Foreign Employees and Foreign Vendors Federal Tax Withholding Form

advertisement

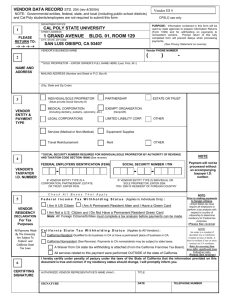

Foreign Employees and Foreign Vendors Federal Tax Withholding Form and Procedures WHY DO YOU NEED TO KNOW THIS? Foreign vendors such as international guest speakers, consultants, etc. may be contracted for an STC event. Foreign vendor companies may be used to buy goods or services. Foreign employees may be hired. FOREIGN PERSON Non resident alien individual; Foreign corporation; Foreign partnership; Foreign trust; Foreign estate; and any other person that is not a US person May be subject to Nonresident Alien tax withholding. Taxed differently than payments made to U.S. citizens or resident aliens. U.S. withholding agents are required to generally withhold 30% from the gross payment to be made to foreign vendors for U.S. sourced income unless the country of the foreign vendor has a tax treaty with the U.S. that will allow for a reduced withholding rate. May be subject to Nonresident Alien tax reporting. RESIDENT OR NONRESIDENT ALIEN (INDIVIDUALS ONLY) Taxed differently and therefore, determining ones tax status prior to payment is essential to accurately report the individual’s tax liability to be in compliance with IRS tax laws. Nonresident Alien Individual who is not a U.S. citizen or a resident alien. Taxed under special laws – NRA withholding Resident Alien Individual who is not a citizen or national of the U.S. Meets the green card test or the substantial presence test for the calendar year. Taxed the same as U.S. citizens RESIDENT ALIEN Foreign person may be a resident alien by meeting either the Green Card Test or the Substantial Presence Test for the calendar year. Green Card Test Individual was a lawful permanent resident of the US at any time during the year. Substantial Presence Test Must be physically present in the US at least: 31 days during the current calendar year 183 days during the current year and the 2 preceding years counting all the days of physical presence in the current year 1/3 the number of days of presence in the first preceding year 1/6 the number of days in the second preceding year TAX RESIDENCY BO-3420 Form - Foreign Status for Federal Tax Withholding Obtained from the Business Office website Must be completed and submitted to the Business Office to determine tax residency. Completed by foreign individuals only. Completed prior to STC payment, preferably during time of hiring/contract agreement with STC. Visa and immigration documentation must be provided. TYPES OF PAYMENTS AND TAX AND REPORTING REQUIREMENTS Goods/Products – Not subject to U.S. tax reporting or withholding. Personal Services (i.e. independent personal services, honoraria) Services provided in the U.S. - subject to U.S. tax reporting and withholding when applicable. Services provided outside the U.S. - considered foreign source and not subject to U.S. tax reporting or withholding. Note: Honoraria payments require eligibility. BO-9300 Honoraria Eligibility Certification Form must be completed. Royalties (i.e. software) Software or information downloaded onto a U.S. server – U.S. source income subject to U.S. tax reporting and withholding when applicable. Software or information downloaded in a foreign country server foreign source income and not subject to U.S. tax reporting or withholding. TAX TREATIES The withholding tax rate may be eliminated or reduced if the foreign vendor employee is a resident in a country that has a tax treaty with the U.S. Foreign vendor must provide Form W-8BEN to claim an exemption or a reduced rate of withholding. FOREIGN VENDOR PROCEDURES 1. Prior to agreement/vendor payment – the department engaging the foreign vendor reviews and makes copies of documentation to verify that the vendor’s status allows for payment to be received. 2. Department notifies foreign vendor of tax withholding and reporting implications. 3. Department contacts Purchasing and BO Tax departments regarding these payments. 4. Proper forms (i.e. Form W-8BEN) and other documentation is submitted to Purchasing department. 5. Purchasing will review documentation for completion and approval for purchase. Copies of documentation must be provided to BO Tax and Accounts Payable. FOREIGN INDIVIDUALS PAID THROUGH A/P PROCEDURE Purchasing and BO will review documentation for completion and approval for entering into an agreement. Copies of documentation must be provided to BO Accounts Payable. 6. BO Tax will confirm tax withholding and/or reporting and provide it to BO Accounts Payable. If further information is needed the BO will inform Purchasing or the Department for appropriate information to obtain from vendor. 7. The BO Accounts Payable will withhold taxes according to tax residency status. FOREIGN EMPLOYEES Foreign employees must fill out BO-3420 if they indicate on their I-9 that they are “other aliens authorized to work until mm/dd/yyyy”. HR will contact the BO tax department regarding foreign employees. Form BO-3420 along with supporting documentation must be submitted to the BO for tax determination. If further information is needed the BO will inform HR for appropriate information to obtain from employee. The BO Tax services will contact HR on employee status. HR will tax employee according to tax residency status. The BO Tax services provides HR and Payroll with supporting NRA status. FURTHER GUIDANCE Further guidance may be obtained in the Business Office website under Business Office Procedures: “Foreign Vendors or Foreign Individuals Paid Through Accounts Payable Guidelines” THANK YOU Delia Orellana Accounting Group Supervisor dorellan@southtexascollege.edu 872-4622