asymmetric information.

European Econ. Rev. 34, 311-21 (1990)

354

G. B, Asheim and T. Nilssen

Dionne, G., Doherty, N. A,: Adverse selection, commitment and renegotiation: extension to and

evidence from insurance markets. J. Pol. Econ. 102, 209-235 (1994)

Greenberg, J.: The theory of social situations. Cambridge: Cambridge University Press 1990

Hamilton, J. H., MacLeod, W. B., Thisse, J.-F.: Spatial competition and the core. Quart. J. Econ.

106, 925-37 (1991)

Harsanyi, J. C.: An equilibrium-point interpretation of stable sets and a proposed alternative

definition. Management Science 20, 1472-95 (1974)

Hillas, J.: Contributions to the theory of market screening. Technical report 519, IMSSS, Stanford

University 1987

Hosios, A., Peters, M.: Self-selection with renegotiation. Working paper 8814, University of

Toronto 1988

Kahn, C. M., Mookherjee, D.: Coalition proof equilibrium in an adverse selection insurance

economy. J. Econ. Theory 66, 113-138 (1995)

Kreps, D.: A course in microeconomic theory. New York: Harvester Wheatsheaf 1990

Lacker, J. M., Weinberg, J. A.: A 'coalition-proof' equilibrium for a private information credit

economy. Econ. Theory 3, 279-296 (1993)

Lacker, J. M., Weinberg, J, A.: The coalition-proof core in adverse selection economies. Working

paper 94-9, Federal Reserve Bank of Richmond 1994

Marimon, R.: The core of private information economies. Working paper 131.90, Universitat

Autonoma de Barcelona 1990

Ray, D.: Credible coalitions and the core. Int. J. Game Theory 18, 185-187 (1989)

Stiglitz, J.: Monopoly, non-linear pricing and imperfect information: the insurance market. Rev.

Econ. Stud. 44, 407-30 (1977)