OPPORTUNITIES AND OBSTACLES IN CREATING AFFORDABLE by

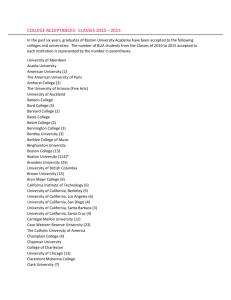

advertisement