MAT4760/MAT9760 4.1 Risk Measures [FS 153]

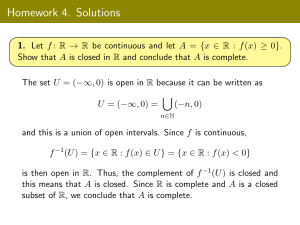

advertisement

![MAT4760/MAT9760 4.1 Risk Measures [FS 153]](http://s2.studylib.net/store/data/011458085_1-e3d89406871a87b111009197f4065778-768x994.png)

MAT4760/MAT9760

4.1 Risk Measures [FS 153]

Date

A risk measure, denoted by ρ, is a function that quantifies the risk associated 17.01.11

with some financial position X, where X : Ω 7→ R. Ω is the set of all possible

outcomes, and X(ω) is the discounted value of the financial position in the

outcome ω ∈ Ω. We define X to be the set of financial positions. X is a linear

space of bounded functions containing the constants. The norm we use is the

supremum norm: kXk := supω∈Ω |X(ω)|.

Definition 4.1 [FS 153]

A mapping ρ : X 7→ R is called a monetary measure of risk if it satisfies the

following conditions for all X, Y ∈ X .

Monotonicity: X ≤ Y =⇒ ρ(X) ≥ ρ(Y ),

X(ω) ≤ Y (ω), ∀ω ∈ Ω

Cash Invariance: m ∈ R =⇒ ρ(X + m) = ρ(X) − m,

∀m ∈ R.

Consequences of cash invariance:

ρ X + ρ(X) = ρ(X) − ρ(X) = 0

(4.1)

ρ(m) = ρ(0) − m

When we do not have a financial position, we do not have any risk. In this

case we say the risk measure is normalized.

Normalization: ρ(0) = 0

Lemma 4.3 [FS 154]

Any monetary measure of risk ρ is Lipschitz continuous wrt the supremum

norm k · k. Lipschitz continuity implies continuity.

ρ(X) − ρ(Y ) ≤ kX − Y k

Proof

X = X ± Y ≤ Y + kX − Y k =⇒ X ≤ Y + kX − Y k

By monotonicity and cash invariance:

ρ(X) ≥ ρ Y + kX − Y k = ρ(Y ) − kX − Y k

1

kX − Y k ≥ ρ(Y ) − ρ(X)

(⋆)

The same reasoning with Y instead of X.

Y = Y ± X ≤ X + kX − Y k =⇒ Y ≤ X + kX − Y k

By monotonicity and cash invariance:

ρ(Y ) ≥ ρ X + kX − Y k = ρ(X) − kX − Y k

ρ(Y ) − ρ(X) ≥ −kX − Y k

(⋆⋆)

By combining (⋆) and (⋆⋆) we get:

−kX − Y k ≤ ρ(Y ) − ρ(X) ≤ kX − Y k

|ρ(Y ) − ρ(X)| ≤ kX − Y k

Definition 4.4 [FS 154]

A monetary measure of risk ρ : X 7→ R is called a convex risk measure if it

satisfies the convexity property: For some 0 ≤ λ ≤ 1,

ρ λX + (1 − λ)Y ≤ λρ(X) + (1 − λ)ρ(Y )

Convexity is a way to implement a risk reduction for diversifying the

investment.

Lemma [FS 154]

If ρ is convex and normalized, then we have the following properties.

ρ(aX) ≤ aρ(X),

ρ(aX) ≥ aρ(X),

∀a ∈ [0, 1], X ∈ X

(i)

∀a ∈ [1, ∞), X ∈ X

(ii)

Proof

(i) By convexity and normalization:

ρ(aX) = ρ aX + (1 − a)0 ≤ aρ(X) + (1 − a) ρ(0) = aρ(X)

|{z}

=0

(ii) Using (i):

aX 1

≤ ρ(aX) =⇒ aρ(X) ≤ ρ(aX)

ρ(X) = ρ

a

a

2

Definition 4.5 [FS 155]

A convex measure of risk ρ is called a coherent risk measure if it satisfies

positive homogeneity.

For λ ≥ 0,

ρ(λX) = λρ(X)

Lemma

A coherent risk measure is always normalized.

Proof

Take any m ≥ 0, m 6= 1.

ρ(m) = ρ(0 + m) = ρ(0) − m

(⋆)

Using positive homogeneity.

ρ(m) = ρ(m · 1) = mρ(1) = m ρ(0) − 1 = mρ(0) − m

(⋆⋆)

Combining (⋆) and (⋆⋆): ρ(m) = ρ(m), which gives ρ(0) − m = mρ(0) − m,

⇒ mρ(0) − ρ(0) = 0 ⇒ ρ(0) m − 1 = 0 ⇒ ρ(0) = 0

| {z }

6=0

Lemma [FS 155]

For a coherent risk measures ρ, convexity ⇔ sub-additivity, defined as:

ρ(X + Y ) ≤ ρ(X) + ρ(Y ),

Proof

e =

⇒) For a, b > 0 define X

positive homogeneity:

a+b

X

a

∀X, Y ∈ X .

and Ye =

a+b

Y

b

. Using convexity and

a

b e

a

e

e + b ρ(Ye ) =

ρ(X + Y ) = ρ

X+

Y ≤

ρ(X)

a+b

a+b

a+b

a+b

b a + b a a + b ρ

X +

ρ

Y = ρ(X) + ρ(Y )

a+b

a

a+b

b

3

e = λX and Ye = (1 − λ)Y . Using sub-additivity and positive

⇐) Define X

homogeneity:

e + Ye ≤ ρ(X)

e + ρ(Ye ) = λρ(X) + (1 − λ)ρ(Y ) ρ λX + (1 − λ)Y = ρ X

Positive homogeneity is a restrictive assumption as it requires risk measures

to be linear.

From the m.r.m (monetary risk measure) we get its acceptance set.

Aρ := X ∈ X | ρ(X) ≤ 0

The set of all acceptable positions in the sense that “they do not need any

additional capital”. Here are two results that summarize the relations between

m.r.m and their acceptance set.

Proposition 4.6 [FS 155]

Assume ρ is a m.r.m with acceptance set A := Aρ .

(a) A is non-empty, A 6= ∅, and satisfies the following conditions.

inf m ∈ R | m ∈ A > −∞

X ∈ A, Y ∈ X , Y ≥ X =⇒ Y ∈ A

(4.3)

(4.4)

Moreover, A has the following closure properties. For X ∈ A and Y ∈ X ,

n

o

S := λ ∈ [0, 1] λX + (1 − λ)Y ∈ A is closed in [0, 1]

(4.5)

(b) We can get ρ just by knowing A.

ρ(X) = inf m ∈ R | m + X ∈ A

(4.6)

(c) ρ is a convex risk measure ⇐⇒ A is convex.

(d) ρ is positively homogeneous ⇐⇒ A is a cone. In particular,

ρ is coherent ⇐⇒ A is a convex cone.

Proof

20.01.11

(a) (A 6= ∅)

Define z := ρ(0), then ρ(0) ∈ R. Choose some m ∈ R such that z − m ≤ 0.

Then, by cash invariance, ρ(m) = ρ(0) − m ≤ 0, so m ∈ A, and A is nonempty.

4

(4.3)

Consider any constant m ∈ A. By cash invariance, ρ(m) = ρ(0) − m ≤ 0. If

we set z := ρ(0) this means we have z ≤ m, which implies - since the left

side is independent of m,

z ≤ inf m ∈ R | ρ(m) ≤ 0

z is a number, z ∈ R, so z > −∞.

(4.4)

X ∈ A =⇒ ρ(X) ≤ 0

Y ≥ X =⇒ ρ(Y ) ≤ ρ(X)

Combining these inequalities means ρ(Y ) ≤ ρ(X) ≤ 0, hence Y ∈ A.

(4.5)

By assumption, X ∈ A and Y ∈ X . For all λ ∈ S,

λX + (1 − λ)Y ∈ A =⇒ ρ λX + (1 − λ)Y ≤ 0.

By lemma 4.3, ρ is continuous. For fixed X, Y

fX,Y : λ 7→ λX + (1 − λ)Y

is also a continuous function, which means that the composite function

ρ ◦ fX,Y is also continuous,

ρ ◦ fX,Y (λ) = ρ λX + (1 − λ)Y

−1

Now we set S = ρ ◦ fX,Y

, and use the result that the counter image of

a closed set is still closed, thus S is closed.

(b) By the defining property of A:

inf m ∈ R | m + X ∈ A = inf m ∈ R | ρ m + X ≤ 0

Using cash invariance and the definition of the infimum:

inf m ∈ R | ρ X ≤ m = ρ(X)

(c)

⇒) Assume first that ρ is convex. Assume X, Y ∈ A and λ ∈ [0, 1].

ρ λX + (1 − λ)Y ≤ λρ(X) + (1 − λ)ρ(Y ) ≤ 0 =⇒ λX + (1 − λ)Y ∈ A

which means A is a convex set.

5

⇐) Assume A is convex. We choose arbitrary X1 , X2 ∈ X and let λ ∈ [0, 1].

We now consider m1 , m2 ∈ R such that, by cash invariance, ρ(mi + Xi ) =

ρ(Xi ) − mi ≤ 0 for i = 1, 2. By the construction of A, both m1 + X1 and

m2 + X2 are elements in A. Using that A is a convex set and the property

for all elements in A:

λ(m1 +X1 )+(1−λ)(m2 +X2 ) ∈ A =⇒ ρ λ(m1 +X1 )+(1−λ)(m2 +X2 ) ≤ 0

By cash invariance,

ρ λX1 + (1 − λ)X2 − [λm2 + (1 − λ)m2 ] ≤ 0

ρ λX1 + (1 − λ)X2 ≤ λm2 + (1 − λ)m2 =

λ inf m1 | m1 + X1 ∈ A + (1 − λ) inf m2 | m2 + X2 ∈ A =

λρ(X) + (1 − λ)ρ(Y ) =⇒ ρ is convex.

(d)

⇒) Assume ρ is positively homogeneous. Recall that X ∈ A =⇒ ρ(X) ≤ 0

and for any λ ≥ 0 we have the positive homogeneity property: ρ(λX) =

λρ(X). Since ρ(X) ≤ 0 then λρ(X) ≤ 0, so λρ(X) ∈ A for all λ ≥ 0, so A is

a cone.

⇐) Now suppose A is a cone and suppose X ∈ X . From part (b), ∃m ∈ R

such that ρ(X) ≤ m, or equivalently, m + X ∈ A. Since A is a cone, we have

for λ ≥ 0 that λ(m + X) ∈ A.

λm + λX ∈ A =⇒ 0 ≥ ρ λm + λX = ρ(λX) − λm =⇒ ρ(λX) ≤ λm

ρ(λX) ≤ λ · inf m ∈ R | m + X ∈ A = λρ(X) =⇒ ρ(λX) ≤ λρ(X)

We are going to show that ρ is positively homogeneous, so now we only need

the reverse inequality. We consider m0 ∈ R such that m0 < ρ(X). By cash

invariance (and using λ ≥ 0):

m0 < ρ(X) =⇒ 0 < ρ(X + m0 ) =⇒ X + m0 6∈ A =⇒ λ(X + m0 ) 6∈ A

0 < ρ λ(m0 + X) = ρ(λX) − λm0 =⇒ λm0 < ρ(λX)

=⇒ λ · sup m0 ∈ R | X + m0 6∈ A ≤ ρ(λX)

(⋆)

|

{z

}

=ρ(X)?

If we can show that the underbraced sup-term in the proof is equal to ρ(X)

the proof will be concluded. We know from above that:

sup{M0 } := sup m0 ∈ R | X + m0 6∈ A ≤ ρ(X)

6

and we know

ρ(X) = inf m ∈ R | ρ(X) ≤ m =: inf{M}

Strategy: show that the sup cannot be less than ρ(X), and therefore must

be equal. If sup{M0 } < ρ(X) = inf{M}, then we can define:

ε=

inf{M} − sup{M0 }

> 0.

2

}

< ρ(X),

We also define m

e :=

e = sup{M0 }+inf{M

2

sup{M0 } + ε. We note that m

and that ρ X + m

e = ρ(X) − m

e > 0, so X + m

e 6∈ A, however m

e > sup{M0 },

so we have a contradiction! This means sup{M0 } cannot be strictly less than

ρ(X) which means they are equal. Returning to (⋆) we have λρ(X) ≤ ρ(λX),

and with the first inequality we have shown that λρ(X) = ρ(λX).

From a m.r.m we can find an acceptance set, and conversly, from a set A ⊆ X

we can define a m.r.m ρA :

ρA := inf m ∈ R : m + X ∈ A , ∀X ∈ X

and we note that ρAρ = ρ.

Proposition 4.7 [FS 156]

Assume that A ⊆ X satisfies:

(i)

(ii)

(iii)

A 6= ∅

inf m ∈ R | m ∈ A > −∞

X ∈ A, Y ∈ X , Y ≥ X =⇒ Y ∈ A

then ρA satisfies:

(a) ρA is a monetary measure of risk.

(b) A is convex =⇒ ρA is a convex risk measure.

(c) A is a cone =⇒ ρA is positively homogeneous.

(Note that property b and c combined imply that ρA is coherent).

(d) Define

AρA := X ∈ X | ρA (X) ≤ 0

Then A ⊆ Aρ and if we have the closure property, i.e for X ∈ A, Y ∈ X ,

S := λ ∈ [0, 1] | λX + (1 − λ)Y ∈ A

then A = Aρ .

7

Lemma

(A) If X ∈ A, then ρA (X) ≤ 0. (Follows from the definition).

(B) A ⊆ AρA . (Follows from (a)).

(C) If (i), (ii) and (iii) from prop. 4.7 are satisfied, then X 6∈ A implies

ρA ≥ 0. In particular

X 6∈ AρA

=⇒ ρA (X) > 0

(C1 )

X ∈ AρA \ A =⇒ ρA (X) = 0

(C2 )

Proof

A, B and C1 are obvious. Proving C2 : We know that,

X ∈ AρA \ A =⇒ ρA ≤ 0.

Suppose for a contradiction that ρA (X) < 0, then ∃m < 0 such that

m + X ∈ A. Note that

m + X < |{z}

X

| {z }

6∈A

∈A

but by (iii) this is absurd! Strictly less is impossible, so we have equality. Proof of Proposition 4.7

27.01.11

(a) To prove that ρA is a m.r.m, we must verify that it is monotone and cash

invariant.

Monotonicity

Let X, Y ∈ X and assume X ≤ Y . Of course, m + X ≤ m + Y . Choose

m such that

(iii)

m + X ∈ A =⇒ m + Y ∈ A

inf m ∈ R | m + X ∈ A ≥ inf m

e ∈R|m

e +Y ∈A

ρA (X) ≥ ρA (Y )

Cash invariance

Let a ∈ R.

ρA (X + a) = inf m | m + X + a ∈ A = inf m

e −a|m

e +X ∈A

= inf m

e |m

e + X ∈ A − a = ρA (X) − a

8

Verifying two additional properties.

The risk measure always has an upper bound: ρA (X) ∈ R, ∀X ∈ X .

Take X ∈ X and Y ∈ A ⊆ X . Since X is the set of bounded functions,

∃m ∈ R such that X + m > Y .

Y ∈A

ρA (X) − m = ρA (X + m) ≤ ρA (Y ) ≤ 0 =⇒

ρA (X) ≤ m < ∞.

Risk measures are not minus infinity. For X ∈ X we can find a ∈ R

such that a + X ≤ 0. By monotonicity and cash invariance:

ρA (a + X) ≥ ρA (0)

(ii)

ρA (X) − a ≥ ρA (0) = inf m | m + 0 ∈ A} > −∞ =⇒

ρA (X) ≥ ρA (0) + a > −∞

(b) We assume A is convex, and show that ρA is convex.

We assume X1 , X2 ∈ X and take λ ∈ [0, 1]. We then consider

m1 , m2 ∈ R such that m1 + X1 ∈ A and m2 + X2 ∈ A. Since we

have assumed A is convex:

λ m1 + X1 + (1 − λ) m2 + X2 ∈ A

By definition of A, and then cash invariance.

0 ≥ ρA λ m1 + X1 + (1 − λ) m2 + X2

= ρA λX1 + (1 − λ)X2 − λm1 + (1 − λ)m2

We get,

ρA

ρA λX1 + (1 − λ)X2 ) ≤ λm1 + (1 − λ)m2

λX1 +(1−λ)X2 ) ≤ λ·inf m1 | m1 + X1 ∈ A +(1−λ)·inf m2 | m2 + X2 ∈ A

|

{z

}

{z

}

|

ρA (X1 ) by 4.6(b)

ρA (X2 ) by 4.6(b)

=⇒ ρA λX1 + (1 − λ)X2 ) ≤ λρA (X1 ) + (1 − λ)ρA (X2 )

With this we have proved that ρA is a convex function.

9

(c) We assume A is a cone, and show that ρA is positively homogeneous.

We consider some X ∈ X and m ∈ R : m + X ∈ A. Choose a λ > 0.

Since A is a cone, m + X ∈ A ⇒ λ(m + X) ∈ A. By definition of A

and cash invarianc:

0 ≥ ρA λ(m + X) = ρA (λX) − λm

In general, ρA (λX) ≤ λm, and in particular

ρA (λX) ≤ λ inf m | m + X ∈ A

≤λ·m

ρA (λX) ≤ λρA (X).

If we can show the opposite inequality as well, we have shown that ρA

is positively homogeneous. We consider m ∈ R such that we have the

strict inequality m < ρA (X).

m < ρA (X) =⇒ 0 < ρA (X) − m =⇒ 0 < ρA (X + m) =⇒ m + X 6∈ A

For λ > 0, and using that A is a cone, we also have λ(m + X) 6∈ A.

0 < ρA λX − λm =⇒ λm < ρA (λX) =⇒

λ · sup m ∈ R | m + X 6∈ A ≤ ρA (λX)

From this inequality, we can derive the following:

sup m ∈ R | m + X 6∈ A ≤ inf m ∈ R | m + X ∈ A

We show, as we did in the proof by contradiction of Proposition 4.6(d),

that the left side can not be strictly less, and therefore we must have

equality. This results in λρA (X) ≤ ρA (λX) which is the required

inequality, and we have proved (c).

(d) We assume

A ⊆ AρA := X ∈ X | ρA (X) ≤ 0

(i)

and that X has the “closure property”, i.e for every X ∈ A, Y ∈ X and

[0, 1] ⊇ S := λ ∈ [0, 1] | λX + (1 − λ)Y ∈ A

(ii)

(where S is closed in [0, 1]), and show that (i) and (ii) imply that A = Aρ .

10

By (i), we have A ⊆ Aρ which implies Acρ ⊆ Ac . To show that these

sets are equal we only have to show that Ac ⊆ Acρ .

We observe that λ = 1 ∈ S since we know that X ∈ A, but for λ = 0

we do not know, since we don’t know wether or not Y is in A.

Consider a new X ∈ Ac = X \ A, which we know is bounded since X

is bounded. We can find a m ∈ R such that

0 ≤ sup |X(ω)| = kXk < m.

ω∈Ω

Choose an ε ∈ (0, 1) such that

ε · m + (1 − ε) |{z}

X 6∈ A

6∈A

X is not in A by assumption, but we don’t know if m is.

0 ≤ ρA εm + (1 − ε)X = ρA (1 − ε)X − εm

=⇒ εm ≤ ρA (1 − ε)X

4.3 0 ≤ ρA (1 − ε)X − ρA (X) ≤ (1 − ε)X − X = εkXk < εm

Rearranging:

ρA (X) ≥ ρA (1 − ε)X − εkXk ≥ εm − ε = ε(m − kXk) > 0

so ρA (X) > 0 which means X 6∈ Aρ which is equivalent to saying

X ∈ Acρ . For an arbitrary X ∈ Ac we have X ∈ Acρ , so Ac ⊆ Acρ , and

the proof is completed.

Examples

As usual X denotes the linear space of all bounded, measurable functions on

some probability space (Ω, F ), and M1 = M1 (Ω, F ) denotes the class of all

probability measures on (Ω, F ).

Ex 4.8 Worst-case Risk measure [FS 157]

We define the worst-case r.m by

ρmax (X) = − inf X(ω)

ω∈Ω

The r.m ρmax is in fact a coherent r.m, which we can see by verifying

monotonicity, cash invariance and checking that Aρmax is a convex cone.

11

Monotonicity

If X ≤ Y , or more precisely, X(ω) ≤ Y (ω) ∀ω ∈ Ω, then

inf X(ω) ≤ inf Y (ω) =⇒

ω∈Ω

ω∈Ω

− inf X(ω) ≥ − inf Y (ω) =⇒

ω∈Ω

ω∈Ω

ρmax (X) ≥ ρmax (Y )

Cash invariance

For some m ∈ R we need to show that ρmax (X + m) = ρmax (X) − m.

ρmax (X + m) = − inf X(ω) + m

ω∈Ω

= − inf X(ω) − m

ω∈Ω

= ρmax (X) − m

Aρmax is a convex cone

Aρmax = X ∈ X such that ρmax (X) ≤ 0

= X|X≥0

From this we see that Aρmax is convex cone, and by Proposition 4.7 (b)

and (c), it follows that ρmax is a coherent risk measure.

Ex 4.11 Value at Risk (V aR) [FS 158]

We assume we have fixed a probabiliy measure P on the measurable space

(Ω, F ). A position X ∈ X is acceptable if P (X < 0) ≤ λ for some λ ∈ (0, 1).

Usually denote this r.m by V aRλ . The acceptance set for V aRλ is:

A = X ∈ X | P (X < 0) ≤ λ

(X does not necessarily have to be less than 0, could also be e.g a small

constant). The corresponding monetary risk measure is

V aRλ (X) = ρvar (X) = inf m ∈ R | P (m + X < 0) ≤ λ

We verify that this actually is a m.r.m by verifying monotonicity and cash

invariance.

12

Monotonicity

Assume X ≤ Y and derive the inequality V aRλ (Y ) ≥ V aRλ (X).

Writing out the risk measures.

V aRλ (X) = inf m ∈ R | P (m + X < 0) ≤ λ

V aRλ (Y ) = inf n ∈ R | P (n + Y < 0) ≤ λ

Since Y is larger than X, we need a bigger number to make it negative,

hence n ≥ m, so

X ≤Y

=⇒ V aRλ (Y ) ≥ V aRλ (X).

Cash invariance

V aRλ (X + a) = inf m ∈ R | P (m + a + X < 0) ≤ λ

= inf x − a ∈ R | P (x + X < 0) ≤ λ m=x−a

= inf x | P (x + X < 0) ≤ λ − a

= V aRλ (X) − a

Positive homogeneity

We assume a > 0.

V aRλ (aX) = inf m ∈ R | P (aX + m < 0) ≤ λ

= inf ax ∈ R | P (X + x < 0) ≤ λ x=m/a

= a inf x ∈ R | P (X + x < 0) ≤ λ

= a · V aRλ (X)

Ex 4.41 Value at Risk 2 [FS 158]

We consider the case where we invest in two corporate bonds, each with

payoff re, where r is the return on a riskless investment and re > r ≥ 0.

These bonds are defaultable, i.e they can default and become worthless. We

assume the bonds are independently defaulting (e.g they belong to dofferent

non-connected market sectors). We introduce w > 0 as the size of the initial

investment.

The discounted net gain for bond i is given by (probabilities denoted by pi )

−w

default

pi

re − r Xi =

w

otherwise (1 − pi )

1+r

13

Now we have enough information to find the V aR for the first bond, which

defaults with probability p1 . We choose some λ ∈ (0, 1) so p1 ≤ λ.

V aRλ (Y ) = inf a | P (a + Y < 0) ≤ λ

a = w =⇒ P X1 < −w = 0 ≤ λ

(It is impossible to loose more than the initial investment).

a = −w

So,

re − r 1+r

V aRλ (X1 ) = −w

re − r =⇒ P X1 < w

= p1 ≤ λ

1+r

re − r < 0 =⇒ X1 is acceptable.

1+r

Let us see what happens if we diversify our investment, by investing w/2 in

each bond, so we have Z = 12 X1 + 21 X2 , and if both default, one defaults or

none default we get (with the corresponding probabilities):

p1 p2

−w

w re − r

−

1

<0

p1 (1 − p2 ) ∨ p2 (1 − p1 )

Z=

2 1+r

w re − r

(1 − p1 )(1 − p2 )

1+r

In the second column we used

w w re − r w re − r

− +

=

−1

2

2 1+r

2 1+r

and to establish the last, strict inequality,

0 ≤ r < re < 2r + 1.

a = w =⇒ P (Z < −w) = 0 ≤ λ

w

re − r w re − r

a=

1−

=⇒ P Z <

− 1 = p1 p2

2

1+r

2 1+r

a = −w ·

re − r re − r

= p1 p2 + p1 (1 − p2 ) + p2 (1 − p1 )

=⇒ P Z < w

1+r

1+r

= p1 + p2 − p1 p2

14

To simplify we assume p1 = p2 = p, so p1 p2 = p2 and p1 + p2 − p1 p2 = 2p − p2 .

Since p ≤ λ, we get p2 ≤ λ ≤ 2p − p2 , so we get

V aRλ (Z) =

w

re − r 1−

> 0 =⇒ V aRλ (Z) > V aRλ (X1 )

2

1+r

so V aRλ is not a convex measure which subsequently means it punishes

diversification. This means that the acceptance set, A is not convex, but

that is not obvious:

A = X ∈ X | P (X < 0) ≤ λ .

4.2 Robust Representations of Risk Measures [FS 161]

Linear functions vs Additive Set functions

Definition A.49 [FS 426]

Let (Ω, F ) be a measurable space. A mapping µ : F 7→ R is called a finitely

additive set function if (i) and (ii) are satisfied. It is called a finitely additive

probability measure if we also have (iii):

(i)

(ii)

µ(∅) = 0

Pairwise disjoint A1 , . . . , AN ∈ F , implies µ

(iii)

µ(Ω) = 1.

N

[

i=1

Ai =

N

X

µ(Ai )

i=1

We use M1,f := M1,f (Ω, F ) to denote the set of all finitely additive set

functions µ : F 7→ [0, 1] where µ(Ω) = 1, so M1,f is the set of all finitely

additive probability measures. The total variation of a finitely additive set

function µ is defined, where A1 , . . . , AN are mutually disjoint sets in F and

N ∈N

N

X

kµkvar := sup

|µ(Ai)|

A1 ,...,AN

i=1

With ba := ba(Ω, F ) we denote the collection of set functions with finite

total variation. We note that M1,f ⊂ ba, since for some Q ∈ M1,f ,

(A := {A1 , . . . , AN }),

kQkvar

N

N

[

X

≤ sup

Q(Ai ) = sup Q

Ai ≤ Q(Ω) = 1 < ∞

A

i=1

A

15

i=1

Integration Theory

This is a brief outline of the integration theory wrt a measure µ ∈ ba. The

space X endowed with the supremum norm k · k,

kF k := sup |F (ω)|, F ∈ X

ω∈Ω

is a Banach space. This is a space with a nice structure where we can define

a topology, Cauchy sequences converge and we can define a limit. For an

element F ∈ X , we can define the simple (or elementary) representation:

F ∈ X =⇒ F =

N

X

αi 1Ai

i=1

for some constants αi . From this representation, we can define the integral.

Z

F dµ :=

Ω

N

X

αi µ(Ai ) =: ℓµ (F )

i=1

We have

N

N

X

Z

X

|αi ||µ(Ai )| ≤ sup |F (ω)| ·

|µ(Ai )| ≤ kF k · kµkvar

F dµ ≤

ω

i=1

i=1

For any F ∈ X can be approximated by simple functions:

k·k

Fn −→ F, n → ∞.

Z

Z

Z

=

(F

−

F

)dµ

F

dµ

−

F

dµ

≤ kFn − Fm k · kµkvar −→ 0

n

m

n

m

m,n→0

R

som

Fn dµ n is Cauchy. By setting µ = Q ∈ M1,f ⊂ ba, we denote the

integral by

Z

F dQ = EQ [F ].

Theorem A.50 [FS 427]

The integral

ℓ(F ) =

Z

F dµ,

F ∈X

defines a one-to-one correspondence with the finitely additive set functions

µ ∈ ba, and the linear continuous functionals ℓ on X . We have a one-to-one

correspondence ℓ ↔ µ.

16

Proof

←) From µ ∈ ba to the definition of ℓµ we simply follow the construction of

the integral.

→) We define µ(A) = ℓ(1A ) for A ∈ F , where 1 is the indicator function.

For pairwise disjoint sets A1 , . . . , AN , which we abbreviate as A, we get

kµkvar = sup

A

N

X

µ(Ai )

i=1

= ℓ(1Ai )

We divide the sum into negative and positive terms.

= sup

A

= sup

A

= sup

A

The norm of ℓ is given by

N

X

µ+ (Ai ) + µ− (Ai )

i=1

X

X

ℓ(1Ai ) + ℓ(1Bj )

ℓ(1Ai + 1Bj ) ≤ kℓk

kℓk := sup kℓ(X)k

kXk≤1

For linear, continuous functions they are bounded.

µ ∪ Ai = ℓ 1∪Ai = ℓ ΣAi = Σℓ 1Ai = Σµ(Ai )

For finite measures, in the sense that the total variation is finite, we have

a one-to-one correspondence to linear, continuous functionals, The mapping

that links them is an integral.

Summary

03.02.11

R

The integral ℓ(F ) = F dµ for F ∈ X defines a one-to-one relationship

between the spaces

X = ℓ | X 7→ R where ℓ is continuous and linear

and

ba = ba(Ω, F ) = µ : F 7→ R | signed additive bounded tot. variation

σ-additivity is equivalent to An ր Ω, that is, An ⊆ An+1 ⇒ ∪n An = Ω.

For the measure Q : Q(An ) ≤ Q(An+1 ), a monotonic sequence, Q(An ) ր

Q(Ω) = 1 (for a probability measure). ℓ is continuous and linear: ℓ(X) ≥

0, X ≥ 0, ℓ(1) = 1.

17

Theorem 4.15 [FS 162] - Rep. Theorem for Risk Measures

Any convex risk measure ρ : X 7→ R admits representation as:

ρ(X) = sup EQ [−X] − αmin (Q)

Q∈M1,f

where

αmin (Q) = sup EQ [−X],

X∈Aρ

Q ∈ M1,f .

If there is any other α penalty function such that

ρ(X) = sup EQ [−X] − α(Q)

Q∈M1,f

then α(Q) ≥ αmin (Q), for all Q ∈ M1,f . (The penalty function isn’t unique).

We can use the max instead of sup. The EQ [−X] is the linear part, and αmin

is an element in the family of penalty functions, and it penalizes linearity.

In general:

α : M1,f 7→ R ∪ {∞},

such that

inf

Q∈M1,f

α(Q) ∈ R.

The function

X 7→ EQ [−X] − α(Q)

is convex, cash invariant and convex, and these properties are preserved when

we take the sup (we call this function ρ for now).

ρ(0) = − inf α(Q)

ρ(X) : X 7→ sup EQ [−X] − α(Q) ,

Q∈M1,f

Q∈M1,f

Proof of Theorem 4.15

We show that ρ(X) both dominates and is dominated by the representation

in theorem 4.15.

Step 1

ρ(X) ≥ sup

Q∈M1,f

EQ [−X] − αmin (Q)

If we define X ′ := X + ρ(X) for X ∈ X , we get, by cash invariance,

ρ(X ′ ) = ρ X + ρ(X) = ρ(X) − ρ(X) = 0 =⇒ X ′ ∈ Aρ .

18

By the definition of αmin we have that for all Q ∈ M1,f ,

αmin (Q) = sup EQ [−Z] ≥ EQ [−X ′ ] = EQ [−X − ρ(X)] = EQ [−X] − ρ(X)

Z∈Aρ

αmin (Q) ≥ EQ [−X] − ρ(X) =⇒ ρ(X) ≥ EQ [−X] − αmin (Q)

The left side of the inequality is independent of Q, so we can take the sup

on the right side, and we have derived the first inequality.

ρ(X) ≥ sup EQ [−X] − αmin (Q)

Q∈M1,f

Step 2

ρ(X) ≤ sup

Q∈M1,f

EQ [−X] − αmin (Q)

To derive this inequality, we find a measure QX such that

ρ(X) ≤ EQX [−X] − αmin (QX ) .

When this is true, it is also true when we take the sup over all Q, and this

will subsequently result in the required inequality. We need a result from

functional analysis:

Theorem A.54 [FS 429]

In a topological vector space E, any two disjoint convex sets B and C,

where at least one of them has an interior point, can be separated by a

non-zero continuous linear functional ℓ on E:

ℓ(X) ≤ ℓ(Y ) ∀X ∈ C, ∀Y ∈ B.

We define the set X0 ⊆ X by

X0 := X ∈ X | ρ(X) = 0

Suppose Y ∈ X \ X0 , and define X := Y + ρ(Y ) If ρ(X) = 0, then

Y = X − ρ(Y ) [?]. Without loss of generality we can assume ρ(0) = 0,

since if ρb(0) = c which implies, by cash invariance, ρb(−c) = 0, then we can

set ρ(X) := ρb(X − c) for X ∈ X .

Take X ∈ X0 and define the set

B := Y ∈ X | ρ(Y ) < 0 ,

19

then we have X 6∈ B and X ∈ C = Bc , which are complementary sets, and

one of them is non-empty. These are the necessary conditions of Theorem

A.54, and we have the existence of a non-zero, continuous ℓ:

∃ℓ : X 7→ R =⇒ ℓ(Z) ≤ ℓ(Y ),

In fact,

∀ |Z {z

∈ C}, ∀Y ∈ B

∀X∈X0

ℓ(X) ≤ inf ℓ(Y ) := b ∈ R.

Y ∈B

By properties of ℓ we have:

ℓ(X)

(1) ℓ(X) ≥ 0, X ≥ 0

b

which means we can normalize: ℓ(X)

=

(2)

ℓ(1) > 0

ℓ(1)

Verifying these two properties.

(1) Y ≥ 0 ⇒ ℓ(Y ) ≥ 0 We first claim that:

Y ≥ 0 =⇒ 1 + λY ∈ B, ∀λ > 0

By monotonicity,

Y ≥ 0 =⇒ λY ≥ 0 =⇒ ρ(λY ) ≤ ρ(0)

We can exploit the following relationship: 1 + λY > λY .

ρ(1 + λY ) = ρ(λY ) − 1 < ρ(λY ) ≤ ρ(0) = 0

So 1+λY ∈ B. Now, for X 6∈ B (with ρ(X) = 0) we apply the inequality

for ℓ, and also use that ℓ is a linear functional:

ℓ(X) ≤ ℓ(1 + λY ) = ℓ(1) + λℓ(Y ), ∀λ > 0.

This holds for all λ, so this inequality would not be possible if ℓ(Y ) < 0,

hence ℓ(Y ) ≥ 0.

(2) ℓ(1) > 0 For some Y ∈ X we have

0 < ℓ(Y ) = ℓ(Y + ) − ℓ(Y − )

Also,

kY k := sup |Y (ω)| = sup Y + (ω) + Y − (ω) < 1

ω∈Ω

ω∈Ω

20

From these equations, we know that

ℓ(Y + ) > 0,

and 1 > Y + + Y − ≥ Y + ≥ 0

=⇒ 1 − Y + > 0 =⇒ ℓ(1 − Y + ) ≥ 0

Now we can use linearity of ℓ again:

ℓ(1) = ℓ(1 − Y + + Y + ) = ℓ(1 − Y + ) + ℓ(Y + ) > 0 =⇒ ℓ(1) > 0

| {z } | {z }

≥0

>0

b

The normalized ℓ(X)

:= ℓ(X)/ℓ(1) for X ∈ X is in a one-to-one relationship

b

with some Q.

b

EQb [X] = ℓ(X),

X∈X

With this we can derive the following inequality (in (⋆) we are reducing the

set, which we will verify)

(⋆)

b )=− b

b

b = sup E b [−Y ] ≥ sup E b [−Y ] = sup ℓ(−Y

) = − inf ℓ(Y

αmin (Q)

Q

Q

Y ∈B

ℓ(1)

Y ∈B

Y ∈B

Y ∈Aρ

Now we verify that we can do the step indicated by (⋆). This is true if B ⊆ Aρ ,

which is true if any arbitrary element Y ∈ B is automatically in Aρ , but by

the defining properties of each set this is true:

Y ∈ B =⇒ ρ(Y ) < 0 =⇒ ρ(Y ) ≤ 0 =⇒ Y ∈ Aρ , =⇒ B ⊆ Aρ.

To derive the other inequality,

Y ∈ Aρ , ∀ε > 0 =⇒ Y + ε ∈ B, since ρ(Y + ε) = ρ(Y ) − ε < 0

Now, for all ε > 0 and all Y ∈ Aρ ,

b

sup EQb [−Z] ≥ EQb [−(Y + ε)] =⇒ sup EQb [−Z] ≥ sup EQb [−Y ] = αmin (Q)

Z∈B

Z∈B

Y ∈Aρ

b =

Combining these inequalities, we have αmin (Q)

b

b = ℓ(−X)

EQb [−X] − αmin (Q)

−

−

−b

.

ℓ(1)

b b − ℓ(X)

=

≥ 0 = ρ(X)

ℓ(1)

ℓ(1)

b ∈ M1,f ,

which is true for all X ∈ X0 . We have, for some Q

b

ρ(X) ≤ EQb [−X] − αmin (Q)

21

b so we can take the sup and keep the

The left side is independent of Q,

inequality.

ρ(X) ≤ sup EQ [−X] − αmin (Q)

Q∈M1,f

and we have proved the representation of ρ from Theorem 4.15.

Now we verify that αmin is the smallest penalty function. From our

representation theorem and for some α:

ρ(X) = sup EQ (−X) − α(Q) ≥ EQ [−X] − α(Q)

Q∈M1,f

Shifting terms, we get:

α(Q) ≥ EQ [−X] − ρ(X)

We get:

α(Q)

≥ sup EQ [−X] − ρ(X)

X∈X ≥ sup EQ [−X] − ρ(X)

since Aρ ⊆ X

X∈Aρ

≥ sup EQ [−X]

X∈Aρ

since X ∈ Aρ ⇒ ρ(X) ≤ 0

so α(Q) ≥ αmin (Q).

= αmin (Q)

Remarks: From Theorem 4.15 we have:

αmin (Q) = sup EQ [−X]

ρ(X) ≥ EQ [−X] − αmin (Q), ∀X

and

Aρ

So,

αmin (Q) ≥ EQ [−X] − ρ(X) =⇒

αmin (Q) ≥ sup

X∈Aρ

EQ [−X] − ρ(X)

≥ sup EQ [−X] = αmin (Q) =⇒

X∈Aρ

αmin (Q) = sup

X∈Aρ

EQ [−X] − ρ(X)

22

(♥)

Definition A.59 [FS 430] - Fenchel-Lengendre Transform

For a function f : X 7→ R ∪ {∞}, we define the Fenchel-Legendre transform,

f ∗ : X ′ 7→ R ∪ {±∞} by

f ∗ (ℓ) := sup ℓ(X) − f (X) , ℓ ∈ X ′ .

X∈X

If f 6≡ ∞, then f ∗ is a proper convex (true for risk measures) and lower

semicontinuous function as the supremum of affine functions.

lim inf f ∗ (ℓ) ≥ f ∗ (ℓ0 )

ℓ→ℓ0

(ℓ converges to ℓ0 in X ′ in the weak star sense). If f is itself a proper convex

function, then f ∗ is proper convex and lower semicontinuous. We call f ∗

the conjugate functional. Theorem A.61 [FS 431] states that if f is lower

semicontinuous, then f ∗∗ = f .

Remark [FS 164]: In view of this, we have that the equation (♥) corresponds

to the Fenchel-Legendre transform (or conjugate function) of the convex

function ρ on the Banach space X . More precisely:

αmin (Q) = ρ∗ (ℓQ )

where ρ∗ : X ′ → R ∪ {+∞} is defined on the dual X ′ of X by

ρ∗ (ℓ) = sup ℓ(X) − ρ(X)

X∈X

and where ℓQ (X) = EQ [−X] for X ∈ X and Q ∈ M1,f .

Given a set A, we can find a risk measure:

ρA (X) = inf m ∈ R | m + X ∈ A

By Theorem 4.15, this r.m has the representation:

ρA (X) = max EQ [−X] − αmin (Q)

Q∈M1,f

where:

αmin (Q) = sup EQ [−X] ≥ sup EQ [−X].

X∈AρA

X∈A

23

We want to have an expression for αmin with A and not AρA . We know the

following inequality is true, but now we want to derive the opposite inequality

and get the expression with only A.

Y ∈ AρA =⇒ ρ(Y ) ≤ 0

∀ε > 0, ρ(Y + ε) = ρ(Y ) − ε < 0 =⇒ Y + ε ∈ A

sup EQ [−X] ≥ EQ [−(Y + ε)]

X∈A

sup EQ [−X] ≥ sup EQ [−Y ].

X∈A

Y ∈AρA

This shows that we have αmin (Q) = supX∈A EQ [−X].

Corollary 4.18 [FS 165]

If ρ is a coherent risk measure, then

0

in Qmax ⊆ M1,f

αmin (Q) =

c

+∞ in Qmax

Qmax is a convex set and it is the largest set where you can find a

representation

ρ(X) = sup EQ [−X] − αmin (Q) = max EQ [−X].

Q∈Qmax

Q∈M1,f

We define

Qmax := Q ∈ M1,f | αmin (Q) = 0

Proof

From Proposition 4.6 we know that the acceptance set Aρ of a coherent r.m

is a cone. For λ > 0 we apply positive homogeneity:

αmin (Q) = sup EQ [−X] = sup EQ [−λX] = λ· sup EQ [−X] = λ·αmin (Q).

X∈Aρ

λX∈Aρ

λX∈Aρ

This is true for all Q ∈ M1,f and λ >. Hence αmin can only take values 0

and +∞.

Now we focus our attention to the convex risk measures that admit a

representation in terms of the σ-additive probability measures. Such measures

24

ρ can be represented by a penalty function α which is infinite outside the set

M1 := M1 (Ω, F ).

ρ(X) = sup EQ [−X] − α(Q)

(⋆)

Q∈M1

Lemma 4.20 [FS 166]

If a convex risk measure admits the representation (⋆), then it is

(a) continuous from above:

Xn ց X =⇒ ρ(Xn ) ր ρ(X).

(b) Property (a) is equivalent to lower semicontinuity with respect to

bounded pointwise conergence. If {Xn } is a bounded sequence in X

which converges pointwise to X ∈ X , then

ρ(X) ≤ lim inf ρ(Xn ).

n→∞

Proof

We show that (⋆) ⇒ (a), then (a) ⇒ (b) and finally (b) ⇒ (a).

(⋆) ⇒ (a)

Xn → X is a bounded sequence, so by dominated convergence, E[Xn ] →

E[X]. For all Q ∈ M1

lim EQ [−Xn ] − α(Q)

Q∈M1 n→∞

≤ lim inf sup EQ [−Xn ] − α(Q)

(⋆)

ρ(X) = sup

n→∞

Q∈M1

= lim inf ρ(Xn )

n→∞

We use the liminf because we don’t know if we have convergence.

(b) ⇒ (a)

For Xn ց X we have ρ(Xn ) ≤ ρ(X), since ρ(Xn ) ≤ ρ(Xn+1 ) etc. This

means: limn→∞ ρ(Xn ) ≤ ρ(X) but as we verified in the first step: ρ(X) ≤

lim inf ρ(Xn ), thus

n→∞

ρ(X) = lim ρ(Xn )

n→∞

(a) ⇒ (b)

Xn → X is a bounded sequence. If we define Ym := supn≥m Xn we have

25

a decreasing sequence (and we know that Ym ց X). By monotonicity,

Yn ≥ Xn ⇒ ρ(Yn ) ≤ ρ(Xn ), so since Yn ց X:

ρ(X) = lim ρ(Yn ) ≤ lim inf ρ(Xn )

n→∞

n→∞

Proposition 4.21 [FS 167]

Let ρ be a convex risk measure which is continuous from below:

Xn ր X =⇒ ρ(Xn ) ց ρ(X).

Let α be some penalty function in

ρ(X) = max EQ [−X] − α(Q) .

M1,f

Then α is concentrated on the class M1 of probability measures, i.e

α(Q) < ∞ =⇒ Q is additive.

Proof

Result follows since we know Q ∈ M1,f , which is all we need.

Q is σ-additive ⇐⇒ An ր Ω : Q(An ) ր Q(Ω) = 1

Lemma 4.22 [FS 167] (Not proved)

Let ρ be a convex risk measure with the usual representation:

ρ(X) = max EQ [−X] − α(Q) .

Q∈M1,f

Now consider the set:

Λc := Q ∈ M1,f | α(Q) ≤ c ,

[

Q ∈ M1,f | α(Q) < ∞ =

Λc

c

for c > −ρ(0) = inf Q∈M1,f α(Q) > −∞. Then for any sequence {Xn } in X

where 0 ≤ Xn ≤ 1, the following two statements are equivalent.

ρ(λX) → ρ(λ), ∀λ ≥ 1

26

inf EQ [Xn ] → 1, ∀c > −ρ(0).

Q∈Λc

Sketch of proof

For all λ ≥ 0,

ρ(λ1An ) → ρ(λ1Ω ) = ρ(λ).

By monotonicity, Q(An ) ≤ Q(An+1 ), so

inf Q(An ) ≤ inf Q(An+1 ),

Q∈Λc

Q∈Λc

and we have a growing sequence. By monotone convergence,

inf Q(An ) ր 1, ∀c =⇒ Q(An ) ր 1.

Q∈Λc

Remark: If ρ is convex and continuous from below, then, by Proposition 4.21:

ρ(X) = sup EQ [−X] − α(Q)

Q∈M1

and then, by Lemma 4.20, ρ is continuous from above, which implies that for

all bounded sequences, we can use the dominated convergence theorem, so

Xn → X means that ρ(Xn ) → ρ(X).

From now on, we make some assumptions:

Ω

F = B(Ω)

X

Cb (Ω) ⊂ X

Separable metric space

the Borel σ-algebra on Ω.

linear space of bounded functions on (Ω, F )

Bounded, continuous functions on Ω.

Proposition 4.25 [FS 168]

If ρ : X 7→ R is a convex risk measure on X such that ρ(Xn ) ց ρ(λ) for any

pointwise convergence Xn ր X, where Xn ∈ Cb (Ω) for all n and λ > 0, then

there exists a penalty function α : M1 7→ R ∪ {∞} such that

ρ(X) = sup EQ [−X] − α(Q) , X ∈ Cb (Ω).

Q∈M1

General representation (true for a larger set)

ρ(X) = max EQ [−X] − αmin (Q) , X ∈ X

Q∈M1

We can choose α:

α(Q) =

inf

e

Q∈M

1,f

e ,

αmin (Q)

EQe [Y ] = EQ [Y ], ∀Y ∈ Cb (Ω)

27

10.02.11

The equality between the expectations is a special kind of equality, similar

to equality under distributions.

Recall:

αmin (Q) = sup EQ [−X] = sup EQ [−X] − ρ(X)

X∈X

X∈Aρ

4.3 Convex Risk Measures on L∞ [FS 171]

From now on we assume we have a fixed probability measure P on (Ω, F ),

identify X as L∞ and consider risk measures ρ such that

ρ(X) = ρ(Y ),

if X = Y P − a.s.

(4.28)

Lemma 4.30 [FS 172]

If ρ is a convex risk measure satisfying (4.28), and it has the representation

ρ(X) = sup EQ [−X] − α(Q) ,

Q∈M1,f

then α(Q) = +∞ for any Q ∈ M1,f (Ω, F ) which is not absolutely continuous

wrt P . (Q is abs. cont. to P , Q ≪ P if P (A) = 0 =⇒ Q(A) = 0).

Proof

Assume Q 6≪ P , then ∃A ∈ F such that P (A) = 0 and Q(A) > 0. Take some

X ∈ Aρ = X ∈ X | ρ(X) = 0 ,

and construct a sequence Xn := X − n · 1A , so Xn = X P -a.s, which means

ρ(Xn ) = ρ(X).

e

0 ≥ ρ(Xn ) = sup EQ [−Xn ] − α(Q) ≥ EQe [−Xn ] − α(Q)

Q∈M1,f

e

e =⇒

= EQe [−X] + n Q(A)

−αQ

| {z }

>0

e ≥ E e [−X] + nQ(A)

e

α(Q)

Q

The same argument applies to the representation of ρ via αmin

e

e = sup EQ [−X] ≥ E e [−X] + nQ(A)

=⇒

αmin (Q)

Q

X∈Aρ

e ≥ αmin (Q)

e ≥ E e [−X] + n · Q(A)

e

α(Q)

−→ ∞

Q

n→∞

28

Theorem 4.31 [FS 172]

Suppose ρ : L∞ 7→ R is a convex risk measure. Then the following statements

are equivalent.

(a) ρ can be represented by some penalty function on M1 (P ) ⊆ M1 , where

M1 (P ) = Q | Q ≪ P

(b) ρ admits the representation

ρ(X) = sup

EQ [−X] − αmin (Q) , X ∈ L∞

Q∈M1,f (P )

where αmin M1 (P ) = αmin .

(c) ρ is continuous from above: if ∀Xn ց X P -a.s, then ρ(Xn ) ր ρ(X).

(d) The “Fatou property”. For any bounded sequence Xn → X (P -a.s

pointwise convergence):

ρ(X) ≤ lim inf ρ(Xn )

n→∞

(e) ρ is lower semicontinuous for the weak∗ topology on L∞ .

(f) The set Aρ ⊂ L∞ is weak∗ closed.

Proof

We will prove (b) ⇒ (a) ⇒ (c) ⇒ (d) ⇒ (e) ⇒ (f ) ⇒ (b).

(b) ⇒ (a). This is obvious.

(a) ⇒ (c). Recall Lemma 4.20 part (a). For ρ : X 7→ R and ρ(X) given as in

Lemma 4.20, we have continuity from above.

(c) ⇒ (d). Lemma 4.20 part (b). Continuity from above is equivalent to

ρ(X) ≤ limn→∞ ρ(Xn ) for all Xn → X where {Xn } is bounded. P -a.s.

(d) ⇒ (e). We have lower semi-continuity for ρ if ∀c ∈ R the set C ,

{X ∈ L∞ | ρ(X) ≤ c} := C

is closed (in the weak∗ sense). For weak∗ convergence we must specify

closedness. Note that C is convex, since for X, Y ∈ C and some λ ∈ [0, 1]

(using that ρ is convex):

ρ λX + (1 − λ)Y ≤ λρ(X) + (1 − λ)ρ(Y ) ≤ λc + (1 − λ)c = c

29

=⇒ λX + (1 − λ)Y ∈ C

The set C is weak∗ closed if ∀r > 0, the set Cr ,

Cr := C ∩ Y ∈ L∞ kY k∞ ≤ r

L

1

is closed in L1 . Take a sequence Xn ∈ Cr such that for all n, Xn −→

X. We

want to show that X ∈ Cr , which means it is closed. Every Xn is bounded,

so the limit X is also bounded, and hence

X ∈ Y ∈ L∞ kY k∞ ≤ r .

Now for L1 convergence, we have a subsequence that converges P -a.s.in a

pointwise sense: ∃{Xnk }k ⊆ {Xn }n such that Xnk −→ X. Then property (d)

k→∞

tells us:

ρ(X) ≤ lim inf ρ(Xnk ) ≤ c =⇒ X ∈ C .

k→∞

This proves that C is a closed set.

(e) ⇒ (f ). For Aρ : X | ρ(X) ≤ 0 just take c = 0 in C and we are done.

(f ) ⇒ (b). Given a X ∈ L∞ , and defining

m :=

sup

Q∈M1 (O)

EQ [−X] − αmin (Q) .

We want to show that m = ρ(X) and do that by showing that ρ(X) ≥ m

and then ρ(X) ≤ m.

For the first inequality:

ρ(X) = max

Q∈M1,f

≥

EQ [−X] − αmin (Q)

sup {EQ [−X] − αmin (Q) = m.

Q∈M1 (P )

For the other inequality, we use the representation:

ρ(X) = inf a ∈ R | X + a ∈ Aρ .

With this we want to show that ρ(X) ≤ m, which by cash invariance amounts

to ρ(X + m) ≤ 0 which is equivalent to showing that X + m ∈ Aρ . For a

contradiction we assume m + X 6∈ Aρ . Since ρ is a convex measure, we know

that Aρ is a convex set. By our assumption that (d) is true, we also have

that Aρ is weak∗ closed.

30

We define the single point set B = {X + m}, and by our assumption B 6∈ Aρ ,

so B ∩Aρ = ∅. By applying the Hahn-Banach Theorem (Thm A.56 [FS 429]),

∃ℓ : L∞ 7→ R which is non-zero, linear and continuous such that

sup ℓ(X + m) < inf ℓ(Y ) abbreviated as γ < β.

Y ∈Aρ

B

(⋆)

we also know that −∞ < γ. We always have the representation ℓ(Y ) = E[Y Z]

for Y ∈ L∞ and Z ∈ L1 , where Z ≥ 0, P -a.s., and P (Z > 0) > 1.

Now take Y ≥ 0 and λ > 0, which means:

λY ≥ λ·0 =⇒ ρ(λY ) ≤ ρ(0) =⇒ ρ λY +ρ(0) ≤ 0 =⇒ λY +ρ(0) ∈ Aρ

By (⋆),

γ

ℓ(ρ(0))

γ < ℓ λY + ρ(0) = λℓ(Y ) + ℓ(ρ(0)) =⇒

= ℓ(y) +

λ

λ

and when passing to the limit: λ → ∞, 0 ≤ ℓ(Y ) = E[Y Z]. Now define

Z

0

Q0 ∈ M1 (P ), given by dQ

= E[Z]

, which implies

dP

h

Z i

=⇒

EQ0 [Y ] = E Y ·

E[Z]

β = inf ℓ(Y ) = inf EQ0 [Y ] · E[Z] =⇒

Y ∈Aρ

Y ∈Aρ

β

= sup EQ [−Y ] = αmin (Q0 )

E[Z] Y ∈Aρ

Hence, (with the strict inequality a consequence of (⋆)):

EQ0 [X] + m =

ℓ(X + m)

β

<

= −αmin (Q0 ) =⇒

E[Z]

E[Z]

m < EQ0 [−X] − αmin (Q0 )

This is a contradiction, since by definition:

m = sup

EQ [−X] − αmin (Q) .

Q∈M1 (P )

Our assumption that m + X 6∈ Aρ was false, so ρ(X) ≤ m and we have

proved ρ(X) = m.

31

Entropic Risk Measure

For risk measures Q and P we have the relative entropy:

h

i

dQ

dQ

dQ

EQ log

=E

if Q ≪ P

log

dP

dP

dP

H(Q | P ) =

+∞

otherwise

(⋆)

We have H(Q|P ) = 0 if Q = P . (For f (x) = x·log x ⇒ Jensen’s inequality).

For β > 0 we set:

α(Q) =

1

H(Q|P ).

β

With this we have risk measure for when we strongly believe that P is the

correct measure.

ρ(X) =

1

EQ [−X] − H(Q|P )

β

Q∈M1 (P )

sup

(⋆⋆)

An alternative representation of the expression in (⋆), (but one that isn’t

very important to us) is

H(Q|P ) = (⋆) = sup EQ [−Z] − log E[eZ ] .

Z∈L∞

If we set Z = −βX in this expression, and remove the supremum, we have:

H(Q|P ) ≥ EQ [−βX] − log E[e−βX ]

1

1

1

H(Q|P ) ≥ EQ [−βX] − log E[e−βX ]

β

β

β

1

1

H(Q|P ) ≥ EQ [−X] − log E[e−βX ]

β

β

1

1

log E[e−βX ] ≥ EQ [−X] − H(Q|P )

β

β

The left side is now independent of Q, so we can take the supremum on the

right.

1

1

log E[e−βX ] ≥ sup

EQ [−X] − H(Q|P ) = ρ(X)

β

β

Q∈M1 (P )

For a particular choice:

b

dQ

e−βX

=

dP

E[e−βX ]

32

(♠)

we derive from (⋆):

and

so,

b

b

d

Q

d

Q

b )=E

H(Q|P

log

dP

dP

−βX

e−βX

e

log

=E

E[e−βX ]

E[e−βX ]

−βX e

−βX

−βX

=E

log e

− log E[e

]

E[e−βX ]

−βX

e

−βX

− βX − log E[e

]

=E

E[e−βX ]

h

bi

e−βX

dQ

= E −X ·

EQb [−X] = E − X ·

dP

E[e−βX ]

1

b )=

EQb [−X] − H(Q|P

β

−βX

1

e

e−βX

−βX

− E

− βX − log E[e

] =

E −X ·

E[e−βX ]

β E[e−βX ]

−βX

e−βX

e

1

−βX

E −X ·

−E

− X − log E[e

] =

E[e−βX ]

E[e−βX ]

β

−βX

e−βX 1

e−βX

e

−βX

log E[e

] =

E −X

· −βX + X · −βX +

] E[e

] E[e−βX ] β

E[e

h e−βX 1

i

i

h1

1

−βX

−βX

E

e

=

E

log

E[e

]

= E[e−βX ]

b

Q

−βX

E[e

]β

β

β

b

The Q-expectation

disappears because the interior is just a number.

Summarising, we have:

EQb [−X] −

1

b ) = 1 E[e−βX ]

H(Q|P

β

β

Taking the supremum over all Q on the left side, we get the reverse inequality

from (♠), so:

1

ρ(X) = log E[e−βX ]

β

The logarithm is not a linear function, so for λ ≥ 0 we have ρ(λX) 6= λρ(X).

The measure is in fact normalized, but it is not coherent since it is not

homogeneous.

33

For the representation:

ρ(X) =

sup

Q∈M1 (P )

EQ [−X] − αmin (Q)

we see from equation (⋆⋆) that αmin = β1 H(Q|P ).

By definition (X = L∞ ):

αmin (Q) = sup EQ [−X] = sup EQ [−X] − ρ(X)

X∈X

X∈Aρ

1

1

EQ [−X] − log E[e−βX ] = H(Q|P )

β

β

X∈L∞

= sup

Definition 4.32 [FS 173]

A convex risk measure is sensitive (or relevant) w.r.t P if:

ρ(−X) > ρ(0) ∀X ∈ L∞ such that X ≥ 0 P -a.s., P (X > 0) > 0.

Corollary 4.35 [FS 175]

For a coherent risk measure ρ on L∞ , the following conditions are equivalent.

(a) ρ is continuous from below:

∀Xn ր X P -a.s. =⇒ ρ(Xn ) ց ρ(X).

(b) There exists a set Q :

Q ⊂ M1 (P ) such that ρ(X) = sup EQ [−X].

Q⊂Q

(c) There exists a set Q ⊂ M1 (P ) representing ρ such that the set of densities:

dQ D :=

Q∈Q

dP

is weakly compact in L1 (P ).

So a coherent risk measure on L∞ can be represented on Q ⊂ M1 (P ) if, and

only if the conditions of this corollary are met. We can use:

Qmax := Q ∈ M1 (P ) | αmin (Q) = 0 .

34

Recall: M1,f denotes the set of measures that sum to 1, and are finitely 17.02.11

additive. M1 denotes the set of measures that sum to 1 and are σ-additive.

X dentes the set of bounded random variables.

If ρ is a convex risk measure

ρ(X) = max

Q∈M1,f

EQ [−X] − αmin (Q)

with αmin (Q) = supX∈Aρ E[−X] for finitely additive probability measures.

ρ(X) = sup EQ [−X] − α(Q)

Q∈M1

for σ-additive probability measures. This implies continuity above, which

actually is equivalent to the Fatou property: ρ(X) ≤ lim inf ρ(Xn ), and since

n→∞

{Xn } is a bounded sequence, we have P -a.s convergence Xn → X. It is

important to know what kind of convergence you have!

Convergence

In the box, the probability measure P is fixed. For the ⋆-implication

we use dominated convergence or monotone convergence. For the ⋆⋆implication we use uniform integrability. In general we do not have

equivalence between the convergence types. For our applications, convergence

in measure is convergence in probability measures. Finally, the weakest kind

of convergence: convergence in distribution, is on that does not depend on

the measure space.

For a risk measure X = {bounded r.v}. ρX → R that is convex (P equiv.?)

we have the representation

ρ(X) = sup

EQ [−X] − α(Q)

Q∈M1 (P )

35

where

M1 (P ) = Q prob. measure on F | Q ≪ P .

For convex risk measures on L∞ we have a representation property, lower

semicontinuity:

ρ(X) ≤ lim⋆ inf ρ(Y )

Y →X

for a weak ⋆ convergence.

We will now consider spaces X = Lp for p ∈ [1, ∞] and its dual space:

X ′ = ℓ | X → R are linear continuous .

For X = Lp for p ∈ (1, ∞), the dual is X ′ = Lq where

1

p

+

1

q

= 1.

For X = L1 , the dual is X ′ = L∞ .

For X = L∞ , the dual is X ′ ≃ ba(P ), which are the bounded, signed,

finite, additive measures that are absolutely continuous wrt P . In general

L1 ⊆ ba(P ).

Riesz Representation Theorem

For p ∈ [1, ∞). Let ℓ : Lp → R be linearly continuous (then ℓ ∈ L′p , the dual

space). Then there exists a unique g ∈ Lq (Lq = L′p ) such that

Z

ell(X) = gXdP, ∀X ∈ Lp = E[gX]

where g is unique P -a.s. (All linear functionals have the form of the

expectations).

For p = ∞. Let ℓ : L∞ → R be linearly continuous. Then ∃µ ∈ ba(P ) such

that

Z

ℓ(X) = Xdµ.

(we will use the weak ⋆ topology as a convention).

Expectations can be written as linear function and vice versa.

Result

The (convex?) measure ρ : X → R admits the representation

ρ(X) = sup ℓ(X) − α(ℓ)

ℓ∈P

where α : X ′ → R ∪ {∞} is convex, and P ⊆ X ′ is convex.

36

Theorem

a) If ρ : X → R is

convex and lower semicontinuous, i.e for all c ∈ R,

C = X : ρ(X) ≤ c is a closed set. Then

ρ(X) = sup ℓ(X) − α(ℓ) , X ∈ X .

ℓ∈X ′

b) The converse is true.

Proof Sketch

Let c ∈ R, and C = X ∈ Lp = X ρ(X) ≤ c ⊆ Lp . Since ρ is convex,

then so is C .

n

C = X ∈ Lp

n

= X ∈ Lp

o

sup ℓ(X) − α(ℓ)

′

ℓ∈X o

sup E[gX] − α(ℓ)

g∈Lq

Lp

Take a sequence {Xn } ∈ C for all n and we consider if Xn → X. If X ∈ C ,

then C is closed.

E[gXn ] − α(ℓ) ≤ ρ(Xn ) ≤ c,

∀g∈Lq

∀n

Passing to the limit:

E[gX] − α(g) ≤ c

∀g

Take the sup and we are done.

Proposition

If ρ : X → R is convex, lower semicontinuous and

ρ(X) ≤ ρ(0), ∀X ≥ 0 (monotonicity),

then

ρ(X) = sup ℓ(−X) − α(ℓ) ,

′

X+

where

X∈X

X+′ = ℓ ∈ X ′ | ℓ(X) > 0, X ≥ 0

(ℓ(0) = 0).

37

(♣)

Remark: If ρ is convex and lower semicontinuous, then (♣) is equivalent to

monotone:

ρ(X) ≤ ρ(Y ), ∀X ≥ Y.

The converse is also true.

From now on, we will regard X as Lp spaces for p ∈ [1, ∞].

Proposition

1) If ρ : X → R is convex, lower semicontinuous and ∀X ≥ 0; ρ(X) ≤ ρ(0),

then

ρ(X) = sup ℓ(−X) − α(ℓ) , X ∈ X .

ℓ∈P

P = X+′ = ℓ ∈ X ′ ℓ(X) ≥ 0, X ≥ 0 .

The converse is also true. (X+′ is the dual. The ℓ’s are linear functionals which

are related to the expectation. ℓ(−X) = E[Y (−X)] = EQ [−X]. See Riesz’

representation theorem, and the Radon-Nikodym theorem).

2) If ρ : X → R is convex, lower semi-continuous and ρ(0) = 0, then

= sup E[−Y X]

ρ(X) = sup ℓ(−X)

ℓ∈X ′

where

Y ∈Lq

X ′ = ℓX → R linear and cont. .

The converse is also true.

Revision:

We write L′p ≃ Lq , which is identifiable equality. From the definition of the

dual space, we have Lq and its dual is: L′p = Lq when q is the conjugate of p.

For ℓ ∈ Lq , we have ℓ : Lp → R. For the random variable Y : Ω → R, where

E[Y ] < ∞, we have ℓ(X) = E[Y X]. By a representation theorem, there is a

one-to-one correspondene: ℓ(·) = E[Y ·].

Proof of Proposition

1) ⇒) Since ρ is convex and lsc (lower semicontinuous) we have the general

representation

ρ(X) = sup ℓ(−X) − α(ℓ) , X ∈ X .

X∈X ′

We restrict this to finite α’s.

ρ(X) =

sup

X∈X ′ ,α(ℓ)<∞

ℓ(−X) − α(ℓ) = (⋆)

38

24.02.11

From X ≥ 0, ρ(X) ≤ ρ(0), we get, for all ℓ ∈ X ′ (and using that α(ℓ) < ∞):

ρ(X) ≤ ρ(0) =⇒

ℓ(−X) − α(ℓ) ≤ ρ(0) =⇒

ℓ(−X) ≤ α(ℓ) + ρ(0) < ∞ ∀X ≥ 0 =⇒

ℓ(−X) ≤ 0 ∀X ≥ 0

(Must be negative for this to be true for all X).

=⇒ ℓ(X) ≥ 0 =⇒ ℓ ∈ X+′ =⇒

(⋆) = sup ℓ(−X) − α(ℓ)

′

ℓ∈X+

⇐) From the shape of the representation, we know that ρ : X → R is convex

and lsc. It remains to show that ρ(X) ≤ ρ(0).

X ≥ 0 =⇒ ℓ(X) ≥ 0 =⇒ ℓ(−X) ≤ 0 =⇒

ρ(X) = sup ℓ(−X) − α(ℓ) ≤ sup 0 − α(ℓ) = − inf′ α(ℓ) =: ρ(0).

ℓ∈X+

′

ℓ∈X+

′

ℓ∈X+

2)

ρ(X) =

sup

ℓ∈X ′ ,α(ℓ)<∞

ℓ(−X) − α(ℓ) = sup{ℓ(−X)}

(Used 0 = ρ(0) = sup{−α(ℓ)}. Recall that ρ(0) is always represented by the

penalty function). The equality is verified by showing ≤ and ≥. Since we are

working with the sup, this is quite obvious.

ρ(X) =

sup

(⋆⋆)

ℓ(−X)

ℓ∈X ′ ,α(ℓ)=0

If ρ is lsc, convex and positive homogeneous, we get (⋆⋆) and ρ(0) = 0.

If ρ is lsc, convex, ρ(0) = 0 and sub additive, we get (⋆⋆) and positive

homogeneity.

If ρ is lsc and sub-linear (i.e sub-aditive and positive homogeneous), then we

get (⋆⋆), ρ(0) = 0 and convexity.

For the properties convex, positive homogeneous and sub-additivity, two of

these combined with ρ(0) = 0 imply the third one. Consider

ρ(X) ≤ ρ(Y ),

X ≥Y

and

ρ(X) ≤ ρ(0),

X ≥0

We immediately have ⇒, but for ⇐ we need convexity and lsc.

39

6 Backwards Stochastic Differential Equations [Ph 139]

Preliminaries/Revision

A complete probability space (Ω, F , P ), is a space where ∀A ∈ F , where

P (A) = 0, and ∀C ⊂ A then C ∈ F (and an obvious observation is that

P (C) = 0.

An probability space is P -augmented if all the P -null sets belong to F0 .

For a general space (Ω, F , P ), if A ∈ F and P (A) = 0, then A ∈ F0

but C ⊂ A 6⇒ C ∈ F0 . An example: Ω = {a, b, c, d}, we can have

F = ∅, {a, b}, {c, d}, Ω , then {a, b} ∈ F but a 6∈ F . Augmented and

completeness are not the same concepts.

For a measure space (Ω, F , P ), with the filtration F and the index set T (e.g

T = [0, T ]), we have the process {Xt }t∈T , where we write X : Ω × T → Rd or

X : T → {r.v. : Ω → R}.

Important properties the process can have:

1) Measurability: ∀A ∈ B(Rd ), X −1 (A) ∈ F × BT .

2) Adaptedness: ∀t ∈ T, Xt is Ft -measurable. (How randomness is moving

with time).

3) Progressive Measurability: ∀A ∈ Rd and ∀t ∈ T,

(ω, s) ∈ Ω × [0, t] X(ω, s) ∈ A = X −1 (A) ∩ (Ω × [0, t]) ∈ Ft × B[0, t]

Another way to see this is:

X [0,t] : Ω × [0, t] → Rd .

(Note: for (R, τ ) → (R, τ ), the topology τ is X −1 (O) ∈ τ . The σ-algebra is

generated by the topology, and is bigger than the topology. B(R) = σ{τ }).

Property 3) implies 1),2), but 1),2) does not imply 3)! However if X satisfies

1),2) then there exists a Y , which is a modification of X, that satsifies 3). If

X is 2) and is either right or left continuous, then it satisfies 3).

Predictability (used in integration)

P = A × (s, t] ∀A ∈ Fs , ∀s, t : 0 ≤ s ≤ t

For 1A×(s,t] (ω, u) = 1A (ω) × 1(s,t] (u), then A ∈ Fs . For simple functions

φ(u) =

N

X

ei (ω)1(ti−1 ,ti ) (u)

i=1

40

03.03.11

If ei (ω) ∈ Fti−1 -measurable, ei (ω) is left continuous.

Random Time

We define the concept of random time as a random variable τ : Ω → [0, ∞].

We call random time a stopping time if:

∀t, {τ ≤ t} ∈ Ft

(the stopping depends on the filtration). We call random time for optional

time if:

∀t, {τ < t} ∈ Ft

An optional time implies it is a stopping time. A stopping time is optional if

the filtration F is right continuous.

We say that F is right continuous if

Ft = Ft+ :=

\

u>t

Fu .

This is in general true for the filtration, since the information does not make

“jumps”.

If τ and σ are stopping times, then min(τ, σ) and sup(τ, σ) are stopping

times, and it is left as an exercise to verify that τ + σ is a stopping time.

Local Martingales - (terminology and notation from Karatzas & Shreve).

Definition: A local martingale, denoted with Mt for a finite or infinite time

horizon T is such that ∃{τn }n of F-stopping times, τn ր ∞ P -a.s as n → ∞

such that ∀n

Mt

0 ≤ t < τn is an F-martingale.

Mt∧τn :=

Mτn t ≥ τn

(A local martingale produces an infinite amount of local martingales).

From the definition of Mt , it follows that it is (1) adapted, (2) Mt ∈ L1 (P )

for all t and (3) E[Mt |Fs ] = Ms . (Martingales or Local Martingales?)

41

Uniform Integrability (K&S, Pham and Øksendal appendix)

For {Yt }t∈T ,

lim sup E |Yt |1{|Yt |>c} = 0

c→∞

t

Is E[|Yt |1{|Y −t|≤c} ≤ 0?

For Mt , t ∈ [0, T ] we can write Mt = E[MT |Ft]. For Mt with t ∈ [0, ∞)

we can write Ms = E[Mt |Fs ] for any future t, but in general we can

not write Ms = E[M∞ |Fs ], since M∞ may not exist. If M∞ exists and

limt→∞ Mt = M∞ , we can write it.

If the martingale converges P -a.s and in L1 (P ), it has right continuous

trajectories with left side limits, and we have uniform integrability.

(This isn’t true for the Girsanov transform Zt ? Zt → Z∞ as t → ∞, but

Zt 6= E[Z∞ |Ft ]).

- If Mt is a local martingale and

E[sup |Ms |] < ∞,

s≤t|

∀t,

then Mt is also a martingale.

- Mt is a local martingale, M0 ∈ L1 (P ) and Mt is non-negative, thn Mt is a

super martingale.

- If Mt is a continuous local martingale, M0 = 0 and Mt has finite total

variation:

n

X

Mt − Mt < ∞,

sup

i

i−1

t1 ,...,tn

i=1

then Mt ≡ 0. In Ito calculus we have the important equality (dBt )2 = dt,

which is a result from the quadratic variation.

The notation for local martingales is d < Bt >.

Burkholder-Davis-Gundy (BDG)

For all p > 0, there exists constants cp , Cp > 0 such that for all continuous

local martingales Mt , and for all stopping times τ < ∞ P -a.s., we have the

inequalities:

h

h

h

p2 i

p i

p2 i

cp E < Mt >τ

≤ E sup |Ms |

≤ Cp E < Mt >τ

0≤s≤τ

This inequality gives a sufficient condition to determine if Mt is a martingale.

42

Doob

Assume Mt for t ∈ [0, T ] (or t ∈ [0, ∞)) is a non-negative submartingale.

Then ∀τ stopping times, τ < ∞ P -a.s we have

E[M ]

τ

P sup |Mt | ≥ λ ≤

, λ>0

λ

0≤t≤τ

h

p i p p

E[|Mτ |p ], p > 1.

E sup |Mt |

≤

p

−

1

0≤t≤τ

Gives us an upper bound on the supremum, which we do not know.

Simple integrals (Elementary integrals)

1)

X

φn =

ei 1(ti−1 ,ti ]

i

where ei is Fti−1 -measurable and bounded. The set of such functions are

denoted by V[0, T ] in Øksendals book. From the step function we define the

simple integral:

X

It (φn ) =

ei ∆Bti .

i

2) The set {It (φn )}n are all in L2 (P ).

3) ∀φ ∈ V[0, T ], there exists φn such that φn → φ (in L2 (P × dt)).

4) {In (φn )} is a Cauchy sequence. Banach spaces (L2 ) are complete, so the

limit exists.

A common assumption:

hZ

E

T

0

i

φ2t dt < ∞

but for many applications this is too strong, for instance when we work with

local martingales. A way to relax this assumption is:

Z t

2

P

φt dt < ∞ = 1,

∀t

0

(in Øksendal’s notation this is the assumption for the set W[0, T ]). Under this

weaker assumption we loose the Ito isometry. Instead we have ψn → φ, a P a.s. pointwise convergence, and bound it with a stopping time. I(ψn ) → I(φ),

and

Z t

It (φ) =

φs dBs .

0

If φ ∈ V[0, T ] we have the standard Ito construction. If φ ∈ W[0, T ] this is a

local martingale and we don’t know if it is integrable.

43

On a probability space (Ω, F , P ), we have the Brownian motion Wt for

t ∈ [0, T ], T < ∞ and the filtration F = FW which is the filtration generated

by Brownian motion, F = {Ft | 0 ≤ t ≤ T }.

For a martingale Mt ∈ L2 (P ) for all t, we have, by the martingale

representation theorem:

Z t

Mt = M0 +

φs dWs

0

for some φ ∈ V[0, T ] and E[Mt ] = M0 . By the martingale property we also

have:

Mt = E[MT | Ft ],

∀t.

Now consider the equation

−dMt

MT

= 0dt − φt dWt

= ξ

We can find the solution to this with the martingale representation theorem

(MRT).

Z t

φs dWs

Mt = E[ξ] +

Mt

0

= E[ξ | Ft ]

If we exchange 0 in the equation with f (Mt , φt ) (called the driver), we have

a BSDE. Solutions to BSDE’s consist of a process Mt and the function

φ. We solve BSDE’s with the MRT and stochastic differentiation. For

ξ ∈ L2 (P ) being Ft -measurable, φt = Dt ξ (a non-anticipating derivative).

If ξ ∈ D1,2 ( L2 (P ), then φt = Dt ξ = E[Dt ξ|Ft]. (?)

They are called ’Backwards’ because we know the terminal point MT .

44

BSDE’s [Ph 139]

We have the Brownian motion Wt , the probability space (Ω, F , P ) with the

filtration generated by Brownian motion F = FW . For the theory of BSDE’s,

we always work with a finite, fixed time horizon T = [0, T ], T < ∞. Two

important spaces are:

S2 (0, T ), the set of real valued, progressively measurable processes Y such

that

E sup |Yt |2 < ∞,

t≤T

and H2 (0, T ), the set of Rd -values, progressively measurable processes Z such

that

hZ T

i

E

|Zt |2 dt < ∞.

0

For each BSDE we are given a pair (ξ, g), where ξ is the terminal condition

and the function g is called the driver (or the generator). Assumptions we

make:

(A)

(B)

−

−

−

ξ ∈ L2 (FT )

g : Ω × [0, T ] × R × Rd → such that:

g(·, t, y, z) ∼ g(t, y, z) is progressively measurable for all y,z

g(t, 0, 0) ∈ H2 (0, T )

g satisfies a uniform Lipschitz continuity in (y, z):

There exists a constant Cg such that

g(t, y1 , z1 ) − g(t, y2, z2 ) ≤ Cg y1 − y2 + z1 − z2 P -a.s., dt-a.e

for y1 , y2 ∈ R and z1 , z2 ∈ Rd .

A BSDE is an equation on the form:

−dYt = g(t, Yt , Zt )dt − Zt dWt

YT = ξ

Definition 6.2.1 [Ph 140]

A solution to a BSDE is a pair (Y, Z) ∈ S2 (0, T ) × H2 (0, T ) satisfying:

Z T

Z T

Yt = ξ +

g(s, Ys, Zs )ds −

Zs dWs , 0 ≤ t ≤ T.

t

t

45

Theorem 6.2.1 - Existence & Uniqueness [Ph 140]

Given a BSDE with the pair (ξ, g) satisfying the assumptions above, there

exists a unique solution (Y, Z).

Proof

We have the function Φ : S2 (0, T ) × H2 (0, T ) → S2 (0, T ) × H2 (0, T ), for

(U, V ) → Φ(U, V ). We define the martingale

Z

h

Mt := E ξ +

T

0

i

g(s, Us , Vs )ds Ft

which, under the assumptions in (A),(B), is square integrable: E[|Mt |2 ] < ∞

for all t. By the MRT we have

Z t

Mt = M0 +

Zs dWs , Z ∈ H2 (0, T ).

0

It follows from the MRT that Z exists and is unique. Next we define Yt .

Z T

h

i

Yt := E ξ +

g(s, Us , Vs )ds Ft

t

Z T

Z t

h

i

=E ξ+

g(s, Us , Vs )ds ±

g(s, Us, Vs )ds Ft

t

0

Z T

Z t

h

i

=E ξ+

g(s, Us , Vs ds) −

g(s, Us, Vs )ds Ft

0

0

Z t

Z T

h

i

=E ξ+

g(s, Us , Vs ds) Ft −

g(s, Us , Vs )ds

0

0

Z t

= Mt −

g(s, Us , Vs )ds

0

Z t

Z t

= M0 +

Zs dWs −

g(s, Us , Vs )ds

(⋆)

0

0

Similarly,

YT = ξ = MT −

= M0 +

Z

T

0

Z T

0

g(s, Us , Vs )ds

Z T

Zs dWs −

g(s, Us , Vs )ds

0

46

(⋆⋆)

Now we continue with (⋆):

Z t

Z t

Z T

Z T

(⋆) = M0 +

Zs dWs −

g(s, Us , Vs )ds ±

Zs dWs ±

g(s, Us , Vs )ds

0

0

t

t

Z T

Z T

Z T

Z T

Zs dWs +

g(s, Us , Vs )ds

= M0 +

Zs dWs −

g(s, Us , Vs )ds −

t

t

0

0

{z

}

|

=ξ−

=(⋆⋆)=YT =ξ

Z

T

Zs dWs +

t

Z

T

g(s, Us , Vs )ds

t

which is the general form of the solution to a BSDE. The next step is to show

that Y ∈ S2 (0, T ). Use that |a + b + c|2 ≤ 5(|a|2 + |b|2 + |c|2 ).

Z T

Z T

2 i

h

i

h

2

2

2

E[ sup |Yt | ] ≤ 5E[ξ ]+5E sup

|g(s, Us , Vs )| ds +5E sup Zs dWs 0≤t≤T

0≤t≤T

0≤t≤T

t

t

We want to determine if this is finite. The two first terms are finite, as the

first term is a constant in L2 (P ) and the second term is a continuous function

on a finite interval. The third term is unknown, but we can find an upper

bound by using Doob’s inequality.

2 i 2 2 h Z T

Z T

2 i

hZ T

i

h

·E

Zs dWs

= 4E

|Zs |2 ds < ∞.

E sup Zs dWs ≤

2−1

0≤t≤T

0

0

t

(The square of a martingale is a sub-martingale). The third term is also

finite, so Y ∈ S2 (0, T ). The final step is to verify that we have a contraction.

For the pairs (U, V ) and (U ′ , V ′ ), we define U = U − U ′ , V = V − V ′ and

g = g(t, Ut , Vt ) − g(t, Ut′ , Vt′ ). For some constant β > 0 that we determine

later, we apply Ito’s formula (product formula with some substitutions) to

2

eβs Y s , for 0 ≤ s ≤ T :

2

2

2

d eβs · Y s = βeβs Y s ds − 2eβs Y s g s ds + 2Y s eβs Z s dWs + eβs Z s ds

βT

2

T

2

0

e Y −Y =

hZ

2

E[Y 0 ]+E

0

T

eβs

Z

T

βs

e

0

βY s − 2Y s g s +

i

hZ

2

2

βY s +Z s ds = E

0

T

2

Z s ds

+2

Z

T

eβs Y s Z s dWs

0

i h Z T

i

βs

2e Y s g s ds +E 2

eβs Y s Z s dWs

0

|

{z

}

=0

The last term should be 0, which is the case if Y s Z s is a martingale, which we

will show separately. For now we simply assume that is 0. For the remaining

47

terms we work with the right hand side of the equality. Since g is constrained

(since it is Lipschitz), we get:

hZ T

i

hZ T

i

βs

E

2e Y s g s ds ≤ 2Cg E

eβs Y s U s + V s ds

0

0

√

2 · 2 · Cg Y s and b = (|U s | + |V s |)/ 2:

i 1 hZ T

hZ T

i

βs

2

βs 2

e U s + V s ds

≤ 4Cg E

e Y s ds + E

2

0

0

Using that ab ≤

a2

2

+

b2

,

2

for a =

√

Now we choose β = 1 + 4Cg2 , and obtain:

Z

hZ T

i

i 1 h T βs 2

2

2

βs

E[Y 0 ] + E

e U s + V s ds

e Y s + Z s ds ≤ E

2

0

0

This shows that Φ is a strict contraction on the Banach space S2 (0, T ) ×

H2 (0, T ) endowed with the norm:

hZ T

1

i 2

βs

2

2

.

k(Y, Z)kβ = E

e Ys + Zs ds

0

For a contraction in a complete space, we immediately get uniqueness and

existence. To conclude the proof, we have to verify that the term

h Z T

i

E 2

eβs Y s Z s dWs

0

is zero, which we do by applying the Burkholder-Davis-Gundy

(BDG)

q R

·

< 0 eβs Y s Z s dWs >t < ∞ for

inequality, and showing that it is finite: E

all t. We study the quadratic variation (by the Doob-Meyer decomposition),

and show that the quadratic variation is finite. We use that Y ∈ S2 (0, T )

(which, incidentally is the reason why we require that assumption), and use

the product to sum inequality ab ≤ (a2 + b2 )/2.

s

s

Z t

Z t

Z T

r

i

eβT h

2 2

2

2

2

2

2βs

βt

E

E sup Y t +

sup e Y t

Z s ds ≤

Z s ds < ∞

e Y s Z s ds ≤ E

2

t≤T

0≤t≤T

0

0

0

| {z } | {z }

∈S2 (0,T )

∈H2 (0,T )

This is finite, and this is a sufficient condition for a local martingale to be a

martingale, and hence the integral is 0 and the proof is concluded.

48

Linear BSDE

10.03.11

We continue using the spaces S2 (0, T ) and H2 (0, T ). In the Peng article, we

generally work with adapted processes Yt , while we work with progressively

measurable spaces in Pham, so Pham is more rigorous than Peng.

As we saw in the existence and uniqueness result, we know that the BSDE

is well defined when the pair (ξ, g) is given (final condition and a driver).

We recall that we have certain assumptions on the driver g, denoted by (B).

Sometimes we write the Lipschitz condition:

|g(t, y1, z1 ) − g(t, y2, z2 )| ≤ Cg |y1 − y2 | + |z1 − z2 |

|g(t, y1, z1 ) − g(t, y2, z2 )| ≤ ν|y1 − y2 | + µ|z1 − z2 |

where Cg = max(ν, µ).

Digression

Consider the BSDE given by:

−dYt = g(t, Yt , Zt )dt − Zt dWt

YT = ξ

where ξ ∈ L2 (Ω) and ξ is FT -measurable. What happens if ξ is Ft measurable

for some t < T ? This means that at some point t we reach the final

condition, which we already know. An exercise: If ξ is Ft -measurable, prove

that the solution applies to the interval [t, T ]. The solution is a couple

(Y· , Z· ) ∈ S2 (0, T ) × H2 (0, T ).

Remember that the solution of a BSDE is on the form:

Z T

h

i

Yt = E ξ +

g(u, Yu, Zu )duFt .

t

Since the integral goes from t to T , this is not a martingale. We get a proper

martingale (not just a local martingale) if we define

Z T

h

i

Mt = E ξ +

g(u, Yu, Zu )duFt .

0

Due to the assumptions we made on g (listed in (A)), g is integrable from 0

to T . From g you can get properties on Yt .

49

Linear BSDEs are BSDEs where we have the time dependent coefficients

At , Bt , Ct , and have the form:

−dYt = At Yt + Bt Zt + Ct dt − Zt dWt

YT = ξ

Both At and Bt are bounded, progressively measurable processes, and Ct ∈

H2 (0, T ).

Proposition 6.2.1 [Ph 142]

The unique solution (Y, Z) to the linear BSDE is given by

Z T

h

i

Γt Y t = E ΓT ξ +

Γu Cu du Ft , t ∈ [0, T ]

t

with the corresponding linear SDE, also called the adjoint or dual SDE.

dΓt = Γt At dt + Γt Bt dWt

Γ0 = 1

By solving the SDE, you also solve the linear BSDE.

Proof

By Ito’s product formula:

d(Γt Yt ) = Yt dΓt + Γt dYt + dΓt dYt

+ B dW − Γ A

Z

= Γt Yt At

dt

t

t

t t Yt + t Bt + Ct dt

+ Γt Zt dWt + Γt

Zt

Bt dt

= −Γt Ct dt + Γt (Yt Bt + Zt )dWt =⇒

Z t

Z t

Γt Yt = Γ0 Y0 −

Γu Cu du +

Γu Yu Bu + Zu dWu

0

0

Now, is this a local martingale? Rewrite the equation:

Z t

Z t

Γt Y t +

Γu Cu du = Γ0 Y0 +

Γu Yu Bu + Zu dWu

0

0

(and recall that Γ0 = 1). Now we apply the BDG-inequality for p = 1, and

get an estimate of the sup. Look at the quadratic variation (think of Ito

isometry. See definitio of quadratic variation which we can use for stochastic

integrals):

s

#

"s Z

Z t

·

2

Γ2u Yu Bu + Zu du ≤

<

Γu Yu Bu + Zu dWu > = E

E

0

0

50

r

E

sup Γ2u

u

sZ

t

2

Yu Bu + Zu du

0

Since both A and B are bounded, then so is Γ. Now we apply the product to

sum inequality: ab ≤ (a2 + b2 )/2. We also use that (c + d)2 = c2 + 2cd + d2 ≤

2c2 + 2d2 and |Bu | ≤ bmax for all u (it is bounded).

Z T

Z T

1

2

2

bmax Yu du + 2

Zu du < ∞

≤ E sup Γu + 2

2

u

0

0

To see that Γt is finie, just study E[supu Γ2u ]. From here you can show that

the expression for Γt Yt is a martingale, and not just a local martingale, which

concludes the proof.

Theorem 6.2.3 Comparison Theorem [Ph 142]

Let (ξ 1 , g 1) and (ξ 2 , g 2) be two pairs of terminal conditions and generators

satsifying the conditions in (A) and (B), and let (Y·1 , Z·1 ) and (Y·2 , Z·2 ) be

solutions to the corresponding BSDEs. Assume:

− ξ1 ≤ ξ2

P -a.s

1

1

1

2

1

1

− g (t, Yt , Zt ) ≤ g (t, Yt , Zt ) dt × dP a.e

− g 2 (t, Yt1 , Zt1 ) ∈ H2 (0, T )

Then Yt1 ≤ Yt2 for all 0 ≤ t ≤ T a.s.

Also, if Y02 ≤ Y01 , then Yt1 = Yt2 for 0 ≤ t ≤ T . In particular, if

P (ξ 1 < ξ 2 ) > 0, or if g 1 < g 2 (depends on time and ω) on a set of strictly

positive measure dt × dP , then Y01 < Y02 .

Proof

We define the differences:

Y·

Z·

= Y· 2 − Y· 1

= Z·2 − Z·1

The pair (Y · , Z · ) is a solution to the BSDE corresponding to the pair of

terminal condition and driver given by: (ξ 2 − ξ 1 , ∆y Y · + ∆z Z · + g), where

∆yt

g 2 (t, Yt2 , Zt2 ) − g 2(t, Yt1 , Zt2 )

· 1{Yt2 −Yt1 6=0}

:=

Yt2 − Yt1

51

∆zt :=

g 2(t, Yt1 , Zt2 ) − g 2 (t, Yt1 , Zt1 )

· 1{Zt2 −Zt1 6=0}

Zt2 − Zt1

g t := g 2 (t, Yt1 , Zt1 ) − g 1 (t, Yt1 , Zt1 )

Starting from the BSDE:

−dYt = dYt2 − dYt1

h

i

= g 2 (t, Yt2 , Zt2 ) − g 1 (t, Yt1 , Zt1 ) dt − (Zt2 − Zt1 )dWt

(⋆)

we work our way do incorporate ∆y and ∆z . We add and subtract terms.

g 2 (t, Yt2 , Zt2 ) − g 1 (t, Yt1 , Zt1 ) ± g 2 (t, Yt1 , Zt2 ) ± g 2 (t, Yt1 , Zt1 )

g 2 (t, Yt2 , Zt2 )−g 2 (t, Yt1 , Zt2 )+g 2 (t, Yt1 , Zt2 )−g 2 (t, Yt1 , Zt1 )+g 2 (t, Yt1 , Zt1 ) − g 1 (t, Yt1 , Zt1 )

{z

}

|

=g t

g 2(t, Yt1 , Zt2 ) − g 2(t, Yt1 , Zt1 ) 2

g 2 (t, Yt2 , Zt2 ) − g 2 (t, Yt1 , Zt2 ) 2

1

1

Y

−Y

+

Z

−Z

t

t

t

t +g t

Yt2 − Yt1

Zt2 − Zt1

∆yt Yt2 − Yt1 + ∆zt Zt2 − Zt1 + g t =⇒

h

i

(⋆) = ∆yt (Yt2 − Yt1 ) + ∆zt (Zt2 − Zt1 ) + g(t, Yt1 , Zt1 ) dt − Z t dWt

i

h

= ∆yt Y t + ∆zt Z t + g(t, Yt1 , Zt1 ) dt − Z t dWt

Both ∆yt and ∆zt are progressively measurable and bounded, and g ∈

H2 (0, T ). We see that this has the form of a linear BSDE where At = ∆yt ,

Bt = ∆zt and Ct = g t .

g(t, Y 1 , Z 1 ) = g 2 (t, Y 1 , Z 1 ) − g 1 (t, Y 1 , Z 1 ) =

t

t

t

t

t

t

2

g (t, Y 1 , Z 1 ) −g 2 (t, 0, 0) + g 2(t, 0, 0) −g 1(t, Y 1 , Z 1 ) −g 1 (t, 0, 0) + g 1(t, 0, 0) ≤

t

t

t

t

2

g (t, Y 1 , Z 1 )−g 2 (t, 0, 0)+g 2 (t, 0, 0)+g 1 (t, Y 1 , Z 1 )−g 1 (t, 0, 0)+g 1(t, 0, 0) ≤

t

t

t

t

Cg2 |Yt1 | + |Zt1 | + g 2 (t, 0, 0) + Cg1 |Yt1 | + |Zt1 | + g 1 (t, 0, 0)

The solution to the linear BSDE is given by:

Z T

h

i

Γt Y t = E ΓT ξ +

Γs g s ds Ft

t

with the adjoint SDE:

(

dΓt

Γ0

=

=

Γt ∆yt dt + ∆zt dWt

1

52

Since the expression for dΓt contains Γt , we know that it is on the form of

an exponential function, so Y t ≥ 0.

If Y01 = Y02 , we get Y 0 = 0, and since the integral grows to the left:

0 = E[Γ0 Y 0 ] ≥ E[Γt Yt ].

Now we see recall that a non-negative local martingale is a supermartingale.

A supermartingale with constant expectation is a martingale. Γt Y t ≥ 0 for

all t and E[Γt Y t ] ≥ 0, but E[Γt Y t ] = 0 for all t implies Γt Yt = 0, so in this

case we have Yt1 = Yt2 P -a.s.

Corollary

Let (ξ, g) satisfy:

(a)

ξ ≥ 0, P -a.s

(b)

g(t, 0, 0) ≥ 0, dP × dt-a.s.

Then the solution (Y· , Z· ) is such that Yt ≥ 0 for all t, P -a.e. Moreover, if

P (ξ > 0) > 0 or g(t, 0, 0) > 0, dP × dt-a.e, then Y0 > 0 P -a.s.

Proof