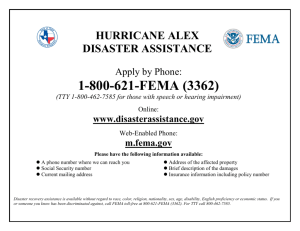

FEDERAL EMERGENCY MANAGEMENT AGENCY

advertisement