Back to Basics Part II Creating Enforceable Agreements with Independent Contractors, Interns

advertisement

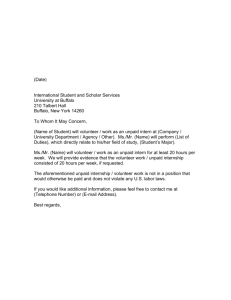

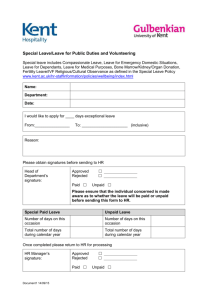

Back to Basics Part II Creating Enforceable Agreements with Independent Contractors, Interns and Short Term Employees Caitlin Russell Geoff Breen Laurie Jessome Wednesday, October 1, 2014 Back to Basics Part II: Fixed Term Contracts Caitlin Russell Wednesday, October 1, 2014 Fixed Term Contracts ● What is a fixed term contract? ● Fixed Term vs. Indefinite Term ● What are the benefits of a fixed term contract? ● Certainty on termination ● When is a fixed term contract appropriate? ● Logical basis to limit the term of the employment ● Examples… slide | 3 Fixed Term Contracts: Termination ● Employments ends at the end of the Term ● ESA Regulation 288/01 – 12 month limit ● Employment ends before the end of the Term ● ESA Regulation 288/01 ● Common Law – Balance of Contract ● Employment ends after the end of the Term ● ESA Regulation 288/01 ● Common Law – Turns into indefinite term slide | 4 Fixed Term Contracts: Common Mistakes ● Multiple or Automatic Renewals ● Ceccol v. Ontario Gymnastic Federation 2001 ONCA ● Flynn v. Shorcan Brokers Ltd. 2006 ONCA ● Allowing Employees to Work Past Term ● Triggers ESA in 90 days, common law in less than 90 days ● Excessively Long Terms ● Employers and Employees Act — 9 year maximum term ● Failure to Draft Clear Duration Term slide | 5 Fixed Term Contracts: Common Mistakes ● Failure to Include Early Termination Clause ● Reasonable notice vs. Balance of term ● Loyst v. Chatten’s Better Hearing Service 2013 ONCA ● Failure to Include a Mitigation Clause ● Mitigation may not apply to fixed term contracts slide | 6 Fixed Term Contracts: Cautionary Tale ● Termination vs. Non-Renewal — Thompson v. Cardel Homes Limited Partnership 2014 ABCA ● 1 month prior to expiry, Thompson was notified that his contract would not be renewed and he was told not to report to work for his last month ● Thompson argued that his employment had been terminated prior to the expiry of his contract entitling him to the 12 months salary under the termination clause in the contract ● The court agreed with Thompson and awarded 12 months slide | 7 Fixed Term Contracts: Tips ● Consider if a fixed term is appropriate ● Clearly communicate that employment will be for a fixed term ● Provide unequivocal contractual language on duration ● Include an early termination clause ● Give the employee time to review and seek legal advice ● Carefully monitor expiry dates ● Renegotiate and renew early ● Beware of long terms & multiple and automatic renewals slide | 8 Back to Basics Part II: Unpaid Internships Geoff Breen Wednesday, October 1, 2014 Unpaid Internships — A Win-Win? ● Intern gains valuable on-the-job experience that is otherwise difficult to obtain ● Business gets cheap labour ● A good way to groom potential employees and prepare them for the workforce while offsetting expensive training costs ● Everyone is happy slide | 10 Unpaid Internships — The Problem ● “Unpaid intern” is not a legal term — in fact, the concept is relatively foreign to modern employment laws ● As a result, in most cases, an unpaid internship will contravene employment standards laws ● The ESA broadly defines “employee” with very limited exemptions. ● Unless an exemption applies, an “intern” is actually considered an employee ● Employees are entitled to basic rights – minimum wage, vacation, notice of termination, etc. slide | 11 Unpaid Internships — Current Hot Topic ● April, 2014 — MOL announces “Inspection Blitzes and Initiatives” targeting internships in various sectors ● March 4, 2014 — First Reading of private member bill in the Ontario Legislature: Employment Standards Amendment Act (Greater Protection for Interns and Vulnerable Works), 2014 ● March 27, 2014 — Ministry of Labour enforcement steps lead to the shut down of unpaid internship programs at magazines “Toronto Life” and “The Walrus”; “Canadian Geographic” and “Rogers Publishing” follow suit ● August 8, 2014 — Bell cancels its unpaid internship program slide | 12 So When is an Unpaid Internship Permitted in Ontario? 1. Specific exemptions from the entire ESA: ● A secondary school student performing an internship authorized by his/her school board ● A student carrying out a work placement approved by a college or university ● Several other exemptions from the ESA that are not likely to be applicable to interns include inmates in jail and those holding political office slide | 13 So When is an Unpaid Internship Permitted in Ontario? 2. Students training for specific professions are exempt from much of the ESA such as minimum wage, overtime, and rest periods: ● This includes law, architecture, surveying, professional engineering, public accounting, medicine and optometry, among others ● These students are not exempt from certain rights, including the right to take protected leaves of absence slide | 14 So When is an Unpaid Internship Permitted in Ontario? 3. Those who are receiving training from an employer are normally considered to be “employees” and therefore the ESA will apply, unless ALL of the following criteria are satisfied: 1. The training is similar to that which is given in a vocational school 2. The training is for the benefit of the individual 3. The employer providing the training derives little, if any, benefit from the activity of the individual while he or she is being trained slide | 15 So When is an Unpaid Internship Permitted in Ontario? 3. Those who are receiving training from an employer are normally considered to be “employees” and therefore the ESA will apply, unless ALL of the following criteria are satisfied: 4. The individual does not displace employees of the employer providing the training 5. The individual is not accorded a right to become an employee of the employer providing the training 6. The individual is advised that he or she will receive no remuneration for the time that he or she spends in training slide | 16 Fitness Plus v. McPherson, 2010 OLRB ● An application for a whopping $109.20 in unpaid wages! ● Fitness Plus hired unpaid interns, the applicant included, to receive training allegedly similar to that which a student enrolled in a college level fitness program would receive ● Fitness Plus argued that it provided training to the exclusive benefit of the interns ● Intern duties included turning on tanning beds, reading chlorine levels for the hot tub, turning on televisions, selling products and booking fitness assessments slide | 17 Fitness Plus v. McPherson, 2010 OLRB — The Test Applied ● The individual is advised that he or she will receive no remuneration for the time that he or she spends in training ● NEUTRAL This was mutually understood ● The individual does not displace employees of the person providing the training ● NEUTRAL Technically, the interns did not replace active employees ● The training is to the benefit of the individual and the person providing the training receives little, if any benefit ● FAIL Instead, Fitness Plus received free labour in exchange for essentially no benefit to the interns slide | 18 Fitness Plus v. McPherson, 2010 OLRB — The Test Applied ● The individual is not accorded a right to become an employee of the person providing the training. ● FAIL While a job was not guaranteed, it was certainly understood that employment was what the interns were being assessed for ● The training is similar to that which is given in a vocational school ● “LUDICROUS” slide | 19 Eric Glatt, et al v. Fox Searchlight Pictures Inc. — 2013, New York ● Involved class actions by unpaid interns who had worked on movies such as “Black Swan” and “500 Days of Summer” ● The New York Court applied effectively the same 6 step test set out in the ESA ● Other than the mutual understanding that the interns would not be paid, none of the other 5 criteria were satisfied ● Plaintiffs in one action were granted judgment. Another action was certified to proceed slide | 20 Breakdown — The Perils of Unpaid Interns ● ESA Enforcement ● Order to pay unpaid back wages ● Provincial offence prosecution — up to $100,000 for first offence ● Court Actions ● Class action risk = many employees and potentially enormous liability ● Subject to the applicable limitation period, an intern can sue an employer for unpaid wages AFTER the internship ends ● Bad Press ● This issue is getting attention and has been the subject of social media shaming. slide | 21 Federally Regulated Employers ● Essentially uncharted territory ● The Canada Labour Code is silent on interns and similar employment standards exemptions — anyone performing “work” is entitled to minimum wage ● Some of Canada’s largest employers are federal — as noted, some companies, including Bell, are pre-emptively getting rid of unpaid internship programs slide | 22 Where is this Going? ● This an area that has been relatively untouched until recently ● There is now increased scrutiny by the public, the media and the MOL; cases and fines are likely to increase ● Even stricter legislation may be on the way, further limiting unpaid internships ● In sum: there is likely to be little tolerance for unpaid internships that do not fulfill a bona fide educational training purpose slide | 23 The Take-Aways ● Be wary of taking on unpaid interns — unless the unpaid internship is specifically accredited by a school board, college, university or prescribed profession, you are taking a risk ● Don’t fall into the trap — the fact that an individual offers or even asks to work for free does not help; employees cannot contract out of the ESA and can change their position after having benefited from the internship slide | 24 The Take-Aways ● If you do have an internship program, ensure that it is truly about a training experience for the intern — unpaid internships cannot be used as an alternative to entry level employment positions and are not intended to be directly beneficial to an employer slide | 25 A Note on Temporary Help Agency Workers ● In 2009, new provincial regulations were introduced to protect temporary help agency employees ● When dealing with temps, take note that: ● They are not your employees but should be made aware of and subject to your policies and procedures ● A help agency cannot stop you from giving references to or hiring a temporary help employee ● A help agency can charge you a fee for hiring a temporary employee working for you, but only if this is within the first six months of the assignment — for certainty, these fees should be agreed upon in advance ● slide | 26 Back to Basics Part II: Drafting Enforceable Independent Contractor Agreements Laurie Jessome Wednesday, October 1, 2014 Overview ● Purpose of today’s session: ● To discuss the risks for companies that arise from independent contractor relationships that are improperly managed or created ● To provide an overview of the test applied by Courts to determine whether or not you have an employee or an independent contractor ● To provide some “dos and don’ts” for companies who want to enter into independent contractor relationships with workers slide | 28 Risks ● Tax implications ● Statutory remittances – Canada Pension Plan, Employment Insurance ● Compliance with the minimum requirements of the Employment Standards Act, 2000 ● Litigation risk on termination — wrongful dismissal claims, claims for “reasonable notice” for dependent contractors slide | 29 The Test ● Various iterations of the test over the years: the “four part test”, the “control test” ● Recently clarified by the Federal Court of Appeal in Connor Homes v. Canada (National Revenue), 2013 FCA 85 ● Now a two part analysis: subjective and objective slide | 30 The Test: Step One ● Step one: Subjective Analysis ● Is there a mutual understanding or common intention to create an independent contractor relationship? ● Look to the written agreement between the parties and their behaviour ● Did the contractor issue invoices? ● Did the contractor register for GST? ● Were the income tax filings of the contractor consistent with an independent contractor? slide | 31 The Test: Step Two ● Step Two: Objective Analysis ● Do the pertinent facts support that the worker is providing the services as a business on his or her own account? ● Factors to examine: ● Degree of control exercised by the contractor over his or her own activities ● Who supplies the equipment and tools? ● Can the contractor hire his or her own employees to perform the work? slide | 32 The Test ● Essential issue: Does the contractor operate his or her own business? ● “The ultimate question to determine if a given individual is working as an employee or as an independent contractor is deceivingly simple. It is whether or not the individual is performing the services as his own business on his own account.” (1671122 Ontario Ltd. v. Sagaz Industries Canada Inc. 2001 SCC 59 (CanLii)) slide | 33 How to Satisfy the Connor Homes Test ● Two concepts: form and substance ● Form ● The written agreement between the parties ● How you address the contractor and represent him or her to outside parties ● Written communications between the contractor and you ● Substance: ● Structure the relationship such that the independent contractor is truly independent and readily distinguished from your employees slide | 34 Dos and Don’ts for Independent Contractors ● DO have an agreement. ● Intention of the parties much harder to assess when nothing has been reduced to writing ● Gives you the opportunity to negotiate favourable clauses such as a tax indemnity and explicit acknowledgements regarding the expectations of the parties slide | 35 Dos and Don’ts for Independent Contractors ● DON’T call it an employment agreement ● Use consistent language throughout ● Don’t use an employment agreement as a template ● DO require the contractor to provide services through a personal corporation and issue invoices ● The Canada Revenue Agency is much less likely to review your relationship if it is corporation to corporation slide | 36 Dos and Don’ts for Independent Contractors ● DON’T reimburse the contractor for expenses ● The contractor should be required to absorb own cost of doing business ● Shows they are taking a risk and running an independent operation ● DON’T give them benefits coverage ● Classic feature of an employment relationship slide | 37 Dos and Don’ts for Independent Contractors ● DO structure the compensation so that the worker has the opportunity for profit and risk ● Fixed monthly or weekly compensation not advisable ● Tie compensation to the success of certain projects or to sales figures ● DON’T give them an office and a business card ● If you treat them like one of your employees and represent to the outside world that they are an employee, a Court will be more likely to find that they are, in fact, an employee slide | 38 Dos and Don’ts for Independent Contractors ● DO have a termination clause in the agreement ● Independent vs. dependent contractors ● Consider making it in excess of the minimum requirements of the Employment Standards Act, 2000 ● DON’T make it exclusive ● Contractor should ideally have the ability to hire workers to perform the services ● Contractor should be able to take on other assignments with other companies slide | 39 Dos and Don’ts for Independent Contractors ● DO require independent legal advice for the contractor ● Will assist with meeting Step One of the test ● Assist with enforcing important clauses in the agreement ● DO think about whether you want them as an independent contractor in the first place ● Duty of good faith & fidelity ● Fiduciary obligations ● Ability to enforce non-solicitation and non-competition clauses ● Loyalty and exclusivity slide | 40 Cassels Brock & Blackwell LLP Suite 2100, Scotia Plaza 40 King Street West Toronto, ON Canada M5H 3C2 Suite 2200, HSBC Building 885 West Georgia Street Vancouver, BC Canada V6C 3E8 Tel: 416 869 5300 Fax: 416 350 8877 Tel: 604 691 6100 Fax: 604 691 6120 © 2011–2014 CASSELS BROCK & BLACKWELL LLP. ALL RIGHTS RESERVED. This document and the information in it is for illustration only and does not constitute legal advice. The information is subject to changes in the law and the interpretation thereof. This document is not a substitute for legal or other professional advice. Users should consult legal counsel for advice regarding the matters discussed herein.