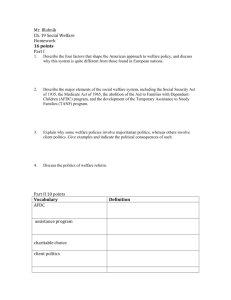

The Impact of Welfare Reform’s TANF Program in Georgia

advertisement