Benefits News May 2013

advertisement

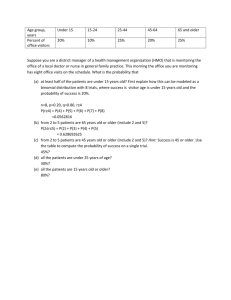

$39 Benefits News May 2013 For Eligible Non-represented Employees; Faculty; and Non-faculty Athletic Coaches covered under the PPOBlue or HMO Plans Pennsylvania State System of Higher Education (PASSHE) Group Health Program Health Care Plan Open Enrollment is May 6 to May 17, 2013 Key Points For the 2013/2014 Plan Year THE FOLLOWING BENEFIT DESIGN CHANGES WILL BE MADE: o FOR ALL HEALTH PLANS - OFFICE VISIT CO-PAYMENTS FOR SPECIALISTS WILL INCREASE FROM $15 TO $25 (INCLUDING URGENT CARE FACILITIES). THE OFFICE VISIT CO-PAYMENT FOR PRIMARY CARE PROVIDERS REMAINS AT $15 o THE CO-PAYMENT FOR EMERGENCY ROOM VISITS FOR THE PPO BLUE AND MOST HMO PLANS WILL INCREASE FROM $50 TO $100 (WAIVED IF ADMITTED) o THE PRESCRIPTION DRUG CO-PAYMENTS WILL INCREASE (SEE PAGE 4 FOR MORE INFORMATION) o ADULT CHILDREN UP TO THE AGE OF 26 CAN BE COVERED/ENROLLED ON ANY PASSHE HEALTH PLAN REGARDLESS OF WHETHER THEY HAVE HEALTH PLAN COVERAGE AVAILABLE THROUGH THEIR OWN EMPLOYER o WOMEN’S PREVENTIVE HEALTH CARE SERVICES WILL BE EXPANDED o ALL PASSHE HEALTH PLANS WILL PROVIDE ACCESS TO A WIDE RANGE OF PREVENTIVE HEALTH SERVICES AT NO MEMBER COST, INCLUDING PREVENTIVE PHYSICAL EXAMS, ANNUAL GYNECOLOGICAL EXAMS AND WELL BABY/CHILD EXAMS New Highmark ELITE Dedicated Customer Service Unit 1-(888) 745-3212 (Monday thru Friday, 8:00 am to 5:00 pm) All Highmark members in our groups will be receiving new identification cards for July 1, 2013 Plan Costs for the July 1, 2013 Plan Year – SEE PAGES 7 THROUGH 10 FOR BI-WEEKLY CONTRIBUTIONS EFFECTIVE JULY 1, 2013 DON’T LOSE YOUR DENTAL AND VISION BENEFITS!! Important information for all non-faculty employees (including coaches, nurses, security/police and nonrepresented employees) - In order to retain your dental and vision benefits, YOU MUST ELECT COVERAGE through Employee Self-Service (ESS) (https://portal.passhe.edu/irj/portal) during open enrollment which ends May 17, 2013. You will be receiving additional e-mails which will include more information about this supplemental plan and the enrollment actions which are required of you. Benefit News Page Two Changing Plans or Adding/Dropping Dependents? ALL CHANGES MUST BE MADE ONLINE USING EMPLOYEE SELF-SERVICE GO TO PASSHE’S EMPLOYEE SELF-SERVICE (ESS): https://portal.passhe.edu/irj/portal INSTRUCTIONS ON EMPLOYEE SELF-SERVICE (ESS) PROCEDURES ARE FOUND BELOW PLEASE REVIEW AND RETAIN E-MAIL CONFIRMATION AS VERIFICATION OF CHANGES SUBMIT ANY REQUIRED ELIGIBILITY DOCUMENTATION NO LATER THAN MAY 17, 2013 REMEMBER PLAN CHANGES AND DEPENDENT CHANGES CAN ONLY OCCUR DURING OPEN ENROLLMENT UNLESS THERE IS A QUALIFYING LIFE EVENT. SEE PAGE 6 FOR DETAILS For Information on the Various Plans available to you – SEE THE PLAN COMPARISON ON PAGE 11 OR THE PLAN SERVICE AREAS/CONTACT INFORMATION INCLUDING WEBSITES ON PAGE 12 Attention PASSHE Highmark PPOBlue Members - The participation deadline of the Healthy U wellness program is May 31, 2013. Don’t wait until the last minute to complete your participation requirements! Both you and your covered spouse/same-sex domestic partner(if applicable) need to accumulate a minimum of 70 Healthy U points each by the deadline of May 31, 2013. There are a wide variety of activities and programs that individuals can choose from to earn Healthy U points. Everyone is REQUIRED to complete the Wellness Profile (worth 30 points). If you attain 70 points without completing the Wellness Profile, you still must complete the Wellness Profile to qualify for the premium incentive. You can access Healthy U at www.highmarkblueshield.com. Log in with your Highmark user name and password, and select the “Rewards Program” link to get started. Need More Information or Assistance with Healthy U? Call Highmark’s Member Services 1-888-745-3212 for general assistance Call Highmark’s Technical Support 1-877-298-3918 for website or login issues Contact your university Human Resources office for Healthy U information and resources INSTRUCTIONS FOR OPEN ENROLLMENT (ENROLL OR MAKE CHANGES) THROUGH EMPLOYEE SELF-SERVICE (ESS) Connect to the PASSHE portal through the internet at the following link: https://portal.passhe.edu/irj/portal Sign in at the Self Service Portal screen. On the tabs across the top of your page, select Employee Self-Service. Select “Help Documents” for instructions on how to utilize ESS for Open Enrollment (SSHE Health Enrollment). Review and retain the e-mail confirmation to verify open enrollment changes. If you do not receive an email confirmation of open enrollment changes, contact your human resources office no later than May 17, 2013. Benefit News Page Three GRANDFATHERED PLAN STATUS The Healthcare Reform law places various requirements on group health plans. Certain plans known as “grandfathered health plans” must comply with some of these requirements, but not all of them. All of the PASSHE benefit plans are now categorized as Non-grandfathered health plans: What impact does a health plan’s non-grandfathered status have on you as a participant? : Your adult children up to the age of 26 are eligible for coverage as your dependent regardless of whether they have health plan coverage available through their own employer. The Dependent Attestation process for adult children is no longer necessary. You will have access to a wide range of preventive health services at no cost to you. This means no co-payments for services such as preventive physical exams, annual gynecological exams, or well-baby/child exams. Female participants will have expanded benefits to include the Women’s Preventive Health Services mandates. Some of the more significant changes included in this benefit expansion are the provision of contraception and lactation support and supplies at no member cost. ELIGIBILITY RULES FOR SPOUSE OR SAME-SEX DOMESTIC PARTNER Date of Employment Rules for spouse/domestic partner eligibility Hired Prior to July 1, 2001 No restriction on spouse and their eligibility for PASSHE Health coverage Hired July 1, 2001 to June 30, 2013 Spouses eligible for fully-paid employer coverage through his/her employer must be enrolled in their employer’s coverage and PASSHE health coverage will provide benefits as secondary payer only Effective July 1, 2007 - Same-sex domestic partners of FACULTY AND COACHES are eligible for PASSHE benefits. If the spouse/same-sex domestic partner is eligible for fully-paid employer coverage through his/her employer, they must be enrolled in their employer’s coverage and PASSHE health coverage will provide benefits as secondary payer only Effective November 1, 2007 - Same-sex domestic partners of NON-REPRESENTED EMPLOYEES are eligible for PASSHE benefits. If the spouse/same-sex domestic partner is eligible for fully-paid employer coverage through his/her employer, they must be enrolled in their employer’s coverage and PASSHE health coverage will provide benefits as secondary payer only Hired on or after July 1, 2013 If an employee enrolls a spouse or same-sex domestic partner in the PASSHE health plan and that person is eligible for coverage under their own employer’s plan, the spouse/same-sex domestic partner shall be required to enroll in their own employer’s plan for their primary coverage as a condition for eligibility for secondary coverage under the State System plan regardless of the cost to spouse/same-sex domestic partner of that coverage. Benefit News Page Four PLAN CHANGES EFFECTIVE JULY 1, 2013 For employees enrolled in the PPO or HMO Plans: The office visit co-payment for specialists will increase from $15 to $25 (includes visits to urgent care facilities) Office visit co-payments for primary care providers will remain at $15. Office visits to gynecological providers for annual gynecological examinations will have no co-payment assessed. However, if the office visit is for a medical issue, the specialist co-payment of $25 will be charged. The co-payment for emergency room visits for the PPO Blue and most HMO plans will increase from $50 to $100 (waived if the patient is admitted to the hospital). The following changes have been made to the prescription drug co-payments: Retail purchase (30 day supply) Generic drug co-payment increased from $0 to $5 Brand name formulary drug co-payment increased from $15 to $18 Brand name non-formulary drug co-payment increased from $30 to $36 Mail order purchase (90 day supply) Generic drug co-payment increased from $0 to $10 Brand name formulary drug co-payment increased from $30 to $36 Brand name non-formulary drug co-payment increased from $60 to $72 Same-Sex Domestic Partner Eligibility for Annuitants Upon retirement, faculty, coaches and non-represented employees will be permitted to enroll a same-sex domestic partner in the Annuitant Health Care Program (AHCP) with approved PASSHE Annuitant Same-Sex Domestic Partnership Certification. Please note that there may be potential tax ramifications as the result of adding a domestic partner to the AHCP coverage, and it is recommended that a qualified tax professional be consulted for guidance regarding the tax issues involved. PASSHE Supplemental Benefits The supplemental benefit plan (providing dental and vision coverage to coaches, SPFPA, nurses and nonrepresented employees) will have a nominal annual participant contribution of $5.00 per year assessed ($0.19 per pay) to remain in compliance with health care reform. MANDATORY INSURER REPORTING LAW Social Security numbers are required for employees and dependents – effective immediately, PASSHE will not enroll a dependent without a Social Security Number, except for a newborn. The new Mandatory Insurer Reporting Law (Section 111 of Public Law 110-173) requires all insurers to report the Social Security and Medicare health insurance claims numbers of its members who meet certain reporting criteria to the Centers for Medicare and Medicaid Services (CMS). If a dependent is not eligible for a Social Security Number, the employee will be required to provide a letter of explanation from the Social Security Administration. Employees in this situation or with any questions should contact their university human resources office. Benefit News Page Five ADDING DEPENDENTS TO YOUR HEALTH CARE COVERAGE To enroll your dependents, you will need to provide any required DOCUMENTATION (e.g., birth certificate) to verify their eligibility and provide their SOCIAL SECURITY NUMBER. Who Is Eligible for Coverage under the PASSHE Health Plans? The following categories of individuals may be eligible for coverage under the PASSHE health plan for active employees: Legal Spouse Same-sex domestic partner (applicable to Faculty, non-faculty Coaches and non-represented employees) Children under 26 years of age who meet the following requirements: A natural child of your own A legally adopted child (including a child living with the employee during the probation period) A stepchild A child for whom the employee is the legal guardian A foster child, if the employee was the child’s legal guardian or foster parent prior to the child’s 18th birthday (foster children under age 18 are not eligible dependents) A child being supported by the employee under a court order as a result of a divorce decree A newborn child of an employee is automatically covered from the moment of birth to 31 days after the date of birth. To be covered as a Dependent beyond the 31-day period, the employee has 60 days to add the child as a Dependent through the Human Resources office. A child of a Domestic Partner (applicable to Faculty, non-faculty Coaches and non-represented employees) Unmarried dependent child 26 years of age or older, who is incapable of self-support because of a physical or mental disability that commenced before the age of 26 What Do I Need To Do to Add a Dependent During Open Enrollment? You will need to provide documentation that verifies your dependent’s eligibility for PASSHE coverage, e.g., birth certificate, marriage certificate, court approved adoption order, etc. Please refer to Documentation Requirements which can be found at http://www.passhe.edu/inside/hr/syshr/Additional_Benefits_Docs/Documentation%20Requirements.pdf More About Adult Children to Age 26 Health care reform legislation requires group health plans covering active employees and their dependents to make coverage available to adult children until they turn age 26. During open enrollment, you may enroll your adult children up to the age of 26. Here are some specifics: Student status is not required Your adult children can be married. If married, the coverage does not extend to your adult children’s spouse, or to your adult children’s own children Your adult children do not have to live with you, be financially dependent on you, or be claimed as a dependent on your tax return (continued) Benefit News Page Six PLAN AHEAD! The eligibility documentation must be provided to your Human Resources office by May 17, 2013, or your dependent(s) will not be enrolled in the health plan. Take the time now to locate your documentation, or refer to the Documentation Requirements for resources to contact in replacing lost documents. This document can be found at http://www.passhe.edu/inside/hr/syshr/Additional_Benefits_Docs/Documentation%20Requirements.pdf When Can I Make Changes To My Covered Dependents? Outside of open enrollment, if you experience a qualifying life event you have the opportunity to add or remove dependents from your coverage, or make other changes to your benefit elections. You will need to notify your Human Resources office within 60 days of the event occurring. Below are some of the more common examples. Removing Dependents You are required to contact your Human Resources office and remove a dependent that is no longer eligible for PASSHE coverage under the following situations: Covered child attains age 26 (unless disabled) Divorce (removal of spouse and stepchildren) Termination of a domestic partnership (removal of partner and children of partner) Death of a dependent Adding Eligible Dependents You may add a dependent for PASSHE health coverage due to a qualifying life event. You must notify your Human Resources office and submit the enrollment change within 60 days of the qualifying life event. You gain a dependent through birth or adoption You get married or enter into a qualifying domestic partnership Your dependent loses coverage under another employer’s plan Your dependent loses eligibility for coverage in a Medicare plan, a Medicaid plan or a state children’s health insurance program Other Plan Enrollment Changes You must notify your Human Resources office and submit the enrollment change within 60 days of the qualifying life event. You lose coverage under your spouse’s plan You move, either to an area outside of your current plan’s service area, or to an area where a different plan option is available You are enrolled in a plan option that is no longer available, or is substantially reduced Is There Anything Else I Should Know? Please note that the PASSHE Highmark PPO Plan does not provide maternity benefits for dependent daughters. The extension of coverage of adult children to age 26 only affects the PASSHE group health plan for active employees. For individuals enrolled in a PASSHE Annuitant Health Plan, these plans will continue to follow their current eligibility criteria for dependent children, i.e., coverage to age 19, or coverage to age 25 if a fulltime student. Benefit News Page Seven Employee Contributions (Effective July 1, 2013) Non-Represented Employees and Faculty – Deductions Based on 26 pays FULL-TIME EMPLOYEES Highmark PPO Blue HEALTHY U PARTICIPANT (15% of cost) Single Contract Two-Party Contract Family Contract NON-PARTICIPANT HEALTHY U (25% of cost) Single Contract Two-Party Contract Family Contract $39.51 $87.60 $107.36 Geisinger Keystone Keystone Health Plan Health Plan Health Plan UPMC HMO HMO Central HMO East HMO PARTICIPATION IN WELLNESS PROGRAM NOT APPLICABLE $43.07 $94.89 $116.43 $50.89 $103.51 $150.44 $55.02 $113.04 $156.29 Keystone Health Plan Central HMO Keystone Health Plan East HMO $42.24 $93.57 $114.69 $65.86 $146.01 $178.93 PART-TIME EMPLOYEES Highmark PPO Blue HEALTHY U PARTICIPANT (57.5% of cost) Single Contract Two-Party Contract Family Contract NON-PARTICIPANT HEALTHY U (62.5% of cost) Single Contract Two-Party Contract Family Contract $151.47 $335.81 $411.55 Geisinger Health Plan HMO UPMC HMO HMO COVERAGE NOT OFFERED TO PART-TIME EMPLOYEES $164.64 $365.01 $447.33 HIPAA PRIVACY NOTICE As required by the Health Insurance Portability and Accountability Act (HIPAA), the Pennsylvania State System of Higher Education is required to notify employees of the availability of the HIPAA Privacy Notice. A copy of the HIPAA Privacy Notice can be obtained from your Human Resources Office. Benefit News Page Eight Non-Faculty Athletic Coaches Contributions (Effective July 1, 2013) Deductions Based on 26 pays FULL-TIME EMPLOYEES Highmark PPO Blue HEALTHY U PARTICIPANT Single Contract Two-Party Contract Family Contract NON-PARTICIPANT HEALTHY U Single Contract Two-Party Contract Family Contract 2.0% of salary Geisinger Health Plan HMO Keystone Health Plan Central HMO Keystone Health Plan East HMO UPMC HMO 2.0% of salary PARTICIPATION IN WELLNESS PROGRAM NOT APPLICABLE 4.5% of salary PART-TIME EMPLOYEES Highmark PPO Blue HEALTHY U PARTICIPANT Single Contract Two-Party Contract Family Contract 2.0% of salary plus $131.71 2.0% of salary plus $292.01 2.0% of salary plus $357.87 NON-PARTICIPANT HEALTHY U Single Contract Two-Party Contract Family Contract 4.5% of salary plus $131.71 4.5% of salary plus $292.01 4.5% of salary plus $357.87 HMO COVERAGE NOT OFFERED TO PARTTIME EMPLOYEES Contribution rates for Non-Faculty Athletic Coaches will increase with the first pay date in 2014 (January 10, 2014) Please see page 9 for 2014 contribution rates Benefit News Page Nine Non-Faculty Athletic Coaches Contributions (first pay date in 2014 – January 10, 2014) Deductions Based on 26 pays FULL-TIME EMPLOYEES Highmark PPO Blue HEALTHY U PARTICIPANT Single Contract Two-Party Contract Family Contract NON-PARTICIPANT HEALTHY U Single Contract Two-Party Contract 2.5% of salary Geisinger Health Plan HMO Keystone Health Plan Central HMO Keystone Health Plan East HMO UPMC HMO 2.5% of salary PARTICIPATION IN WELLNESS PROGRAM NOT APPLICABLE 5.0% of salary Family Contract PART-TIME EMPLOYEES Highmark PPO Blue HEALTHY U PARTICIPANT Single Contract Two-Party Contract Family Contract NON-PARTICIPANT HEALTHY U Single Contract Two-Party Contract Family Contract 2.5% of salary plus $131.71 2.5% of salary plus $292.01 2.5% of salary plus $357.87 5.0% of salary plus $131.71 5.0% of salary plus $292.01 5.0% of salary plus $357.87 HMO COVERAGE NOT OFFERED TO PARTTIME EMPLOYEES Benefit News Page Ten Employee Contributions (Effective July 1, 2013) Faculty (20 pays) FULL-TIME EMPLOYEES Highmark PPO Blue HEALTHY U PARTICIPANT (15% of cost) Single Contract Two-Party Contract Family Contract NON-PARTICIPANT HEALTHY U (25% of cost) Single Contract Two-Party Contract Family Contract $51.36 $113.88 $139.57 Geisinger Keystone Keystone Health Plan Health Plan Health Plan UPMC HMO HMO Central HMO East HMO PARTICIPATION IN WELLNESS PROGRAM NOT APPLICABLE $55.99 $123.36 $151.36 $66.16 $134.56 $195.57 Two-Party Contract Family Contract $54.91 $121.64 $149.10 $85.62 $189.81 $232.61 PART-TIME EMPLOYEES Geisinger Keystone Highmark PPO Health Plan Health Plan Blue HMO Central HMO HEALTHY U PARTICIPANT (57.5% of cost) Single Contract Two-Party Contract Family Contract NON-PARTICIPANT HEALTHY U (62.5% of cost) Single Contract $71.53 $146.95 $203.18 Keystone Health Plan East HMO UPMC HMO $196.91 $436.55 $535.02 HMO COVERAGE NOT OFFERED TO PART-TIME EMPLOYEES $214.03 $474.51 $581.53 Important Health Care Coverage Notification The Women’s Health and Cancer Rights Act requires that health care plan members receive annual notification of the coverage provided for mastectomy patients who elect reconstructive surgery. Your PASSHE coverage provides benefits for reconstruction of the breast on which the mastectomy is performed, surgery and reconstruction of the other breast to produce a symmetrical appearance, and prostheses and treatment of physical complications for all states of mastectomy, including lymphedemas. These services are elective and should be chosen by consulting your physician. Benefits are subject to any deductible and coinsurance provisions. Benefit News Page Eleven Pennsylvania State System of Higher Education Group Health Program 2013 - 2014 Health Plan Comparison General Features Deductibles Co-payments and/or CoInsurance Lifetime Maximum Preventive Care Emergency Room Services Mental Health-Inpatient Mental Health-Outpatient Prescription Drug Coverage-same for all plans Highmark PPOBlue (Preferred Provider Organization) In-Network Out-of-Network In-network providers accept Services performed by out-ofHighmark allowance as network providers are paid at payment in full. 80% of allowance after a deductible. Providers can bill employees for charges above allowances. Covers medically necessary surgery, diagnostic services, therapy, inpatient services and preventive benefits. Not necessary to select a primary care physician. No deductible. $250 per person/$500 per family deductible per year. $15 for primary care After deductible, employee pays physician office visits. $25 20% until $1500 per for specialist office visits person/$3000 per family out-of(including urgent care pocket maximum is paid. facilities) Unlimited. $1,000,000/person. No member cost. Preventive Employee pays 20% after care is covered in accordance deductible for adult and with Highmark’s Preventive pediatric exams and certain Schedule based on preventive care. Deductibles do age/gender and includes not apply for gynecological routine physical exams for exams, Pap tests, and pediatric adults and children along immunizations. with certain diagnostic screenings, as well as pediatric and certain adult immunizations, gynecological exams, Pap tests and routine mammograms. $100 co-payment. Co-payment waived if admitted. In-network providers accept Highmark allowance as payment in full. Health Maintenance Organization (HMO) Payment in full to participating providers for medically necessary surgery, diagnostic services and inpatient services. Services must be authorized by HMO primary care physician. Covered services vary by HMO. No payment for services out of the HMO network. Must select a primary care physician. No deductible. $15 for primary care physician visit; $25 for specialist office visits. Co-payments for other services vary by HMO. Unlimited. No member cost. Preventive care is covered and includes routine physical examinations for adults and children, pediatric immunizations, gynecological exams and Pap test. Diagnostic screenings vary by HMO. Co-payment vary by HMO. Covered if considered a medical emergency as defined by the HMO. Copayment may be waived if admitted. Coverage varies by HMO. See HMO literature. Services performed by out-ofnetwork providers are paid at 80% of allowance after a deductible. Providers can bill employees for charges above allowances. $25 office visit co-payment. Employee pays 20% after deductible. No deductible; $5/$18/$36 co-payment for 30-day supply at retail when using a participating network pharmacy; $10/$36/$72 co-payment for 90-day supply through mail order. For more detail on Highmark’s Preventive Schedule, please see http://www.passhe.edu/inside/hr/syshr/Medical_docs/Preventive%20Schedule.pdf This summary highlights the Pennsylvania State System of Higher Education Health Program. Information is provided for general purposes only. Legal plan documents will govern any discrepancies that may arise. For additional information concerning these benefits, contact your human resource office. Benefit News Page Twelve Plan Service Areas and Contacts Offered in all geographic areas. HIGHMARK PPOBLUE (888) 745-3212 www.highmarkblueshield.com GEISINGER HEALTH PLAN HMO (800) 631-1656 Pre-enrollment questions (800) 447-4000 Current members www.thehealthplan.com KEYSTONE HEALTH PLAN CENTRAL HMO (800) 669-7061 www.capbluecross.com KEYSTONE HEALTH PLAN EAST HMO (800) 275-2583 www.ibx.com UPMC HMO (800) 644-1046 Pre-enrollment questions (888) 876-2756 Current members www.upmchealthplan.com HIGHMARK PRESCRIPTION DRUG – (included with all medical plans) Offered in the following counties: Adams, Bedford , Berks, Blair, Bradford, Cambria, Cameron, Carbon, Centre, Clearfield, Clinton, Columbia, Cumberland, Dauphin, Elk , Fulton, Huntingdon, Jefferson, Juniata, Lackawanna, Lancaster, Lebanon, Lehigh, Luzerne, Lycoming, Mifflin, Monroe, Montour, Northampton, Northumberland, Perry, Pike, Potter, Schuylkill, Snyder, Somerset, Sullivan, Susquehanna, Tioga, Union, Wayne, Wyoming and York DENOTES PARTIAL COUNTY Offered in the following counties: Adams, Berks, Centre, Columbia, Cumberland, Dauphin, Franklin, Fulton, Juniata, Lancaster, Lebanon, Lehigh, Mifflin, Montour, Northampton, Northumberland, Perry, Schuylkill, Snyder, Union and York Offered in the following counties: Berks, Bucks, Chester, Delaware, Lancaster, Lehigh, Montgomery, Northampton and Philadelphia Offered in the following counties: Allegheny, Armstrong, Beaver, Bedford, Blair, Butler, Cambria, Cameron, Clarion, Clearfield, Crawford, Elk, Erie, Fayette, Forest, Greene, Huntingdon, Indiana, Jefferson, Lawrence, McKean, Mercer, Potter, Somerset, Venango, Warren, Washington and Westmoreland Offered in all geographic areas. (888) 745-3212 (Highmark Customer Service number) www.highmarkblueshield.com For more detail on the benefit summary of each HMO, please see http://www.passhe.edu/inside/hr/syshr/Medical_docs/HMO%20List.pdf INFORMATION ON MEDICARE FOR ACTIVELY EMPLOYED MEMBERS If you and/or your spouse qualify for and are enrolled in benefits from Social Security, you or your spouse are automatically enrolled in Medicare Part A and Medicare Part B beginning the first day of the month in which you or your spouse turn age 65. Because you are an active employee and you are receiving benefits under the PASSHE Group Health Program, it is not necessary to enroll in Medicare Part B coverage at this time, and you and your spouse can avoid the monthly Medicare Part B premium until you retire. There will be no penalty for enrolling upon your retirement since you and your spouse were enrolled in an active employee health coverage program. You (or your spouse) will need to contact Social Security to advise them that you do not need Medicare Part B at this time. If covering a domestic partner, please be aware that because the Defense of Marriage Act (DOMA) provides that domestic partners and same-sex spouses covered as dependents under employer-sponsored plans cannot be considered “spouses” for purposes of federal law, including Medicare, the waiver of the Part B late-enrollment penalty does not apply. (continued on Page 13) Benefit News Page Thirteen Information on Medicare for Actively Employed Members (con’d) It is critical for you and/or your spouse to contact Social Security about three months prior to retirement to enroll in Medicare Part B so that this coverage is in place at the time of retirement. Typically the Medicare Part B premium is deducted from your Social Security check and/or your spouse’s Social Security check, if receiving a monthly benefit from Social Security. You may receive numerous mailings from other vendors regarding Medicare Complement plans, which you do not need while you have coverage as an active employee under the PASSHE Group Health Program. For more information about Medicare Parts A and B, please contact Medicare at 1-800-633-4227. You can learn more by visiting the Medicare website at www.Medicare.gov. If you have questions or need further assistance regarding how your coverage changes upon retirement, please contact your university human resources office. IF YOU DO NOT ENROLL IN MEDICARE PART B WHEN YOU RETIRE, MOST PHYSICIAN AND MEDICAL/SURGICAL SERVICES WILL NOT BE COVERED. IMPORTANT NOTICE MEDICAID AND THE CHILDREN’S HEALTH INSURANCE PROGRAM (CHIP) OFFER FREE OR LOW-COST HEALTH COVERAGE TO CHILDREN AND FAMILIES If you are eligible for health coverage from your employer, but are unable to afford the premiums, some States have premium assistance programs that can help pay for coverage. These States use funds from the Medicaid or CHIP programs to help people who are eligible for employer-sponsored health coverage, but need assistance in paying their health premiums. If you or your dependents are already enrolled in Medicaid or CHIP, you can contact your State Medicaid or CHIP office to find out if premium assistance is available. If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligible for either of these programs, you can contact your State Medicaid or CHIP office or dial 1-877-KIDS NOW or www.insurekidsnow.gov to find out how to apply. If you qualify, you can ask the State if it has a program that might help you pay the premiums for an employer-sponsored plan. Once it is determined that you or your dependents are eligible for premium assistance under Medicaid or CHIP, your employer’s health plan is required to permit you and your dependents to enroll in the plan – as long as you and your dependents are eligible, but not already enrolled in the employer’s plan. This is called a “special enrollment” opportunity, and you must request coverage within 60 days of being determined eligible for premium assistance. For Pennsylvania – Medicaid: Website: http://www.dpw.state.pa.us/HIPP Phone: 1-800-644-7730 For more information on special enrollment rights, or for information on other states, you can contact either: U.S. Department of Labor Employee Benefits Security Administration www.dol.gov/ebsa 1-866-444-EBSA (3272) U.S. Department of Health and Human Services Centers for Medicare & Medicaid Services www.cms.gov 1-877-267-2323, Ext. 61565