Risk in Agriculture - A Study of Crop Yield Distributions

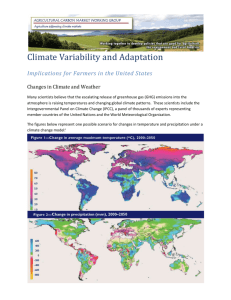

advertisement