GAO HOMELAND SECURITY Successes and

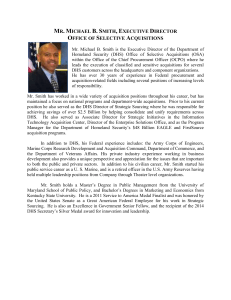

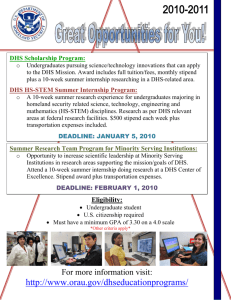

advertisement