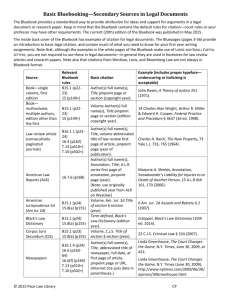

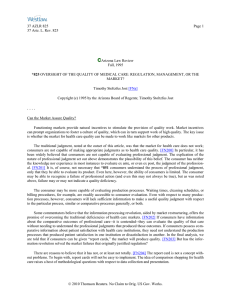

Boston College Environmental Affairs Law Review

advertisement