Bringing Good Things to Life: New Markets Tax Credits and... income Communities to Investment, Including a Case Study of Pittsfield,...

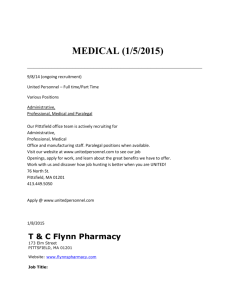

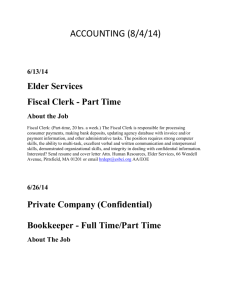

advertisement