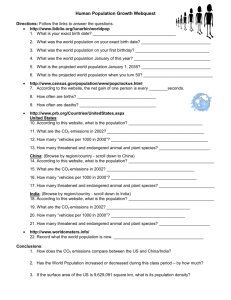

DISCUSSION PAPER A Tax-Based Approach to Slowing

advertisement