Inventory Estimation From Transactions via

Hidden Markov Models

by

Nirav Bhan

B.Tech, Electrical Engineering

Indian Institute of Technology-Bombay, 2013

Submitted to the MIT Department of Electrical Engineering and

Computer Science

in Partial Fulfillment of the Requirements for the Degree

of

Master of Science in Electrical Engineering

at the

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

September 2015

c 2015 Massachusetts Institute of Technology. All rights reserved

Author

Department of Electrical Engineering and Computer Science

August 26, 2015

Certified by

Devavrat Shah

Associate Professor of Electrical Engineering and Computer Science

Thesis Supervisor

Accepted by

Leslie A. Kolodziejski

Professor of Electrical Engineering and Computer Science

Chair, EECS Committee on Graduate Students

2

Inventory Estimation From Transactions via

Hidden Markov Models

by

Nirav Bhan

Submitted to the MIT Department of Electrical Engineering and Computer Science

on August 26, 2015, in partial fulfillment of the

requirements for the degree of

Master of Science in Electrical Engineering

Abstract

Our work solves the problem of inventory tracking in the retail industry using Hidden

Markov Models. It has been observed that inventory records are extremely inaccurate

in practice (cf. [1–4]). Reasons for this inaccuracy are item losses due to item theft,

mishandling, etc. which are unaccounted. Even more important are the lost sales due

to lack of items on the shelf, called stockout losses. In several industries, stockout is

responsible for billions of dollars of lost sales each year (cf. [4]). In [5], it is estimated

that 4% of annual sales are lost due to stockout, across a range of industries.

Traditional approaches toward solving the inventory problem have been geared

toward designing better inventory management practices, to reduce or account for

stock uncertainity. However, such strategies have had limited success in overcoming

the effects of inaccurate inventory (cf. [1]). Thus, inventory tracking remains an

important unsolved problem. The work done in this thesis is a step toward solving

this problem.

Our solution follows a novel approach of estimating inventory using accurately

available point-of-sales data. A similar approach has been seen in other recent work

such as [1, 6, 7]. Our key idea is that when the item is in stockout, no sales are

recorded. Thus, by looking at the sequence of sales as a time-series, we can guess

the period when stockout has occured. In our work, we find that under appropriate

assumptions, exact stock recovery is possible for all time.

To represent the evolution of inventory in a retail store, we use a Hidden Markov

Model (HMM), along the lines of [6]. In the latter work, the authors have shown that

an HMM-based framework, with Gibbs sampling for estimation, manages to recover

stock well in practice. However, their methods are computationally expensive and do

not possess any theoretical guarantees. In our work, we introduce a slightly different HMM to represent the inventory process, which we call the Sales-Refills model.

For this model, we are able to determine inventory level for all times, given enough

data. Moreover, our recovery algorithms are easy to implement and computationally

3

fast. We also derive sample complexity bounds which show that our methods are

statistically efficient.

Our work also solves a related problem viz. accurate demand forecasting in presence of unobservable lost sales (cf. [8–10]). The naive approach of computing a timeaveraged sales rate underestimates the demand, as stockout may cause interested

customers to leave without purchasing any items (cf. [8, 9]). By modelling the retail

process explicitly in terms of sales and refills, our model achieves a natural decoupling

of the true demand from other parameters. By explicitly determining instants where

stock is empty, we obtain a consistent estimate of the demand.

Our work also has consequences for HMM learning. In this thesis, we propose an

HMM model which is learnable using simple and highly efficient algorithms. This is

not a usual property of HMMs; indeed several problems on HMMs are known to be

hard (cf. [11–13]). The learnability of our HMM can be considered a consequence of

the following property: We have a few parameters which vary over a finite range, and

for each value of the parameters we can identify a signature property of the observation sequence. For the Sales-Refills model, the signature property is the location of

longer inter-sale intervals in the observation sequence. This simple idea may lead to

practically useful HMMs, as exemplified by our work.

Thesis Supervisor: Devavrat Shah

Title: Associate Professor

4

Acknowledgements

I would firstly like to express my utmost gratitude to my advisor, Devavrat Shah.

His guidance has been instrumental in my research. His enthusiasm, wisdom and

patience are remarkable, and I hope that some of these qualities rub off on me during

the course of our work together. In addition, his detailed guidance with writing has

allowed me to express my thoughts more clearly.

Secondly, I would like to express my thanks toward my friends. I wish to thank

Pritish, Anuran, Gauri, Sai, Ganesh and many others who have made my stay at

MIT pleasureable.

Thirdly, I would like to thank my past advisors, Prof. Vivek Borkar and Prof.

Volkan Cevher. The positive research experiences I had with them are responsible

for my pursuing an academic career.

Lastly, I am deeply thankful to my parents. Their support has been key to my

ability to focus on work undisturbed. Although leaving home for the first time is not

easy, for me or them, they have shown a great deal of support and understanding,

allowing me to do what I love.

5

6

Contents

1 Introduction

12

1.1

Background: Inventory Inaccuracy in Retail Industry . . . . . . . . .

12

1.2

Our Approach . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

1.2.1

Literature Survey . . . . . . . . . . . . . . . . . . . . . . . . .

15

1.2.2

Our contributions . . . . . . . . . . . . . . . . . . . . . . . . .

16

1.3

A spectral algorithm for learning HMM . . . . . . . . . . . . . . . . .

17

1.4

Formulation as a Constrained HMM Learning Problem . . . . . . . .

21

1.5

Organization of Thesis . . . . . . . . . . . . . . . . . . . . . . . . . .

23

2 Model Description and Estimation

25

2.1

Definitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

2.2

The Sales-Refills Model . . . . . . . . . . . . . . . . . . . . . . . . .

26

2.2.1

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

2.2.2

Formal definition . . . . . . . . . . . . . . . . . . . . . . . . .

27

Estimation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

2.3

3 Algorithm

3.1

3.2

31

Estimating stock (or inventory) . . . . . . . . . . . . . . . . . . . . .

31

3.1.1

Estimating C, X0 mod C . . . . . . . . . . . . . . . . . . . . .

31

3.1.2

Estimating hidden stock . . . . . . . . . . . . . . . . . . . . .

32

Estimating q and p . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

7

3.3

Computational efficiency . . . . . . . . . . . . . . . . . . . . . . . . .

33

3.4

General C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

3.4.1

Idea . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

3.4.2

General estimator for C, U . . . . . . . . . . . . . . . . . . . .

34

4 Proof of Estimation

36

4.1

Invariance modulo C . . . . . . . . . . . . . . . . . . . . . . . . . . .

36

4.2

Correctness of Ĉ T and Û T . . . . . . . . . . . . . . . . . . . . . . . .

37

T

4.3

Correctness of X̂t

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

41

4.4

Correctness of q̂ T . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

41

4.5

Correctness of p̂T . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

42

4.6

Correctness of C̄T , ŪT . . . . . . . . . . . . . . . . . . . . . . . . . . .

45

4.7

No-refill probability . . . . . . . . . . . . . . . . . . . . . . . . . . . .

49

5 Sample complexity bounds

52

5.1

Error bounds for stock estimation . . . . . . . . . . . . . . . . . . . .

52

5.2

Data sufficiency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

60

6 Generalized and Noise-Augmented models

6.1

6.2

6.3

6.4

62

Generalized Sales-Refills model . . . . . . . . . . . . . . . . . . . . .

62

6.1.1

Modifications . . . . . . . . . . . . . . . . . . . . . . . . . . .

62

6.1.2

Description . . . . . . . . . . . . . . . . . . . . . . . . . . . .

64

Estimation of the Generalized Sales-Refills model . . . . . . . . . . .

66

6.2.1

Simplifying Assumptions . . . . . . . . . . . . . . . . . . . . .

66

Estimation with Uniform Aggregate Demand . . . . . . . . . . . . . .

67

6.3.1

Estimation of stock and U . . . . . . . . . . . . . . . . . . . .

68

6.3.2

Estimation of sales parameters . . . . . . . . . . . . . . . . . .

69

Augmenting the Sales-Refills model with Noise

. . . . . . . . . . . .

70

6.4.1

Description of Noisy Sales-Refills Model . . . . . . . . . . . .

72

6.4.2

Equivalence of hidden sales and Source uncertainty viewpoints

72

8

6.4.3

Estimation with Noise . . . . . . . . . . . . . . . . . . . . . .

7 Conclusion

73

76

7.1

Summary of contributions . . . . . . . . . . . . . . . . . . . . . . . .

76

7.2

Significance and Future Work . . . . . . . . . . . . . . . . . . . . . .

77

9

List of Figures

2.1

Shifted order-2-hmm, representing the hidden state variables Xt ’s and

observation variables Yt0 s. Notice that the observation sequence has

shift 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.2

26

State transition diagram for the stock MC. Sales occur in all states

besides 0, while refills only occur in states ≤ R. . . . . . . . . . . . .

10

28

11

Chapter 1

Introduction

1.1

Background: Inventory Inaccuracy in Retail

Industry

Inventory inaccuracy is an important operational challenge in the modern retail industry, cf. [1–4,6,8]. Inspite of the availability of modern high-tech tools and methods,

it is found that many store managers do not know their inventory correctly. For example, the authors of [2] found that over 65% of all Stock Keeping Units (SKUs)

in a study of 370,000 SKUs did not match the physical inventory. Moreover, about

20-25% of the SKUs differed from the inventory by six or more items. Such inaccurate

records can have a serious negative impact on operational decisions in the store. For

example, stores rely on the inventory record to order a fresh batch of items, replenishing sold-out products on the shelf. If such orders are not made in a timely manner,

they may lead to a ‘stock-out’ situation, where sales are halted due to lack of items on

the shelf. Clearly, stock-out leads to significant losses for the store in terms of missed

sales. This problem is even more acute for stores that rely on automated inventory

management systems. In [4], it is estimated that the revenue lost due to stockout

equals 4% of annual sales, averaged across various industries.

12

There are several explanations for why the inventory records in stores are not

accurate. The most important reason is widely believed to be stock loss (cf. [4]).

Stock loss (also known as inventory shrinkage) refers to the loss of items in the store

due to employee theft, shoplifting, mishandling, damage etc. By its nature, stock loss

is unpredictable and hence very difficult to account for. It can also mean significant

economic losses for the store. In [4], it is noted that stores lose 1.5% to 2% of their

annual sales due to stock loss. They also note that for certain goods like batteries and

razor blades, which are prone to theft due to their small size and high value, the stock

loss can be as high as 5 to 8%. Unfortunately, stores are often ill-posed to combat

these effects due to poor inventory records. Moreover, although stock loss is an

important economic issue in its own right, its consequence viz. inventory inaccuracy

can have an even bigger impact, due to the stock-out phenomenon noted above. In [3],

the authors explain how inventory inaccuracy, while a serious issue for all industries,

can be especially problematic in industries where there is close collaboration between

various levels of the supply chain, and where demand uncertainity is lower and lead

times are shorter.

All of the above shows that inventory record inaccuracy is an important issue,

and one that traditional methods have failed to resolve. Recently, there have been

some attempts to use Machine Learning methods for solving these problems. These

methods are based on 2 key observations:

1. In all modern stores, sales are recorded in a highly detailed, accurate and usable

form.

2. When stockout happens, no sales will be recorded in the system, for a long

period of time.

Since the inventory must be regarded as not fully known, it is customary to replace

hard knowledge of the inventory with a probablistic representation of the same. For

example, in [1], the authors use a Bayesian inventory record, which is a vector of

13

probabilities about various inventory levels. The beliefs are updated from one time

period to the next based on 3 factors - the belief in the previous interval, the sales

recorded, and the time until the last sale. The authors also provide evidence via

simulations that their idea is useful in practice.

There is another important problem in retail that has attracted a lot of attention.

This is the problem of estimating aggregate demand for supplies. The obvious method

for estimating demand is to divide the number of sales in a large time period, by the

total time. This gives us the average number of sales per unit time, which is assumed

to equal demand. The problem with this approach is that it ignores the phenomenon

of stockout viz. no sales occur when shelfs are empty. Hence, the number of sales

per unit time is a strictly lower estimate than the actual demand, and it is difficult

to guess this gap. Statistical and machine learning techniques have been applied

to this task for quite some time. Works such as [8–10] address this problem using

quite elaborate models. In our work, we present a relatively simple HMM model

which addresses both of the above problems viz. inventory inaccuracy and demand

estimation.

1.2

Our Approach

A common feature of the two problems above is that they both rely on identifying

stockout periods. It can therefore be imagined that a single mechanism could solve

both problems. Our work in this thesis can be regarded as an important step in

this direction. Our work solves the problem of inventory inaccuracy in a novel way,

inspired from [6]. Following their approach, we give a Hidden Markov Model (HMM)

description of the retail system, which we call the Sales-Refills model. The hidden

state in our HMM is precisely the inventory level. Using accurately recorded sales

data, we show that this hidden state can be estimated consistently for all time. The

estimation of the hidden state is performed by identifying the stockout periods in a

14

clever way. This enables us to solve both the problems of inventory inaccuracy and

demand estimation in retail.

As an illustrative example, consider a candy shop using a point-of-sales (POS)

system like Square, Inc. The candy shop sells one type of candies. Whenever a

customer comes to the shop, if candies are not equal to 0 (i.e. stockout has not

happened), then the customer may buy a candy resulting into a transaction being

recorded in the POS. On the other hand, if candies available are 0 then customer shall

not be able to purchase any candy. Of course, this may be confused with the fact that

lack of customers arriving may not lead to recording of a transaction either. Thus,

observing transactions provides some information about the hidden state (number of

candies or inventory), but it is not clear if we can reconstruct the exact value of the

inventory using transactions.

To aid the process of estimation of the hidden state (inventory), we take note of

the following standard practice in retail industry called (the (s, S) policy (cf. [14,15]):

every time inventory level goes below a threshold s ≥ 0, a refill is ordered to get

inventory to level (at least) S > s. With the knowledge of this practice along with

the model that customers arrive as per Bernoulli process for a discrete time system

(cf. [8]) and make purchasing decisions independently, the resulting setup is that

of Hidden Markov Model where hidden state is the inventory that evolves as per a

Markov chain and observations, transactions, depend on the hidden state.

1.2.1

Literature Survey

The problem of estimating inventory and demand from observations has been considered in earlier work [1, 6, 7, 9, 10] Our work is inspired by that of [6] where authors

introduce a (second order) Hidden Markov Model for the question of inventory estimation from transaction data that we briefly alluded to in the text above. In [6], authors

show that using Gibbs Sampling to estimate the marginals in the usual method for

estimation of HMM, it is feasible to estimate inventory accurately in practical set15

ting. However, their result lacks theoretical guarantees. We also take note of [9] that

utilizes the Baum-Welch (or EM) algorithm for estimation of demand in a similar

context.

In general, this problem can be seen as estimation of hidden state of an HMM. It is

well known that in general estimation of hidden state is not possible from observations

(cf. [11]). However, under the model dependent specific conditions, it may be feasible

to recover the hidden state from observations. For example, over years there have

been various approaches developed to learn mixture distributions (simplest form of

HMM) [16–20]. In the recent and not so recent past, various sufficient conditions for

identifiability for HMMs have been identified, cf. [21–23]. None of these approaches

seem to provide meaningful answer to the HMM estimation problem considered here.

1.2.2

Our contributions

We provide a simple estimation procedure for which we establish that all the inventory

states can be estimated accurately with probability 1 after enough observations are

made. We derive the precise sample complexity bound to find how many samples are

needed to estimate inventory at all states with high enough probability and we find

that it to be efficient. Precisely, to get with probability at least 1-ε it takes O ε12

samples.

1

The key insight in our ability to learn the hidden state of the HMM is as follows.

In the HMM of interest, we establish that the primary source of uncertainty arises

due to the unknown value of the inventory in the beginning (initial state) along with

refill amount. That is, if the initial state and refill amount is known, then by using

transaction information, we can reconstruct the value of inventory for all subsequent

states. Here we utilize the fact that inventory refill is happening as per an (s, S)

policy (with unknown S). If maximum value of S is known (i.e. upper bound on

1

This is a loose bound, we actually get close to O

bounds should be possible for our model

16

1

ε

in chapter 5. We believe that stronger

S), then effective uncertainty in the system is captured by finitely many different

values (combination of initial state value and value of S). With each of these finite

option, we produce a verifiable condition that is asymptotically true if and only if

that particular finite option corresponds to the system uncertainty. This leads to

consistent estimator of the unknown inventory. The finite sample bound follows by

showing that this asymptotic property holds with high probability with few samples.

Thus we obtain efficient estimator.

In addition to solving the specific problem of mitigating inventory inaccuracies

using transaction data, our approach identifies a class of Hidden Markov Models that

are learnable. This class of models may be simple, but as exemplified by the above

setting, it could be of relevance in practice.

1.3

A spectral algorithm for learning HMM

We give a brief summary of the work in [21], and explain why it does not apply to our

current problem. In this work, the authors propose a method for learning comb-like

graphical models, which can be easily extended to learning HMMs. They provide a

PAC algorithm for learning a set of probabilities such that the output distribution

is close to the empirical output distribution (cf. Theorem 5 in [21]). We paraphrase

this theorem below for completeness.

Theorem A (From [21], Theorem 5 ). Let φd , κπ > 0 be constants. Let C be a

finite set and Mn denote the collection of |C| × |C| transition matrices P , where 1 ≥

|detP | ≥ n−φd . Then there exists a PAC-learning algorithm for (TC3 (n) ⊗ Mn , nκπ ).

The running time and sample complexity of the algorithm is poly(n, |C|, 1ε , 1δ ).

Note: The object (TC3 (n)⊗Mn , nκπ ) refers to the collection of all possible Caterpillar Trees on n leaves, endowed with transition matrices from Mn , for which the

stationary probability at every node for every state exceeds n−φd .

17

Strictly speaking, the above method only learns finite-size, HMM-like graphical

models 2 . To extend this method to HMMs, we use a result from [24]. The result

allows us to characterize the infinite output distribution of a HMM with a small block

of the output distribution. Precisely, their result is as follows:

Theorem B (From [24], Theorem 3). Let Θ(d,k) be the class of all HMMs with output

alphabet size d and hidden state size k. There exists a measure zero set E ⊂ Θ(d,k) such

that for all output processes generated by HMMs in the set Θ(d,k) \ E, the information

in P(N ) is sufficient for finding the minimal HMM realization, for N = 2n + 1, with

n > 2dlogd (k)e.

Combining the results from theorems A and B above, we obtain a method for

learning an HMM. This can be done as follows: instead of learning the entire (infinite)

output distribution of the HMM, we learn a finite block of our HMM of size l =

4dlogd ke + 1. We can obtain IID samples for this finite graphical model from the

infinite output stream of our HMM, by collecting blocks of ‘l’ consecutive samples,

leaving a gap of several observations after each block. Assuming the HMM is ergodic,

which is always true in practice, we shall obtain samples from the finite-length output

distribution that are nearly independent. These samples can be used to learn the

transition probabilities for our graphical model according to theorem A. By theorem

B, the same probabilities will correctly reproduce the infinite output distribution of

the HMM.

3

Limitations:

While the above result constitutes a useful step toward solving the hard problem of

HMM learning, it has several limitations. One consequence of these limitations is that

3

Note that the finite graphical model could in principle, have different transition and emission

probabilities for each of its edges. However, one expects the learnt probabilities to be equal in the

limit, since our observations are generated from a time-homogenous HMM.

18

the method is ineffective for our Sales-Refills model. We describe these limitations

below.

1. Homogeneity of Alphabet Size: The result of Theorem A requires all nodes

in the graphical model to have the same state space. In particular, this means

that we can only learn HMMs for which the number of hidden states equals the

alphabet size of the observed variable. Hence, thiis method cannot be used for

our Sales-Refills HMM, since the hidden state takes C + R + 1 different values,

while the observation variable is binary.

2. Spectral Conditions on Matrices and Stationary Probabilities: Theorem A also requires 2 important conditions to be satisfied, viz.

• All probability matrices (i.e. both transition and emission matrices) must

have determinant bounded polynomially away from 0.

• All nodes must take on each possible state with probability that is polynomially bounded away from 0. In other words, there should be no ‘rare’

states at any node.

These constraints restrict the class of models for which these methods can be

applied. However, there is a reason why such constraints are needed, viz. to

avoid hard instances such as the ‘Parity Learning with Noise’ HMM described

in [21].

3. Independence of Samples: Theorem A uses the concept of PAC-learning,

and hence it assumes the existence of an oracle which provides i.i.d. samples

from the output distribution of a block graphical model. In practice we are

likely to not have i.i.d. samples, but a single, infinitely long, continous data

stream from the output of an HMM. Our workaround is to take block samples

at large intervals, and assume these to be almost i.i.d. (assuming ergodicity).

While one expects this method to work in practice, the theorems will have to

19

be adapted to work with near-independence instead of independence, and the

error rates would have to be calculated.

4. Interpretability/Learning a Constrained System: We explore yet another issue, which is not often discussed in relation to HMM learning, although

it is quite important. In our Sales-Refills model, we are not trying to learn an

HMM from scratch, but rather trying to learn a model for which some information about the parameters is already available (see section 1.4 for a detailed

description). There does not seem to be any easy way to adapt the results of

theorem A for such a constrained HMM learning problem. If we ignore these

constraints, the model may not even be identifiable, as indeed the Sales-Refills

model is not. Although the PAC-learning framework does not require identifiability, and hence in principle it may be possible to apply the theorem A for

such an HMM, the resulting parameters are unlikely to have any meaning (since

they do not satisy the constraints) and hence may not be ‘interpretable’.

5. Measure-Zero Set Issues: The result of [24] viz. theorem 1.3 holds for all

HMMs except those in a measure zero set in the parameter space. Unfortunately,

whether measure zero sets are ‘negligible’ in practice is a rather philosophical

question. Since our linearly constrained HMM model has many parameters

forcibly set to 0, it is not easy to say our HMM is outside the measure zero set.

In case the result of theorem 1.3 is not applicable, there exist other results for

sufficiently large block size, but these may be much larger (polynomial rather

than logarithmic) and hence may not be very efficient.

20

1.4

Formulation as a Constrained HMM Learning

Problem

The HMM problem we are trying to solve can be described as learning the parameters

of the model given some partial knowledge about them. For our particular HMM,

these parameters are the initial state, the (hidden state) transition probabilities, and

the emission probabilites. The partial knowledge available to us in this case may

be regarded as linear constraints being imposed upon the probability matrices. In

our work, we also show that it is possible to learn a high-level parameter ‘C’ which

influences the output distribution in a more complex way. To present our problem

in a more general framework, we shall simplify the problem here by assuming C is

known. We also make one diversion from our Sales-Refills model in what follows: we

make sale and refills events exclusive rather than independent 4 .

The HMM learning problem we solve can be regarded as a special case of the

following general problem:

Definition 1 (HMM Learning with Linear Constraints). Given a partial HMM description viz. a hidden state size k, an output alphabet size d, constraint matrices Ae ,

At , Be , Bt ; where the transition and emission probability matrices Pt and Pe satisfy

the following:

Ae · Pe ≤ Be

At · Pt ≤ Bt

T

The problem is to find consistent estimators P̂T

t and P̂e based on T observations,

such that

T

P̂T

t , P̂e → Pt , Pe

4

In this case, the transition probabilities for low stock (i.e. less than R) become ternary variables,

divided into p, q, and 1 − (p + q). The reader can verify that this model is no more complex than

the model described in chapter 2, and can be solved by the same methods

21

as T → ∞. Furthermore, we can solve the problem ‘efficiently’ if our algorithm

produces estimates of the stochastic matrices such that every element of the matrix

is within distance ε of its true value, with probability exceeding 1 − δ, in time upper

bounded by a polynomial in

1

δ

and 1ε .

We will now show that our problem fits into this general framework. For this,

we shall briefly describe our model from a purely mathematical point of view. For a

more complete discussion including its motivation from the retail industry, the reader

is encouraged to read chapter 2.

Our HMM is of order C + R, meaning the hidden state takes values in the set

{0, 1, 2, . . . , C + R − 1} (remember that C is known). The observation alphabet is

of size 2, i.e. binary. We have the following information about the transition and

emission probabilities:

1. For any (hidden) state, the probability of moving to a lower state, that is lower

by more than 1, equals 0. That is,

P(Xt+1 < j − 1|Xt = j) = 0,

∀t, j

2. For any non-zero state, the probability of moving to a state which is lower by

exactly 1, is equal to a constant (i.e. independent of the state). That is,

P(Xt+1 = j − 1|Xt = j) = P(Xt+1 = i − 1|Xt = i),

∀t, j ≥ 1, i ≥ 1

3. For any state, the probability of moving to a bigger state equals 0, unless the

bigger state is exactly C larger, and the current state is less than or equal to

R. For transitions satisfying the 2 conditions, the transition probability is a

constant. That is,

P(Xt+1 > j|Xt = j) = 0 ∀t, j > R

P(Xt+1 = j|Xt = i) = 0 ∀t, i ≤ R, j > i, j 6= (i + C)

P(Xt+1 = j + C|Xt = j) = P(Xt+1 = i + C|Xt = i) ∀t, i ≤ R, j ≤ R

22

4. For any non-zero state, the probability of emitting a 1 is equal to a constant.

That is,

P(Yt = 1|Xt = j) = P(Yt = 1|Xt = i) ∀t, i ≥ 1, j ≥ 1

5. If the hidden state equals zero, the only symbol that can be emitted is a zero.

That is,

P(Yt = 0|Xt = 0) = 1 ∀t

All of the above facts can be encoded as linear constraints on the transition and

emission matrices.

Hence, the HMM problem we solve is a special case of HMM learning with linear

constraints. In fact, our work solves a somewhat more general problem than what

we describe above, since it allows us to find not just the transition and emission

probabilities, but also the starting state X0 and the high-level parameter C.

1.5

Organization of Thesis

Chapter 2 describes our HMM model for retail scenario, namely, the Sales-Refills

model. We also note down our key results for parameter estimation in this model, in

the form of 2 theorems.

Chapter 3 describes our estimation algorithm. We define estimators for each parameter mentioned in theorem 1.

Chapter 4 describes the proof of our estimation algorithm. In this chapter, we argue

for consistency of our model, by showing that all estimators defined in chapter 3

converge almost surely to the true quantities. Chapters 3 and 4 together constitute

our proof of theorem 1.

Chapter 5 describes our sample complexity bounds for the stock estimation. We show

that in addition to being consistent, our estimators are also efficient in the sense of

giving error bounds from polynomially many samples. This chapter gives the proof

of theorem 2.

23

Chapter 6 offers extensions of the Sales-Refills model, showing how our model can

be learnt even with some generalizations. In addition, it outlines our idea for Noisy

Sales-Refills model, which would overcome the key limitations of the basic model.

Chapter 7 summarizes our work, discusses its significance and gives pointers for future

work.

24

Chapter 2

Model Description and Estimation

2.1

Definitions

To describe our mathematical model for the retail system, we shall first define a

general order-k-hmm.

Definition 2 (Order-k-hmm). For any natural number k, we define an order-k-hmm

to consist of 2 sequences of random variables X0 , X1 , X2 , . . . and Y0 , Y1 , Y2 , . . . such

that Xi ’s form a markov chain, and Yi is a function of Xi , Xi−1 , . . . , Xi−k+1 for all

i ∈ N. We shall call X0 , X1 , X2 , . . . the sequence of hidden states, and Y0 , Y1 , Y2 , . . .

the sequence of observations. Thus, we allow each observation to depend on the past

k states.

Definition 3 (Shifted order-k-hmm). Given an order-k-hmm with state sequence

X0 , X1 , X2 , . . . and observation sequence Y0 , Y1 , Y2 , . . . , we say that the observation

sequence has shift d if Yi is a function of Xd+i , Xd+i−1 , . . . , Xd+i−k+1 , for all i.

Our HMM model shall be an order-2-hmm, with the observation sequence having

shift 1. As a directed graphical model, this can be represented as in figure 2.1.

25

X0

X1

X2

X3

Y0

Y1

Y2

Figure 2.1: Shifted order-2-hmm, representing the hidden state variables Xt ’s and

observation variables Yt0 s. Notice that the observation sequence has shift 1.

2.2

2.2.1

The Sales-Refills Model

Overview

Our model describes how the inventory or stock for an item in a retail store evolves

with time. The random variable Xt denotes the stock at time t 1 . We assume that

the stock evolves according to a markov process i.e. X0 , X1 , X2 , . . . , XT form a markov

chain (MC). Since the stock is not observable, this is a hidden MC. We also have transactions or sales, which we denote by the random variable Yt , at time t. Sales are observed in our model. Taken together, the sequences X0 , X1 , . . . , XT and Y0 , Y1 , . . . , YT

form a shifted order-2-hmm with shift 1 (figure 2.1).

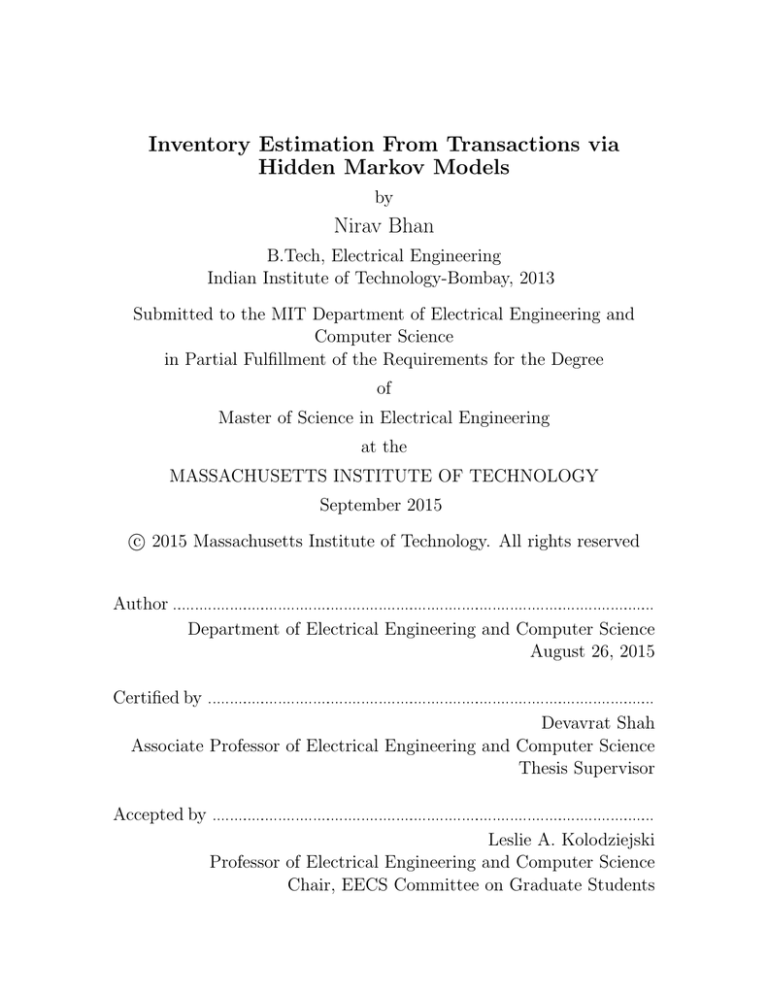

Our model incorporates two ways in which stock can change - sales and refills.

Whenever the stock is non-zero, there is a probability q that a customer buys an

item. For simplicity, we shall assume that a customer can only purchase 1 item at

a time 2 . Since sales are observed, we have Yt = 1 if a sale occurs at time t. Sales

decrease the current stock by 1. We also allow refill events. If the current stock is

smaller than a number R, the store manager may decide to order a fresh batch of

stock. We assume that the stock refill happens with probability p, and this increases

1

2

We assume there is a notion of time. For more details, we refer the reader to [6]

Some justification for this assumption is provided in [6], by suitably defining non-purchase events

26

the stock by a fixed amount C. Clearly, R < C. Our refill policy is thus a variant of

the popular (s, S) policy for inventory management ( [15]). In our model, refills are

not observed. We also allow sales and refills to occur independently of each other.3

2.2.2

Formal definition

We will now formally describe our HMM as a generative model. We assume that

Xt ∈ {0, 1, 2, . . . , S}, where S = C + R is the maximum stock value. The initial stock

value viz. X0 is a parameter in our model. Knowing Xt , we show how to generate Xt+1

as well as Yt . For this, we define 2 variables 4s,t and 4r,t representing the change in

stock due to sales and refills respectively, at time t.

(a) 4s,t : Sales decrement.

i.

4s,t =

When Xt > 0 :

1 w.p. q

0 w.p. 1 − q

4s,t = 0

ii. When Xt = 0 :

(b) 4r,t : Refill increment.

i.

When Xt ≤ R :

4r,t =

C

w.p. p

0

w.p. 1 − p

4r,t = 0

ii. When Xt > R :

We now define Xt+1 and Yt as follows:

3

Yt

,

4s,t

Xt+1

,

Xt + 4r,t − 4s,t

In this paper, we use terms stock for inventory and sales for transaction during the formal

treatment. We use R and C respectively for the s and S in the modified (s, S) policy.

27

The above tells us how, starting from a particular X0 , we can generate a sequence

of state variables X1 , X2 , . . . , XT and a sequence of observations Y0 , Y1 , . . . , YT . This

completes our description of the model. For clarity, the possible transitions of the

stock MC are shown diagrammatically in figure 2.2.2.

C+R

C+1

Sale

(q)

Refill

(p)

C

R+1

Sale

(q)

R

Refill

(p)

1

Sale

(q)

0

Figure 2.2: State transition diagram for the stock MC. Sales occur in all states besides

0, while refills only occur in states ≤ R.

28

2.3

Estimation

For the Sales-Refills model of section 2.2.2, assuming that we know R, we claim that

it is possible to obtain consistent estimates of all parameters of interest. Further,

this will allow us to estimate the hidden stock accurately at all times. We formalize

this claim in two theorems. For the sample complexity bounds, we shall make an

additional assumption about C, namely C ∈ {K, K + 1, . . . , 2K − 1} for some known

integer K. We call this assumption ‘restricted C’. We shall describe how it can be

removed in section 3.4.

Theorem 1 (Consistent Estimation). Let R be known. Then, there exist estimators

q̂ T , Ĉ T , X̂0T , p̂T and X̂tT , based on observation Y0T = (Y0 , Y1 , . . . , YT ), so that as T →

∞,

a.s.

(q̂ T , Ĉ T , X̂0T , p̂T , X̂tT ) → (q, C, X0 mod C, p, Xt mod C).

(2.1)

That is, our estimators converges almost surely.4

The result states that there exist consistent model estimators. Next, we discuss

the finite sample error bound.

Theorem 2 (Sample Complexity). Let R be known, and C satisfy the above stated

restriction that C ∈ {K, . . . , 2K − 1} for known value of K. Then, for any ε ∈ (0, 1),

!

sup

P

|(X̂t − Xt ) mod C| > 0

≤ ε,

t∈{0,...,T }

for all T ≥ max

4B 2 4

,

ε2 ε

. The constant B is defined explicitly in terms of model

parameters, via equations 5.20 , 5.13, 5.14, and 4.35.

Theorem 1 constitutes the main result of this paper, as it shows our model is

learnable, while theorem 2 shows that the estimation procedure is efficient. As a

4

a.s.

Note that aT −−→ a as T → ∞, means that the random variable aT converges to a with

probability 1, as T → ∞

29

consequence, whenever the stock lies strictly between R and C, our algorithm yields

the exact stock. On the other hand, if the stock is too low i.e. smaller than R, there is

no way to discern whether a refill has occurred as per ours, or indeed any algorithm.

It should be noted that in practice one expects R C and hence this uncertainty is

of minimal relevance.

We prove the above theorems by giving explicit algorithms for parameter recovery,

in chapter 3. The proof of correctness of these algorithms is given in chapter 4, and

provides the proof of theorem 1. The proof of finite-sample error bounds (i.e. theorem

2) is described in chapter 5.

30

Chapter 3

Algorithm

We describe our methods for stock and parameter recovery.

3.1

Estimating stock (or inventory)

In order to estimate the stock correctly, we must first estimate parameters C and

X0 mod C. Then, we use these values to recover the hidden stock values.

3.1.1

Estimating C, X0 mod C

Although X0 is a parameter in our model, we shall only be interested in the value of

X0 mod C, which we denote by U for convenience. That is,

U , X0 mod C

(3.1)

Define the set Sc,i , as being the set of time indices t, such that number of observed

sales from 0 up to t is congruent to i modulo c. These sets are defined for each

c ∈ {K, . . . , 2K − 1}, and for a fixed c, for each i ∈ {0, 1, . . . , c − 1}.

Thus, we have the following sets, indexed by parameters c and i:

(

)

t−1

X

STc,i , t ∈ {1, . . . , T } :

Yj ≡ i mod c

∀ c, i

j=0

31

(3.2)

Define the sale events for c, i up to time T , as the number of time instants t in

STc,i , such that Yt > 0. In other words,

T

Ec,i

,

X

1(Yt =1)

∀ c, i

(3.3)

t∈ST

c,i

Define the average window length for c, i up to time T :

LTc,i

|STc,i |

, T

Ec,i

(3.4)

Define the maximizing indices:

c∗T , i∗T , arg max LTc,i

(3.5)

c,i

Then, Ĉ T = c∗T and Û T = i∗T are our estimators for C and U respectively.

3.1.2

Estimating hidden stock

Using our estimators for C and U , we can now easily recover the stock modulo C for

T

all times. We define an estimator X̂t for Xt mod C, as follows:

T

X̂t =

Û T −

t−1

X

!

Yj

mod Ĉ T

(3.6)

j=0

3.2

Estimating q and p

Estimating q

Having already described the method for estimating C and U in the section 3.1.1, we

now assume that these are known. In order to estimate p and q from the data, we

define the following empirically-obtained quantities:

P

T

i∈{0,...,C−1},i6=U |SC,i |

TST , P

(average sale time)

T

i∈{0,...,C−1},i6=U EC,i

T

TSZ

,

|STC,U |

= LTC,U

T

EC,U

(average sale time at ‘zero’ stock)

32

(3.7)

(3.8)

Our consistent estimator for q is q̂, where:

q̂ T ,

1

TST

(3.9)

Estimating p

We now look into estimating the refill probability, p. Let q̂ be our estimate of q from

the previous section. Define function f : [0, 1] × [0, 1] → R+ as

R

q − qp

1

.

f (p; q) =

p q − qp + p

(3.10)

As argued in Lemma 5, for fixed q, f is a strictly decreasing function in it’s first

argument p. That is, it has well defined inverse f −1 in its first argument. Using this

property, we define

T

p̂T = f −1 ((TSZ

− TST )+ , q̂ T ).

3.3

(3.11)

Computational efficiency

Our estimation algorithms, due to their simplicity, are computationally very efficient.

The most expensive step in our algorithm is computing |STc,i | and |Ec,i |T for each c

and i. By doing computations cleverly, we can do all computations for one value of c

in a single pass over the observations. Hence, the total time required for computing

all values equals O((no. of values of c to try) ∗ T ) = O(K T ). Since K ≤ C < 2K,

we can also write the time complexity as O(C T ).

3.4

3.4.1

General C

Idea

We extend the estimator described in section 3.1.1 to general C, not necessarily

between K and 2K. In the general case, we assume that C ∈ {Cmin , . . . , Cmax }, where

33

Cmin and Cmax are 2 positive integers, and Cmax ≥ Cmin ≥ 2.

1

Our observations in

lemma 3 still hold. Namely, if we guess an incorrect value C 0 , the fraction of times we

shall see a longer interval equals

gcd(C,C 0 )

.

C

However, it is now possible that we choose

a C 0 which may be a multiple of C, in which case the quantity above equals 1. Thus,

we are likely to be confused between the true C and its multiples, since these will

have the same expected window length.

The way to resolve this is to notice that for large T , all multiples of C will give

‘approximately equal’ window lengths, and this length will be the maximum among

all (c, i) indices. Thus, we can look at all (c, i) pairs for which LTc,i lies within a suitable

distance δ of maxc,i LTc,i . If we have sufficient data, all values of c which attain such a

maximum should be multiples of each other, of the form c∗T , 2c∗T , 3c∗T , . . . etc. We then

pick the smallest of these multiples viz. c∗T as our estimator for C. For the above

value of c, there shall be exactly one value of i, viz. i∗T , such that LTc∗T ,i∗T is close to

maxc,i LTc,i . We pick i∗T as our estimator for U .

3.4.2

General estimator for C, U

Assume that Cmax and Cmin are known, and the true C lies between them. Our aim

is to determine the true C, along with the corresponding X0 mod C (i.e. U ).

As in section 3.1.1, define sets STc,i , for each c ∈ {Cmin , . . . , Cmax } (note the range),

and for a fixed c, for each i ∈ {0, 1, . . . , c − 1}. Similarly, define the sale events and

average window length up to time T , for each choice of the parameters c and i. Thus,

we have the following quantities:

(

STc,i ,

t ∈ {1, . . . , T } :

t−1

X

)

Yj ≡ i

mod c

∀ c, i

(3.12)

j=0

T

Ec,i

,

X

1(Yt =1)

∀ c, i

(3.13)

t∈ST

c,i

1

It may be of interest from a theoretical standpoint to consider the case when Cmax is allowed

to depend on T . However, we do not consider this scenario in the current work.

34

LTc,i ,

|STc,i |

T

Ec,i

∀ c, i

(3.14)

Define the maximizing quantity:

L∗T , max LTc,i

c,i

(3.15)

Also define the following min-max quantity:

L̃T , max min LTc,i

c

i

Define the following set of candidate indices for C, viz.

3 ∗

1

T

T

C = c ∈ {Cmin , . . . , Cmax } : max Lc,i ≥ LT + L̃T

i

4

4

(3.16)

(3.17)

Now, we define the following indices:

C̄ T , min(CT )

(3.18)

Ū T , arg max LTC̄ T ,i

(3.19)

i

Then, C̄ T and Ū T are our general estimators for C and U respectively.

35

Chapter 4

Proof of Estimation

We now prove that the methods described in chapter 3 give correct answers. We start

by proving an important lemma.

4.1

Invariance modulo C

We shall prove the following lemma, which states that given the true C and U , it is

possible for us to determine the stock modulo C at all times. This lemma captures

the observability of our model.

Lemma 1. In a Sales-Refills model, let X0 represent the starting state, Xt represent

the hidden state at time t, C represent the refill quantity, and let U , X0 mod C.

Then the following congruence relation holds modulo C:

Xt ≡ U −

X

Yi

mod C

∀t ∈ {1, 2, . . . , T }

(4.1)

0≤i≤t−1

Proof. Intuitively, if we look at the value of the hidden state modulo C, it can change

in only 2 ways: by either a sale or a refill. Since sales are observed, we can simply

subtract them out to get the updated value of X . Although refills are unobserved,

they do not affect the value of X mod C. Hence, it is possible to determine the

36

value of Xt mod C from the observations alone. To prove this formally, we use the

definitions of Xt and Yt .

Xt+1 = Xt + 4r,t − 4s,t

Yt = 4s,t

(by definition)

(by definition)

Since 4r,t ∈ {0, C},

4r,t ≡ 0

∀t

mod C

∴

Xt+1 ≡ Xt − 4s,t

∴

Xt+1 ≡ Xt − Yt

mod C

mod C

Adding up these equations for 0 ≤ t ≤ t0 − 1, we get:

Xt0 ≡ X0 −

X

Yt

mod C

0≤t≤t0 −1

∴ Xt ≡ U −

X

Yi

mod C

0≤i≤t−1

4.2

Correctness of Ĉ T and Û T

We first prove few lemmas regarding the quantities defined in section 3.1.1. To that

end, define

PN R ≡ PN R (p, q) =

q − qp

q + p − qp

R

.

(4.2)

Lemma 2. Let Lc,i be defined as in equations (3.2)-(3.4). Then,

1 PN R

+

,

q

p

1

E[LC,i ] =

,

∀i ∈ {0, 1, . . . , C − 1} \ {U }.

q

E[LC,U ] =

Proof. From the definition 3.2 and lemma 1, we can re-write STC,i as

STC,i = {t ∈ {1, 2, . . . , T } : Xt ≡ U − i mod C}

37

(4.3)

(4.4)

Thus, STC,U represents the set of times when stock equals 0 mod C, and hence contains

all instants when the stock is empty (or equal to C). Now, Li is the average window

length in STC,i , and represents the average length of time we need to wait in order to

observe a sale (immediately after the previous sale). Hence if i 6= U , then the stock is

always non-empty, so LTC,i is the average time for sale from a non-empty stock. Since

the sale time is a geometric random variable with success probability q, we get:

1

E[LTC,i ] = ,

q

∀i 6= U.

The distribution for i = U is more complex. In our refill policy, we allow for the

possibility that the stock has been refilled before reaching 0. We call this an ‘early

refill’. Thus, if we observe the stock value to be 0 modulo C, the true stock could be

either 0 or C. We need to treat these cases separately.

We define the No-Refill Probabillity PN R in section 4.7 to be the long-term probability of the event that when the stock attains a value congruent to 0 modulo C

immediately after a sale, the true stock is actually 0. When this is true, we need

to wait for a refill before we can observe the next sale. Thus, with probability PN R ,

the window length is a sum of 2 geometric random variables, one of which has mean

1

p

and the other has mean 1q . With probability 1 − PN R , the stock is refilled before

reaching 0, so the window length is a geometric random variable with mean 1q . Hence,

we can write:

Average window length in STC,U = (average sale time) + PN R ∗ (average refill time | no early refill)

1

1

∴ E[LC,U ] =

+ PN R

q

p

Lemma 3. For a Sales-Refills mode of section 2.2, with the definitions described in

lemma 2, the following holds:

E[Lc,i ] ≤

1 PN R

+

q

2p

38

∀c 6= C, ∀i

(4.5)

Proof. In this case, we do not assume that our c equals the true C, so it is more

difficult to interpret the various sets STc,i . To that end, think of the sequence of intersale gaps as representing a sequence of intervals. The interval lengths are random,

with two possible means - either d1 =

1

q

or d2 =

1

q

+ PN R p1 . Clearly d2 > d1 . The

intervals with mean d2 occur at a fixed period of once every C intervals, and all

other intervals have mean d1 . The leftmost interval with mean d2 occurs at position

U ∈ {0, 1, . . . , C − 1}. Our problem can be stated as figuring out the correct period

C and starting position U for these longer intervals.

We attempt to solve this by guessing a value of C (which we call c) and a value

of U (which we call i). We then compute the average interval length, of intervals

starting at i and at a gap of c intervals respectively, up to a total of T intervals. We

call this average length LTc,i . Clearly, if we guess the correct values of c and i, viz.

C and U respectively, then we shall obtain interval length whose average value is d2 ,

the largest possible. On the other hand, if we guess an incorrect value of c, say C 0 ,

then the question is what is the longest average interval length that will be observed.

We would like to show that it is strictly less than d2 so as to allow for our ability to

distinguish such an incorrect choice of C 0 from the true value of C.

Indeed, we shall establish this fact. Let C 0 6= C. Then we shall observe the longer

intervals at most a fraction

gcd(C 0 ,C)

C

of the time for any value of i. We establish this

fact next.

There are two possibilities for a particular choice of C 0 6= C and i. One possibility

is that we never observe longer intervals e.g. if all longer intervals are even numbered,

and we are only looking at odd-numbered intervals. In this case, the fraction of longer

intervals is 0. Now, suppose that our choice of C 0 and i is such that we observe at least

1 longer interval. Then the next time we observe a longer interval is exactly when C 0

and C have a common multiple. This will happen once in every lcm(C, C 0 ) intervals.

Meanwhile, our average length LTC 0 ,i is computed by considering one interval in every

C 0 intervals. Thus, over the long term, the fraction of longer intervals in our average

39

equals:

1/lcm(C, C 0 )

gcd(C, C 0 )

C0

=

=

1/C 0

lcm(C, C 0 )

C

For any C 0 which is not a multiple of C, this quantity is at most 21 . Now, in any set

of the form {K, K + 1, . . . , 2K − 1}, where K is a positive integer, there are no two

numbers such that one is a multiple of the other. Thus, at most half the intervals in

our average shall have mean d2 . Hence, we can write:

E[LTc,i ] = d1 · (fraction of intervals with mean d1 ) + d2 · (fraction of intervals with mean d2 )

= d1 + (d2 − d1 ) · (fraction of intervals with mean d2 )

1

≤ d1 + d2

(since d2 − d1 > 0)

2

1 1 PN R

≤

+

∀c 6= C, ∀i

q 2 p

since by assumption, LTc,i is only defined for c ∈ {K, K + 1, . . . , 2K − 1}. This proves

the required result.

Combining lemmas 2 and 3, we are ready to prove the correctness of our estimators.

Proposition 1. Under the setup of Theorem 1, as T → ∞

a.s.

(Ĉ T , Û T ) → (C, U ).

Proof. From lemmas 2 and 3, we get:

= 1q +

T

E[Lc,i ]

≤ 1 +

q

PN R

,

p

(4.6)

c = C, i = U

(4.7)

PN R

,

2p

o.w.

Moreover, since LTc,i is an empirical average of integrable i.i.d. random variables,

we have by Strong Law of Large Numbers that

40

a.s.

LTc,i −−→ E[LTc,i ] ∀c, i,

a.s.

∴

arg max LTc,i −−→ arg max E[LTc,i ],

∴

arg max LTc,i

c,i

c,i

∴

4.3

c,i

a.s.

−−→ C, U

(from equation 4.7),

a.s.

Ĉ T , Û T −−→ C, U.

Correctness of X̂t

(4.8)

T

Proposition 2. Under setup of Theorem 1, as T → ∞

T a.s.

X̂t → Xt

mod C.

(4.9)

a.s.

Proof. This follows directly from lemma 1 and the fact that (Ĉ T , Û T ) → (C, U ) as

per Proposition 1.

4.4

Correctness of q̂ T

Proposition 3. Under setup of Theorem 1,

a.s.

q̂ T → q,

as T → ∞.

(4.10)

Proof. The quantity TST above represents the average length of time for a sale to occur,

when the initial stock does not equal 0 modulo C. Since the stock must be non-empty

in such instances, the length of time for a sale is a geometric random variable with

success probability q. Hence, E[TST ] = 1q . Moreover, since TST is the empirical average

of integrable i.i.d. random variables, by Strong Law of Large Numbers, we have

a.s.

TST −−→ E[TST ]

41

a.s. 1

−−→ .

q

(4.11)

And hence

q̂ T ,

4.5

1

TST

a.s.

−−→ q.

(4.12)

Correctness of p̂T

First, we state few lemmas.

Lemma 4. Under the setup of Theorem 1,

T

E[TSZ

− TST ] = f (p; q),

where f is defined in (3.10).

Proof. From lemma 2 and proposition 3, we know that:

1

1

+ PN R ,

q

p

1

E[TST ] =

.

q

T

E[TSZ

] = E[LTC,U ] =

Hence,

T

E[TSZ

− TST ] =

1

PN R .

p

(4.13)

From equations (3.10) , (4.13) and (4.35),

T

E[TSZ

− TST ] = f (p; q).

Lemma 5. Given fixed R ≥ 0, let f : [0, 1] × [0, 1] → R+ be defined as

R

1

q − qp

f (p; q) =

.

p q − qp + p

(4.14)

Then for any q ∈ (0, 1), f is a strictly monotonically decreasing function of variable

p ∈ (0, 1).

42

Proof. Effectively, f is product two terms, each of which is strictly decreasing in p

(for fixed q ∈ (0, 1) and R ≥ 0). Clearly, the first term, 1/p is strictly decreasing

function in p ∈ (0, 1). The second term is

q − qp

q − qp + p

R

=

1

1+

p

q(1−p)

!R

.

If R = 0, then it is constant. If R > 0, then the second term is strictly decreasing

function of p ∈ (0, 1) since p/(1 − p) is strictly increasing in p. Therefore, f is strictly

decreasing function of p, for fixed q, R.

Proposition 4. Under setup of Theorem 1, as T → ∞

a.s.

p̂T → p.

(4.15)

T

Proof. First, note that both TST and TSZ

are empirical averages of i.i.d. random

variables with finite mean. By Strong Law of Large Numbers,

1

,

q

1

1

a.s.

−−→

+ PN R ,

q

p

1

a.s.

−−→ PN R = f (p; q).

p

a.s.

TST −−→

T

TSZ

Hence,

T

TSZ

− TST

Given q, the function f is strictly decreasing in p. Therefore, with respect to argument

p, there exist an inverse of f which we defined as f −1 ≡ f −1 (·, q). Because we do not

have access to the true q, as stated in Section 3.2, we used our estimate q̂ T to make

f −1 computable from observations. That is, we used f −1 (·; q̂ T ) to obtain p̂T as

T

p̂T = f −1 ((TSZ

− TST )+ , q̂ T ).

(4.16)

T

− TST )+ .

f (p̂T , q̂ T ) = (TSZ

(4.17)

That is,

43

As argued before, we have

a.s

q̂ T → q,

(4.18)

a.s

T

(TSZ

− TST )+ → f (p, q).

That is,

a.s.

f (p̂T , q̂ T ) → f (p, q).

(4.19)

Now f is a continuous function and it is strictly decreasing in its first argument.

Therefore, by Lemma 6 and (4.18) and (4.19), it follows that it must be p̂T → p. This

completes the proof.

We state a useful analytic fact.

Lemma 6. Consider function f : [0, 1] × [0, 1] → R+ . Let f continuous. Further, for

any given q ∈ (0, 1), let f (·, q) be strictly decreasing function (in its first argument).

Let there be (pn , qn , xn ), n ≥ 1 so that f (pn , qn ) = xn for all n; as n → ∞, qn → q

and xn → f (p, q) for some (p, q) ∈ (0, 1) × (0, 1). Then pn → p as n → ∞.

Proof. Suppose the contrary that pn does not converge to p. Without loss of generality, let p∗ = lim inf pn < p. That is, there exists sub-sequence nk → ∞ as k → ∞

so that pnk → p∗ < p. That is, for all k large enough, pnk < p and we shall consider

only such values of nk . Using the fact that f (·, q) is strictly decreasing, we have that

f (pnk , q) > f (p, q) + δ,

(4.20)

for some δ > 0. Since qn → q and f is continuous function, we have that for all n

large enough,

|f (pn , qn ) − f (pn , q)| < δ/4.

(4.21)

Now considering nk for k large enough so that both (4.20) and (4.21) are satisfied,

we obtain

f (pnk , qnk ) > f (pnk , q) − δ/4,

> f (p, q) + 3δ/4.

44

But by assumption of the Lemma, we have that f (pnk , qnk ) → f (p, q). Therefore, our

assumption is wrong and hence pn → p as desired.

4.6

Correctness of C̄T , ŪT

The correctness of the general estimators follows directly from some simple facts. We

shall prove these in the form of lemmas.

Lemma 7. With respect to the quantities defined in section 3.4.2, the following hold:

1

1

+ PN R

q

p

1

1

1

a.s.

−−→

+ PN R

q C

p

a.s.

−−→ {c ∈ {Cmin , . . . , Cmax } : c = kC, for some k ∈ N} 1

a.s.

L∗T −−→

(4.22)

L̃T

(4.23)

CT

(4.24)

Proof. We shall prove the above convergence relations one at a time. Consider the

first relation:

a.s.

L∗T −−→

1

1

+ PN R

q

p

where L∗T , maxc,i LTc,i . From lemma 3, we obtain the following:

= 1q + PNp R , c = kC, i mod C = U

E[LTc,i ]

≤ 1 + PN R , o.w.

q

2p

(4.25)

Moreover, since LTc,i is an empirical average of i.i.d. integrable random variables,

a.s.

LTc,i −−→ E[LTc,i ] ∀c, i as T → ∞. Hence,

a.s.

max LTc,i −−→ max E[LTc,i ] =

c,i

1

c,i

1

1

+ PN R

q

p

By almost sure convergence of a sequence of sets, we mean the following: For every possible

element, the sequence of indicator functions corresponding to its membership in the sets converges

almost surely. For finite sets, this means the sequence of sets eventually becomes constant.

45

Since the LHS equals L∗T , this proves equation 4.22 .

Now, consider the second relation:

a.s.

L̃T −−→

1

1

1

+ PN R

q C

p

To prove this, we rely on a slightly deeper understanding of lemma 3. As described in the lemma, consider the sequence of inter-sale intervals as a sequence of

intervals, with longer intervals occuring regularly at some period. U and C represent

respectively the starting point and period of the longer intervals. As proved in the

lemma, if we guess a C 0 6= C, the fraction of times we shall see the longer intervals is

given by

gcd(C,C 0 )

,

C

provided at least 1 longer interval is observed.

However, since we are minimizing over the starting point, we now ask the question

- for which C 0 is it possible to observe a sequence with no longer intervals? It turns out

that for all C 0 which have a common factor with C (i.e. gcd(C, C 0 ) > 1), there exists

a starting location such that no longer intervals are observed. This can be proved as

follows: suppose gcd(C, C 0 ) = x, and suppose U, U 0 are the true and assumed starting

states, such that U 6≡ U 0 mod x. Since both C and C 0 are congruent to 0 modulo x,

the true sequence with C, U and the assumed sequence with C 0 , U 0 will never overlap,

since they will be different modulo x. Conversely, if C and C 0 are co-prime, then for

every starting point, we shall observe some longer intervals, and their frequency is

exactly

1

.

C

Now, consider the definition of L̃T , viz. L̃T , maxc mini LTc,i . Since we are

minimizing over i, for any c which has a common factor with C, asymptotically a

starting state will be selected for which there are no longer intervals. Hence, the

average window length of this sequence will tend to the average sale time. However,

since we are also maximizing over choice c, this means that the c chosen in our minmax definition will asymptotically always be co-prime to C. For such a co-prime C 0 ,

we shall observe the longer intervals only a fraction

1

C

of the time, as mentioned above

(by lemma 3). Thus, we obtain the required equation:

46

a.s.

L̃T −−→

1

1

1

+ PN R

q C

p

This completes the proof of the second result.

We now consider the third equation, viz.:

a.s.

CT −−→ {c : c = kC, for some k ∈ N}

Recall the definition of C, viz.:

T

c ∈ {Cmin , . . . , Cmax } :

C =

max LTc,i

i

3

1

≥ L∗T + L̃T

4

4

Using equations 4.22 and 4.23, we see that asymptotically, the set CT is close to

C̄T , where the latter is defined as follows:

3 1 PN R

1 1 PN R

T

T

+

+

C̄ ,

c ∈ {Cmin , . . . , Cmax } : max Lc,i ≥

+

i

4 q

p

4 q p·C

1

1 PN R 3

T

T

+

i.e. C̄ =

c ∈ {Cmin , . . . , Cmax } : max Lc,i ≥ +

(4.26)

i

q

p

4 4C

Note: C̄T defined above is not an empirically obtained set, but because of equations 4.22 and 4.23, the empirically defined set CT behaves like it asymptotically.

We define two sets, C̄TL and C̄TU to bound the above set. These sets are defined as

follows:

∴

C̄TU

∴

C̄TL

c ∈ {Cmin , . . . , Cmax } :

,

,

max LTc,i

i

c ∈ {Cmin , . . . , Cmax } : max LTc,i

i

1 3 PN R

≥ +

q 4 p

1 7 PN R

≥ +

q 8 p

(4.27)

(4.28)

Assuming C ≥ 2, it is easy to see that C̄TL ⊆ C̄T ⊆ C̄TU . Now, we consider the

behaviour of the 2 bounding sets as T goes to ∞. From lemma 3, we know that for

every c that is not a multiple of C, maxi E LTc,i ≤ 1q + 12 PNp R . On the other hand,

47

for every c that is a multiple of C, maxi E LTc,i =

1

q

+

PN R

.

p

And since the Lc,i ’s are

empirical averages, they converge to their expectations as T → ∞. Hence:

1 PN R

+

, for all c = kC for some k ∈ N

q

p

1 gcd(c, C) PN R

1 1 PN R

a.s.

−−→

+

≤

+

, otherwise

q

C

p

q 2 p

a.s.

max Lc,i −−→

(4.29)

max Lc,i

(4.30)

i

i

Using the above equations, we can determine what the sets C̄TL and C̄TU look like,

asymptotically. In particular, we see that these sets converge to the following:

a.s.

C̄TL −−→ {c ∈ {Cmin , . . . , Cmax } : c = kC, for some k ∈ N}

a.s.

C̄TU −−→ {c ∈ {Cmin , . . . , Cmax } : c = kC, for some k ∈ N}

(4.31)

(4.32)

Since C̄TL ⊆ C̄T ⊆ C̄TU , and C̄TL , C̄TU both converge a.s. to the same set, this implies

that C̄T must also converge a.s. to the same limit set. Hence:

a.s.

C̄T −−→ {c ∈ {Cmin , . . . , Cmax } : c = kC, for some k ∈ N}

From equations 4.22 and 4.23, and from the definition of C̄T in equation 4.26, it

follows that CT has the same convergence properties as C̄T . In particular :

a.s.

CT −−→ {c ∈ {Cmin , . . . , Cmax } : c = kC, for some k ∈ N}

Thus we have proven the third statement of the lemma viz. equation 4.24. This

completes our proof of the lemma.

From equation 4.24 in lemma 7, it directly follows that:

a.s.

min(CT ) −−→ C

i.e.

a.s.

C̄T −−→ C

48

(4.33)

This proves the consistency of our estimator for C. We now prove the consistency

of our estimator for U . This proof is relatively straightforward. Since C is a discrete

variable, the a.s. convergence of C̄T to C means that with probability one, we shall

have the correct C after finitely many steps. Once the correct C is obtained, we

recover U as the index which maximizes the window length for this C.

It is easy to show that if C were known apriori, the estimator for U would be

correct. This can be seen as follows:

∀i 6= U : E[LTC,U ]

∀i :

∴

E[LTC,i ]

>

a.s.

LTC,i −−→ E[LTC,i ]

a.s.

arg max LTC,i −−→ arg max E[LTC,i ]

i

i

∴

a.s.

ŪT −−→ U

Although we do not know C apriori in this case, we have shown above that we

will know it eventually, with probability 1. Once C is known, all future observations

can be regarded as independent events which will bias LC,U toward a larger value

than LC,i , for all other i. Since the variables Lc,i ’s are empirical averages, finitely

many observations will not affect their long term behaviour. Thus, eventually we

shall recover the correct U as arg maxi LTC,i . Hence, our estimator for U is consistent

as well. That is,

a.s.

ŪT −−→ U,

where U¯T

arg max

,

i∈{0,1,...,C̄T −1}

4.7

(4.34)

LC̄T ,i

No-refill probability

Definition 4. We define the No-Refill Probability PN R , as the long-term probability

that the stock equals 0 given that it equals 0 modulo C, in a time instant immediately

after a sale.

49

In order to estimate refill probability p, we shall need to explicitly compute PN R .

Below, we provide an expression for this probability. To do this, we will first prove a

lemma about doimnance probabilities in Geometric random variables.

Lemma 8. Consider 2 independent Geometric Random Variables X and Y , generated

from Bernoulli processes with success probabilities a and b respectively, both defined

on the support {1, 2, . . . ∞}. Then the probability that we see a success of the first

process before the second i.e. P(X < Y ) =

a−ab

.

a+b−ab

Proof. By definition:

P(X = i) = a(1 − a)i−1

∀ i ∈ {1, 2, . . . }

P(Y = i) = b(1 − b)i−1

∀ i ∈ {1, 2, . . . }

∴ P(Y > i) =

+∞

X

b(1 − b)j−1 = b(1 − b)i

j=i+1

∴ P(Y > X) =

=

+∞

X

i=1

+∞

X

1

= (1 − b)i

b

P(X = i)P(Y > i)

a(1 − a)i−1 (1 − b)i

i=1

a(1 − b)

1 − (1 − a)(1 − b)

a − ab

=

a + b − ab

=

We now want to find the probability that we arrive at a stock of 0 without any

refill occuring. Since refills only occur when the stock is ≤ R, we can be certain that

when the stock equals R + 1 mod C, it’s actual value is R + 1. Immediately after

the next sale, the value of the stock equals R. Thus, in order to see a stock of 0 the

next time when it equals 0 mod C, we need to see R consecutive sale transactions

occuring before any refill. By the Markov property of our model, the probabillity

50

that the r + 1-th sale transaction occurs before a refill transaction is independent of

r. Thus, the probability of having 0 stock is simply the R-th power of the probability

that the next sale occurs before a refill.

Thus, PN R = P(Sale before Refill)R . From lemma 8, this implies:

PN R =

q − qp

q + p − qp

51

R

(4.35)

Chapter 5

Sample complexity bounds

In this section,we analyze the amount of data (i.e. observations) required to learn

our parameters effectively. We thereby establish the efficiency of our estimators.

5.1

Error bounds for stock estimation

We wish to find the probability that our estimators in section 3.1.1 return the wrong

values, for a finite amount of data. That is, we want to find:

P (Ĉ T , Û T ) 6= (C, U )

T

= P (C, U ) 6= arg max Lc,i

c,i

[

= P

LTc,i ≥ LTC,U

(c,i)6=(C,U )

≤ 2K 2

max

(c,i)6=(C,U )

P LTc,i ≥ LTC,U

(union bound)

(5.1)

We now bound the above probability for any (c, i) 6= (C, U ) 1 . To do this, we

first prove a lemma which expresses the distribution of these random variables in a

convenient form.

1

By (c, i) 6= (C, U ), we mean that at least one of the following holds: c 6= C, or i 6= U .

52

d

d

d

Lemma 9. Define the random variables: A ∼ Geometric(q), W ∼ Geometric(p), Z ∼

Bernoulli(PN R ).

2

Let A1 , A2 , . . . be i.i.d. random variables distributed identically as

A; and likewise for W and Z . Let all random variables defined above be independent

of each other.

With respect to the setup in theorem 1 and section 3.1.1, the following 2 properties

hold:

d

LTC,U ∼

I.

N1

1 X

(Ai + Zi Wi )

N1 i=1

(5.2)

T

where N1 = EC,U

LTc,i

II.

d 1

∼

N2

where

N2

X

!

Ai

i=1

+

N3

X

!

Zi W i

(5.3)

i=1

T

N2 = Ec,i

and

1 T

N3 ≤ Ec,i

2

for any fixed values of (c, i) other than (C, U )

Proof. The proof follows largely from arguments made in section 4.2.

We first prove the statement for LTC,U . By definition, LTC,U =

ST

C,U

T

EC,U

. As noted in

lemma 2, the set STC,U consists of those time instances from 0 up to T , for which the

stock Xt satisfies: Xt ≡ 0 mod C. This set consists of many different ‘windows’ of

observations, where each window represents a set of contiguous time instances, ending

with an instance where sale occurs. No other time instance in a window has a sale,

T

except the last. Hence, the number of such windows is exactly EC,U

. Moreover, each

window represents either a sale time (if there is early refill), or the sum of a refill and

sale time (otherwise). Accordingly, we define the Bernoulli random variable Z , which

equals 1 if there is no early refill, which happens with probability PN R . It may be

noted that Z is independent of any other sale/refill times in STC,U .

By definition, the RV A has the same distribution as a sale time, and the RV W

2

d

The notation X ∼ Y means that r.v. X has the same distribution as r.v. Y

53

has the same distribution as a refill time. Thus, a single window length in STC,U is

distributed identically as A with probability 1 − PN R , and distributed as A + W the

rest of the time. Hence, a single window length is distributed as A+ZW , and therefore

T

PEC,U

the average window length viz. LTC,U is distributed as E T1

i=1 (Ai + Zi Wi ).

C,U

We now turn to proving the second statement, which concerns the distribution of

T

windows holds

LTc,i , when (c, i) 6= (C, U ). Note that the same subdivision into Ec,i

for the set of indices in STc,i as described above. But this time, we cannot exactly

determine the stock modulo C in this set. However, following the argument of lemma

3, we can say that the fraction of times we see a ‘longer interval‘ (i.e. window in which

Xt ≡ 0 mod C) is at most 12 . If we let N2 be the total number of windows, and let

N3 be the number of windows where stock is congruent to 0 mod C, then N3 ≤ 21 N2 .

Also, in these N3 windows, the window length is a sale time with probability (1−PN R ),

while the rest of the time it is the sum of a sale and refill time. In the remaining

T

N2 − N3 windows, the window length is simply a sale time. Also, N2 = Ec,i

as noted

earlier. Thus, the distribution of LTc,i is identical to:

1

N2

N2

X

i=1

Ai +

N3

X

i=1

!

Zi Wi

,

1

T

where N2 = Ec,i

, N3 ≤ N2

2

We now obtain a bound on the probabiliity that LTc,i ≥ LTC,U for any (c, i) 6= (C, U ).

Lemma 10. With respect to the setup in theorem 1 and section 3.1.1, fix any arbitrary

T

T

(c, i) 6= (C, U ). Also, let N1 = EC,U

and N2 = Ec,i

, and assume that N1 , N2 ≥ N for

some positive integer N . Then, the following holds:

1 32p2 2

2

P LTc,i ≥ LTC,U ≤

σA + σW

Z

2

N PN R

1−q

(2 − p)PN R − PN2 R

2

where σA2 =

and

σ

=

WZ

q2

p2

54

(5.4)

Proof. First, notice that:

P

LTc,i