Norwegian inflation forecasts, January 2008 University of Oslo, Department of Economics

advertisement

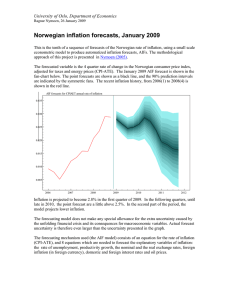

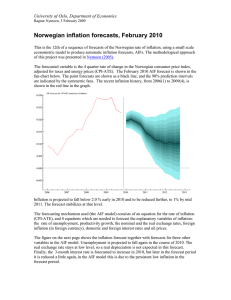

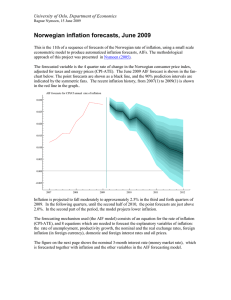

University of Oslo, Department of Economics Ragnar Nymoen, 4 February 2008 Norwegian inflation forecasts, January 2008 This is the eight of a sequence of forecasts of the Norwegian rate of inflation, using a small scale econometric model to produce automatized inflation forecasts, AIFs. The approach taken, and model used, is the same as has been useful in analyzing the failure affecting Norges Bank's inflation earlier forecasts, see Nymoen (2005). The forecasted variable is the 4 quarter rate of change in the Norwegian consumer price index, adjusted for taxes and energy prices (CPI-ATE). The forecast based on the end of January 2008 version of the AIF model is shown in the fan-chart below. The point forecasts are shown as a thick blue line, and the 90% prediction intervals are indicated by the symmetric fans. Based on the AIF forecasting model, future inflation rates inside this narrower interval are more likely events than inflations rates outside the narrower forecast band. The recent inflation history, from 2004(1) to 2007(4) is shown by the red line. 0.040 AIF forecast 4 February 2008. Rate of inflation (CPI−AET) 0.035 0.030 0.025 0.020 0.015 0.010 0.005 2004 2005 2006 2007 2008 2009 2010 2011 Inflation is projected to increase in the first three quarters of 2008. For most of the forecast period the point forecast is between 2% and 2.5%. Late in the period the forecasted rate of inflation is decreasing. The estimated uncertainty allows for inflation both higher and lower than the 2.5% inflation target. Towards the end of the forecast horizon, inflation below 2.5% is regarded by the model as more likely than inflation above 2.5% though. The forecasting mechanism used (the AIR model) consists of an equation for the rate of inflation (CPI-ATE), and 8 equations which are needed to forecast the following variables: the (logarithm of the) rate of unemployment, productivity growth, the nominal and the real exchange rates, foreign inflation (in foreign currency), domestic and foreign interest rates and oil prices. University of Oslo, Department of Economics Ragnar Nymoen, 4 February 2008 The figure on this page shows the nominal 3 month interest rate (money market rate) which is forecasted together with inflation and the other variables in the AIF forecasting model. Over the 2008-2010 period as a whole, there is no significant rise in the forecasted interest rate, although the point forecast shows a continuation of the increases from 2006 and 2007, but in smaller steps. AIF forecasts 4 February 2008. The 3−month nominal interest rate 0.10 0.09 0.08 0.07 0.06 0.05 0.04 0.03 0.02 2004 2005 2006 2007 2008 2009 2010 2011