Allows for donation of an employee’s accrued sick leave to another employee within the same state agency. Recipient HB 1771 Sick Leave Donation (SLD)

advertisement

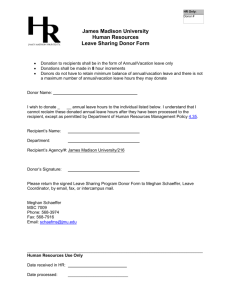

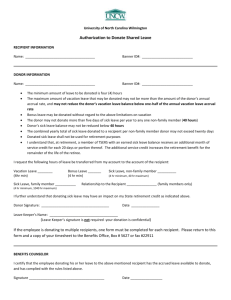

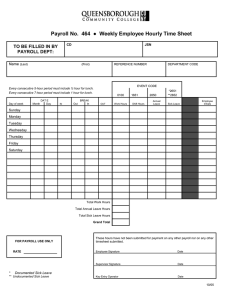

HB 1771 Sick Leave Donation (SLD) Allows for donation of an employee’s accrued sick leave to another employee within the same state agency. Recipient has to exhaust accrued sick leave including available draws from the sick leave pool. Unused hours cannot transfer to another agency or employee and cannot be paid out upon recipient termination of job. Institutional policy will also require vacation leave be exhausted before SLD hours are available. Donor ‐ ‐ ‐ Submit Direct Sick Leave Donation form to Payroll & Tax Services. Donor is taxed up to 32.65%. If additional Medicare threshold met then additional 0.9% is added. Receives notification from Payroll & Tax Services when donation has processed, sick leave hours have been adjusted, and taxes applied to on‐cycle payroll. Recipient ‐ ‐ ‐ Receives Sick Leave Recipient form for completion from Payroll & Tax Services. Nonexempt employee will report SLD on timesheet. Exempt employee elects SLD on leave report. Nonexempt employee will receive payment in on‐cycle payroll check. Exempt employee has adjustment processed and will receive a refund of tax withholding. Payroll ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ Calculate recipient’s SLD hours based on value of donated hours Apply taxes up to 32.65% to donor (FICA and FIT). Additional .09% Medicare, if applicable. Charge donor’s labor FOP(s) with proportional FICA match, including grant funds. Notify donor of taxes that will be withheld from earnings in the payroll cycle. Notify recipient of leave hours donated and request confirmation of acceptance of hours. Notify recipient’s supervisor and HR of SLD hours available and potential need to adjust LWOP. Bank recipient’s SLD hours (if needed) until sick leave, vacation leave, and sick leave pool are exhausted. Charge SLD hours used against recipient’s department labor FOP(s). Charge institutional fringes to recipient’s department (exclude FICA and FIT). Refund taxes withheld from exempt employees after leave report submitted claiming SLD hours. Perform quarterly edit checks: o Recipient reporting SLD with an existing sick leave balance. o Exclude SLD hours from death payout. o Remove SLD available hours upon job transfer between charts (agencies) or termination. o Adjust recipient SLD balance if pay rate changes. Human Resources ‐ ‐ ‐ Receives completed Recipient form from Payroll & Tax Services. Adjusts leave without pay (LWOP) status as needed. Notifies Payroll & Tax Services of Sick Leave Pool award/changes. *NOTE: Recipient is tied to institutional agency through home department/hiring department regardless of labor distribution. I acknowledge that I have read and understand the information provided in this document. (Donor Initials) Updated 1/4/2016 Examples of Donor Tax Calculation 1. Donor is an exempt employee and annual salary is $50,000, equivalent to $24.04/hour. (annual salary/months per year/hours per month)($50,000/12/173.33) Donor elects to donate 10 hours of available sick leave to employee A. Calculated gross amount of pay donated is $240.40. $240.40 in additional income will be included in donor’s gross wages on annual Form W‐2. Donor will also have taxes of $78.49 deducted from the next on‐cycle payroll and amounts withheld will also be reported on the annual Form W‐2. $240.40 x 25% (FIT) = $60.10 $240.40 x 7.65% (FICA) = $18.39 2. Donor is a non‐exempt employee and rate of pay is $17.50/hour. Donor elects to donate 30 hours of available sick leave to employee A. Calculated gross amount of pay donated is $525.00. $525.00 in additional income will be included in donor’s gross wages on annual Form W‐2. Donor will also have taxes of $171.41 deducted from the next on‐cycle payroll and amounts withheld will also be reported on the annual Form W‐2. $525.00 x 25% (FIT) = $131.25 $525.00 x 7.65% (FICA) = $40.16 3. Donor is an exempt employee and annual salary is $250,000, equivalent to $120.19/hour. Donor will meet the additional Medicare tax withholding threshold on the October 1 paycheck. Donor elects on November 2 to donate 20 hours of available sick leave to employee A. Calculated gross amount of pay donated is $2,403.80. $2,403.80 in additional income will be included in donor’s gross wages on annual Form W‐2. Donor will also have taxes of $806.47 deducted from the next on‐cycle payroll and amounts withheld will also be reported on the annual Form W‐2. $2,403.80 x 25% (FIT) = $600.95 $2,403.80 x 7.65% (FICA) = $183.89 $2,403.80 x 0.9% (addt’l Medicare) = $21.63 Updated 1/4/2016