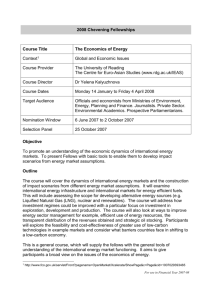

Low Carbon, High Stakes Do you have the power to transform?

advertisement