GAO FEDERAL DISASTER ASSISTANCE Improved Criteria

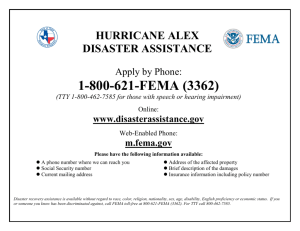

advertisement