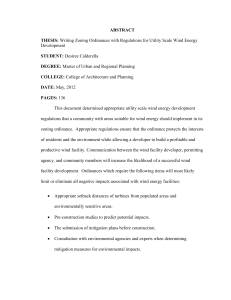

Zoning on the Urban Fringe Results from a New Approach to

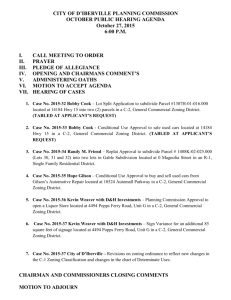

advertisement