MANAGING AFFORDABLE HOUSING IN THE INNER-CITY: by

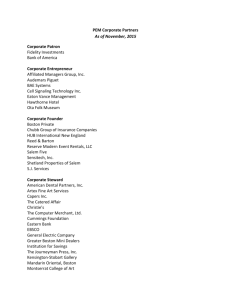

advertisement