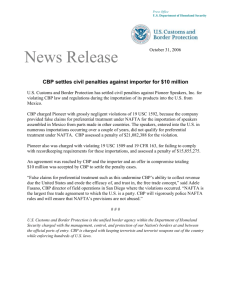

Report to the Ranking Member, Subcommittee on Immigration, Refugees and Border Security,

advertisement