Business Groups Exist in Developed Markets Also: Britain since 1850 Geoffrey Jones

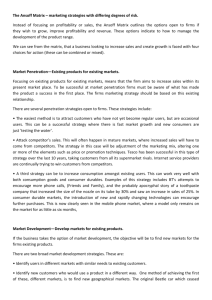

advertisement