S M CIENTIA ARINA

advertisement

SCI. MAR., 67 (Suppl. 1): 89-97

SCIENTIA MARINA

2003

FISH STOCK ASSESSMENTS AND PREDICTIONS: INTEGRATING RELEVANT KNOWLEDGE.

Ø. ULLTANG and G. BLOM (eds.)

Integrative fish stock assessment by frequentist

methods: confidence distributions and likelihoods

for bowhead whales*

TORE SCHWEDER

Department of Economics, University of Oslo, Box 1095 Blindern, 0317 Oslo, Norway.

E-mail: tore.schweder@econ.uio.no

SUMMARY: Frequentist concepts of confidence distribution, reduced likelihood and likelihood synthesis are presented as

tools for integrative statistical analysis, leading to distributional inference. Bias correction, often achieved by simulations,

is emphasised. The methods are illustrated on data concerning bowhead whales off Alaska, and they are briefly compared

with Bayesian methods.

Key words: bowhead whales, likelihood synthesis, confidence distribution, reduced likelihood, meta-analysis.

INTRODUCTION

Fish stock assessments are often based on data

from different and independent sources. Methods

for integrating diverse data have been somewhat

neglected in the frequentist statistical tradition.

There, emphasis has usually been on one set of data

without much regard to previous relevant data, or to

the future use of the data in question. Many fisheries

scientists have therefore turned to Bayesian methods. Representing the results in distributional terms,

e.g. posterior distributions, adds attraction to the

Bayesian approach. There are, however, frequentist

methods available for integrative analysis, and distributional inference. The purpose of this paper is to

present the basic concepts of confidence distributions, reduced likelihoods and likelihood synthesis.

The methodology is illustrated by some recent applications to the assessment of bowhead whales off

*Received December 6, 2000. Accepted January 9, 2002.

Alaska. Bayesian methods are also briefly compared

with the frequentist methodology in the context of

fish stock assessment.

In the frequentist tradition, the properties of a

statistical method are analysed in probabilistic terms

ex ante, before data are observed. The main property of a method of confidence interval estimation is,

for example, the coverage frequency in repeated

applications. Ex post, one is left with an observed

confidence interval. The given degree of confidence

is a property of this interval, a property that is inherited from the coverage probability of the interval

estimation method ex ante. Wade (1999) discusses

and compares frequentist, Bayesian and likelihood

methods in the context of fish stock assessment. He

comments that what is lacking from the frequentist

methodology is a “strength of evidence” type argument, and he is critical of the widespread pre-specification of the level of significance in hypothesis

testing and of the degree of confidence in interval

estimation. The confidence distribution provides,

FREQUENTIST ASSESSMENT 89

however, the “strength of evidence” type argument

that Wade (1999) is missing. The confidence distribution is a generalisation and unification of confidence intervals and p-values. It can be regarded as

the frequentist analogue of the Bayesian posterior

distribution. Confidence distributions are not

uncommon in fisheries assessment (Gavaris, 1999;

Patterson et al., 2001), but often half-baked as bootstrap distributions.

Patterson et al. (2001) discuss briefly the merits

of the Bayesian approach to fish stock assessment.

They also discuss frequentist methods aiming at

confidence distributions representing the knowledge

and uncertainty that the data allow for. Patterson et

al. (2001) mention that the standard frequentist

methodology does not offer a structured framework

to incorporate prior information. They do mention

the method of likelihood synthesis (Schweder and

Hjort, 1996; 2002), but remark correctly that this

approach is not in common use.

CONFIDENCE DISTRIBUTIONS

Fisher (1930) introduced the concept of fiducial

probability distributions. Fisher could not accept the

use of Bayesian inference based on flat priors, and

his fiducial distribution was meant as a replacement

for the Bayesian posterior distribution. Efron (1998)

and others prefer the term “confidence distribution”

rather than “fiducial probability distribution”. The

defining property of a confidence distribution is that

its quantiles span all possible confidence intervals.

Confidence distributions and fiducial probability

distributions are essentially the same thing.

Consider a statistical model for the data X. The

model consists of a family of probability distributions for X, indexed by the vector parameter (ψ,χ),

where ψ is a scalar parameter of primary interest,

and χ is a nuisance parameter (vector).

A univariate data-dependent distribution for ψ,

with cumulative distribution function C(ψ; X) and

with quantile function C–1(α; X) is an exact confidence distribution if

)

Pψχ ψ ≤ C −1 (α ; X ) = Pψχ (C(ψ ; X ) ≤ α ) = α

for all α ∈ (0,1) and for all probability distributions

in the statistical model.

90 T. SCHWEDER

Definition 2

A function of the data and the interest parameter,

p(X, ψ), is a pivot if the probability distribution of

p(X,ψ) is the same for all (ψ, χ), and the function

p(x,ψ) is increasing in ψ for almost all x.

If based on a pivot with cumulative distribution

function F, the cumulative confidence distribution is

Definition 1

(

By definition, the stochastic interval (–∞,

C–1(α;X)) covers ψ with probability α, and is a onesided confidence interval method with coverage

probability α. The interval (C–1(α;X), C–1(β;X))

will for the same reason cover ψ with probability β

– α, and is a confidence interval method with this

coverage probability. When data have been

observed as X = x, the realised numerical interval

(C–1(α;x), C–1(β;x)) will either cover or not cover

the unknown true value of ψ. The degree of confidence β – α that is attached to the realised interval

is inherited from the coverage probability of the

stochastic interval. The confidence distribution has

the same dual property. Ex ante data, the confidence distribution is a stochastic entity with probabilistic properties. Ex post data, however, the confidence distribution is a distribution of confidence

that can be attached to interval statements. For simplicity, I will speak of confidence instead of

“degree of confidence”.

The realised confidence C (ψ0;x) is the p-value of

the one-sided hypothesis H0 : ψ ≤ ψ0 versus ψ > ψ0

when data have been observed to be x. The ex ante

confidence, C (ψ0;X) is from the definition uniformly distributed. The p-value is just a transformation of

the test statistic to the common scale of the uniform

distribution (ex ante). The realised p-value when

testing the two-sided hypothesis H0 : ψ = ψ0 versus

ψ ≠ ψ0 is 2 min {C (ψ0), 1 – C (ψ0)}.

Confidence distributions are easily found when

pivots (Barndorff-Nielsen and Cox, 1994) can be

identified.

C (ψ;X) = F(p(X,ψ)).

From the definition, a confidence distribution is

exact if and only if

C (ψ;X) ∼ U

is a uniformly distributed pivot. The symbol ∼

means “distributed as”.

Example: Linearity and normality

In linear normal models, a linear parameter, µ,

has a normally distributed estimator, µ̂, and an independent estimator of standard error, σ̂. Then,

µ − µˆ

~ tν ,

σˆ

meaning that the left hand side has a Student t-distribution with ν degrees of freedom, independent of

the parameters µ and σ, and is thus a pivot. With Fν

being the cumulative t-distribution,

µ − µˆ

C( µ ) = Fν

σˆ

is the student confidence distribution.

Fisher’s fiducial argument is in this case in short

hand:

( µ − µˆ ) ~ t

ˆ ˆ ,

ν ⇒ µ ~ µ + σtν

σˆ

meaning that the confidence distribution is the t-distribution scaled by σ̂, and located at µ̂. This is a

specification ex ante, with µ̂ and σ̂ being stochastic,

and ex post with observed values for these variates.

The sampling distribution for the standard error

estimator is related to the chi-square distribution χ2ν.

In short hand, it is given by the pivot

σˆ

~ χν2 / ν .

σ

The confidence distribution is therefore

C(σ ) = σˆ ν / χν2 .

If, say, the data result in the estimate σ̂ = 2, the

realised confidence distribution is

C(σ ) = 2 ν / χν2 .

Sampling distributions are different from confidence distributions. The sampling distribution of an

estimator ψ̂ at the observed estimate ψ = ψ̂obs has

cumulative distribution function

S(ψ ) = Pψˆ obs (ψˆ ≤ ψ ) = Fψˆ obs (ψ ) .

The cumulative confidence distribution is, however,

a p-value:

must therefore be converted to confidence distributions. The difference between the sampling distribution and the confidence distribution is illustrated for

the standard error in the above example.

Confidence distributions are unbiased by definition. The coverage probabilities of their confidence

intervals are correct, and the confidence median is a

median unbiased point estimator. Confidence distributions also have power properties. The NeymanPearson lemma specifies the conditions for the likelihood ratio tests to be most powerful. A parallel theorem exists for confidence distributions. An ex ante

confidence distribution based on the likelihood ratio

statistic is, in fact, less dispersed in a stochastic

sense (has smallest variance, and is also less dispersed for non-quadratic measures of dispersion)

than any confidence distribution based on other statistics for the same data (Schweder and Hjort, 2002).

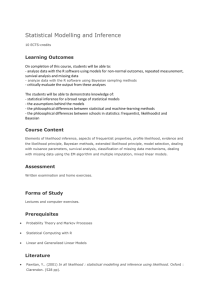

Example: Multiple capture-recapture data

Consider a closed population of N differently

marked individuals. As an example, take the population component of marked immature bowhead

whales off Alaska. These whales were subject to

photo surveys in the summer and autumn of both

1985 and 1986, leading to Xt unique animals being

sampled in survey t = 1,…, 4, and X unique captures

in the pooled survey. From these data, N is to be estimated. Assume that each animal has an unknown

probability of being captured in a given survey, and

that captures are independent across animals and

surveys. The observed data are presented in Table 1.

The multiple capture-recapture model of Darroch

(1958) leads to a confidence distribution based on

the conditional distribution of X given {Xt}

(Schweder, 2003).

Calculating the half-corrected p-value for H0: N ≤

N0 for a number of values of N0, a very good normal

—

approximation in 1/√N emerge:

C( N ) = P( X > 62) +

(

~ Φ 5.134 − 87.307 / N

)

(1)

TABLE 1. – Number of individual captures in each of four photo surveys of bowhead whales in summer and autumn of 1985 and 1986,

and total number of individual captures. Source: da Silva et al.

(2000).

C(ψ ) = Pψ (ψˆ > ψˆ obs ) = 1 − Fψ (ψˆ obs ) .

Sampling distributions are often estimated by

bootstrap distributions. To obtain distributional

results for the parameter, bootstrap distributions

1

P( X = 62)

2

Marked immature

Marked mature

X1

X2

X3

X4

X

15

44

32

20

9

49

11

7

62

113

FREQUENTIST ASSESSMENT 91

Definition 3

The reduced likelihood function is given by

(

dp

.

) dT

Lreduced (ψ ; X ) = f F −1 (C(ψ ; T ))

FIG. 1. – Confidence density of number of marked immature

bowhead whales off Alaska in 1986.

These probabilities are conditional given {Xt} =

(15, 32, 9, 11), and Φ is the cumulative normal distribution function. The resulting confidence density

is skewed, with a long tail to the right (Fig. 1).

REDUCED LIKELIHOODS

In integrative fish stock assessment, and in

other situations where different pieces of data are

joined in an integrated analysis, the challenge is

often to find appropriate weights for the various

data components. This problem is solved if wellfounded likelihood functions exist for the various

independent pieces of data. The likelihood function is the eminent tool for data integration

whether the various data are collected in the same

investigation, or whether some pieces of data are

old and some are new. Old data might be problematic when they only exist in the format of published summaries. The challenge is then to establish a likelihood function based on these summaries. This is possible when sufficient information is provided, or even better, when the author in

addition to the summaries and the inference provides what is called the reduced likelihood

(Schweder and Hjort, 2002).

Let us, as we did for confidence distributions,

restrict attention to cases in which exact reduced

likelihoods are available and can be constructed

from a pivot p. Let the pivot be a function of a onedimensional statistic T providing the cumulative

confidence distribution

C (ψ;T) = F(p(T,ψ)).

Let the pivot have density f =F´. Then

92 T. SCHWEDER

It is remarkable that Fisher (1930) not only presented his fiducial distribution, which here is called

the confidence distribution, but in passing he also

mentioned the basics for the reduced likelihood. He

did not use the term, but he clearly understood its

significance.

The reduced likelihood is often a marginal or a

conditional likelihood (Barndorff-Nielsen and Cox,

1994). I prefer the term “reduced likelihood” since

its main property is to be a likelihood for the interest parameter ψ, with the nuisance parameter χ

reduced away. In less clear-cut situations, when no

exact pivot exists, one can find approximate pivots

leading to approximate reduced likelihoods.

The confidence density is only appropriate as a

likelihood when the pivot is linear in ψ and additive

in the parameter and the data. The relationship

between the confidence density and the reduced

likelihood is generally

c(ψ ; X ) = Lreduced (ψ ; T )

dp dp

/

.

dψ dT

If the pivot is non-linear, the use of the confidence density as a likelihood introduces an unwanted term. Note that the Bayesian approach is to multiply prior densities with the likelihood of the new

data. When the confidence density is taken as the

prior density, the product of the prior and the likelihood agrees with Fisher’s likelihood analysis only

when the underlying pivot is linear and additive.

For large data, the pivot distribution is often normal. More precisely, the pivot can be transformed to

a scale to make it additive and normally distributed.

In this case the reduced log likelihood agrees with

the implied likelihood of Efron (1993). The normal

score of the cumulative confidence at ψ is

Φ–1(C(ψ)). The reduced (and implied) likelihood is

then

(

)

2

1

L(ψ ) = exp − Φ −1 (C(ψ ))

2

(2)

and is called the normal score reduced likelihood.

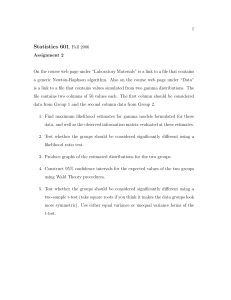

Example: Bowhead whales from photo-id

From the confidence distribution of the number

of marked mature whales, obtained as that for

FIG. 2. – Log likelihood and log confidence density.

marked immature whales in (1), the normal score

reduced likelihood is easily calculated. It is graphed

in Figure 2. A graph of the exact log likelihood is

also included. They agree well. The log confidence

density is in disagreement with the two. This is due

to non-linearity in the pivot. The Bayesian would

thus introduce a negative bias in his analysis by

using the confidence density as a prior to combine

with new or other data, and he would over-state the

precision of the photo-id data.

INTEGRATIVE STOCK ASSESSMENT:

BOWHEAD WHALES

As an alternative to the Bayesian assessment of

the Bering-Chukchi-Beaufort Seas stock of bowhead whales (International Whaling Commission,

1999), Schweder and Ianelli (2000) presented a frequentist assessment. In addition to data included in

the Bayesian analysis, they also included age-reading data and data from the photo-identification study

mentioned above. This is not the place to fully

review the data and the model. For details, see

Schweder and Ianelli (2000) and International

Whaling Commission (1999), and the papers

referred to in these two sources. The integrative

stock assessment by frequentist means is briefly

reviewed here in order to illustrate the main points

of the analysis. Punt and Butterworth (2000) compared Bayesian and frequentist approaches to

assessing the stock of bowhead whales.

The aim of the analysis is to estimate the current

replacement yield for the purpose of setting catch

limits for the aboriginal subsistence hunt in Alaska.

A point estimate of replacement yield is not satisfactory. For reasons of precaution, a confidence dis-

tribution is needed for this parameter (the Bayesian

analysis provided a posterior distribution), and the

emphasis is on the lower tail of the distribution. To

this end, the population dynamics is assumed to follow an age-specific Pella-Tomlinson model with

density dependence in fecundity. Available data,

including ‘soft data’ in the format of prior distributions, are used to estimate the parameters of the

model, and consequently the current replacement

yield.

The soft data are given as independent prior distributions on: Maximum sustainable yield rate;

Maximum sustainable yield level; Carrying capacity; Adult mortality; Age at sexual maturity; and

Maximum pregnancy rate, f. These prior distributions are partly based on general knowledge of

baleen whales, on data from similar species of

baleen whales, and to some degree on data from

bowhead whales. The best supported prior distribution is in my view that on f. Inter birth intervals, 1/f,

are found to follow a uniform distribution over the

interval 2.5 to 4 years. Consequently, the prior distribution for f has cumulative distribution function

C(f) = (8 f–2)/(3f), 0.25< f <0.4, which here is interpreted as a cumulative confidence distribution. The

other prior distributions are also interpreted as confidence distributions. In the present brief presentation, they are not given.

The observational data consist of: relative abundance estimates based on visual surveys 1978-1988;

an abundance estimate (visual and acoustic) for

1993; an abundance estimate based on photo-id for

1985/86; stock composition (proportion of calves

and adults); length and age readings of 45 whales

(aspartic acid racemisation in eye balls, George et

al., 1999) together with the length distribution in the

catch; catches from 1848 to present. These data are

assumed independent. Each data set provides a likelihood component. Considerable work has been

invested in obtaining these likelihood components.

The reader is referred to the primary documents for

details.

The frequentist analysis starts by constructing

the likelihood for all the data. Schweder and Ianelli

(2000) assumed all prior distribution to have arisen

from normally distributed pivots, making the

reduced log-likelihoods of the normal score type (2).

The log-likelihood resulting from the prior distribution of f is thus

2

1 −1 8 f − 2

l( f ) = − Φ

.

2

3 f

FREQUENTIST ASSESSMENT 93

FIG. 3. – Log likelihood from the prior distribution of maximum

pregnancy rate. The normalised log confidence density is drawn as

a dotted line.

This log-likelihood is displayed in Figure 3. The

confidence density is 2/3 f –2. The reduced likelihood

favours intermediate values of f, and is quite different from the confidence density.

The underlying structural model can in general

be parameterised in many different ways. A onecomponent Pella Tomlinson model, Pt+1 = Pt + α Pt

(1 – (Pt /K)z) in the 3 parameters α, z, and K, might

just as well have been parameterised in MSYR,

MSYL and K. In the first parameterisation, α and z

are input parameters (Raftery et al., 1995), while

MSYR and MSYL are outputs, while their roles are

interchanged in the second parameterisation. What

are input parameters of the structural model and

what are output parameters is a matter of choice.

This choice should not, however, influence the

results of the analysis. Likelihoods are invariant to

parameterisation, which is an important property.

In the chosen parameterisation, some likelihood

components are functions of input parameters, while

others are functions of output parameters, and some

might be functions of both. This applies to the prior

likelihood components, as well as to the observational components. The likelihood component based

on the important abundance estimate (visual and

acoustic) in 1993 is, for example, only a function of

the total stock size in 1993, which in the parameterisation chosen by Schweder and Ianelli (2000) is an

output parameter. Issues of parameterisation have

been discussed in connection with bowhead assessments (Schweder and Hjort, 1996; Punt and Butterworth, 1999).

When the various likelihood components have

been constructed, they are multiplied together to

form the total likelihood function. The model is then

fitted to the data by maximising the total likelihood.

Since some data are softer than others, the more

94 T. SCHWEDER

dubious priors are discarded provided the model can

be fitted to the surviving data. Discarding a prior is

equivalent to changing the corresponding likelihood

component to the non-informative flat likelihood.

Note that a constant likelihood is non-informative in

the strict sense, while the concept of non-informative prior distributions is problematic in the

Bayesian sense.

When the data on which the model is to be fitted

has been identified, one might want to look for simplifications in the structural part of the model. This

is ordinary model selection, and the guiding principle is to allow simplifications that make biological

sense but do not inflict substantial (statistically significant) loss of fit as measured by the likelihood

ratio.

Finally, confidence distributions for one-dimensional interest parameters are obtained, usually by a

simulation exercise. This should be done for one

parameter at the time. The aim is to identify an

approximately pivotal quantity and its distribution.

The pivot will usually be based on an estimator or a

test statistic for the parameter of interest, i.e. its

maximum likelihood estimator. This simulation

exercise might be seen as a parametric bootstrap,

and bias-correction methods to obtain confidence

distributions can be employed (Efron and Tibshirani, 1993; Schweder and Hjort, 2002)

The main findings concerning data, priors and

the parameter of primary interest: current replacement yields for the bowhead stock, are as follows

(Schweder and Ianelli, 2000).

1. The age data of George et al. (1999) are inconsistent with the survey data. The age data point

towards a much slower dynamics than indicated by

the survey data. The survey data and the photo-identification data are consistent within the Pella Tomlinson model.

2. The dubious priors on MSYL, MSYR and K can

safely be dropped.

3. Based on survey data, the photo-identification

data, and the remaining prior data, the lower end of

the confidence distribution for Replacement Yield in

number of bowhead whales have quantiles given in

Table 2.

TABLE 2. – Lower confidence quantiles of Replacement Yield in

Alaskan bowhead whales.

Confidence

Replacement Yield

1%

63

5%

86

10%

116

25%

140

50%

155

DISCUSSION

The methodology I have sketched is, I believe, in

the best Fisher-Neyman-Cox-Efron tradition (Efron

1998). Instead of reporting results in the format of

test results or 95% confidence intervals, I suggest

inference concerning parameters of primary interest

to be reported in terms of confidence distributions.

The spread and shape of a confidence distribution

convey a picture of the information and the statistical uncertainty in the inference, in much the same

way as a posterior distribution is interpreted in a

Bayesian analyses.

Since information updating is done via the likelihood function, it is important to have all data to be

integrated in the analysis represented as likelihood

components. The likelihood of prior data, reduced of

nuisance parameters, is in general different from the

prior confidence density of the parameter. Thus, in

order to allow results to be efficiently used in future

meta analyses or other integrative analyses, reduced

likelihoods for important parameters should be

obtained and presented along with their confidence

distributions.

Confidence distributions and reduced likelihoods

are usually obtained via simulation experiments.

Since simulations are likely to be used in future

analyses where the reduced likelihood of the study is

integrated with other likelihood components, one

should also report how the resulting reduced likelihood is to be simulated. To avoid multiple uses of

data, it is necessary to know the data basis for the

published reduced likelihood.

Compared to the Bayesian tradition, the subjectivity involved in priors not based on data is avoided. In the frequentist approach, the Bayesian’s problem with finding ‘non-informative’ priors does not

exist. A flat likelihood is non-informative in every

sense of the word. Also, the problem the Bayesian

has when there are more prior distributions than

there are free parameters (Schweder and Hjort,

1996; Pool and Raftery, 1998) does not affect the

frequentist analysis.

By multiplying independent likelihood components, also for prior data, data are integrated in an

optimal way. Integrating data solely through the

likelihood function could be called likelihood synthesis.

It happens that different data are inconsistent

with each other. This was the case for the age data

and the survey data in the bowhead example. But

this is then a scientific problem to be resolved, not a

problem of the method of analysis. Both Bayesian

and frequentist methods are useful in model selection and data confrontations. The use of informative

priors in the Bayesian approach might, however,

obscure the confrontation of one set of data with

another.

From the applied and pragmatic point of view,

the most important asset of the frequentist methodology is, perhaps, that it strives towards unbiased

inference. The very concept of bias is difficult for

the Bayesian, particularly for the subjectivist.

Bayes’ formula is certainly a mathematically correct

way to update a prior distribution in the light of new

data summarized in the likelihood function. The

subjectivist scientist can be wrong, but can he be

biased? Bias understood of systematic error in

repeated use of the method on data of the type specified in the statistical model is indeed a frequentist

notion. A frequentist point of view is thus needed to

declare a Bayesian posterior distribution free of

bias. As is demonstrated by the example below,

Bayesian posteriors can be badly biased, often due

to non-linearities and nuisance parameters. If, however, the posterior distribution can be declared free

of bias in the sense that its quantile spans intervals

with given coverage probability in repeated use, the

Bayesian posterior is a confidence distribution, and

is totally acceptable from the frequentist point of

view. Berger et al. (1999) report that the pragmatic

Bayesian approach of using flat priors on well-chosen transforms of the basic parameter often leads to

nearly unbiased posteriors.

Example

There are 10 independent normally distributed

observations Xi, each with a separate mean µ, but

with common variance 1. The interest parameter is

ψ = µ41+…+µ410. Taking µ1 = … = µ10 = 3, and thus ψ

= 810, the simulated data vector is

x = (3.2, 4.3, 4.2, 3.0, 4.1, 3.8, 1.2, 3.1, 2.7, 3.3).

The maximum likelihood estimate is ψ̂ = 1568.

With a flat prior on the vector µ, the joint

Bayesian posterior distribution is the joint normal,

µ ~ N10(x,I). The posterior distribution for ψ is then

the corresponding marginal distribution shown in

Figure 4.

By parametric bootstrapping, I found the following local approximate sampling distribution

4

ψˆ ~ .864 + .944 4 ψ + .647 Z

FREQUENTIST ASSESSMENT 95

FIG. 4. – Bayesian posterior distribution and approximate

confidence density for a non-linear parameter.

in the neighbourhood of µ̂= x. Here, Z is a standard

normal variate. The approximate cumulative confidence distribution is then,

.864 + .944 4 ψ − 4 ψˆ

(3)

C(ψ ) = Φ

.647

with confidence density shown in Figure 4. As

opposed to the Bayesian posterior, the confidence

distribution automatically corrects for the inherent

bias, at least approximately.

To illustrate the frequency behaviour of the

Bayesian posterior, as well as the confidence density, 10 replicates of µ̂ were simulated. For each replicate, the Bayesian posterior density, and the confidence density calculated from (3) are displayed in

Figure 5. This ends the example.

Often in fish stock assessments, the purpose is to

predict the status of the stock at some future point in

time. The parameters of the model are only of secondary interest. This problem is handled well in the

Bayesian approach, particularly when a frequentist

view is taken and potential bias is removed from the

FIG. 5. – In ten simulated replicates, the Bayesian posterior density

(solid lines) and confidence densities based on (3) (dashed lines) are

displayed. The vertical line indicates the true value of the parameter.

96 T. SCHWEDER

prediction distribution. Hall et al. (1999) show how

bootstrapping techniques can be used in a straightforward manner to obtain nearly unbiased prediction

distributions. Their method is well suited for the frequentist approach outlined here.

The attractions of the type of ‘frequentist

Bayesianism’ sketched above come at a price. A

Bayesian analysis ends up in a joint posterior for the

vector of basic parameters. From this joint distribution, one-dimensional posterior distributions are

obtained for any scalar parameter of interest simply

by calculating the appropriate marginal distribution.

This is particularly easy to do when the joint posterior distribution is approximated by a (large) sample.

In the frequentist approach, a joint confidence distribution cannot in general yield confidence distributions for scalar parameters of interest by computing

its marginal distributions. Here, unbiasedness is of

primary importance, and simulations with bias correction (Efron and Tibshirani, 1993) are usually

needed to obtain approximately valid confidence

distributions.

In most applications, the parameter is multi-dimensional. For each selection of an interest parameter,

there is then a vector of nuisance parameters. The

handling of nuisance parameters to obtain approximate priors with consequential approximate confidence distributions and reduced likelihoods can be difficult. This is an area of statistical research. Some

guidelines are given in Schweder and Hjort (2002).

REFERENCES

Barndorff-Nielsen, O.E. and D.R. Cox. – 1994. Inference and

Asymptotics. Chapman & Hall, London.

Berger, J.O., B. Liseo and R.L. Wolpert. – 1999. Integrated likelihood methods for eliminating nuisance parameters. Statist. Sci.,

14: 1-28.

da Silva, C.Q., J. Zeh, D. Madigan, J. Laake, D. Rugh, L. Baraff, W.

Koski and G. Miller. – 2000. Capture-recapture estimation of

bowhead whale population size using photo-identification data.

J. Cetacean Res. Manag., 2: 45-61.

Darroch, J.N. – 1958. The multiple-recapture census. I: Estimation

of a closed population. Biometrika, 45: 343-359.

Efron, B. – 1993. Bayes and likelihood calculations from confidence intervals. Biometrika, 80: 3-26.

Efron, B. – 1998. R.A. Fisher in the 21st century (with discussion).

Statist. Sci., 13: 95-122.

Efron, B. and R.J. Tibshirani. – 1993. An Introduction to the Bootstrap. Chapmann & Hall.

Fisher, R.A. – 1930. Inverse probability. Proc. Cambridge Phil.

Society, 26: 528-535.

Gavaris, S. – 1999. Dealing with bias in estimating uncertainty and

risk. In: V. Restrepo (ed.), Providing Scientific Advice to Implement the Precautionary Approach Under the MagnussonStevens Fishery Conservation and Management Act, pp. 17-23.

NOAA Technical Memorandum NMFS-F/SPO-40.

George, J.C., J. Bada, J. Zeh, L. Scott, S.E. Brown, T. O’Hara and

R. Suydam. – 1999. Age and growth estimates of bowhead

whales (Balaena mysticetus) via aspartic acid racemization.

Can. J. Zool. 77: 571-580.

Hall, P., L. Peng and N. Tajvidi. – 1999. On prediction intervals

based on predictive likelihood or bootstrap methods. Biometrika, 86: 871-880.

International Whaling Commission. – 1999. Report of the Scientific Committee, Annex G. Report of the Sub-Committee on Aboriginal Subsistence Whaling. J. Cetacean Res. Manag.,

1(SUPPL.): 179-94.

Patterson, K., R. Cook, C. Darby, S. Gavaris, L. Kell, P. Lewy, B.

Mesnil, A. Punt, V. Restrepo, D.W. Skagen and G. Stefansson.

– 2001. Estimating uncertainty in fish stock assessment and

forecasting. Fish and Fisheries, 2: 125-157.

Poole, D. and A.E. Raftery. – 1998. Inference for Deterministic

Simulation Models: The Bayesian Melding Approach. Technical Report no. 346, Department of Statistics, University of

Washington (unpublished).

Punt, A.E. and D.S. Butterworth. – 1999. On assessment of the

Bering-Chukchi-Beaufort Seas stock of bowhead whales (Balaena mysticetus) using a Bayesian approach. J. Cetacean Res.

Manag., 1: 53-71.

Punt, A.E. and D.S. Butterworth. – 2000. Why do Bayesian and

maximum likelihood assessments of the Bering-Chukchi-Beaufort Seas stock of bowhead whales differ? J. Cetacean Res.

Manag., 2: 125-133.

Raftery, A.E., G.H. Givens and J.E. Zeh. – 1995. Inference from a

deterministic population dynamics model for bowhead whales

(with discussion). J. Am. Statist. Ass., 90: 402-430.

Schweder, T. – 2003. Abundance estimation from photo-identification data: confidence distributions and reduced likelihood for

bowhead whales off Alaska. Biometrics (to appear).

Schweder, T. and N.L. Hjort. – 1996. Bayesian synthesis or likelihood synthesis - what does the Borel paradox say? Rep. int.

Whal. Commn, 46: 475-479.

Schweder, T and N.L. Hjort,. – 2002. Confidence and likelihood.

Scandinavian J. Statist., 29: 309-332

Schweder, T. and J.N. Ianelli. – 2000. Assessing the BeringChukchi-Beaufort Seas stock of bowhead whales from survey

data, age-readings and photo-identifications using frequentist

methods. Paper IWC/SC/52/AS13 presented to The International Whaling Commission Scientific Committee, June 2000,

179-194.

Wade, P.R. – 1999. A comparison of statistical methods for fitting

population models to data. In: G.W. Garner, S.C. Amstrup, J.L.

Laake, B.F.J. Manly, L.L. McDonald and D.G. Robertson

(eds.), Marine Mammal Survey and Assessment Methods, pp

249-270. AA Balkema, Rotterdam.

FREQUENTIST ASSESSMENT 97