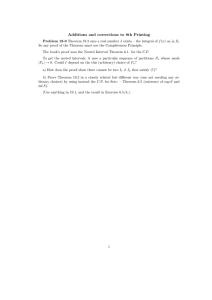

Long Memory versus Stochastic Trend

advertisement

Long Memory versus Stochastic Trend

Alexander Aue

1

Lajos Horváth 1

Josef Steinebach

2

Abstract: We study the limiting behaviour of the prominent V /S and R/S test statistics,

aimed at detecting long–range dependence, under the presence of a stochastic trend,

which is given by cumulative random shocks. Depending on the size of these shocks, the

asymptotic distribution is characterized either solely by the stochastic trend, or solely by

the error sequence, or it is a mixture of both random components. Moreover, we also

derive the rate of convergence to the limit.

AMS 2000 Subject Classification: Primary 62M10; Secondary 91B70

Keywords and Phrases: long memory, long–range dependence, stochastic trend, V /S

statistic, R/S statistic, compound Poisson process, convergence rate

1

Department of Mathematics, University of Utah, 155 South 1440 East, Salt Lake City, UT 84112–

0090, USA, emails: aue@math.utah.edu and horvath@math.utah.edu

2

Mathematisches Institut, Universität zu Köln, Weyertal 86–90, D–50931 Köln, Germany, email:

jost@math.uni-koeln.de

Corresponding author: A. Aue, phone: +1–801–581–5231, fax: +1–801–581–4148.

Research partially supported by NATO grant PST.EAP.CLG 980599 and NSF–OTKA grant INT–

0223262

1

Introduction

Many empirical data sets obtained in scientific fields as diverse as geophysics, telecommunications, computer networks and economics [see, for instance, Giraitis et al. (2001) and

the references therein] give rise to determining long–range dependence and to discriminating it from other effects such as [deterministic or stochastic] drifts and level shifts under

weak dependence. The question originally arose in the context of measuring the waterflow of the Nile river. Hurst (1951) reported convincingly that data exihibit the so–called

Hurst effect, which will be explained briefly in the following. We say that a sequence of

random variables is weakly dependent if it is second–order stationary with an absolutely

summable covariance function, whereas the sequence is said to be long–range dependent

if it is second–order stationary with covariances that are not absolutely summable.

Let X1 , . . . , Xn be a collection of random variables. The most prominent test statistic

for detecting long–range dependence is the R/S statistic Qn = Rn /sn , where

Rn = max

1≤k≤n

k

X

(Xj − X̄n ) − min

j=1

1≤k≤n

k

X

(Xj − X̄n )

(1.1)

j=1

is the adjusted range of the partial sums of the Xj ’s,

s2n =

n

1X

(Xj − X̄n )2

n j=1

(1.2)

is the sample variance, and X̄n = n−1 nj=1 Xj is the sample mean. We say that the

Hurst effect is present if, for some H > 1/2, the ratio n−H Qn converges to a limit which

is nonzero with probability one but possibly degenerate. The parameter H is called the

Hurst exponent. There are various controversial theoretical approaches to explain the

phaenomenon. One of them is the presence of long–range dependence in the underlying

sequence, a second one is the presence of a trend function along with weak dependence.

For example, Battacharya et al. (1983) studied the model

P

Xk = fn (k) + εk ,

1 ≤ k ≤ n,

where fn (k), 1 ≤ k ≤ n, is an arbitrary deterministic trend function and {εk } is an

ergodic sequence of short memory random variables. Examining, e.g., the special trend

f (k) = ck β , c 6= 0, they could show that the Hurst effect is present if −1/2 < β < 0 and

β > 0. In the first case it could also be confused with long memory.

2

A second test statistic, the so–called V /S statistic Tn = Vn /s2n , which is based on the

comparison of the sample variances instead of the adjusted range Rn given in (1.1), was

introduced by Giraitis et al. (2001). Here,

Vn =

1

n2

k

n

X

X

(Xj

k=1

j=1

2

− X̄n ) −

k

n X

X

1

(Xj

n k=1 j=1

2

− X̄n )

.

(1.3)

The latter statistic possesses somewhat nicer asymptotic and finite–sample properties.

Moreover, the findings of Bhattacharya et al. (1983)—which involved the R/S statistic—

were transfered also to the V /S statistic [see Giraitis et al. (2001, 2003)].

Leipus and Viano (2003) studied the asymptotics of the V /S statistic in a setting with

stochastic trend

fn (k) =

k

X

j=1

cj,n ηj ,

1 ≤ k ≤ n,

where—amongst other conditions—it is assumed that

{cj,n , 1 ≤ j ≤ n} are independent, identically Bernoulli variables with

P {c1,n = 1} = π/n and P {c1,n = 0} = 1 − π/n for some 0 < π < ∞,

(1.4)

{ηj , 1 ≤ j ≤ n} are independent, identically distributed random variables

(1.5)

such that E|η1 |ν < ∞ for some ν > 0,

(1.6)

{cj,n , 1 ≤ j ≤ n} and {ηj , 1 ≤ j ≤ n} are independent.

(1.7)

and

The setting is referred to as mixture model and has been examined, for instance, by

Diebold and Inoue (2001), and Granger and Hyung (2004). Note that the Bernoulli

parameter π does not depend on n. Therefore, with increasing n, random shocks modelled by fn (k) occur very rarely. Properties of the autocorrelation function and the log

periodogram estimate have been reported in Perron and Qu (2004).

First aim of this paper is to reinvestigate the results of Leipus and Viano (2004) under

a minimal set of assumptions [see Theorem 2.1]. Furthermore, we show that the limit

theorems obtained hold true also in an extended setting in which the stochastic trend

function does not solely determine the limit behaviour anymore [see Theorem 2.2]. To

3

this end, the trend function fn (k) will be modified so that it contains a sequence {an }

converging to zero at a certain rate. Depending on this specific rate, the limit distribution

can be either described in terms of the trend, or in terms of the noise, or it is a mixture of

both. Also, the setting allows for weakly dependent errors {εk } [see Theorem 2.3]. Finally,

we will answer a question of Perron and Qu (2004), by giving the rate of convergence to

the limit distribution in Theorem 2.1 [see Theorem 2.4].

The paper is organized as follows. In Section 2 we collect all results. Proofs shall be

given in Section 3.

2

Results

Throughout, we will work with all or some of the following assumptions. In addition to

(1.4)–(1.7) it is required that

{εk : k ≥ 1}, {cj,n : 1 ≤ j ≤ n} and {ηj : j ≥ 1} are independent,

(2.1)

{εk : k ≥ 1} are independent, identically distributed random variables

(2.2)

E|ε1 |µ < ∞ for some µ > 4.

(2.3)

such that Eε1 = 0 and 0 < σ 2 = Eε21 < ∞,

and

2.1

A limit theorem and some extensions

We start by introducing some more notations. Let {N(t) : t ≥ 0} be a homogeneous

Poisson process with intensity parameter π [that is, EN(t) = πt for all t ≥ 0] which is

independent of {ηj : j ≥ 1}. Set

N (t)

P(t) =

X

ηj ,

j=1

P0 (t) = P(t) −

Z

0

1

P(s)ds,

t ∈ [0, 1].

(2.4)

Note that {P(t) : t ≥ 0} is a compound Poisson process. In the next section, we shall

prove that the process {Un (t) : t ∈ [0, 1]} defined by

⌊nt⌋

Un (t) =

X

i=1

ci,n ηi ,

t ∈ [0, 1],

(2.5)

4

converges in D[0, 1], the Skorohod space [cf. Billingsley (1968)], to the compound Poisson

process. Therein, ⌊·⌋ denotes the integer part. In particular, we obtain the following

convergence in distribution results for the test statistics Qn and Tn .

Theorem 2.1 Let (1.4), (1.5), (2.1) and (2.2) be satisfied. Then, as n → ∞,

Qn D

−→

n

Z

Tn D

−→

n

Z

1

0

P02 (s)ds

+σ

−1/2 "

sup

−1 "Z

Z

2

Z

t

0<t<1 0

P0 (s)ds − inf

Z

t

1

Z

P0 (s)ds

0<t<1 0

#

and

1

P02 (s)ds

0

+σ

2

1

0

t

0

P0 (s)ds

2

dt −

Z

0

0

t

2 #

P0 (s)dsdt

.

It can be seen that the cumulative effect of the random shocks of fn (k) completely

dominates the limiting behaviour of both test statistics Qn and Tn , though their single

impacts are small, while the errors {εk } contribute only via the variance σ 2 .

In the following, we shall study even smaller shock sizes. Introducing a sequence {an }

satisfying

an → 0

(n → ∞),

(2.6)

the stochstic trend is modified to

fn (k) =

k

X

cj,n an ηj ,

j=1

1 ≤ k ≤ n,

(2.7)

that is, the jump size, now given by an ηj , gets arbitrarily small for increasing n. Depending

on the rate of convergence of {an } to zero, we get different limit results, which√

are collected

in the next theorem. More exactly, if an is asymptotically larger than 1/ √n then the

random shocks give the limit distribution. If an is exactly of the order 1/ n then the

asymptotic is determined by a mixture of the random

shocks and and the errors {εk }.

√

Finally, if an is asymptotically smaller than 1/ n then the errors are dominating the

cumulative shocks in the long–run.

Denote by {W0 (t) : t ∈ [0, 1]} a Brownian bridge independent of the compound Poisson

process {P(t) : t ∈ [0, 1]}.

Theorem

√ 2.2 Let (1.4), (1.5), (2.1), (2.2), (2.6) and (2.7) be satisfied.

(i) If nan → ∞, then, as n → ∞,

Qn D 1

−→

nan

σ

"

sup

Z

0<t<1 0

t

P0 (s)ds − inf

Z

t

0<t<1 0

5

#

P0 (s)ds .

(ii) If

√

nan → c 6= 0, then, as n → ∞,

"

t

Qn D 1

√ −→

sup c P0 (s)ds + σW0 (t) − inf c

0<t<1

n

σ 0<t<1

0

√

(iii) If nan → 0, then, as n → ∞,

Z

Z

t

0

P0 (s)ds + σW0 (t)

#

.

Qn D

√ −→ sup W0 (t) − inf W0 (t).

0<t<1

n

0<t<1

√

In part (i) of Theorem 2.2, the test statistic Qn is normalized with nan ≫ n, which

is exactly the normalization in the presence of long memory [cf. the discussion on the

Hurst parameter H in the introduction]. However, the limit distribution is completely

different from the expected fractional Brownian motion under long–range dependence.

Straightforward adaptations establish the same limit theorems also for the statistic Tn .

It turns out that Theorems 2.1 and 2.2 can easily be extended to weakly dependent

errors. In this case assumption (2.2) has to be replaced by the following requirement:

There are a Wiener process {W (t) : t ∈ [0, 1]} and a constant τ > 0 such that, as n → ∞,

⌊nt⌋

1 X D[0,1]

√

εi −→ τ W (t)

n i=1

n

1X

P

ε2i −→ σ 2 > 0

n i=1

and

(2.8)

with D[0, 1] denoting the Skorohod space. Then, we obtain the following modification of

the previous theorems. Note that one can choose W0 (t) = W (t) − tW (1), t ∈ [0, 1], as

Brownian bridge. In particular, {W0 (t) : t ∈ [0, 1]} is independent of {P0 (t) : t ∈ [0, 1]},

since, by (2.1), the random variables {ηj } and {cj,n ) are independent of the {εk }.

Theorem 2.3 Let (1.4), (1.5), (2.1), (2.7) and (2.8) be satisfied.

(i) If an = 1, then, as n → ∞,

#

−1/2 "

Z t

Z t

Qn D Z 1 2

2

P0 (s)ds .

P0 (s)ds − inf

sup

P0 (t)dt + σ

−→

0<t<1 0

n

0

0<t<1 0

√

(ii) If (2.6) is satisfied and nan → ∞, then, as n → ∞,

Qn D 1

−→

n

σ

"

sup

Z

t

0<t<1 0

P0 (s)ds − inf

0<t<1 0

(iii) If (2.6) is satisfied and

Qn D 1

√ −→

n

σ

"

sup

0<t<1

Z

c

Z

0

t

√

t

#

P0 (s)ds .

nan → c 6= 0, then, as n → ∞,

P0 (s)ds + τ W0 (t) − inf

6

0<t<1

Z

c

0

t

P0 (s)ds + τ W0 (t)

#

.

(iv) If (2.6) is satisfied and

Q D τ

√n −→

n

σ

"

√

nan → 0, then, as n → ∞,

#

sup W0 (t) − inf W0 (t) .

0<t<1

0<t<1

As before, Theorem 2.3 can be reformulated in terms of the test statistic Tn . The proofs

of all theorems are given in Section 3.

2.2

Rates of convergence

In this small subsection, we address the question of determining the rate of convergence

to the limit distributions in Theorem 2.1, which are given as functionals of a compound

Poisson process. The question of how fast the asymptotics are reached has, for instance,

been discussed in Perron and Qu (2004), who studied the limiting behaviour of test

statistics under the presence of a random level shift.

The proof of Theorem 2.1 shows that one needs to obtain the rate of convergence of

the process

⌊nt⌋

Un (t) =

X

ci,n ηi

i=1

to the compound Poisson limit P(t). Since both {Un (t) : t ∈ [0, 1]} and {P(t) : t ∈ [0, 1]}

are discontinuous, it is very unlikely that an approximation in the supremum norm can

be achieved. Both processes, however, are in D[0, 1], so we will use the natural Skorohod

metric d there to measure the distance between Un (t) and suitably constructed versions

of its limit.

R

R

On the other hand, the integral processes { 0u Un (s)ds : u ∈ [0, 1]} and { 0u Pn (s)ds : u ∈

[0, 1]}, with {Pn (t) : t ≥ 0} denoting compound Poisson processes defined in Theorem 2.4

below, are both continuous with probability one, so that the uniform distance can be

applied conveniently.

Recall that {N(t) : t ≥ 0} denotes a Poisson process with intensity parameter π.

Theorem 2.4 Let (1.4), (1.5), (2.1), (2.2) and (2.3) be satisfied, and let

E|η1 |ν < ∞ with some ν ≥ 2.

Then there are compound Poisson processes {Pn (t) : t ≥ 0} such that, for all n ≥ 1,

(i)

D

{Pn (t) : t ≥ 0} =

(t)

N

X

i=1

ηi : t ≥ 0 ,

7

1

P Qn − Q∗n > Cn−ν/(3(1+ν)) ≤ Cn−ν/(3(1+ν))

n

with a constant C > 0 and

Q∗n

(ii)

=

Z

1

0

2

Pn,0

(s)ds

+σ

Therein, Pn,0 (t) = Pn (t) −

R1

0

2

−1 "

sup

Z

0<t<1 0

t

Pn,0 (s)ds − inf

Z

0<t<1 0

t

#

Pn,0 (s)ds .

Pn (s)ds for all t ∈ [0, 1].

The proof will be given in the following section.

3

Proofs

The section is organized as follows. In a first part, we introduce some auxiliary results,

while Theorems 2.1–2.4 are proved in the successive subsections.

Our first result provides an approximation for the shock process {Un (t) : t ∈ [0, 1]}

given in (2.5) with the compound Poisson process {P(t) : t ∈ [0, 1]}. All processes are

elements of D[0, 1] which will be endowed with the Skorohod metric d.

For j ≥ 1, let ηj+ and ηj− denote the positive, respectively, negative part of ηj .

Lemma 3.1 Let (1.4), (1.5) and (1.6) be satisfied. Then

d(Un , P) = OP

1

n

(n → ∞),

where Un is defined in (2.5).

Proof. Is is well–known that

n (t)

SX

D

{Un (t) : t ∈ [0, 1]} =

where the partial sums

i=1

ηi : t ∈ [0, 1] ,

⌊nt⌋

Sn (t) =

X

i=1

ci,n ,

t ∈ [0, 1],

(3.1)

count the number of shocks up to time ⌊nt⌋. Applying Major (1990), there exist homogeneous Poisson processes {Nn (t) : t ∈ [0, 1]} having intensity parameter π such that

P

(

sup Sn (t) − Nn

0≤t≤1 ⌊nt⌋

n

!

)

=0 ≥1−

8

c

n

(3.2)

with some constant c, and

{Nn (t) : t ∈ [0, 1], n ≥ 1} and {ηj : j ≥ 1} are independent.

(3.3)

Letting tn = ⌊nt⌋/n, by (3.2) we have

P

Sn (t)

X

sup

ηi

0≤t≤1 i=1

ηi Nn (tn )

X

−

i=1

= 0 ≥ 1 −

c

.

n

(3.4)

Since the distribution of Nn (t) does not depend on n [the intensity parameter remains

the same], and since it is also independent of {ηj : j ≥ 1} for any n, it suffices to estimate

the distance

N (t)

N (tn )

X

X

d

ηi ,

i=1

i=1

ηi .

First, it holds for the positive and negative parts of the {ηj : j ≥ 1} that

X

i=1

ηi± −

X

i=1

N (t−1/n)

N (t)

N (tn )

N (t)

0≤

ηi± ≤

X

i=1

ηi± −

ηi± .

X

i=1

[Throughout, we will set N(x) = 0 if x < 0.] Hence, it is enough to obtain upper bounds

for

N (t−1/n)

N (t)

d

X

ηi+ ,

X

i=1

i=1

To do so, define

ρ(t) =

ηi+

N (t−1/n)

N (t)

and

2t

d

X

ηi− ,

i=1

1

n

:

1

n−2

n−1

t−

+

2

n

n

:

i=1

1

n

1

n−2

<t≤

n

n

n−2

<t≤1

n

: 0≤t≤

t+

X

9

ηi− .

and observe that cleary ρ(0) = 0, ρ(1) = 1, and that ρ is strictly monotone increasing

and continuous. Also, for the positive parts {ηj+ : j ≥ 1},

N

(t)

X +

ηi

i=1

N (ρ(t)−1/n)

X

−

i=1

+ ηi ≤

Since

P

(1/n)

NX

ηi+ = 0

i=1

N (1/n)

2

ηi+

X

i=1

0

:

N (1)

ηi+

X

1

.

n

n−2

1

<t≤

.

n

n

: 0≤t≤

:

i=N (1−2/n)+1

n−2

< t ≤ 1.

n

≥ P {N(1/n) = 0} = e−π/n

and, by stationary increments,

P

N (1)

ηi+ = 0

X

≥ P {N(1) − N(1 − 2/n) = 0} = e−2π/n ,

i=N (1−2/n)+1

the proof is complete on recognizing that similar arguments apply to the negative parts

{ηj− : j ≥ 1}.

2

The second auxiliary result shows that one can define a sequence of compound Poisson

processes, all of which have the same distribution as the original {P(t) : t ∈ [0, 1]}, close

to the processes {Un (t) : t ∈ [0, 1]}. Here, distances can be taken with respect to the

uniform metric.

Lemma 3.2 If (1.4)–(1.7) hold, then compound Poisson processes {Pn (t) : t ∈ [0, 1]}

can be defined such that

D

{Pn (t) : t ∈ [0, 1]} = {P(t) : t ∈ [0, 1]}

for all n,

and

P

(

sup

0≤t≤1

Z

0

t

Un (s)ds −

Z

0

with some constants c1 and c2 .

t

Pn (s)ds

−ν/(1+ν)

> c1 n

10

)

≤ c2 n−ν/(1+ν)

for all n

Proof. Recall that tn = ⌊nt⌋/n. By (3.4) it is enough to consider

Z

0

u

N (t)

N (tn )

X

X

i=1

ηi −

i=1

ηi dt.

We examine positive parts and negative parts separately again. It is easy to see that, for

the {ηj+ : j ≥ 1},

0 ≤

Z

u

≤

≤

Z

1

0

0

ηi+ −

X

i=1

N (t)

N (tn )

N (t)

0

Z

X

i=1

ηi+ dt

N (t−1/n)

X

i=1

(t)

1/n N

X

ηi+ −

X

ηi+ dt

Z

i=1

+

i=1

ηi+ dt

(t)

1 N

X

1/n i=1

ηi+ dt

−

Z

0

1 N (t−1/n)

X

ηi+ dt

i=1

(t)

Z 1−1/n N

(t)

Z 1 N

N (1/n)

X

X

1 X +

+

≤

ηi+ dt

ηi dt −

ηi +

n i=1

0

1/n i=1

i=1

Z 1 N

Z 1−1/n N

N (1/n)

(t)

(t)

X

X

1 X +

+

≤

ηi +

ηi dt −

ηi+ dt

n i=1

1/n i=1

1/n

i=1

≤

N (1/n)

N (t)

Z 1

X

1 X +

ηi +

ηi+ dt

n i=1

1−1/n i=1

≤

(1/n)

(1)

1 NX

1 NX

ηi+ +

η+

n i=1

n i=1 i

≤

N (1)

2 X +

η .

n i=1 i

By Minkowski’s inequality [cf. Hardy,Littlewood and Pólya (1952)] we have that

E

k

X

i=1

ηi+

!ν

k

X

ν

Eηi+

≤

i=1

k

X

i=1

= kEη1+

ν

[Eηi+ ]1/ν

!ν

ν

: 0 < ν ≤ 1.

= k ν Eη1+

11

ν

: 1 < ν < ∞.

The latter result implies that

ν

N (1)

E

X

i=1

ηi+ < ∞,

so that Markov’s inequality yields

P

(1)

2 NX

n

i=1

ηi+ ≥ n−ν/(1+ν)

≤ n1−ν/(1+ν)

−ν

N (1)

2ν E

X

i=1

ν

ηi+ .

Using similar arguments in case of the negative parts {ηj− : j ≥ 1} completes the proof of

Lemma 3.2.

2

3.1

Proof of Theorem 2.1

Recall that Qn = Rn /sn , where Rn and sn are defined in (1.1) and (1.2), respectively.

The adjusted range Rn can be decomposed into one term involving {Un (t) : t ∈ [0, 1]}

and a second term containing the errors {εk : k ≥ 1}. Applications of Lemma 3.1 and

Donsker’s invariance principle yield further insight and lead to the desired limit results.

A similar approach works for the sample variance s2n . Details are given next.

Proof of Theorem 2.1. To begin with, we establish the limit distribution of the range

Rn . Note that from Lemma 3.1 we obtain that

D[0,1]

Un (t) −→ P(t)

(n → ∞),

(3.5)

where {P(t) : t ∈ [0, 1]} is the compound Poisson process given by (2.4). On the other

hand, Donsker’s theorem implies

X D[0,1]

1 ⌊nt⌋

√

εi −→ σW (t)

Sn (t) =

n i=1

(n → ∞),

(3.6)

where the processes {Sn (t) : t ∈ [0, 1]} are defined in (3.1) and {W (t) : t ∈ [0, 1]} denotes

a Wiener process. Hence,

k

n

X

Rn

1

kX

max Un (j/n) −

=

Un (j/n)

n

n 1≤k≤n j=1

n j=1

(3.7)

n

kX

Un (j/n) + OP

− min Un (j/n) −

1≤k≤n

n j=1

j=1

k

X

12

!

1

√

.

n

It is easy to see that

1

n

max

1≤k≤n

k

X

j=1

Un (j/n) − sup

Z

u

0<u<1 0

and therefore

1

n

max

1≤k≤n

k

X

j=1

Un (j/n) −

2

≤

sup n 0<u<1

Z

u

Un (s)ds

1

≤

sup n 0<u<1

Z

n

X

k

Un (j/n) − sup

n j=1

0<u<1

Z

u

Z

u

0

u

0

Un (s)ds

Un (s)ds − u

Z

1

Un (s)ds − u

Z

1

0

Un (s)ds .

0

Un (s)ds By the same arguments,

1

n

min

1≤k≤n

k

X

j=1

Un (j/n) −

2

≤

sup n 0<u<1

Z

u

n

X

k

Un (j/n) − inf

0<u<1

n j=1

0

Un (s)ds .

0

0

Un (s)ds So, using (3.6), it follows from (3.7) that

Rn

=

n

sup

0<u<1

Z

− inf

0<u<1

u

Un (s)ds − u

0

Z

0

u

Z

0

Un (s)ds − u

1

Un (s)ds

Z

1

0

(3.8)

Un (s)ds + oP (1)

(n → ∞).

Next, we deal with the asymptotics of the sample variance s2n . By definition, with ε̄n =

1 Pn

i=1 εi ,

n

s2n

n

X

n

X

2

n

1

1

1X

=

Un (j/n) +

(εj − ε̄n )2

Un (j/n) −

n j=1

n j=1

n j=1

n

n

1X

2X

(εj − ε̄n ) Un (j/n) −

Un (i/n) .

+

n j=1

n i=1

!

The weak law of large number yields

n

1X

P

(εj − ε̄n )2 −→ σ 2

n j=1

(n → ∞).

13

Following the lines of the proof of (3.8), one can verify that

2

n

n

1X

1X

Un (j/n) −

Un (j/n) =

n j=1

n j=1

Z

1

Z

Un (t) −

0

0

1

Un (s)ds

2

dt + oP (1).

Similarly,

n

n

1X

1X

(εj − ε̄n ) Un (j/n) −

Un (i/n)

n j=1

n i=1

=

!

n

n

1X

1X

εj Un (j/n) −

Un (j/n)ε̄n ,

n j=1

n j=1

where we conclude by Lemma 3.1 and (3.6),

n

1X

Un (j/n)ε̄n = OP

n j=1

1

√

n

!

(n → ∞).

Also,

n

1X

1

εj Un (j/n) = √

n j=1

n

Z

0

1

Un (t)dSn (t).

In light of (2.1), it follows from (3.5) and (3.6) that

D[0,1]

(Un (t), Sn (t)) −→ (P(t), σW (t))

(n → ∞),

where {P(t) : t ∈ [0, 1]} and {W (t) : t ∈ [0, 1]} are independent. Hence, an application of

Kurtz and Protter (1991) gives

Z

1

0

D

Un (t)dSn (t) −→ σ

Z

1

0

P(t)dW (t)

(n → ∞).

Thus we have

s2n

=

Z

0

1

Un (t) −

Z

0

1

Un (s)

2

ds + σ 2 + oP (1)

(n → ∞)

(3.9)

and the first part of Theorem 2.1 is now an immediate consequence of Lemma 3.1, (3.8)

and (3.9). Adaptations of these arguments also establish the limit for the V /S statistic

Tn = Vn /s2n , where Vn is given in (1.3).

2

14

3.2

Proofs of Theorems 2.2 and 2.3

We shall only give the proof of Theorem 2.2 here. Replacing assumption (2.2) with the

conditions in (2.8) throughout the proofs of Theorems 2.1 and 2.2 immediately implies

the results for weakly dependent errors collected in Theorem 2.3.

Proof of Theorem 2.2. Recall that the stochastic trend now contains a sequence {an }

converging to zero at a specified rate. At first, we establish the limit of the sample variance

s2n . Write

s2n

2

Z 1

n n

a2n X

1X

=

Un (j/n) −

(εj − ε̄n )2

Un (s)ds +

n j=1

n j=1

0

+

Z 1

n an X

Un (j/n) −

Un (s)ds (εj − ε̄n ).

n j=1

0

Since an → 0, we obtain for the first term, as n → ∞,

2

2

Z 1

Z 1

Z 1

n a2n X

Un (j/n) −

Un (s)ds = a2n

Un (t) −

Un (s)ds dt = o(1)

n j=1

0

0

0

a.s.,

that is, independent of the rate of convergence to zero, the first part will not contribute

to the limit at all. For the second term, it holds by the strong law of large numbers,

n

1X

(εj − ε̄n )2 −→ σ 2

n j=1

a.s.

(n → ∞).

Finally, the third term is negligible, which can be seen by an application of Chebyshev’s

inequality.

On the other hand, the different limits for the suitably normalized Qn follow using the

fact that, for all n ≥ 1,

⌊nt⌋

X

j=1

D

Xj : t ∈ [0, 1] = nan

Z

0

t

P(s)ds +

√

nτ W (t) + rn (t) : t ∈ [0, 1] ,

where the remainder term satisfies the relation

√ sup rn (t) = oP max{nan , n}

(n → ∞).

0≤t≤1

Hence, according to the asymptotic√order of an , a leading term exists, which in turn

determines the limit, or—in case of nan → c—the limit is a mixture of both sources of

randomness. This completes the proof.

2

15

3.3

Proof of Theorem 2.4

In order to prove Theorem 2.4, we first provide a result concerning the order of the

difference between the sample variance s2n from (1.2) and its limit obtained during the

course of the proof of Theorem 2.1.

Lemma 3.3 Let (1.4), (1.5) and (2.1)–(2.3) be satisfied, and assume that E|η1 |ν < ∞

for some ν ≥ 2. Then

P

(

2

sn

"

2

− σ +

Z

1

Pn (t) −

0

Z

1

0

Pn (s)ds

2

#

dt −1/3

> Cn

)

≤ Cn−1/3

for all n,

where {Pn (t) : t ∈ [0, 1]} is the sequence of compound Poisson processes, which is defined

in Lemma 3.2, and C is a constant.

Proof. Write

n

1X

Un (j/n) −

n j=1

Z

1

n

1X

=

Un (j/n) −

n j=1

Z

1

s2n =

0

Un (s)ds

0

n

2X

+

Un (j/n) −

n j=1

Un (s)ds + εj − ε̄n

Z

1

0

2

2

(3.10)

n

1X

(εj − ε̄n )2

+

n j=1

Un (s)ds (εj − ε̄n ).

We shall estimate each term of the sum on the right–hand side of the latter equations.

Starting with the first term, it is easy to see that

n

1X

Un (j/n) −

n j=1

Z

0

1

Un (s)ds

2

=

Z

0

1

Un (u) −

Z

1

0

Un (s)ds

2

du.

Using the approxmiation with a sequence of compound Poisson processes {Pn (t) : t ∈

[0, 1]} established in Lemma 3.2, we can estimate

Z 2

2

Z 1

Z 1

Z 1

1

Un (u) −

Un (s)ds du −

Pn (u) −

Pn (s)ds du

0

0

0

0

≤

Z " 2

Z 1

1

Un (u) −

Un (s)ds

0

0

− Pn (u) −

16

Z

0

1

Pn (s)ds

2 #

du

(3.11)

Z

+2 ≤ 2

"

1

0

Un (u) −

1

0

Un (s)ds − Pn (u) −

× Pn (u) −

sup

0<u<1

Z

|Un (u)| + "

sup

0<u<1

Z

1

0

1

Z

0

1

Pn (s)ds

Un (s)ds +

0

×

+2

Z

du

sup

0<u<1

|Un (u) − Pn (u)| du

Z

|Pn (u)| + 1

0

# Z

Pn (s)ds

1

0

Z

1

0

Pn (s)ds

Z

|Pn (u)| + 1

0

#

Pn (s)ds

|Un (u) − Pn (u)| du.

On applying (3.4) we obtain, for any x ≥ 0,

n (1)

NX

c

P sup |Un (u)| > x ≤ + P

|ηi | > x

n

0<u<1

i=1

(

)

(3.12)

with some positive constant c. Clearly, also

Z

1

0

Un (s)ds

≤ sup |Un (u)|.

0<u<1

Recall that ηi+ and ηi− are the positive part, respectively, negative part of ηi and that

tn = ⌊nt⌋/n. In view of (3.4) we estimate

Z

1

0

|Un (u) − Pn (u)|du

Z

≤

1

0

Nn (tn )

Nn (t)

X

i=1

ηi+

−

X

i=1

ηi+ dt

+

Using the method of Lemma 3.2 we have

Z

0

1

Z

1

0

Nn (tn )

Nn (t)

X

i=1

ηi−

−

X

i=1

ηi− dt.

N (1)

2 X

|Un (u) − Pn (u)|du ≤

|ηi |,

n i=1

where the νth moment of the latter sum is finite by assumption, i.e.

N (1)

E

X

i=1

ν

|ηi | < ∞

(3.13)

17

[cf. the proof of Lemma 3.2]. Hence, for any y > 0,

P

Z

1

0

|Un (u) − Pn (u)|du > y ≤ C(ny)−ν ,

(3.14)

where C is a positive constant. Choosing y = n−(1+ν)/(2+ν) in (3.14), x = n1/(2+ν) in

(3.12), we conclude from (3.11) that

P

(Z 2

2

Z 1

Z 1

Z 1

1

Un (u) −

Un (s) ds −

Pn (u) −

Pn (s)ds du

0

0

0

0

−ν/(2+ν)

>n

)

≤ Cn−ν/(2+ν) .

Next, we turn our attention to the second term of the right–hand side in (3.10). Here, an

application of Markov’s inequality and Theorem 2.10 of Petrov (1995, p. 62) yields

P

n

1 X

(ε2

j

n j=1

2 − σ )

> n−µ/(4+2µ)

and similarly, for all x > 0,

P

(

≤ Cn−µ/(4+2µ)

n

1 X

−µ −µ/2

ε

n

.

i > x ≤ Cx

n i=1

)

(3.15)

Therein, the parameter µ > 4 is determined by (2.3). Thus we have, on combining the

latter two inequalities,

P

(

n h

i

1 X

(εi − ε̄n )2 − σ 2 > 2n−µ/(4+2µ)

n i=1

)

≤ Cn−µ/(4+2µ) .

Ultimately, rewrite the third term in (3.10) as

n

1X

Un (j/n) −

n j=1

Z

1

0

Un (s)ds (εj − ε̄n ) =

Then it follows from (2.1) that

Var

n

X

j=1

εj Un (j/n)

= σ

2

n

X

EUn2 (j/n)

j=1

18

n

1X

Un (j/n)εj − ε̄n

n j=1

Z

0

1

Un (s)ds.

n

X

X

= σ2

Eci,n cl,n ηi ηl

j=1 1≤i,l≤j

j

X

1

1

+

≤ C

2

j=1 1≤i,l≤j n

i=1 n

n

X

X

≤ Cn.

By Chebyshev’s inequality, we obtain

P

n

1 X

Un (j/n)εj n j=1

>x

for all x > 0, and therefore

P

n

1 X

Un (j/n)εj n j=1

≤

≥ n−1/3

Cn

(nx)2

≤ Cn−1/3 .

Using (3.12) and (3.13), we arrive at

Z

P 0

1

Un (s)ds > y ≤

C

C

+ ν

n

y

(3.16)

for all y > 0. Applying (3.15) and (3.16) with

x = n−µ(1+ν)/(2[ν+µ(1+ν)])

and

y = nµ/(2[ν+µ(1+ν)]) ,

respectively, we finally conclude

P

Z

ε̄n

1

0

Un (s)ds

−µν/(2[ν+µ(1+ν)])

>n

≤ Cn−µν/(2[ν+µ(1+ν)]) ,

finishing the proof.

2

Recall that, for t ∈ [0, 1], Pn,0 (t) = Pn (t) − tPn (1), where the compound Poisson

processes {Pn (t) : t ∈ [0, 1]} are defined in Lemma 3.2. We are now able to prove

Theorem 2.4.

Proof of Theorem 2.4. First we note that

1

n

max

1≤k≤n

k

X

j=1

Un (j/n) − sup

Z

0<u<1 0

u

Un (s)ds

19

Z

u

1

≤

sup Un (s)ds

n 0<u<1 0

and therefore

1

n

Clearly,

n

kX

Un (j/n) − sup

max Un (j/n) −

1≤k≤n

n

0<u<1

j=1

j=1

k

X

2

≤

sup n 0<u<1

u

Z

sup

0<u<1

Z

u

0

0

Z

u

0

Un (s)ds − u

Z

0

Un (s)ds .

Pn (t)dt

1

Un (s)ds Nn (1)

≤

X

i=1

|ηi |,

where, for each n, Nn (1) are Poisson random variables with mean 1. Markov’s inequality

implies that

P

n (1)

1 NX

n

i=1

|ηi | > n−ν/(1+ν)

≤ n1−ν/(1+ν)

ν

E

ν

Nn (1)

X

i=1

|ηi | ,

where the latter expectation is finite (cf. the proof of Lemma 3.2). So, by Lemma 3.2,

P

(

1

sup n 0<u<1

Z

u

0

Un (s)ds

−ν/(1+ν)

> c1 n

)

≤ c2 n−ν/(1+ν)

(3.17)

with some constants c1 and c2 . Using Lemma 3.2 once more, we obtain

P

1

n

max

1≤k≤n

k

X

j=1

Un (j/n) −

≤ c2 n−ν/(1+ν) .

n

X

k

Un (j/n) − sup

n j=1

0<u<1

Next observe that

k

X

max εi

1≤k≤n i=1

k

n

X

kX

−

εi ≤ 2 max εi .

1≤k≤n n i=1 i=1

Theorem 2.4 of Petrov (1995, p. 52) yields

P

(

k

X

max εi 1≤k≤n i=1

)

> x ≤ 4P

( n

X εi i=1

>x−

20

√

)

2σ 2 n

Z

0

u

P0,n (t)dt

≥ c1 n−ν/(1+ν)

(3.18)

for all x >

P

(

√

2σ 2 n. Hence

k

X

1

max εi > n−µ/(2(1+µ))

n 1≤k≤n i=1 ≤ 4P

( n

X εi )

1−µ/(2(1+µ))

>n

i=1

1−µ/(2(1+µ))

≤ 4 n

−

√

2σ 2 n

(3.19)

−

−µ

≤ cn−µ/(2(1+µ)) ,

√

)

2σ 2 n

µ

n

X

E εi i=1

where the latter inequality is derived from the fact that, by Theorem 2.10 of Petrov (1995,

p. 62), the expected value is of order O(nµ/2 ). It follows from Lemma 3.3 in combination

with Lemma 3.2 and (3.17) that

P

(

s2n

σ2

<

2

)

≤ Cn−1/3 .

(3.20)

Also,

P

(

sup P0,n (t) − inf P0,n (t)

0<u<1

0<u<1

≤ P

n (1)

NX

i=1

)

(

)

> x ≤ P 4 sup |Pn,0 (t)| > x

0<u<1

(3.21)

x

|ηi| >

≤ Cx−ν .

4

Applying (3.18), (3.19) and (3.20), we get that

P

(

1

sn

R

n

n

−

!

sup P0,n (t) − inf P0,n (t) 0<u<1

0<u<1

≤ C n−ν/(1+ν) + n−µ/(2+µ) + n−1/3

≤ Cn−1/3 .

> C n−ν/(1+ν) + n−µ/(2+µ)

Now, for any y > 0,

P

(

1

sup P0,n (t) − inf P0,n (t) sn

0<u<1

0<u<1

= P

1

− > y

s̄n

(

sup P0,n (t) − inf P0,n (t)

0<u<1

0<u<1

)

|s2n − s̄2n |

>y

sn s̄n (sn + s̄n )

21

)

)

where

s̄n = σ 2 +

Z

1

0

Pn (t) −

Z

0

1

Pn (s)ds

2

dt.

Applying (3.21) with x = n1/(3(1+ν)) , (3.20) and Lemma 3.3 to the latter relation with

y = Cn−ν/(3(1+ν)) , we finally arrive at

P

(

sup P0,n (t) − inf P0,n (t)

0<u<1

0<u<1

s2n − s̄2n

> Cn−ν/(3(1+ν))

sn s̄n (sn + s̄n )

)

≤ Cn−ν/(3(1+ν)) ,

which finishes the proof.

2

References

[1] Bhattacharya, R.N., Gupta, V.K., and Waymire, E. (1983). The Hurst effect under

trends. Journal of Applied Probability 20, 649–662.

[2] Billingsley, P. (1968). Convergence of Probability Measures. Wiley, New York.

[3] Diebold, F., and Inoue, A. (2001). Long memory and regime switching. Journal of

Econometrics 105, 131–159.

[4] Giraitis, L., Kokoszka, P., and Leipus, R. (2001). Testing for long memory in the

presence of a general trend. Journal of Applied Probability 38, 1033–1054.

[5] Giraitis, L., Kokoszka, P., Leipus, R., and Teyssiere, G. (2003). Rescaled variance

and related tests for long memory in volatility and levels. Journal of Econometrics

112, 265–294.

[6] Granger, C.W.J., and Hyung, N. (2004). Occasional structural breaks and long memory with an application to the S&P 500 absolute stock returns. Journal of Empirical

Finance 11, 399–421.

[7] Hardy, G. H., Littlewood, J. E., and Pólya, G. (1952). Inequalities (2nd ed.). Cambridge University Press.

[8] Hurst, H. (1951). Long term storage capacity of reservoirs. Transactions of the American Society of Civil Engineers 116, 770–799.

22

[9] Kurtz, T.G., and Protter, P. (1991). Weak limit theorems for stochastic integrals and

stochastic differential equations. Annals of Probability 19, 1035–1070.

[10] Leipus, R., Viano, M.–C. (2003). Long memory and stochastic trend. Statistics and

Probability Letters 61, 177–190.

[11] Major, P. (1990). A note on the approximation of the uniform empirical process.

Annals of Probability 18, 129–139.

[12] Perron, P., and Qu, Z. (2004). An analytical evaluation of the log–periodogram estimate in the presence of level shift and its implications for stock returns volatility.

Preprint, Boston University.

[13] Petrov, V.V. (1995). Limit Theorems of Probability Theory. Clarendon, Oxford.

23