Identifying disruptive customers to nurture for long-term growth ARCHIVES

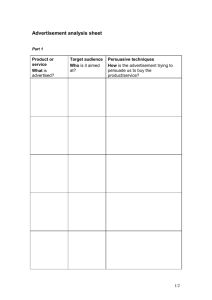

advertisement