Boston CollegeEnvironmental Affairs Law Review Volume 36

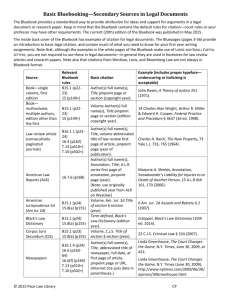

advertisement