Budget Planning, Maintenance & Transfers

advertisement

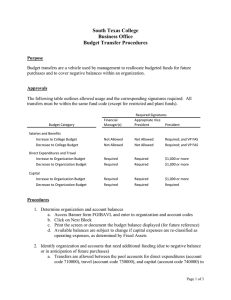

Budget Planning, Maintenance & Transfers Budget Financial Allows plan of all expenses and revenues for performance evaluation Budget Department Responsibilities Construct the College’s annual budget for the upcoming fiscal year Maintain the College’s current fiscal year budget through non-sufficient fund monitoring Budget transfers Requisition approval Reporting Budget Planning – STC’s Annual Budget Compiled annually and plans for a one year period (September 1 – August 31) Lists the expected revenues and expenses for the upcoming fiscal year Must be balanced Utilizes Banner’s Budget Development Application to gather departmental expense budgets Budget Planning – STC’s Annual Budget Comprehensive Approved report that covers all fund types by the Board of Trustees in August Budget booklet is submitted to Governor’s Office, Texas Legislative Board, THECB, and College staff Regulated Legislature by THECB and the Texas State Budget Planning Generally, a 10 month process Open the Budget Development Application for revenue and expense budget entry Project College revenues based on headcount projections, historical trends, and proposed rate schedules Develop revenue scenarios, expense comparison reports, preliminary revenue and expense summaries Prepare budget reports and print Budget booklet Prepare Budget Hearing ad Submit and upload Board approved Budget to external agencies Roll approved budgets into Banner Budget Planning The Budget Planning Process commences through the Budget Development Application accessible through Jagnet Budget Planning Submit proposed organization budget requests for upcoming fiscal year(s) when the application is open Only operating, travel and capital budgets may be updated (+/-). Consider the manual budget transfers processed during the previous year when requesting budget amounts for the upcoming fiscal year(s). Only financial managers and authorized staff may update an organization’s proposed budget Submit the Banner Budget Development Access Request from to grant additional user access (BO-8500) Organization changes may also be made during this time Create new organizations Inactivate existing organizations that will no longer be used Combine organizations that serve the same purpose Budget Planning Enter “Notes” for each expenditure pool (operating, travel and capital) The notes must include the nature of the expense, the estimated total cost, and the IE goal or objective that will be satisfied. Example: Operational Supplies: $63,596 (O6) Travel notes must identify the conferences that will be attended, the number of attendees per conference, and the IE goal or objective that will be supported. Travel requests for destinations that are not itemized in the notes section will require justification when the Travel Authorization form is submitted. Example: Conferences: $10,000 (O1, O2) SACS Annual Conference-1 attendee Banner Annual Summit-2 attendees Budget Planning Notes for the upcoming fiscal year may be updated until August South Texas College Budget Planning Proposed budgets are reviewed and may be adjusted by administrators Organization budgets may be used during the active fiscal year (September 1 – August 31) Budget Maintenance Department expenses must be properly categorized and charged to the most appropriate organization The organization charged with the expense should not be determined by funds availability. If the appropriate organization does not have enough funds available for the expense, complete and submit a budget transfer. Expenses must be properly categorized in order to adhere to the functional expense classifications from the Integrated Postsecondary Education Data System (IPEDS) Financial Survey Budget Maintenance – Transfers Transfers increase or decrease the organization’s available budget for operating, travel and capital expense accounts, in order to: Reallocate budget for future purchases Cover negative balances Budget transfers may be processed between different account codes of the same organization, or between different organizations Budget transfers may not occur between different fund codes Budget Transfers Only typed budget transfer forms will be processed Transfers may be processed using the expenditure pool accounts only 710000 Direct Expenditures (Operating) 730000 Travel Expenditures 740000 Capital Expenditures 770000 Construction If the submitted budget transfer form has errors, a new form must be submitted Preparing Budget Transfers Determine the amount that needs to be transferred (FGIBAVL) Determine the organization and account with sufficient funds available to cover the negative balance (FGIBAVL) Prepare the Budget Transfer form (BO-3500) Submit form for signature approvals Send approved form to Business Office for processing Check the status of the transfer on FGIBDST Budget Transfers - FGIBAVL Enter the Required Fields to View Balances Chart Fiscal Year Organization Account Move to Next Block Budget Transfers - FGIBAVL Budget Transfers - FGIBDST Enter the Required Fields to View Balances Chart Fiscal Year Organization Move to Next Block Down arrow to the expense account pool Click on the Options menu and select Transaction Detail Information (FGITRND) Budget Transfers - FGIBDST Budget Transfers – Approvals Review Budget Transfers Contact Information Elena Jimenez, Budget Specialist 872-4620 elenae@southtexascollege.edu Nicole Perez, Budget Coordinator 872-4633 mnperez@southtexascollege.edu Budget Website: http://www.southtexascollege.edu/businessoffice/forms.html